Warehouse-Racking Market Report Scope & Overview:

To get more information on Warehouse Racking Market - Request Free Sample Report

The Warehouse Racking Market was valued at USD 9.29 billion in 2023, and it is expected to reach USD 13.51 billion by 2032, registering a CAGR of 4.25% during the forecast period of 2024-2032.

Warehouse racking is one of the significant tools to cater to the demand related to storage capacity expansion in the warehouses, which is likely to drive the market growth over the forecast period, owing to the rising demand resulting from the accelerating online retail sector. The racking equipment system plays a vital role in organizing multiple products within the limited area and scales up to store the optimal level of palletized products, thus boosting the demand for the product. Moreover, the equipment increases the total storage capacity and also arranges the stored products in an orderly fashion, which helps to enhance the organization of the product. The alignment of the products helps in identifying the products ordered by patrons and facilitates easy picking and completion of the order, which in turn leads to reduced time and cost. Expansion of the application sectors, including manufacturing, food & beverage, automotive, and retail markets is expected to drive the demand for the product across all applications around the globe. Moreover, the rising need to find and optimize the space within the warehouse determines the surge in need for warehouse spaces to hold and access every product. The racking equipped storage spaces of the warehouse cater to store and save the cost of the warehouse.

In 2023, U.S. e-commerce sales grew to approximately $1.119 trillion, marking a 7.6% rise from $1.040 trillion seen in 2022. Notably, the sector demonstrates consistent growth, as the U.S. e-commerce experienced at least 0.2% points year-over-year rise since 2000. The increasing value is explained by the sector’s weight in absolute retail sales, covering 22.0% of the total. As a result, advanced racking systems are required to manage the augmented inventory and orders. At the same time, warehouse management system-integrated racking systems are more preferable in connection to warehouse automation. It is expected that the U.S. adoption of warehouse automation technologies is going to grow at a compound annual growth rate of about 10% in the following five years. Primary drivers of the trend include the high level of investments by the logistics and distribution industry in the illusion of modern warehousing and proliferation of rack-supported warehouses and racking solutions that are set to boost growth in sales.

Warehouse racking provides a broad range of opportunities for maximizing storage space, and resulting benefits enhance operational efficiency and added value that a company derives. In other words, companies deploy different types of systems for reducing costs and realizing operational benefits, including previously discussed compliance with safety standards and, implicitly, with a constant flow of quality management, which is an important aspect of operational efficiency which cannot be quantified in terms of big cost savings and added value that a company receives. At the same time, the efficient utilization of space is the main advantage of using a rack, because, as a rule, racking systems utilize vertical space that a warehouse would not generally use, as especially tall racks correspond to especially high warehouse ceilings since otherwise, air space would be wasted.

MARKET DYNAMICS:

KEY DRIVERS

The rise in online shopping has created a demand for efficient storage solutions for warehouses to function properly.

The use of warehouse racking systems to increase space utilization, product organization, product picking and order fulfilment speed being especially necessary for e-commerce fulfilment centers. The increase in online shopping, since the onset of the COVID-19 pandemic especially, revolutionized logistics and warehousing. In order to keep up with the new normal, it is especially important to use warehouse racking systems that will improve space utilization, product organization, as well as reduce the time needed to pick up products and fulfil orders. Storage capacity can be increased by up to 40% by using racking systems that use the full vertical space. Although the warehouse footprint remains the same, more products will be able to be present in the same area. Efficient product organization can be achieved through adequate storage systems such as selective racking, through which products are systematically organized.

In addition to the equipment improvements, efficient storage solutions are critical to enhancing the organization and accessibility of inventory. With a well-arranged racking system, there is no difficulty in finding the needed item, and the time spent on pick and pack falls dramatically. In the e-commerce fulfilment industry, being able to pick and pack quickly is essential, because, in order to keep with tight delivery schedules and high standards of customer service, the workforce no longer has time to waste. Furthermore, technology can be used in conjunction with the proper storage solutions, that is, the systems of Warehouse Management Systems, as well as Automated Guided Vehicles. By incorporating WMS and using AGVs, the location of any item at the time is accessible in real-time, and the routes for picking can continuously be optimized. In addition, with the use of AGVs, the error rate in picking is minimized, and the order takes less time to fulfill

Systematic organization with racking systems leads to faster product identification, picking, and order completion.

Systematic organization accelerated by racking systems is advantageous in such operations as product identification, picking, and order completion. These racking systems are designed to categorize and put away goods in an organized manner, thus improving product search and retrieval. It is noted that there are benefits to the use of racking systems as some studies have shown that effective racking use can cut picking time by up to 50%, which directly improves warehouse efficiency. Therefore, racking systems position products systematically, facilitating the visual search and systematic identification of goods. Moreover, the storage configurations that allow for clear dividing of products also facilitate optimal access to all pallets. This, in turn, improves the flow of goods and handling time, making operations, especially in high volume e-commerce fulfilment centers maximum.

RESTRAINTS:

High upfront costs of warehouse racking, especially automation, may limit adoption by smaller players, despite used options and financing.

Warehouse racking systems often require a significant investment in the purchase and installation, especially when it comes to automated racking systems. As such, it may present a burden to smaller businesses and startup companies that operate on a tight schedule and budget. While used racking systems and various financing solutions are designed to ease the financial burden, quality and reliability concerns surrounding these solutions are often present. Used racking systems should not be used in an automatic operation unless its functional state has been checked due to safety and reliability concerns. Even if the above options raise concerns, investing in a racking storage system is beneficial to any kind of business. Quality racking systems are capable of substantially increasing the storage capacity and density, operational workflows, and are usually scalable, which can support business growth and keep the business competitive on the market.

