North America Electrostatic Precipitator Market Report Scope & Overview:

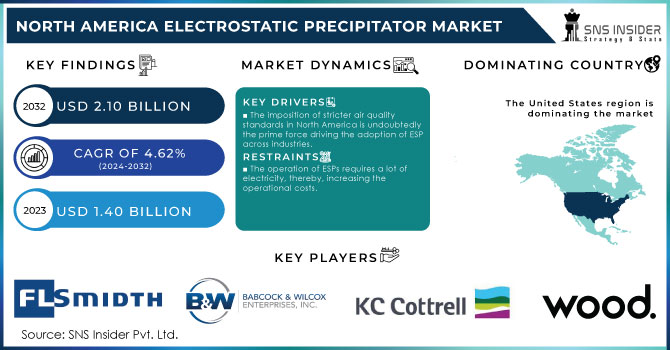

The North America Electrostatic Precipitator Market size was estimated at USD 1.40 billion in 2023 and is expected to reach USD 2.10 billion by 2032 at a CAGR of 4.62% during the forecast period of 2024-2032.

The North America Electrostatic Precipitator Market demand is increasing due to rising industrial activities and strict regulations in the area of reducing air pollution. Electrostatic precipitators are very effective types of filtration systems that can eliminate fine particulate matter from industrial emissions. It is significant as the modern industry and the mining sector use such materials. In other words, industries, such as power generation, cement, steel, and various types of chemicals, will need to invest in ESPs to comply with the standards established by the EPA and similar organizations.

The North America Electrostatic Precipitator Market, the scope of which includes diverse applications across various industries. The power generation requires ESPs that would help control emissions from the coal power plants which represents 40% of the market. The cement industry needs ESPs to collect the dust minerals during the manufacturing of the cement which comprises of 25% of the volume in the North America Electrostatic Precipitator Market. The steel industry uses the ESPs to control the emissions from the blast furnaces which accounts for the remaining 20% of the volume. The rest of the 15% is used for the chemical industries where uses are to control the emissions from the production and other processing sectors of a company

To get more information on Electrostatic Precipitator Market - Request Free Sample Report

The demand for advanced emission control technologies as a result of several key factors promoting awareness of air pollution and its adverse impact on health and the environment is driving the growth of the ESPs market. The industrial safety norms and environmental protection laws implemented by governments to reduce emissions are driving the demand for ESPs. Innovations like high efficiency ESP, the introduction of IoT for monitoring ESPs and their maintenance are anticipated to boost the North America ESP market’s growth. The increasing rate of industrialization and urbanization in developed countries, as well as Mexico, are driving the growth of the electrostatic precipitator market. As industries continue to expand and grow advanced, the demand for ESP is expected to grow in the high point during the forecast.

Market Dynamics

Drivers

-

The imposition of stricter air quality standards in North America is undoubtedly the prime force driving the adoption of ESP across industries.

Stricter air quality standards in North America are having a profound effect on the adoption of Electrostatic Precipitators across a multitude of industries. The United States Environmental Protection Agency and the Canadian Environmental Protection Act have created stringent regulations to curb air pollution and improve people’s health. Among other regulations, these organizations have mandated the power generation, cement, and chemical industries to reduce particulate emissions. ESPs achieve very high efficiencies for fine particles over 99%, which makes them an effective solution for achieving cleanliness standards. Their principle of operation is based on giving the emitted particles of the industrial gases an electric charge. The plates with the opposite charge then accumulate the particles in the process called precipitation. By electing to use ESPs for pollution control, industries ensure they remain operational mustering into compliance means avoiding fines and legal measures.

-

The expanding industrial base and increasing power demand are boosting the need for efficient pollution control solutions like ESPs.

The expanding of industrial base and increasing the power demand is the major driver accounting for the increasing utilization of Electrostatic Precipitators. The increasing industrial applications and the growing power demand of the expanding industrial base are accompanied by the growing emissions of industrial pollutants. The industrial expansion both in manufacturing and mining, and power production increases the particulate matter which can be the major factor contributing to the deterioration of air both in terms of quality and quantity. The application of ESP ensures cleaner emissions which causes the people need not to worry about the nature and the environment. Moreover, urbanization and the increasing economic conditions throughout the world has boosted the power demand of the growing population. There are number of power generation units are increasing to cater the power demand of the increasing population. Power plants are the major contributor of environmental pollution. ESP help the power plants to have quick separation of particles from the emitted gas which helps maintaining the cleaner emission of the power generation unit. The combination of the reasons both the increasing power demand of the expanding population and the growing industrial base are the major factor accounting for the increasing utilization of ESP.

Restrain

-

The operation of ESPs requires a lot of electricity, thereby, increasing the operational costs.

The process of the operation of electrostatic precipitators involves the use of a huge amount of electricity, so that it is a fundamental factor behind their activity that influences the cost factor. For ESPs to work properly and to capture dust particles from the industrial gas flow, they should apply a high-voltage electrical field to electrically charge these particles. The continuous consumption of electricity is directly associated with the need to operate ESPs and to meet the conditions necessary for the treatment of industrial gas flow. Electricity consumption generates significant costs. Therefore, when evaluating the activity of ESPs, these facilities become involved in certain cost concerns. The use of a huge amount of electricity negatively affects the financial conditions of activity of critical sources as well as, which worsens environmental conditions due to the use of electrical energy that is traditionally produced from fossil fuel. In general, it increases the operational costs of the electricity operation due to greater attention to the level of energy used and the maintenance of a comfortable environment in the practical functioning of the industry.

-

ESPs may struggle to efficiently capture very small particulate matter compared to newer technologies.

