Waterproofing Membrane Market Report Scope & Overview:

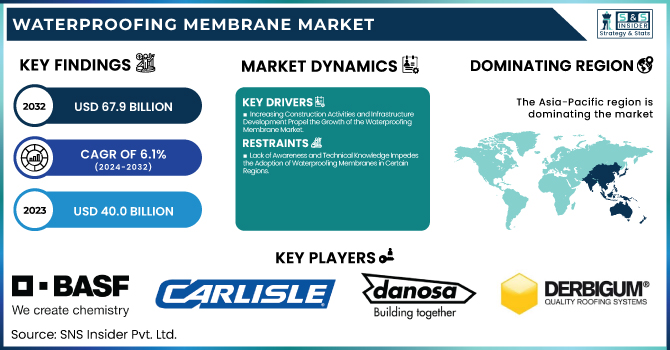

The Waterproofing Membrane Market size was valued at USD 40.0 Billion in 2023 and is expected to reach USD 67.9 Billion by 2032, growing at a CAGR of 6.1% over the forecast period 2024-2032.

To Get more information on Waterproofing Membrane Market - Request Free Sample Report

Waterproofing Membrane Market is witnessing rapid growth with significant demand from the construction industry. Our report consists of supply chain analysis of the key materials along with pricing trends, regulatory and compliance information with respect to building codes, cost-benefit analysis of different membrane types, and customer preference along with environmental sustainability, R&D innovations, and construction industry trends.

Waterproofing Membrane Market Dynamics

Drivers

-

Increasing Construction Activities and Infrastructure Development Propel the Growth of the Waterproofing Membrane Market

The growth of global construction activities, especially in developing countries, is propelling the demand for waterproofing membranes. They are used in residential, commercial, and industrial construction to prevent water ingress and improve the structural strength of the elements. The rapid growth of urbanization and the necessity for sustainable infrastructure are significant factors contributing to the market expansion. A growing number of infrastructure projects such as roads, bridges, and tunnels among others are leading the demand for quality waterproofing solutions. Moreover, the rising penetration of waterproofing membranes is due to the increasing need for sustainable structures with a long lifecycle and low maintenance costs. They are practical and affordable, protecting from outside elements, but also an easy and quick solution for the modern world. As trends in construction to meet the needs of the population and urban planning continue to expand globally, this growing demand is estimated to remain constant.

Restraints

-

Lack of Awareness and Technical Knowledge Impedes the Adoption of Waterproofing Membranes in Certain Regions

In some areas, especially in developing countries, poor awareness and technological knowledge of the waterproofing membranes may act as a major obstacle. Most people involved in the construction business or consumers do not have complete awareness of the potential benefits and the scope of applying waterproofing membranes, thus, underutilizing these advanced technologies. Proper training in the right installation techniques also ensures that applications are done properly, thereby making the membranes less effective and not long-lasting. This problem is further compounded by the fact that low-cost alternatives are available and may seem to be more attractive to budget-conscious construction companies. The adoption rate of waterproofing membranes is, therefore, slower in regions with limited knowledge and awareness of these products.

Opportunities

-

Growth in Green Building Certifications and Sustainable Infrastructure Opens Market for Eco-Friendly Waterproofing Membranes

The growing green building certifications and sustainable infrastructure development an exciting opportunities for the waterproofing membrane market. Due to the strict environmental regulations, more countries will be adopting it, and subsequently, the demand for sustainable construction materials will grow. Waterproofing membranes that feature eco-friendly properties, such as recyclability, energy efficiency, and low environmental impact, become essential in the green building certification known as LEED (Leadership in Energy and Environmental Design). The companies will be able to capture large parts of the market share if the manufacturers invest more in the creation of sustainable membranes that fit well with the established building standards of architects, builders, and developers. It should open up newer avenues for markets and products during this period.

Challenge

-

Fluctuations in Raw Material Prices Pose Challenges to Waterproofing Membrane Manufacturers’ Profitability

Fluctuations in the prices of raw materials pose a major challenge to the manufacturers in the waterproofing membrane market. The main products applied to produce these waterproofing membranes, such as bitumen, PVC, and polyurethane, are volatile, in terms of supply chain and market dynamics. Thus, these price fluctuations can leave an impact on the production cost, affecting the manufacturer's margins. The sudden surge in raw material prices is another challenge for companies, which affects how competitive the price can be for their business. The best method to overcome this challenge is to find alternative materials, improve upon the production process, and have long-term supply agreements for stability in costs. Most of these methods would take time to implement, with companies open to short-term price increases through hikes.

