Water Purifier Market Report Scope & Overview:

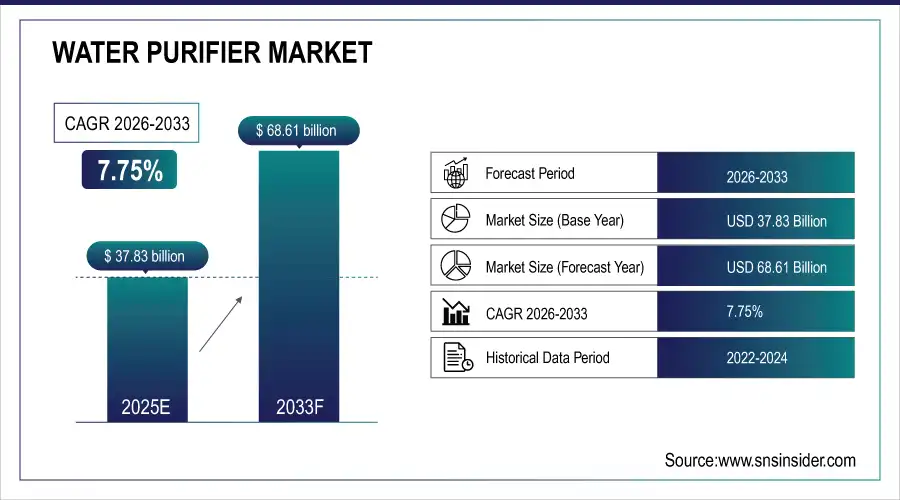

The Water Purifier Market Size was valued at USD 37.83 Billion in 2025E and is projected to reach USD 68.61 Billion by 2033, growing at a CAGR of 7.75% during the forecast period 2026–2033.

Water Purifier Market analysis provides a comprehensive study of trends, innovations, and growth in the industry. The market is segmented by technology (RO, UV, UF, gravity-based), product type (wall-mounted, counter-top, under-the-sink, portable), end user (residential, commercial, industrial, healthcare), price range, source of water, and distribution channel. Rising consumer awareness, increasing water pollution, and growing demand for safe drinking water are driving market expansion globally.

RO purifiers dominate the market, accounting for over 55% of global installations in 2025, driven by high adoption in urban residential and commercial sectors.

Market Size and Forecast:

-

Market Size in 2025: USD 37.83 Billion

-

Market Size by 2033: USD 68.61 Billion

-

CAGR: 7.75% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Water Purifier Market - Request Free Sample Report

Water Purifier Market Trends:

-

An increasingly urban population and growing concerns of contaminated water is driving consumer spending on more sophisticated systems for purification, raising demand in the residential and commercial sectors.

-

These RO and UV technologies are bringing down the cost of operations, maintenance and in turn high-efficiency purifiers are no longer expensive to more middle-class homes.

-

Increasing health awareness and knowledge about waterborne diseases are encouraging the sales of premium and smart water purifiers.

-

Online marketplaces, such as e-commerce and the filter replacement business model are emerging as one of the channels for these players to reach out to customers in a convenient way.

-

Governments, NGOs and corporations are pouring money into clean water projects at the same time that innovation is becoming more accessible in developing markets.

-

IoT and intelligent monitoring in purifiers with app control is a trend, where the hiding spaces for traditional purifier brands are shrinking.

U.S. Water Purifier Market Insights:

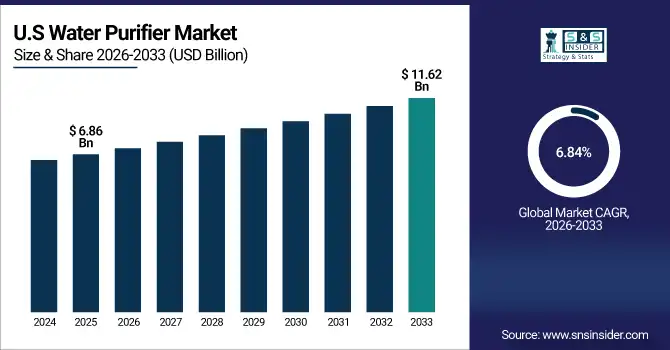

The U.S. Water Purifier Market is projected to grow from USD 6.86 Billion in 2025E to USD 11.62 Billion by 2033 at a CAGR of 6.84%, driven by residential and commercial adoption, technological innovations in RO and UV systems, rising health awareness, and government clean water initiatives, supporting market expansion nationwide.

Water Purifier Market Growth Drivers:

-

Rising global water pollution and health awareness are fueling demand for advanced residential and commercial purification solutions.

