Wind Power Market Report Scope & Overview:

To Get More Information on Wind Power Market - Request Sample Report

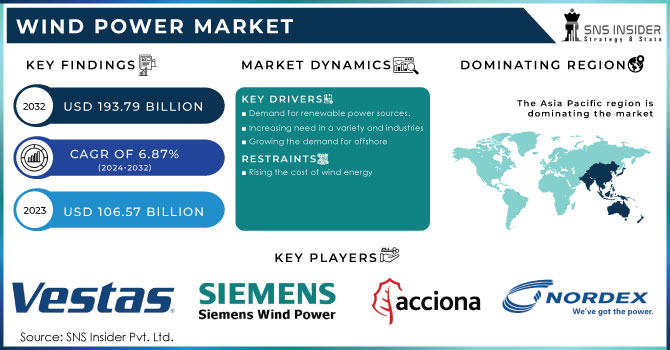

The Wind Power Market size was valued at USD 106.57 billion in 2023 and is expected to grow to USD 193.79 billion by 2032 with a growing CAGR of 6.87% over the forecast period of 2024-2032.

Wind energy harnesses the ambient wind and transforms the velocity of the air into mechanical energy. Different atmospheric pressures lead to the wind. Season, terrain, and geography all affect wind speed. As a result, certain places are more suitable for producing wind energy than others. In general, wind speeds are faster close to the coast and offshore because there are fewer obstructions to slow them down, such as vegetation, mountains, and buildings.

When some areas of the rocky surface of the Earth receive a different quantity of light than others nearby and cool or heat more quickly, wind is created. Air travels over the planet, gaining or losing speed as it crosses rivers and valleys, balancing the variations like mixing hot and cold water in a bathtub. You guessed it, that produces wind. Birds may be propelled through the air by wind, ships can travel across the ocean, and trees can even be uprooted by it. The act of moving wind turbine blades is simple in compared to all that. Electricity is produced by the turbines' rotation.

MARKET DYNAMICS

KEY DRIVERS:

-

Demand for renewable power sources.

-

Increasing need in a variety and industries

-

Growing the demand for offshore

Many governments all over the globe have implemented policies to encourage the growth of wind energy, including feed-in tariffs, tax rebates, and renewable portfolio standards. These regulations have significantly increased the industry's growth and made wind power a more appealing investment.

RESTRAIN:

-

Rising the cost of wind energy

Wind energy has become less expensive recently, it is still more expensive than certain other energy sources, such as coal or natural gas. Due to this, wind power may find it challenging to compete in the electricity market.

OPPORTUNITY:

-

Technological advancement for offshore installation

CHALLENGES:

-

Grid integration

-

Intermittency

Since wind energy is a fluctuating source of energy, its output might change depending on the wind's direction and speed. This can make it challenging to incorporate wind energy into the electrical grid and, if there is not enough wind energy to fulfill demand.

IMPACT OF RUSSIA-UKRAINE WAR

According to the Energy Information Administration, about half of the power produced in the United States from renewable sources last year came from wind energy. The country's use of wind energy has increased significantly over the past two decades, going from 0.2% to 9.2% of all power produced during that time. According to the International Energy Agency, the ongoing Russian invasion of Ukraine, which is in its seventh month, has shaken up the world's energy markets and increased worries about the security and availability of energy globally.

IMPACT OF ONGOING RECESSION

A decline in wind project completions by 2022, however despite a continued Chinese boom in both onshore and offshore wind, this decline was mostly caused by delays to US offshore projects, a slowdown in onshore permits in the US and Europe, and delays to US offshore projects. In September that China revealed rife offshore wind deployments, with increased capacity for the half-year coming in at 6.8 GW, accounting for 78% of all new additions worldwide. Further development was also seen in South Korea and Vietnam, two other countries in Asia.

KEY MARKET SEGMENTATION

By Location

-

Onshore

-

Offshore

By Application

-

Utility

-

Non-utility

REGIONAL ANALYSIS

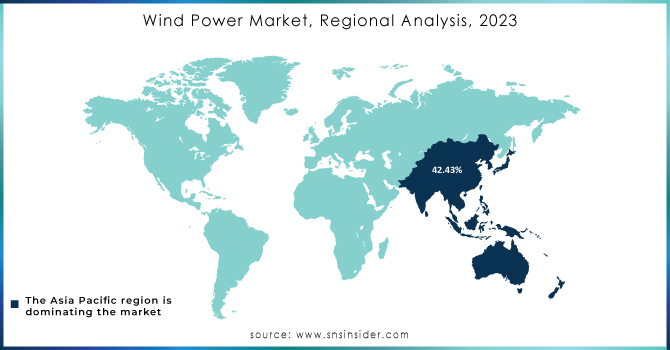

More than 42.43% of global revenue in 2021 came from the Asia Pacific area, and this dominance is anticipated to persist throughout the projection period. Due to continued actions and expenditures made by the government to support industrial growth, China has the highest installation in the area.

China's onshore wind sector is expected to grow gradually over the next few years as the country's leadership promotes the development of renewable infrastructure in an effort to minimize the importance of thermal power and lower pollution levels in the nation's power production. This will probably affect how quickly wind energy projects are completed in the nation, which is expected to fuel industry expansion.

Do You Need any Customization Research on Wind Power Market - Enquire Now

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

RECENT DEVELOPMENTS

-

Suzlon Group received a fresh order in October 2022 from the Aditya Birla Group to construct 144.9 MW wind power projects at locations in Gujarat and Madhya Pradesh. A total of 69 wind turbine generators (Wind Turbines) with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 2.1 MW will be installed as part of the contract by the firm. It's anticipated to start up business before the end of 2023.

-

May 20222 saw the announcement by India's Minister for Power and New & Renewable Energy of intentions to have 30,000 MW of India's offshore wind energy.

-

In October 2021, USW Energy Ltd., a subsidiary of the regional conglomerate JSW Group, awarded GE Renewable Energy a contract. For its planned projects in Tamil Nadu, JSW has bought 810 MW of onshore wind turbines as part of the deal.

KEY PLAYERS

The Major Players are GE Wind, Vestas, Siemens Wind Power, Suzlon Group, Goldwind, United Power, Acciona, Nordex SE, Sinovel Wind Group, EDF Renewable Energy, ReGen Powertech, Vensys Energy, ABB Limited, NextEra Energy Inc., Northland Power Inc., DONG Energy, and other players are listed in a final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 106.57 Bn |

| Market Size by 2032 | US$ 193.79 Bn |

| CAGR | CAGR of 6.87% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Location (Onshore, Offshore), By Application (Utility, Non-utility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | GE Wind, Vestas, Siemens Wind Power, Suzlon Group, Goldwind, United Power, Acciona, Nordex SE, Sinovel Wind Group, EDF Renewable Energy, ReGen Powertech, Vensys Energy, ABB Limited, NextEra Energy Inc., Northland Power Inc., DONG Energy |

| Key Drivers | • Demand for renewable power sources. • Increasing need in a variety and industries • Growing the demand for offshore |

| Market Restraints | • Rising the cost of wind energy |