Waterproofing Membrane Market Segmental Analysis

By Product Type

In 2023, the Liquid-applied Membranes segment dominated the Waterproofing Membrane market with a market share of 45%. Within this segment, Bituminous liquid-applied membranes are the largest subsegment with approximately a 35% share. They are preferred for the long-lasting membrane system that can be easily applied on-site and are also cheaper to install than other systems in case of large-scale implementation like tunnels, bridges, and roofs. Bituminous membranes are durable water barriers and ultraviolet resistant so they are very condition amenable. This dominance is attributed to rising construction demand in residential and commercial sectors and a growing focus on cost-effective and long-lasting waterproofing techniques.

By Raw Material

In 2023, the Modified Bitumen segment dominated the market and accounted for a share of around 40%. Modified bitumen is the most used adhesive, flexible, and lasting material that is chosen for a variety of construction and infrastructure projects that need to be built to last even the harshest of climates. Modified bitumen membranes are commonly used for residential and commercial buildings. They are adopted for their ability to withstand thermal expansion and contraction. This segment is also propelled by government-supported sustainability initiatives and infrastructural development projects, as modified bitumen provides a durable solution and complies with environmental performance metrics.

By Technology

In 2023, the Cold Liquid Applied technology dominated and held approximately 50% share in the Waterproofing Membrane Market. The main advantage of this technology is its application flexibility and that it creates completely bonded, smooth, and weld-free waterproofing layers without applying heat or flame. Cold-applied membranes are generally used for roofing and water management systems projects requiring flexibility and moisture protection. This technology has become dominant due to its growing demand in new construction and refurbishment projects because it has environmental benefits as it does not require high-energy-consuming processes like heating and melting bitumen.

By Construction Type

In 2023, the New Construction segment dominated and held the largest market share of approximately 60% of the market. Rising construction activities globally and an increase in the number of residential, commercial, and industrial developments result in high-performance waterproofing products demand. That is, new builds generally contain the largest installations of modern waterproofing that would help keep them viable for years to come. Urbanization and government incentives for infrastructure development in emerging markets are the primary drivers for new construction to lead the market. The growing need for green building and sustainable infrastructure construction is another factor that accelerates the demand for effective waterproofing solutions in new constructions.

By Application

In 2023, the Roofing application dominated and accounted for more than 40% market share and is anticipated to remain dominant in the Waterproofing Membrane Market. Waterproofing membranes are the primary force against water entering buildings via the roof and are a key component of any solution to keep the framework safe and ensure longevity. Common in residential and commercial building roofs with high rain, these membranes. This segment is expected to remain dominant in the coming years owing to the growing need for energy-efficient, long-lasting, and low-maintenance roofing systems. Furthermore, many developing nations have stringent building codes set by the government to ensure proper waterproofing methods for roofs, hence contributing to the further increase in market growth.

By End-User Industry

In 2023, the Infrastructure segment dominated and accounted for the largest market share of 35% in the Waterproofing Membrane Market. Infrastructure projects like bridges, tunnels, roads & dams require strong waterproofing solutions due to potential water damage & corrosion to critical structures. This segment has been on the lead gaining its share due to high demand for sustainable infrastructure coupled with large-scale construction projects being undertaken by the government. Additionally, the increased attention on the renovation and enhancement of current infrastructure further drives the formation of high-performance waterproofing membranes, which can protect against water intrusion and environmental deterioration.

Waterproofing Membrane Market Regional Outlook

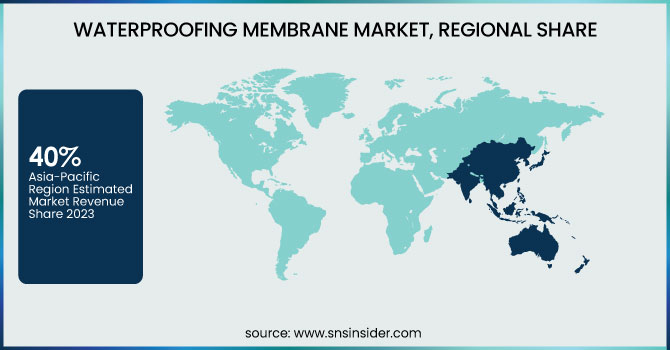

Asia-Pacific dominated the Waterproofing Membrane Market in 2023, accounting for 40% of the market share. China, India, and Southeast Asia recorded growth with high rates of urbanization, good infrastructure investment, and construction activity. China had 55% of regional shares because of mega projects like high-speed rail networks and smart cities. Consequently, it is followed by India, where waterproofing solutions have been boosted through initiatives like Housing for All and Smart Cities Mission. Advanced waterproofing technologies and stringent building regulations on high-performance membranes in Japan and South Korea have also led to regional market growth. Furthermore, regionally, increased eco-friendly waterproofing material preferences have been supported by government policies favoring green building certifications.