The Water Purifier market growth is driven by rising global water pollution and health awareness. In 2025, there are about 120 million households around the world adopt advanced purification system, and it is expected exceed to 220 million in 2033. Growth Opportunities for companies for both Developed and Emerging Markets, aided by growing private investments in smart, low-maintenance RO and UV technologies as well by strong government initiatives focused on clean access to water overall.

Rising demand for advanced water purification accounted for 32% of Water Purifier market activities in 2025, driven by urban adoption, health awareness, and government clean water initiatives.

Water Purifier Market Restraints:

-

High upfront costs and frequent filter replacements are limiting adoption, especially among price-sensitive households in emerging markets.

Market growth is stifled by high initial costs and ongoing upkeep. Expensive RO/UV purifiers and filter change discouraged purchases in 38% of Indian households and 25% in Southeast Asia in 2025. More than 30% of rural users have restricted access to certified technicians, for either installation or maintenance. Small manufacturers find it hard to compete with multinationals, and stringent safety standards and water quality limits also retard adoption even as demand surges globally for safe drinking water.

Water Purifier Market Opportunities:

-

Rising demand for smart, IoT-enabled purifiers presents significant growth opportunities across urban and tech-savvy consumer segments globally.

The demand for smart IoT enabled systems is creating new possibilities in the Water Purifier market. More than 25 million smart purifiers had been installed globally by 2025, and that number was set to hit 70 million in 2033. Growing urbanization and health-aware consumers, along with government clean-water initiatives are driving adoption. Remote monitoring, automated filter alerts and energy-saving functionalities are making these systems more convenient and cost-effective than ever before, as new commercial and residential market opportunities open up.

Smart and IoT-enabled water purifiers accounted for 28% of new global installations in 2025, driven by urban adoption and health-conscious consumers.

Water Purifier Market Segmentation Analysis:

-

By Technology, RO Purifiers held the largest market share of 55.48% in 2025, while UV Purifiers are expected to grow at the fastest CAGR of 8.45%.

-

By Product Type, Wall-mounted purifiers dominated with a 42.37% share in 2025, while Counter-top purifiers are projected to expand at the fastest CAGR of 8.12%.

-

By End User, Residential accounted for the highest market share of 61.24% in 2025, and Commercial users are projected to record the fastest CAGR of 8.50%.

-

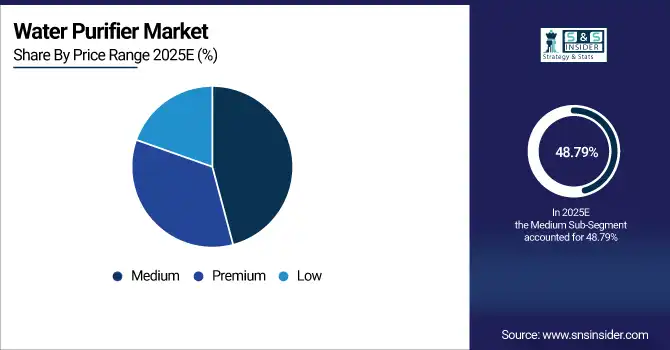

By Price Range, Medium purifiers held the largest share of 48.79% in 2025, while Premium purifiers are expected to grow at the fastest CAGR of 8.32%.

-

By Distribution Channel, Offline Retail dominated with a 53.62% share in 2025, while Online channels are projected to record the fastest CAGR of 9.05%.

-

By Source of Water, Municipal Supply held the largest share of 57.83% in 2025, while Groundwater sources are expected to grow at the fastest CAGR of 8.22%.

By Technology, RO Purifiers Lead While UV Purifiers Expand Rapidly:

RO segment dominated the market with more than 66 million installations globally by 2025 and were predominantly driven by urban residential & commercial needs of advanced water purification. They are the best options due to their effectiveness in eliminating dissolved salts, heavy metals and impurities. UV is the fast-growing segment with 22 million units in 2025, technology as awareness of bacterial and viral threats increases, especially in offices, schools, and hospitals The market is gaining best growth traction due to smaller footprint designs and technological advancements.

By Product Type, Wall-mounted Lead While Counter-top Expands Rapidly:

Wall-mounted segment dominated the market with more than 48 million installations across the world by 2025, as they were highly-built-in capacity, space saving promotion and in homes and small commercial areas. The Counter-top, the fastest-growing segment is now considered the standard for durability and performance, with around 29 million units in 2025, driven by its portability, ease of installation, and increasing adoption in apartments and offices. The consistent induction of multi-level and smart functionalities is driving their demand to surge at a brisk pace.

By End User, Residential Lead While Commercial Expands Rapidly:

Residential segment dominated the market with more than 70 million purifiers in 2025 on account of increasing health consciousness, concerns regarding deteriorating urban water quality and increasing disposable income. This broad availability puts residential demand at the heart of the market. Commercial is the fast-growing segment, with 24 million units installed in 2025, as restaurants, hotels, offices, and hospitals seek reliable water supplies. Growing investments toward high capacity and smart purifiers facilitate quicker adoption across commercial applications.

