Water Blocking Tapes Market Report Scope & Overview:

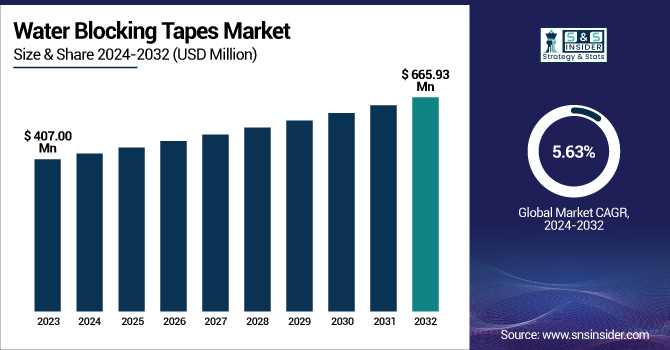

The Water Blocking Tapes Market Size was valued at USD 407.00 Million in 2023 and is expected to reach USD 665.93 Million by 2032, growing at a CAGR of 5.63% over the forecast period of 2024-2032.

To Get more information on Water Blocking Tapes Market - Request Free Sample Report

The Water Blocking Tapes Market is expanding as industries demand advanced moisture protection for optical fiber, power, and submarine cables. Our report explores trade flow and import-export analysis, identifying key manufacturing hubs and global supply shifts. Cutting-edge advancements in technology and materials are enhancing tape durability and conductivity, driving innovation. Strict product certification and quality standards are shaping market adoption, ensuring compliance with international safety regulations. Meanwhile, government policies affecting market growth are pushing sustainability mandates and industry-specific requirements. Rising infrastructure projects and telecommunication advancements are fueling potential investment and funding activities, attracting global stakeholders. This report uncovers these critical trends, offering a strategic outlook on the evolving Water Blocking Tapes Market landscape.

The US Water Blocking Tapes Market Size was valued at USD 54.56 Million in 2023 and is expected to reach USD 100.36 Million by 2032, growing at a CAGR of 7.01% over the forecast period of 2024-2032.

The U.S. Water Blocking Tapes Market is experiencing steady growth, driven by expanding fiber optic networks, power infrastructure upgrades, and submarine cable deployments. Rising investments from U.S. telecommunications giants like AT&T and Verizon in high-speed broadband expansion are fueling demand for these tapes in fiber optic cables. Additionally, government initiatives such as the Infrastructure Investment and Jobs Act (IIJA) are accelerating power grid modernization, further boosting adoption. Strict regulatory standards set by the National Electrical Manufacturers Association (NEMA) and the Telecommunications Industry Association (TIA) ensure high-quality and safety compliance, influencing market preferences. The presence of key manufacturers and ongoing R&D in advanced moisture-resistant materials are strengthening the industry’s competitive edge.

Water Blocking Tapes Market Dynamics

Drivers

-

Increasing Deployment of High-Performance Submarine Cables Enhances the Growth of the Water Blocking Tapes Market

The expansion of submarine communication and power transmission networks is significantly boosting the demand for water blocking tapes. These tapes are essential in protecting underwater cables from moisture penetration, ensuring long-term durability and performance. With the surge in data consumption, global internet connectivity, and offshore wind energy projects, the installation of submarine cables is increasing. The United States is witnessing major investments in high-capacity transatlantic and transpacific submarine cables by companies such as Google, Meta, and Microsoft, which rely on advanced moisture-resistant solutions. Additionally, offshore renewable energy projects like the Coastal Virginia Offshore Wind (CVOW) project require robust transmission infrastructure, further driving demand for protective cable solutions. Innovations in submarine cable design, including high-voltage direct current (HVDC) transmission systems, necessitate advanced water blocking tapes that can withstand high-pressure underwater conditions. As the reliance on submarine cables grows for data transmission, energy distribution, and military applications, the need for high-performance water blocking tapes continues to expand, positioning the market for steady growth.

Restraints

-

High Manufacturing Costs of Advanced Water Blocking Tapes Limit Market Penetration

The production of high-performance water blocking tapes, particularly those with fire-resistant, electrically conductive, and self-healing properties, requires specialized raw materials and advanced manufacturing processes. Materials such as nanostructured conductive polymers, high-temperature adhesives, and halogen-free flame retardants contribute to high production costs. Companies investing in research and development to meet evolving industry standards face financial challenges in maintaining competitive pricing. Small and mid-sized manufacturers, in particular, struggle to absorb these costs, limiting their market participation. Additionally, fluctuating prices of raw materials, especially petrochemical-derived adhesives and moisture-absorbing polymers, create uncertainty in production expenses. While large industry players can leverage economies of scale to offset these costs, price-sensitive sectors like telecommunications and energy transmission may opt for low-cost alternatives such as basic moisture-resistant coatings, restricting the widespread adoption of premium water blocking tapes.

