Smart Transformers Market Size & Analysis:

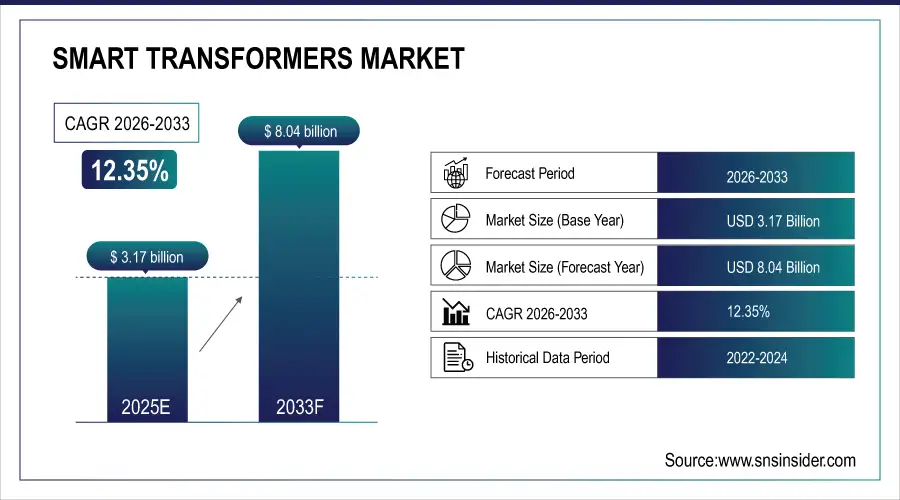

The Smart Transformers Market was valued at USD 3.17 billion in 2025E and is expected to reach USD 8.04 billion by 2033, growing at a CAGR of 12.35% from 2026-2033.

The Smart Transformers market has experienced significant expansion, fueled by the rising need for efficient power distribution systems and the implementation of smart grid technologies. In 2023, a total of 87 billion U.S. dollars was allocated to power grid technology in the U.S., while worldwide investments in power grid technology surpassed 300 billion U.S. dollars. As the globe moves towards more sustainable energy options, utilities are placing greater emphasis on enhancing the reliability and efficiency of their grids, with smart transformers being crucial in this change. These transformers offer real-time oversight and the capability to modify voltage levels from a distance, facilitating improved grid management and allowing for faster reactions to fluctuations in load and fault situations. This technological progress is crucial for enhancing energy distribution and facilitating the incorporation of renewable energy sources.

Smart Transformers Market Size and Forecast:

-

Market Size in 2025E: USD 3.17 Billion

-

Market Size by 2033: USD 8.04 Billion

-

CAGR: 12.35% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Smart Transformers Market - Request Free Sample Report

Key Trends in the Smart Transformers Market:

-

Rising adoption of smart grid infrastructure to enhance grid resilience, efficiency, and real-time monitoring capabilities.

-

Increasing integration of renewable energy sources such as solar and wind, driving demand for intelligent voltage and load management.

-

Growing focus on digital substations and automated distribution networks across utilities.

-

Strong shift toward EV charging infrastructure, accelerating the deployment of smart distribution transformers.

-

Advancements in IoT, AI-based analytics, and edge computing improving transformer predictive maintenance and operational optimization.

-

Expansion of urbanization and rural electrification initiatives boosting localized power distribution needs.

-

Increasing utility investments in replacing aging grid assets with digitally enabled smart transformers.

-

Rising deployment of grid automation technologies, supported by supportive government policies for modernizing transmission and distribution networks.

The U.S. Smart Transformers Market was estimated at USD 0.92 Billion in 2025E and is projected to reach approximately USD 2.38 Billion by 2033, growing at a steady CAGR supported by rising EV charging deployment, modernization of aging grid systems, and increased renewable energy penetration. The push toward improving grid stability and reducing energy losses continues to position smart transformers as a critical component of the evolving U.S. power infrastructure.

Smart Transformers Market Drivers:

- Growing Global Grid Modernization Requirements Increase Deployment of Smart, Digitally Enabled Transformer Technologies Across Utility Networks

The accelerating global push for grid modernization is a major driver of the Smart Transformers Market, as utilities increasingly shift toward digital, automated, and highly reliable electricity systems. Smart transformers enable real-time monitoring, predictive maintenance, voltage optimization, and enhanced fault detection—capabilities essential for ensuring stability amid rising renewable integration, electrification, and growing electricity demand. As governments tighten reliability mandates and implement clean-energy transition goals, utilities are compelled to replace legacy transformers with smart, sensor-equipped alternatives.

In 2024, a major U.S. utility upgraded its regional substations with smart transformers to monitor load fluctuations tied to solar and EV adoption. The project cut downtime, improved energy flow, and demonstrated how modernization programs directly translate into operational benefits and wider smart transformer deployment.