By Price Range, Medium Lead While Premium Expands Rapidly:

The medium segment dominated with 55 million units sold in 2025, serving needs of urban and semi-urban consumers at an affordable price point due to their value-for-money formula means they`re always in high demand. Premium, however, are defined as fast-growing segment, reaching 22 million units in 2025, with smart, IoT-connected, multi-stage systems leading the charge. High-income households and tech-savvy consumers are pushing adoption, and features that include automatic alerts and mineral retention are accelerating expansion in the premium segment.

By Distribution Channel, Offline Retail Lead While Online Expands Rapidly:

Offline Retail segment dominated with 62 million units by 2025 on account of reliable dealer networks, after sales support, and in-store trials. It is by far the biggest, as strong customer confidence makes this channel. Online sales are a fast-growing segment, reaching 34 million units in 2025, driven by e-commerce distribution, subscription-based filter replacements, and the convenience of doorstep delivery. Digital marketing and direct-to-consumer campaigns are driving adoption, especially by younger buyers who want no-friction purchase and maintenance experiences.

By Source of Water, Municipal Supply Lead While Groundwater Expands Rapidly:

Municipal supply segment dominated the market with more than 65 million purifiers installed in 2025, supported by urban households and commercial buildings that filter tap water for taste, odour and lingering impurities. In cities, their omnipresence means that municipal supply is the base of installations. Groundwater is a fast-growing segment, with 29 million units in 2025, due to extensive use in semi-urban and rural areas with hard, iron-laden, and bacteriologically contaminated water. The growing use of RO and UV technologies to help generate safe drinking water is driving quicker adoption.

Water Purifier Market Regional Analysis:

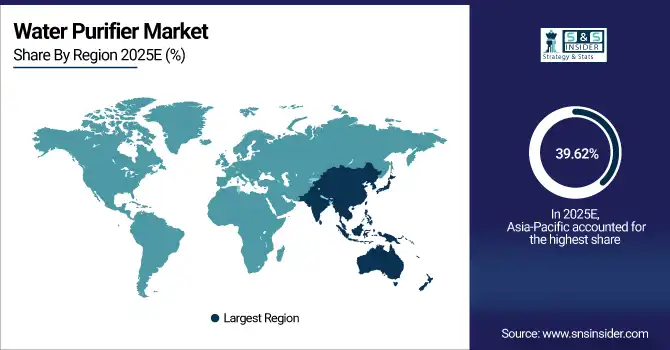

Asia-Pacific Water Purifier Market Insights:

Asia Pacific Water Purifier Market dominated with a market share of 39.62% in 2025 and is projected to remain dominant throughout the forecast period due to an increase in urbanization, water pollution and health consciousness. China is the largest market, with over 28 million units while India has over 15 million. RO purifiers and wall-mounted units are the best sellers while UV and counter-top technologies are growing fast. Rising government programmes, private investment and increasing consumer inclination for safe drinking water drive the market dominance of the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Water Purifier Market Insights:

In 2025, 28 million water purifiers on-site in China, mainly including RO and wall-hanging types. 18 million were residential and the rest commercial. Fast-paced urbanization, increasing health consciousness, government clean water projects and private-sector investment are accelerating growth, while technological advancements and adoption of smart purifier is broadening the market across the country.

North America Water Purifier Market Insights:

North America with over 21 million units installed by 2025, primarily in the US (15 million units) and Canada (6 million units). Residential adoption led the market, while commercial installations grew steadily. Strong government regulations on water quality, rising health awareness, and widespread urban infrastructure are key drivers. Private investments, smart purifier innovations, and efficient distribution networks are accelerating growth across households, offices, and institutional facilities.

-

U.S. Water Purifier Market Insights:

In 2025, the U.S. had installed more than fifteen million water purifiers; 10 million home models and 5 million commercial units. Growth will be boosted by increased health consciousness, urban water quality problems, and expansion of the smart RO & UV system segment and technological developments, government clean water initiatives, and public-private support across India.

Europe Water Purifier Market Insights:

Europe Water Purifier Market was being installed more than 12 million units by 2025 with Germany alone accounted for 4.2 million units followed by UK with 3.5 million units and France with nearly over 2.8 million units. Seven million of those projects were for homes; the other 5 million for businesses. Rise in health consciousness, stringent water quality regulations, technological advances in RO and UV purifiers & increasing public-private partnerships are the factors driving the growth across the regional market.

