Membranes Market Report Scope & Overview:

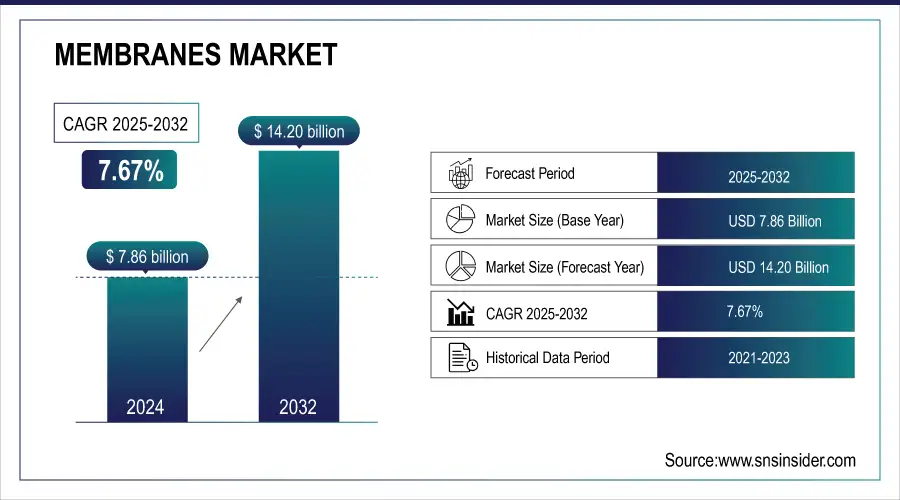

The Membranes Market size was valued at USD 7.86 Billion in 2024 and is expected to reach USD 14.20 Billion by 2032 expanding at a CAGR of 7.67% over the forecast period of 2025-2032. Energy-efficient filtration methods are gaining traction in different sectors to minimize the environmental impact and operational cost of industries. The use of membrane technologies, among others for water treatment and industrial separation, provides higher energy savings over thermal processes. Membranes use much less energy for separation because they rely on physical filtration instead of heat, making them financially and environmentally beneficial. Such a transition is particularly evident in energy-intensive industries such as chemical processing, food and beverage, and pharmaceuticals with increasing sustainability incentives. Consequently, it also means that membranes are now emerging as the technology of choice for companies looking to achieve efficiency and sustainability targets.

Get more information on Membranes Market - Request Sample Report

The U.S. Environmental Protection Agency (EPA) for example reports that the use of advanced membrane filtration systems can result in an energy reduction of up to 40% in wastewater treatment applications compared with conventionally thermal separation technologies, emphasizing efficiency improvements that have been enabled via membrane technologies.

Key Membranes Market Trends

-

Technological advancements in membrane materials, including ceramic and polymer innovations.

-

Rising demand for water treatment, desalination, and wastewater recycling.

-

Growing applications in biopharmaceuticals for drug production and purification.

-

Increasing use in the food and beverage industry for clarification, concentration, and purification.

-

Adoption driven by stricter environmental and health regulatory compliance.

-

Expansion of smart water management and IoT-integrated membrane systems.

-

Emphasis on sustainable and energy-efficient membrane solutions.

Membranes Market Growth Drivers

-

Scarcity of freshwater increasing popularity in the market.

-

Growing pharmaceutical & biomedical advancements in the membranes market.

Around the world, demand from a vibrant pharmaceutical and biomedical industry will continue driving growth in the membranes market. Membrane technologies are important for pharmaceutical and biomedical-related applications where a much higher level of precision, sterility, or purity is needed in the operations involved. Membranes play a stage key role in separating and purifying active ingredients, concentrating enzymes, antibodies and other substances of interest, as well as removing contaminants in pharmaceutical manufacturing. The increasing use of biologic drugs and gene therapies which are delicate and complicated in production have examined the pipeline demand for advanced filtration approaches provided by membrane. Membrane filtration, found in a range of industries, from pharmaceuticals to municipal water supply, is also critical for biomedical research where it grounds cell separation and protein isolation as well as tissue engineering with the aim to cultivate regenerative therapies and diagnostics.

According to the U.S. Food and Drug Administration (FDA), membrane-based filtration is required for sterilizing injectable drugs, which account for over 50% of biopharmaceuticals produced in the United States, demonstrating the critical role of membrane technology in maintaining stringent quality standards in drug production.

Membranes Market Growth Restraint

-

Rising capital costing in the membrane Industry.

The membrane industry faces challenges due to high capital costs. This discourages new players, making it dominated by establishing. Small companies struggling to compete with the high upfront investment needed to set up membrane modules for various applications. These hefty costs create a significant barrier to entry, limiting competition and innovation in the market. Established players leverage their economies of scale and existing infrastructure to further solidify their dominance. To overcome this hurdle, potential solutions include government incentives for new entrants, particularly those focused on innovation, or a strategic shift for smaller players to target niche markets with lower initial investment requirements.