Followed by Asia Pacific, North America is the second leading region in the Waterproofing Membrane Market, gaining 28% of the market share in 2023. The market was boosted by environmental regulations, sustainable constructions, and the requirement for energy-efficient solutions. The U.S. led the way with 70% of the regional market, furthered by the presence of leading manufacturers such as GAF, Carlisle Companies, and Firestone Building Products. Government investments, particularly under the Bipartisan Infrastructure Law (BIL), drove an increased demand for waterproofing membranes in bridges, tunnels, and smart cities. Canada responded by expanding urban infrastructure projects with rapidly increasing demand for green roofing systems. In Mexico, waterproofing membranes are increasingly applied to commercial and industrial projects, in large part due to multinational expansion and rising building standards.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Recent Highlights:

-

May 2024: A Smart, green, and safer waterproofing system was launched combining sustainable materials and superior methods to enhance the water-resistant properties of buildings. This technology sought to tackle climate issues and was enabled by some key infrastructure projects to improve the longevity of waterproofing systems.

-

August 2023: Sika announced the acquisition of Chema, a manufacturer from Peru, complementing the mortar product portfolio. This acquisition enhanced Sika's positioning in Peru, extended the distribution network, and provided cross-selling opportunities for Sika products such as sealants, adhesives and waterproofing solutions.

-

March 2023: Bostik introduces SEAL & BLOCK waterproofing solutions in India for construction applications Proving their commitment to the Indian market, the launch simultaneously met the demands for more effective waterproofing technologies.

Key Players

-

BASF SE (MasterSeal 581, MasterTop 1320, MasterEmaco S 488 CI)

-

Carlisle Companies, Inc. (TPO Membranes, EPDM Membranes, Barricade Vapor Retarders)

-

CICO Technologies Ltd. (CICO Waterproofing Compound, CICO Super Latex, CICO Waterproof Coating)

-

Danosa (Danosa Bituminous Membrane, Danosa HDPE Geomembranes, Danosa PVC Membrane)

-

Derbigum Americas Inc. (Derbigum Standard, Derbigum APP, Derbigum SBS)

-

DowDuPont, Inc. (Tyvek Waterproofing Membranes, Tyvek Air and Water Barrier, DuPont Flashing Tape)

-

Firestone Building Products Company (RubberGard EPDM, UltraPly TPO, MetalWorks Roofing Systems)

-

Fosroc International Ltd. (Fosroc Supercast, Nitoseal, Fosroc Waterproofing Solutions)

-

Fosroc Ltd. (Fosroc Hydrotite, Supercast PVC Waterstop, Dryseal Joint Sealing)

-

GAF Materials Corporation (GAF TPO, GAF EPDM, GAF Modified Bitumen)

-

GCP Applied Technologies, Inc. (Adprufe, Bituthene, Preprufe)

-

IKO Industries Ltd. (IKO Torch-on Membranes, IKO Armourroof, IKO Waterproofing Membranes)

-

Isomat S.A. (Isomat Superflex, Isomat EPDM Membrane, Isomat Thermobit)

-

Johns Manville Corporation (JM TPO Membranes, JM EPDM, JM PVC Membranes)

-

Kemper System America, Inc. (Kemperol V210, Kemperol 2K-PUR, Kemperol 1K-PUR)

-

KOSTER BAUCHEMIE AG (Koster Polysil, Koster KBE Liquid, Koster Waterproofing Systems)

-

MAPEI S.p.A. (Mapelastic, Planiseal, Aquaflex)

-

Paul Bauder GmbH & Co. KG (BauderTEC, BauderVap, Bauder Thermo)

-

RENOLIT SE (RENOLIT ALKORPLAN, RENOLIT ALKORDRAIN, RENOLIT ALKORSOLAR)

-

Sika AG (Sikaplan, SikaProof, Sikalastic)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.0 Billion |

| Market Size by 2032 | USD 67.9 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Liquid-applied Membranes [Cementitious, Bituminous, Polyurethane, Acrylic, Others], Fully Adhered Sheets [Bituminous, Polyvinyl Chloride (PVC), Ethylene Propylene Diene Monomer (EPDM), Others], Self-Adhering Membranes [Sheet Waterproofing Membranes, Bituminous, PVC, EPDM, Others], Others) •By Raw Material (Modified Bitumen, Polyvinyl Chloride (PVC), Acrylic, Polyurethane, Others) •By Technology (Cold Liquid Applied, Fully Adhered Sheet, Hot Liquid Applied, Loose Laid Sheet) •By Construction Type (New Construction, Refurbishment) •By Application (Roofing, Walls, Water Management, Tunnel Liners, Bridges, Others) •By End-User Industry (Residential, Commercial, Industrial, Infrastructure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sika AG, BASF SE, Fosroc International Ltd., MAPEI S.p.A., Carlisle Companies, Inc., GAF Materials Corporation, Johns Manville Corporation, Soprema Group, DowDuPont, Inc., Firestone Building Products Company and other key players |