-

Germany Water Purifier Market Insights:

In 2025, Germany had over 4.2 million water purifiers (2.6 residential and 1.6 commercial). RO and wall-mounted systems dominated. Rising government focus toward clean water, technological advancements, growing health awareness and partnerships with European suppliers and service providers will drive growth across residential and commercial establishments.

Middle East and Africa Water Purifier Market Insights:

The Middle East and Africa water purifier market is a fast-growing region, with a CAGR of 9.46% during the period 2025–2033 with an installation above 5.2 million units, the key lion shares being sucked off by UAE with a massive installation base (2 million) & South Africa (1.2 million). The technology was deployed in around 3.1 million residential units, and 2.1 million commercial units. Wellness awareness, water safety insecurity fears, government actions and private sector investment have been rapidly circulating the region.

Latin America Water Purifier Market Insights:

By 2025, Latin America had over 3.8 million water purifiers installed with Brazil leading (1.5 million units), followed by Argentina (1 million units) and Chile (0.7 million). Some 2.2 million residential units and about 1.6 million commercial units were introduced. Increasing health consciousness, its water-quality related worries and government and private sector efforts are boosting the market in various regions.

Water Purifier Market Competitive Landscape:

Culligan International dominated the water purifier market with more than 3 million installations annually residential commercial and industrial. Backed by over 40 years of global experience in the edible oil industry, its produce meets and exceeds quality standards with one of the most efficient refining processes. Collaborations with town and city initiatives, commercial partnerships and relentless progress in multi-stage h2o purification and smart water surveillance have built Culligan as an international front-runner when it comes to clear water products.

-

In March 2025, Culligan launched its Smart Reverse Osmosis Purifier with IoT-enabled monitoring, allowing real-time filter alerts and water quality tracking for residential and commercial users.

Kent RO Systems is a market leader in India and Nigeria with more than 2.5 million units being sold annually. It’s RO and UV purification along with mineral retention are best suited for urban homes and small commercial establishments. Its aggressive marketing and the after sales support with technology upgrades viz., smart, IoT enabled purifiers etc with its adoption by healthy conscious consumers in the residential and commercial segments has helped Kent to grow fast and become a trusted brand.

-

In February 2025, Kent introduced its RO + UV + UF Smart Purifier with app-based remote monitoring and automatic maintenance notifications, targeting urban households and small offices.

Eureka Forbes is the market leader in India for water purifiers with over 3.2 million units annually, under Aquaguard and Euro brands systems. Leading the pack are its widespread penetration in urban and semi-urban households, strong service network and constant innovation in RO, UV and multi-stage purifiers. Strategic alliances with government health projects and increasing brand confidence and expansion into commercial and institutional establishments have strengthened Eureka Forbes’ leadership position.

-

In January 2025, Eureka Forbes unveiled the Aquaguard Smart iProtect series, featuring multi-stage purification with IoT connectivity and AI-based water quality insights for homes and enterprises.

Water Purifier Market Key Players:

Some of the Water Purifier Market Companies are:

-

Culligan International

-

Kent RO Systems

-

Eureka Forbes Ltd.

-

LG Electronics

-

Panasonic Corporation

-

Whirlpool Corporation

-

Aquaguard (Eureka Forbes)

-

Brita GmbH

-

3M Company

-

AO Smith Corporation

-

Samsung Electronics

-

HUL Pureit (Hindustan Unilever)

-

Coway Co., Ltd.

-

Procter & Gamble (P&G) – Pur Water

-

Blue Star Ltd.

-

Havells India Ltd.

-

Midea Group Co., Ltd.

-

Ion Exchange India Ltd.

-

Aqua Perfecta

-

Angel Water Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 37.83 Billion |

| Market Size by 2033 | USD 68.61 Billion |

| CAGR | CAGR of 7.75% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (RO Purifiers, UV Purifiers, Gravity-based Purifiers, UF Purifiers, Others) • By Product Type (Wall-mounted, Counter-top, Under-the-sink, Portable, Others) • By End User (Residential, Commercial, Industrial, Healthcare, Others) • By Price Range (Low, Medium, Premium) • By Distribution Channel (Online, Offline Retail, Direct Sales, Others) • By Source of Water (Municipal, Groundwater, Surface Water, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Culligan International, Kent RO Systems, Eureka Forbes Ltd., LG Electronics, Panasonic Corporation, Whirlpool Corporation, Aquaguard (Eureka Forbes), Brita GmbH, 3M Company, AO Smith Corporation, Samsung Electronics, HUL Pureit (Hindustan Unilever), Coway Co., Ltd., Procter & Gamble (P&G) – Pur Water, Blue Star Ltd., Havells India Ltd., Midea Group Co., Ltd., Ion Exchange India Ltd., Aqua Perfecta, Angel Water Systems |