Membranes Market Growth Opportunities

-

Focus on Wastewater Treatment and Regulating strict boundaries.

The US Environmental Protection Agency (EPA) has this trend with its stringent regulations. The Clean Water Act, a cornerstone of US water pollution control, targeted sources that discharge contaminants into water bodies. This act maintains stricter wastewater treatment standards and the use of advanced technologies like membrane filtration. These toxic pollutants can pose serious health risks and disrupt aquatic ecosystems. Membranes filter them out, ensuring cleaner wastewater discharge. Membrane filtration plays a major role in safeguarding public health by removing this harmful microbial wastewater.

Membranes Market Segment Highlights:

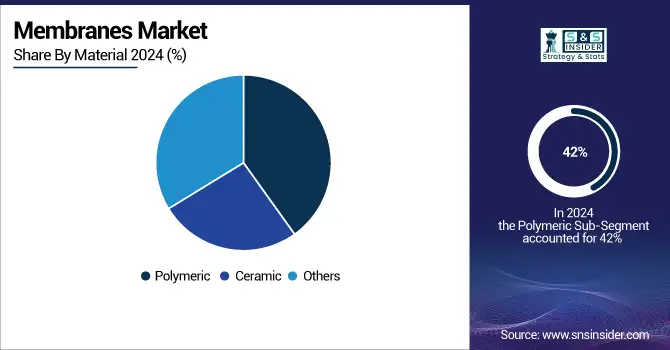

By Material

The polymeric held the largest market share around 42% in 2024. It has rising popularity due to polymeric materials (like PVDF, PES, and PA) which are the building blocks for most membranes. These polymers offer a powerful one-two punch: affordability and impressive performance. The PVDF, for instance, is a champion in both strength and chemical resistance, making it a popular choice. This cost advantage over ceramic membranes makes polymeric options the clear favorite for applications like water and wastewater treatment. This widespread adoption translates to polymeric materials holding the largest market share in the membrane industry.

By Technology

The nanofiltration (NF) seg-segment is the fastest growing within the membrane market in 2024 by technology. These wonder-workers excel at removing dissolved solids from water sources, making them invaluable for applications in various industries. From food & beverage purification to pharmaceutical processing, NF membranes are in high demand due to their exceptional selectivity properties. This, coupled with rising industrialization and a growing global population, is fueling the rapid expansion of the NF segment within the membrane market.

By Application

Water & wastewater treatment applications held the largest market share around 44% in 2024. Due to the increasing demand for clean water and strict environmental regulations worldwide. Water scarcity, especially in the developing part of the world, is a growing problem due to the rapid pace of industrialization, urbanization and population rise. Membrane filtration technologies including reverse osmosis, ultrafiltration, and nanofiltration play a pivotal role in treating and purifying municipal as well as industrial wastewater to facilitate recycling and reuse of water. By eliminating contaminants, chemicals, and pathogens, these technologies guarantee that wastewater released into the environment or reused in industrial processes complies with applicable regulations.

Membranes Market Regional Analysis

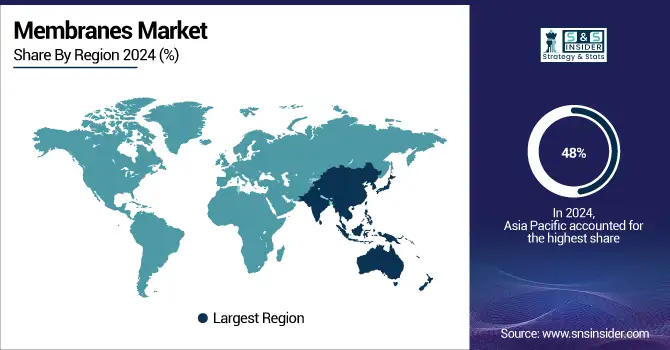

Asia Pacific Membranes Market Insights

The Asia Pacific membranes market has the largest share around 48% in 2024. It is due to rapid industrial growth, increasing urbanization, and increasing water scarcity in the Asia pacific regions China, India, and Japan are among those countries with high levels of industrial pollution, population density, and limited fresh water providing huge environmental challenges. This, in turn, has increased the demand for high-performance water and wastewater treatment solutions along with the increasing investments in water infrastructure by governments and environmental policies. These increasing demands have widely utilized membrane technologies that are one of the successful techniques in water purification and reuse for both municipal and industrial applications.