Opportunities

-

Growing Investments in Smart Grid Infrastructure Create Lucrative Opportunities for Water Blocking Tapes Market

The increasing transition towards smart grids and modernized power transmission networks is driving demand for advanced cable protection solutions, including water blocking tapes. In the United States, initiatives such as the Grid Modernization Initiative (GMI) by the Department of Energy emphasize infrastructure upgrades, necessitating durable and moisture-resistant cables. Smart grids integrate real-time data communication, automated fault detection, and energy-efficient transmission, requiring high-performance fiber optic and power cables that incorporate water blocking tapes. The expansion of electric vehicle (EV) charging networks, underground power transmission systems, and renewable energy projects is further increasing the need for advanced insulation and moisture-blocking technologies. Utilities investing in next-generation transmission lines, such as Dominion Energy’s offshore wind transmission infrastructure, are actively seeking robust cable protection solutions, creating new market opportunities for innovative water blocking tapes.

Challenge

-

Supply Chain Disruptions and Raw Material Shortages Hamper the Water Blocking Tapes Market Growth

Supply chain disruptions, geopolitical tensions, and raw material shortages present major challenges to the Water Blocking Tapes Market. The COVID-19 pandemic exposed logistical vulnerabilities, causing delays in the transportation of essential raw materials such as polymeric absorbent materials, high-performance adhesives, and moisture-resistant coatings. Additionally, fluctuations in crude oil prices and global trade restrictions have significantly affected the cost and availability of petrochemical-derived components used in advanced tapes. The U.S.-China trade tensions and disruptions in semiconductor and polymer supply chains have further impacted production timelines, leading to longer lead times and increased costs for manufacturers. Companies relying on imported materials for high-quality water blocking tapes are now focusing on regional sourcing and developing alternative formulations to mitigate risks. However, persistent challenges in securing a stable supply chain continue to hinder large-scale manufacturing and delay new product innovations, restricting the market's overall growth potential.

Water Blocking Tapes Market Segmental Analysis

By Type

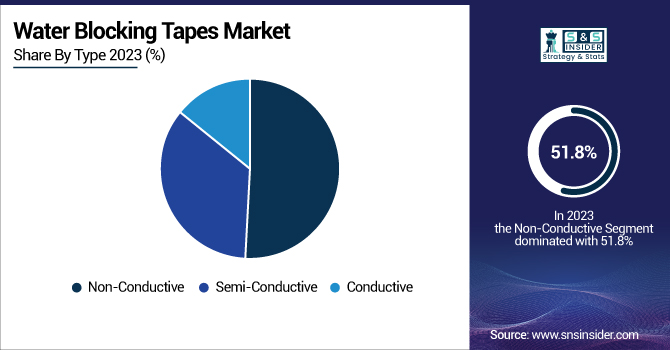

The Non-Conductive segment dominated the Water Blocking Tapes Market in 2023 with a market share of 51.8%. This dominance is attributed to its extensive usage in optical fiber cables, submarine cables, and power cables, where preventing water ingress is critical. Non-conductive tapes, made from superabsorbent polymer (SAP) and non-woven fabric, provide superior moisture absorption and insulation, making them ideal for high-performance applications. The Fiber Broadband Association (FBA) and the International Telecommunication Union (ITU) have emphasized the need for high-reliability materials in fiber optic deployments, further driving demand. Additionally, with governments worldwide investing in 5G and high-speed broadband networks, the need for durable, water-resistant fiber optic cables is at an all-time high. Companies like Chase Corporation and 3M have expanded their non-conductive water blocking tape offerings to cater to these demands. The increasing focus on underground and submarine cabling projects continues to solidify this segment’s market leadership.

By Application

The Submarine Cable segment dominated the Water Blocking Tapes Market in 2023 with a market share of 35.7%, driven by expanding underwater power transmission and communication networks. Governments and organizations such as the International Cable Protection Committee (ICPC) and SubOptic have emphasized the importance of reliable submarine cable infrastructure to support global internet connectivity and offshore energy projects. Major investments in projects like Google’s Dunant transatlantic cable and the Asia-Africa-Europe 1 (AAE-1) submarine cable system have created heightened demand for water-blocking solutions to protect cables from seawater damage. Additionally, the surge in offshore wind energy projects, particularly in Europe and Asia Pacific, has further fueled the need for high-quality submarine cables. The U.S. Department of Energy (DOE) and European Network of Transmission System Operators (ENTSO-E) have also promoted grid interconnection initiatives, reinforcing the role of water-blocking tapes in ensuring long-term cable reliability in deep-sea environments.

