Waterproofing Chemicals Market Report Scope & Overview:

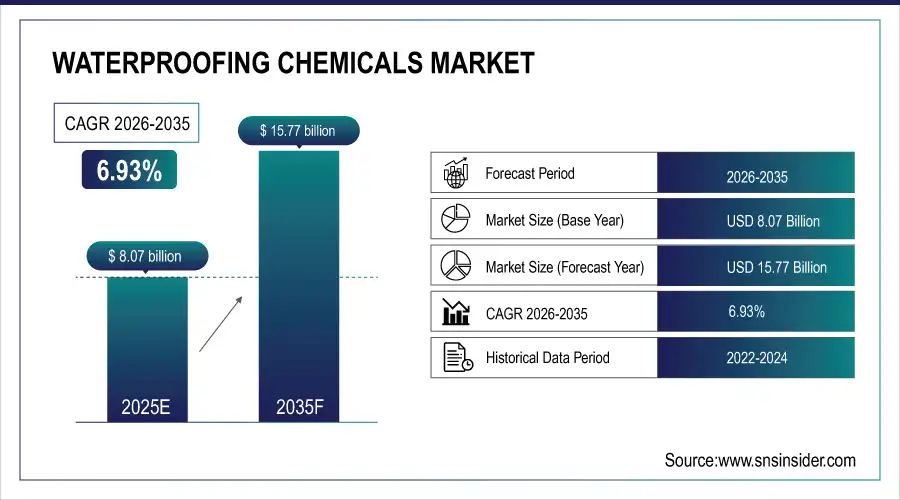

Waterproofing Chemicals Market was valued at USD 8.07 billion in 2025 and is expected to reach USD 15.77 billion by 2035, growing at a CAGR 6.93% of from 2026-2035.

The waterproofing chemicals market is experiencing sustained growth driven by rapid urbanization, expanding infrastructure development, and rising awareness of building durability and lifecycle cost reduction. Increasing investments in residential, commercial, and large-scale infrastructure projects are accelerating demand for advanced waterproofing solutions. Growing emphasis on sustainable construction and regulatory compliance is further supporting market expansion.

Waterproofing chemicals adoption increased by around 6.9% in 2025, driven by strong construction activity, infrastructure development, and rising renovation demand across key regions.

Waterproofing Chemicals Market Size and Forecast

-

Market Size in 2025: USD 8.07 Billion

-

Market Size by 2035: USD 15.77 Billion

-

CAGR: 6.93%

-

Base Year: 2025

-

Forecast Period: 2026-2035

-

Historical Data: 2022-2024

To Get more information On Waterproofing Chemicals Market - Request Free Sample Report

Trends in the Waterproofing Chemicals Market

-

Growing use of integral crystalline admixtures for internal concrete waterproofing

-

Increasing preference for single-component, ready-to-use waterproofing solutions

-

Rising adoption of climate-resilient waterproofing systems for extreme weather conditions

-

Expansion of digital specification tools and BIM-based waterproofing design

-

Shift toward longer warranty, lifecycle-based waterproofing solutions

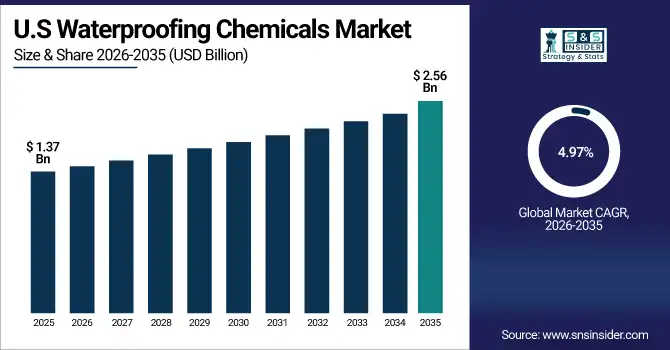

U.S. Waterproofing Chemicals Market Insights:

The U.S. Waterproofing Chemicals Market is projected to grow from USD 1.37 Billion in 2025 to USD 2.56 Billion by 2035, at a CAGR of 4.97%. Growth is driven by aging infrastructure renovation, rising residential and commercial construction, strict building codes, climate-related moisture risks, and increasing adoption of high-performance, durable waterproofing systems.

Waterproofing Chemicals Market Growth Drivers:

-

Rapid Urban Construction in Emerging Economies Fuelling Waterproofing Demand

Rising construction of residential and commercial buildings in emerging economies is a key growth driver for the waterproofing chemicals market. Emerging markets account for nearly 70% of global construction activity, supported by rapid urbanization and expanding middle-class populations. Residential buildings alone contribute around 45% of global waterproofing demand, as developers increasingly prioritize moisture protection to extend building lifespan

Waterproofing Chemicals Market Restraints:

-

Shortage of Skilled Applicators and Installation Inefficiencies Constraining Market Adoption

Lack of trained waterproofing applicators and improper installation practices significantly restrain the waterproofing chemicals market, particularly in developing regions. Industry estimates indicate that over 33% of waterproofing failures are linked to incorrect application or inadequate surface preparation, rather than product quality. Limited contractor training, inconsistent workmanship, and low awareness of system-specific installation requirements often result in leakages and reduced service life. These performance issues increase maintenance costs, discourage repeat adoption, and slow penetration of advanced waterproofing systems across cost-sensitive construction markets.