Electrostatic precipitators are more effective than other available technologies at separating larger particulate matter from emissions. However, they fail to perform the same way with finer particulate matter, which is less than 2.5 micrometers in diameter. It is less effective to collect these smaller particles because the electrical charging mechanism becomes less accurate and is less efficient at capturing it. Meanwhile, there are newer and more effective alternatives to existing technologies, such as fabric filters, or baghouses, and advanced wet scrubbers. They employ mechanical filtration and liquid scrubbing, respectively, which offer higher efficiency. The equipment meets the highest environmental standards and is more commonly used to avoid difficult-to-control particulate matter. Industries are also increasingly considering these advanced alternatives in order to comply with more stringent emission standards.

Key Market Segmentation

By Type

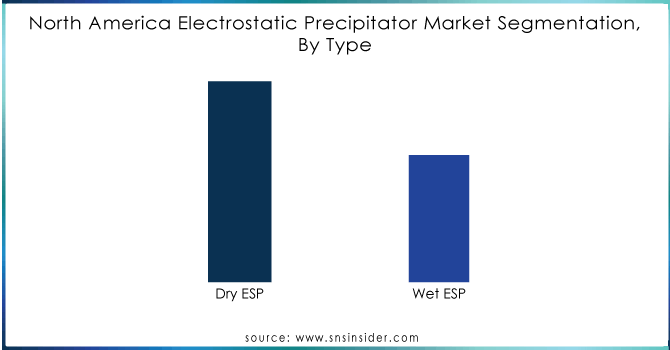

The dry segment dominated the market of over 62% in 2023, due to its resistance to high temperature and high particulate volume, cost-effectiveness, and low electricity consumption. Hardware offering has also accounted for the largest market share of the North America electrostatic precipitator market.

Need any customization research on Electrostatic Precipitator Market - Enquiry Now

By Offering

The hardware offering market held the largest share of over 42.22% in 2023, the North America electrostatic precipitator market. The core function of an ESP involves the handling of electrical charges to remove particulate matter from gas streams.

By End User

The power generation industry has also accounted for the largest share of over 24.18% in 2023, the North America electrostatic precipitator market. There are different power generation and refining companies across the globe which use electrostatic precipitators. Power generation companies have processed with the installation of these systems because of the benefits which they derive in terms of performance, better particulate collection efficiency, and ability to handle a large capacity of fly ash. This has been fueled by the strict environment laws and regulated emission which has also increased the use of these systems in thermal power plants and petroleum refineries.

Regional Analysis

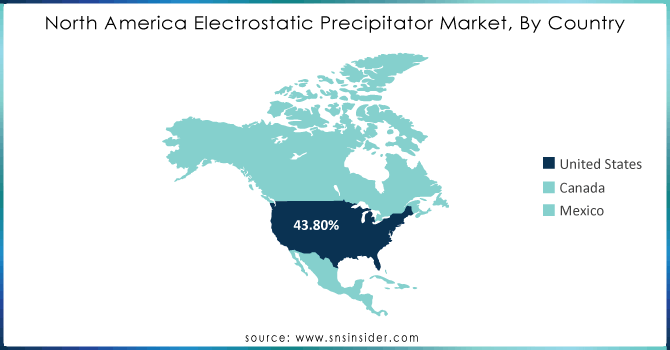

The United States dominated the market in 2023 with a market share of over 43.80% and will continue to flourish its trend of dominance during the forecast period. The countries high number of power plants is the major factor attributable to the dominance. Additionally, the manufacturing units and industries have invested in high-end technology such as ESP which helps to minimize the pollutant. This will help grow ESP in North America.

Key Players

The major Key Players are FLSmidth, Babcock and Wilcox Enterprises, Inc., John Wood Group PLC, KC Cottrell, Thermax Limited., Sumitomo Heavy Industries Ltd, Siemens, Mitsubishi Hitachi Power Systems, Ltd., Alstom, BALCKE-DÜRR GmbH, Mechatronics Systems, Clean Tunnel Air, Ducon Technologies, TAPC, Trion, and others.

Recent Development

In 2021: The mining and mineral processing division of ThyssenKrupp was purchased by FLSmidth and ThyssenKrupp Industrial Solutions AG. The combination created a global mining technology leader with operations from pit to plant, strengthening crucial client relationships with a complementary product line and clientele and providing more comprehensive geographic coverage. This acquisition has helped the business become more valuable in the local mining sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 1.40 Billion |

| Market Size by 2032 | US$ 2.10 Billion |

| CAGR | CAGR of 4.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design (Plate and Tubular) • By Type (Dry ESP, Wet ESP) • By Offering (Hardware and Software, Services) • By Application (Coal Fired Generation, Electric Arc Furnaces, Gas Turbines, Solid-Waste Incinerators, Industrial Powers, Others) • By Conditioning Agent (Sulfur Trioxide, Ammonium Sulfate, Triethylamine, Sodium Compounds, Transition Metals, Others) • By End User (Power Generation Industry, Cement, Manufacturing, Marine, Metals Processing and Mining, Chemicals and Petrochemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLSmidth, Babcock and Wilcox Enterprises, Inc., John Wood Group PLC, KC Cottrell, Thermax Limited., Sumitomo Heavy Industries, Ltd, Siemens, Mitsubishi Hitachi Power Systems, Ltd., Alstom, BALCKE-DÜRR GmbH, Mechatronics Systems, Clean Tunnel Air, Ducon Technologies, TAPC, Trion, |

| Key Drivers | • The imposition of stricter air quality standards in North America is undoubtedly the prime force driving the adoption of ESP across industries. • The expanding industrial base and increasing power demand are boosting the need for efficient pollution control solutions like ESPs. |

| RESTRAINTS | • The operation of ESPs requires a lot of electricity, thereby, increasing the operational costs. • ESPs may struggle to efficiently capture very small particulate matter compared to newer technologies. |