KEY MARKET SEGMENTATION

By Product

- Selective Pallets

- Drive-in

- Push Back

- Pallet Flow

- Cantilever

- Others

In 2023, the selective pallet rack is the segment that dominated the market amassing a greater part totalling over 45.2% of the global revenue. The reason this segment dominates the market is that it includes a cost-effective design and both small and large selective pallets with a large number of accessories. This type of racking is used in standard storage and general utility. The segment’s growth is due to wide and appropriate use in a variety of industries.

By Application

- Automotive

- Food & Beverage

- Retail

- Packaging

- Manufacturing

- Others

Retail application had the largest share in the year 2023, accounting for over 34.42% of the global revenue. The reason for this dominance is because the number of retail premises has recently increased in the form of warehouses, supermarkets, hypermarkets and others. Using miscellaneous racks in retailers’ warehouses allows better use of the available spaces and the consequent proper organization of products increasing customer satisfaction level. High-density storage systems are however much needed in food and beverage warehouses. Suitable racking clustering multiple levels of storage and rail-based systems are needed for the warehouses to run effectively.

Need any customization research on Warehouse Racking Market - Enquiry Now

REGIONAL ANALYSIS:

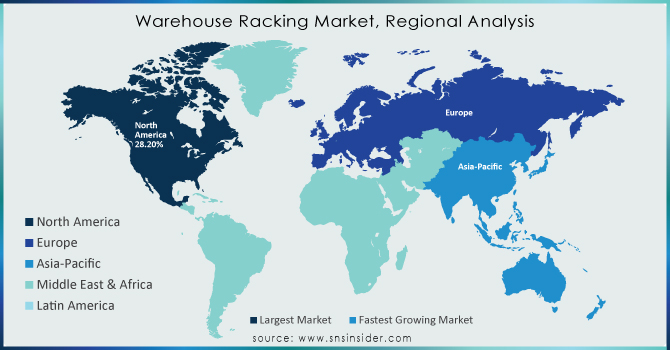

North America leads the warehouse racking market, holding a share of about 28.2% of the aggregate revenue in 2023. The early implementation of warehouse racking systems has facilitated the region in setting a solid footing to expand further. In addition, the demand for wholly automated warehouses is another factor that creates immense prospects for the market. Due to the large number of customers of the ever-growing e-commerce industry across the region, there is a need for strong warehouse infrastructures. Besides, the expansion of construction-oriented activities is expected to fuel the market by developing more warehouses and replacing out dated storage and retrieval technologies.

Asia-Pacific is the fastest-growing market in 2023. The major factors attributing to the industry’s rapid growth include the phenomenon of industrialization, urbanization and the emergence of a burgeoning e-commerce sector. Due to the same, countries like China, India and Southeast Asian nations are experiencing high increments in their e-commerce activities and this creates a high demand for warehouse and effective logistics handling systems. The growth in the number of manufacturing units and investments in the sector of logistics and supply-chain management aid the growth of the warehouse-racking market in the Asia-Pacific region.

REGIONAL COVERAGE

North America

- US

- Canada

- Mexico

Europe

- Eastern Europe

- Poland

- Romania

- Hungary

- Turkey

- Rest of Eastern Europe

- Western Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Switzerland

- Austria

- Rest of Western Europe

Asia Pacific

- China

- India

- Japan

- South Korea

- Vietnam

- Singapore

- Australia

- Rest of Asia Pacific

Middle East & Africa

- Middle East

- UAE

- Egypt

- Saudi Arabia

- Qatar

- Rest of the Middle East

- Africa

- Nigeria

- South Africa

- Rest of Africa

Latin America

- Brazil

- Argentina

- Colombia

- Rest of Latin America

Key players

Some of the major key players in the warehouse racking market are Daifuku Co., Ltd., Mecalux S.A., Kardex Group,, Hannibal Industries, Inc., Emrack International,, Jungheinrich AG, AK Material Handling Systems, SSI SCHAEFER Group, Dematic, Toyota Industries Corp. and other players.

Recent Development

In September 2023: For a leading automation solutions provider KION Group, one of the largest automation projects in Central Europe was successfully completed. This project involved pallet stackers for automated aisle movement, conveyor belts for small load carriers, and an in-line product quality check system. The entire operation requires minimal manpower – only one supervisor per shift.

In May 2023: A manufacturer of warehouse racking systems Steel King Industries, Inc. opened their new headquarters in Stevens Point, Wisconsin. The location, almost three times larger than the previous headquarters, allows the company to more effectively present its products and services.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 9.29 Billion |

| Market Size by 2032 | US$ 13.51 Billion |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by-product (Selective Pallets, Drive-in, Push Back, Pallet Flow, Cantilever, Others), • by Application ( Automotive, Food & Beverage, Retail, Packaging, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daifuku Co., Ltd., Mecalux S.A., Kardex Group,. Hannibal Industries, Inc., Emrack International, Jungheinrich AG, AK Material Handling Systems, SSI SCHAEFER Group, Dematic, Toyota Industries Corporation. |

| Key Drivers |

• The rise in online shopping has created a demand for efficient storage solutions for warehouses to function properly. • Systematic organization with racking systems leads to faster product identification, picking, and order completion. |

| RESTRAINTS | • High upfront costs of warehouse racking, especially automation, may limit adoption by smaller players, despite used options and financing. |