Moreover, significant developments of pharmaceutical, food and beverage, and chemical industries in Asia-Pacific include membrane filtration to control product purity and regulatory compliance. High-quality membrane systems are also in higher demand due to the growing biopharmaceutical industry in the region.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America Membranes Market Insights

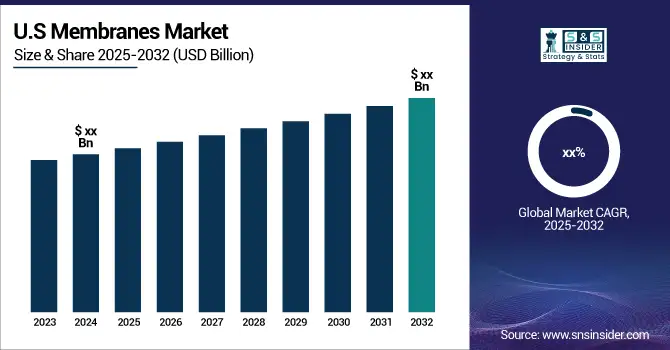

North America is well-established and growing significantly with high growth opportunities for membranes due to technological advancements and strong government regulations for water treatment and environmental protection. The US and Canada are the dominant countries in the region, as they are concentrating on advanced water purification, industrial application, and wastewater reuse. The heavy investment in infrastructure, the growing numbers of stringent regulations against clean water and the environment protection mainly stimulated the increasing reliance of the advanced membrane technologies.

Europe Membranes Market Insights

Europe constituted around 18.07% share of the membrane market – globally in 2024. The demand in the regional market is shaped by stringent environmental regulations, sustainability drives, and emphasis on cutting down industrial emissions and use of chemicals. Major countries such as Germany, France, and Italy are spending in green and energy efficient membrane technologies for water treatment, industrial processes, and the food & beverage applications. High-performance membranes, precision filtration and bio-based solutions are driving moderate growth for Europe’s stress ECO System, with an emphasis on innovation and compliance with regulations and environmental standards.

Latin America (LATAM) and Middle East & Africa (MEA) Membranes Market Insights

The Latin America (LATAM) and the Middle East & Africa (MEA) membranes market is anticipated to grow at a substantial rate on account of the increasing applications of clean water, wastewater treatment, and desalination technologies. With an exploding urbanization and market needs for process optimization, water-rich countries such as Brazil, Mexico and Chile in LATAM are increasingly choosing membranes to address water scarcity problems, same with industries like food and beverages and pharmaceuticals.

Membranes Market Competitive Landscape:

Toray Industries Inc.

Toray Industries Inc. is a leading manufacturer of advanced membrane technologies and filtration solutions, serving water treatment, industrial, and healthcare applications.

- In March 2024, Toray Industries introduced a game-changing reverse osmosis (RO) membrane designed for exceptional longevity. This highly durable membrane not only saves water but also exhibits double the chemical resistance, requiring replacement less frequently and minimizing its environmental impact.

Asahi Kasei Corporation

Asahi Kasei Corporation is a diversified global company providing medical devices, chemicals, and innovative materials solutions.

- In April 2024, Asahi Kasei Corporation introduced TrachFlush, a new medical device designed to improve the comfort of ventilated patients undergoing tracheal suctioning. This innovative device utilizes the ventilator's air pressure to clear airway secretions, reducing discomfort for patients and workload for healthcare professionals.

Membranes Market Key Companies:

-

Toray Industries Inc. (TORAYFIL)

-

Koch Separation Solutions (PURON)

-

Pall Corporation (SUPRAdisc)

-

Asahi Kasei Corporation (Microza)

-

3M (3M Liqui-Flux)

-

Hydranautics (ESPA Series)

-

Mann+Hummel (Water & Wastewater Membranes)

-

DuPont (FILMTEC)

-

LG Chem Ltd. (LG SWRO Membranes)

-

Pentair (X-Flow)

-

Suez Water Technologies & Solutions (ZeeWeed)

-

GEA Group (GEA Filtration Membranes)

-

Merck Millipore (Durapore Membrane Filters)

-

Parker Hannifin Corporation (Domnick Hunter Membranes)

-

Veolia Water Technologies (UFlo)

-

Synder Filtration (NFX Membrane)

-

SPX Flow (Celeros FT Series)

-

Membranium (RM Nanotech) (NanoFilt)

-

Aquaporin A/S (Aquaporin Inside)

-

Pentair X-Flow (Helix Flux Membranes)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 7.86 Billion |

| Market Size by 2032 | US$ 14.20 Billion |

| CAGR | CAGR of 7.67% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Polymeric, Ceramic, Others (Zeolite, Metal, and hybrid)) • By Technology (RO, UF, MF, NF, Others ) • By Application (Water & wastewater treatment, Industrial Processing) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles |

Toray Industries Inc. (Japan), Koch Separation Solutions (US), Pall Corporation (US), Asahi Kasei Corporation (Japan), 3M (US), Hydranautics (US), Mann+Hummel (Germany), DuPont (US)and LG Chem Ltd. (South Korea), Pentair (UK), Suez Water Technologies & Solutions (France) |