Water Blocking Tapes Market Regional Outlook

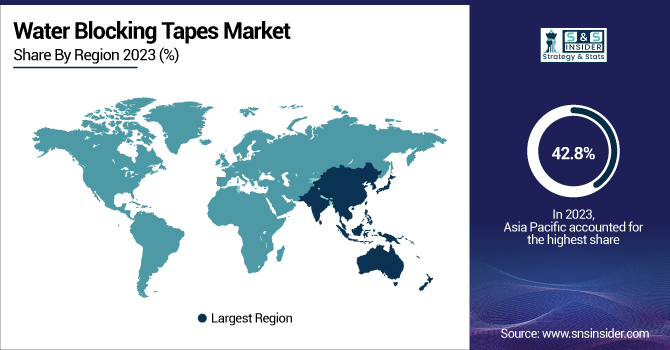

The Asia Pacific region dominated the Water Blocking Tapes Market in 2023 with a market share of 42.8%, driven by rapid infrastructure expansion and heavy investments in fiber optic and power cable networks. Countries like China, India, and Japan have led the region’s dominance due to large-scale deployment of 5G networks, smart grids, and submarine communication systems. China, backed by initiatives such as the Belt and Road Initiative (BRI), has been aggressively expanding its high-speed internet infrastructure, fueling demand for reliable water-blocking solutions. The State Grid Corporation of China (SGCC) and China Telecom have been investing in ultra-high-voltage power transmission and fiber-optic broadband expansion, further propelling the market. India’s BharatNet project, aimed at rural broadband connectivity, and Japan’s offshore wind energy projects have also contributed to the increasing adoption of water-blocking tapes. Additionally, the region is home to key manufacturers such as Nantong Siber Communication, Gurfil, and Chengdu Centran Industrial, further reinforcing its position as the market leader.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Beery Global Inc. (Water Blocking Tape, Semi-Conductive Water Blocking Tape)

-

Cable Tapes UK (Water Blocking Tape, Non-Conductive Water Blocking Tape, Swellable Tape)

-

Chase Corporation (WaterBloc Tape, Conductive Water Blocking Tape, Non-Conductive Water Blocking Tape)

-

Chengdu Centran Industrial (Water Swellable Tape, Conductive Water Blocking Tape, Fiber Optic Cable Tape)

-

Chhaperia International Company (Water Blocking Tape, Cable Wrapping Tape, Swellable Tape)

-

Ekstel (Water Blocking Tape, Semi-Conductive Water Blocking Tape, Swellable Yarn Tape)

-

Fori Group (Water Blocking Tape, Conductive Water Blocking Tape, Semi-Conductive Swellable Tape)

-

Geca Tapes (Water Swellable Tape, Conductive Water Blocking Tape, Non-Conductive Water Blocking Tape)

-

Gurfil (Swellable Tape, Water Blocking Tape, Cable Wrapping Tape)

-

Hanyu Cable Materials (Water Blocking Tape, Non-Conductive Water Blocking Tape, Swellable Tape)

-

Hongzhou Photoelectric Material Technology Ltd (Water Swellable Tape, Cable Water Blocking Tape, Fiber Optic Cable Tape)

-

Indore Composite (Water Blocking Tape, Conductive Water Blocking Tape, Cable Insulation Tape)

-

Lifeline Technologies (Water Blocking Tape, Conductive Water Blocking Tape, Non-Conductive Swellable Tape)

-

Nantong Siber Communication (Water Swellable Tape, Semi-Conductive Water Blocking Tape, Fiber Optic Cable Tape)

-

Scapa Group Ltd (Cable Water Blocking Tape, Conductive Swellable Tape, Non-Conductive Swellable Tape)

-

Shenyang Tianrong Cable Materials Co Ltd (Water Blocking Tape, Swellable Tape, Conductive Water Blocking Tape)

-

Shinyuan Technologies (Water Swellable Tape, Semi-Conductive Water Blocking Tape, Fiber Optic Cable Tape)

-

Sneham International (Water Blocking Tape, Non-Conductive Water Blocking Tape, Swellable Tape)

-

Star Materials (Water Blocking Tape, Semi-Conductive Water Blocking Tape, Swellable Tape)

-

Weihai Hongda Cable Material (Water Swellable Tape, Conductive Water Blocking Tape, Cable Insulation Tape)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 407.00 Million |

| Market Size by 2032 | USD 665.93 Million |

| CAGR | CAGR of 5.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Conductive, Semi-Conductive, Non-Conductive) •By Application (Optical Fiber Cable, Submarine Cable, Power Cable, Communication cable, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chase Corporation, Chhaperia International Company, Scapa Group Ltd, Fori Group, Geca Tapes, Gurfil, Hanyu Cable Materials, Lifeline Technologies, Chengdu Centran Industrial, Weihai Hongda Cable Material and other key players |