Waterproofing Chemicals Market Opportunities:

-

Large-Scale Infrastructure Development Accelerating Demand for Advanced Waterproofing Solutions

Rising infrastructure development worldwide is creating strong demand for high-performance and durable waterproofing chemicals. Infrastructure projects account for nearly 38% of total waterproofing chemical consumption, driven by tunnels, bridges, metro rail networks, and smart city developments. Increasing construction of underground structures and transportation corridors requires long-lasting protection against water ingress and structural deterioration. Governments are emphasizing asset longevity and reduced maintenance costs, accelerating adoption of advanced membranes, polymer-based systems, and integral waterproofing solutions across large-scale infrastructure projects.

Waterproofing Chemicals Market Segment:

-

By Product Type: In 2025, membranes dominated the market with 52% share, while coatings are expected to be the fastest-growing segment, during 2026–2035.

-

By Technology: In 2025, polymer-based waterproofing led the market with 46% share, while cement-based waterproofing systems are projected to witness fastest growth during 2026–2035

-

By Application: In 2025, roofing and terraces accounted for the largest share at 34%, while basements and foundations are anticipated to be the fastest-growing application during 2026–2035

-

By End User: In 2025, residential construction dominated the market with 41% share, while infrastructure projects are expected to grow at the fastest pace during 2026–2035.

-

By Form / Installation Type: In 2025, sheet & roll membrane systems held 58% market share, while liquid-applied waterproofing systems are projected to register the highest CAGR during 2026–2035.

Waterproofing Chemicals Market Segment Analysis:

By Product Type: Membranes Lead as Liquid-Applied Coatings Emerge as Fastest-Growing Segment

Membranes dominate the product type segment due to their high durability, strong water resistance, and extensive use in roofing, basements, and large infrastructure projects. Bituminous and polymeric membranes are widely adopted for their proven performance and long service life.

Liquid-applied waterproofing coatings are the fastest-growing product type, driven by ease of application, seamless coverage, and suitability for complex geometries. Growing demand from residential construction, renovation projects, and rapid repair applications is accelerating adoption.

By Technology: Polymer-Based Waterproofing Leads as Cement-Based Systems Show Rapid Growth.

Polymer-based waterproofing technologies dominate the market owing to superior flexibility, crack-bridging capability, and long-term durability. These systems are extensively used in commercial buildings and infrastructure projects exposed to harsh environmental conditions.

Cement-based waterproofing systems are the fastest-growing technology segment in the forecasted period, supported by their cost-effectiveness, ease of application, and rising use in residential buildings, water tanks, and basements, particularly in emerging economies.

By Application: Roofing & Terraces Dominate as Basements & Foundations Grow Fastest.

Roofing and terraces account for the largest application share due to high exposure to weather conditions and increasing adoption of preventive waterproofing in residential and commercial buildings. Frequent roof leakage issues further sustain demand.

Basements and foundations represent the fastest-growing application segment, driven by rising urban construction, underground infrastructure development, and increasing awareness of structural protection against groundwater seepage

By End User: Residential Construction Leads as Infrastructure Projects Accelerate.

Residential construction dominates the end-use segment, supported by rapid urbanization, housing demand, and growing consumer awareness regarding moitsure protection and building longevity.

Infrastructure projects are the fastest-growing end-use segment, fuelled by large-scale investments in bridges, tunnels, metros, highways, and smart city developments requiring high-performance waterproofing solutions.

By Form / Installation Type: Sheet & Roll Membranes Lead as Liquid-Applied Systems Expand Rapidly.

Sheet and roll membrane systems dominate the market due to their proven reliability, uniform thickness, and widespread adoption in large construction and infrastructure projects.

Liquid-applied waterproofing systems are the fastest-growing installation type, driven by labour efficiency, reduced material wastage, and increasing preference for seamless, easy-to-apply solutions in renovation and residential applications.

Waterproofing Chemicals Market – Regional Analysis:

North America Waterproofing Chemicals Market Insights:

North America represents a mature yet steadily growing waterproofing chemicals market, driven by large-scale renovation of aging infrastructure, stringent building codes, and rising demand for durable, high-performance construction materials. Strong adoption of polymer-based membranes and liquid-applied systems across residential and commercial buildings supports growth. Increasing climate-related risks such as heavy rainfall and flooding are further reinforcing demand for advanced waterproofing solutions across the United States and Canada.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Waterproofing Chemicals Market Insights:

Europe accounts for a significant share of the global waterproofing chemicals market, supported by strict regulatory standards, strong focus on sustainable construction, and widespread renovation of old buildings. Countries such as Germany, France, and the UK lead demand, driven by energy-efficient building initiatives and increased use of low-VOC, eco-friendly waterproofing materials in residential and commercial construction.

Asia-Pacific Waterproofing Chemicals Market Insights:

Asia-Pacific is the dominant and fastest-growing region in the waterproofing chemicals market, expected to grow at a CAGR of 9.16%, driven by rapid urbanization, large-scale infrastructure development, and expanding residential construction across China, India, and Southeast Asia. Government-led smart city projects, affordable housing schemes, and rising awareness of structural durability are accelerating adoption of membranes and polymer-based waterproofing solutions.

Latin America Waterproofing Chemicals Market Insights:

Latin America is an emerging market driven by urbanization and residential construction in Brazil and Mexico, while economic volatility and limited adoption of advanced waterproofing technologies continue to moderate overall growth.

Middle East & Africa Waterproofing Chemicals Market Insights:

The Middle East & Africa market is supported by large infrastructure and commercial projects in GCC countries and extreme climatic conditions, though limited skilled labour and budget constraints in parts of Africa restrict broader market penetration.

Waterproofing Chemicals Market Competitive Landscape:

Sika AG, headquartered in Baar, Switzerland, is a global leader in the waterproofing chemicals market, offering a comprehensive portfolio of membranes, liquid-applied systems, sealants, and admixtures. The company’s strong emphasis on polymer-based and sustainable waterproofing solutions supports applications across residential, commercial, and large-scale infrastructure projects. Sika’s extensive global footprint, continuous innovation, and integration of waterproofing within complete construction systems strengthen its market leadership.

-

In 2024: Sika expanded its sustainable waterproofing product range, focusing on low-VOC liquid membranes and enhanced durability solutions for infrastructure and roofing applications.

MBCC Group (formerly BASF Construction Chemicals), headquartered in Mannheim, Germany, is a key player in waterproofing chemicals, offering high-performance membranes, coatings, and concrete admixtures. The company focuses on durability, structural protection, and lifecycle cost reduction, particularly in infrastructure and industrial applications. MBCC Group’s technical expertise and strong presence in emerging markets support consistent demand growth.

-

In 2024: MBCC Group enhanced its waterproofing portfolio with advanced polymer-modified systems designed for extreme climate and infrastructure applications.

Saint-Gobain, headquartered in Courbevoie, France, plays a significant role in the waterproofing chemicals market through its construction chemicals and building materials portfolio. The company delivers advanced waterproofing membranes, coatings, and integrated building envelope solutions, catering to energy-efficient and green building requirements. Saint-Gobain’s strong focus on innovation, sustainability, and system-based offerings drives adoption across residential and commercial construction.

-

In 2024: Saint-Gobain strengthened its construction chemicals segment by expanding waterproofing solutions aligned with sustainable building standards and renovation-driven demand.

Waterproofing Chemicals Market Key Players

-

Sika AG

-

BASF SE

-

RPM International Inc.

-

MAPEI S.p.A.

-

Fosroc (JMH Group)

-

Pidilite Industries Ltd.

-

Arkema Group

-

Wacker Chemie AG

-

Carlisle Companies Inc.

-

GAF (Standard Industries)

-

Johns Manville (Berkshire Hathaway)

-

Soprema Group

-

The Sherwin-Williams Company

-

Henkel AG & Co. KGaA

-

Tremco CPG Inc.

-

MBCC Group (formerly BASF Construction Chemicals)

-

Köster Bauchemie AG

-

Oriental Yuhong Waterproof Technology Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 8.07 Billion |

| Market Size by 2035 | USD 15.77 Billion |

| CAGR | CAGR of 6.93% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type: (Membranes, Coatings, Sealants, Waterproofing Admixtures) • By Technology: (Cement-Based Waterproofing, Bitumen-Based Waterproofing, Polymer-Based Waterproofing) • By Application: (Roofing & Terraces, Basements & Foundations, Bathrooms & Balconies, Water Tanks & Reservoirs, Tunnels & Infrastructure) • By End User: (Residential Construction, Commercial Buildings, Industrial Facilities, Infrastructure Projects) • By Form / Installation Type: (Liquid-Applied Waterproofing Systems, Sheet & Roll Membrane Systems) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Sika AG, BASF SE, Saint-Gobain, RPM International Inc., MAPEI S.p.A., Fosroc, Pidilite Industries Ltd., Arkema Group, Wacker Chemie AG, Dow Inc., Carlisle Companies Inc., GAF (Standard Industries), Johns Manville, Soprema Group, The Sherwin-Williams Company, Henkel AG & Co. KGaA, Tremco CPG Inc., MBCC Group, Köster Bauchemie AG, Oriental Yuhong Waterproof Technology Co., Ltd. |