Smart Transformers Market Restraints:

-

High Installation, Upgrade, and Lifecycle Costs Limit Adoption of Smart Transformer Technologies Across Price-Sensitive and Developing Regions

High upfront and long-term costs significantly restrain the adoption of smart transformers, particularly in developing economies and smaller utility companies operating with limited capital budgets. Smart transformers require costly sensors, communication modules, digital controllers, and cybersecurity layers—making them considerably more expensive than traditional units. Their installation also demands skilled personnel, advanced testing tools, and specialized maintenance practices, adding to operational expense. These financial burdens create a direct cause-and-effect challenge in which cash-strapped utilities delay modernization, extend the lifespan of older transformers, or adopt partial digital upgrades instead of transitioning fully to smart solutions. As a result, regions with constrained infrastructure funding struggle to benefit from the operational and efficiency advantages smart transformers offer, slowing overall market expansion.

For instance, in 2024, several African and Southeast Asian utilities postponed transformer digitalization due to insufficient funding, opting for basic monitoring retrofits instead. This highlighted how high capital requirements continue to impede full-scale smart transformer deployment.

Smart Transformers Market Opportunities:

-

Rapid Global Expansion of High-Capacity Electric Vehicle Charging Networks Creates Strong Demand for Smart Transformers

The rapid worldwide growth of electric vehicle adoption is creating a major opportunity for smart transformers, as large-scale EV charging networks require stable, efficient, and intelligently managed power distribution systems. Smart transformers regulate voltage, manage peak loads, optimize energy flow, and provide real-time diagnostics capabilities that are essential for supporting fast and ultra-fast charging infrastructure. As governments invest heavily in national EV charging corridors and private operators expand high-capacity charging hubs, the need for advanced smart transformers rises in direct cause-and-effect alignment with EV infrastructure growth. The April 2025 deployment of new ultra-fast charging hubs further illustrates how emerging charging technologies intensify demand for digital transformer solutions capable of handling extreme load variability and high throughput.

In 2025, a major European highway charging project integrated smart transformers into its 350 kW charging stations to maintain stable voltage and reduce overload risks. This demonstrated how intelligent power management enhances charging reliability and supports the rapid scaling of EV ecosystems.

Smart Transformers Market Segmentation Analysis:

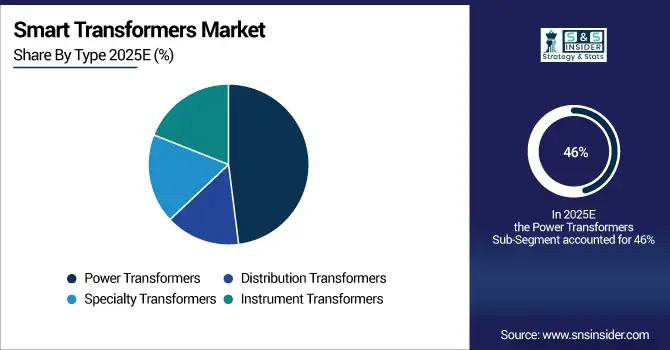

By Type, Power Transformers Dominate Smart Transformers Market with 46% Share in 2025, Distribution Transformers to Record Fastest Growth at 13.80% CAGR

The Power Transformers segment held a dominant share of approximately 46% in 2025. Power transformers continue to lead the Smart Transformers Market due to their critical role in long-distance, high-voltage electricity transmission and their importance in enhancing grid stability and efficiency. As global grids undergo modernization and integrate higher levels of renewable energy, the need for smart, digitally enabled power transformers has surged, especially across industrial and utility-scale applications where reliability and load management are essential.

The Distribution Transformers segment is projected to witness the fastest growth from 2026 to 2033, with an estimated CAGR of 13.80%. Rising urbanization, expansion of rural electrification programs, and the shift toward intelligent distribution networks are fueling demand. Smart distribution transformers support localized voltage management, reduce energy losses, and improve overall grid efficiency making them indispensable for next-generation distribution systems focused on resilience, sustainability, and real-time energy optimization.

By Application, Smart Grid Segment Dominates with 59% Share in 2025, EV Charging to Grow Fastest with 15.89% CAGR

The Smart Grid segment dominated the Smart Transformers Market in 2025, securing approximately 59% revenue share. This leadership is driven by the global push for grid modernization, increasing adoption of renewable energy, and the need for intelligent systems capable of real-time monitoring, load balancing, and automated control. Smart transformers play a central role in enabling reliable and efficient power flow across advanced grid architectures, solidifying their importance in utility transformation initiatives.

The Electric Vehicle Charging segment is anticipated to record the fastest growth, with a CAGR of about 15.89% from 2026 to 2033. The rapid acceleration of EV adoption worldwide is amplifying the need for reliable, high-capacity charging infrastructure. Smart transformers ensure efficient power delivery, enhance charging stability, optimize energy usage, and support peak load management making them a critical enabler of future-ready EV charging networks and a major growth catalyst for the segment.

Smart Transformers Market Regional Insights

North America Dominates the Smart Transformers Market in 2025E

In 2025E, North America is estimated to command around 38% of the Smart Transformers Market, driven by large-scale grid modernization efforts, digital substation expansion, and rising renewable energy integration. Strong federal funding support and advanced utility infrastructure further accelerate adoption, making North America a core hub for intelligent grid technologies.

The United States is the dominating country in North America, backed by massive investments in grid resilience, widespread deployment of digital monitoring systems, and the rapid expansion of EV charging and renewable energy networks. Its mature utility ecosystem, strong presence of leading smart grid technology providers, and ongoing modernization of aging transmission infrastructure reinforce its leadership. The U.S. also leads in deploying advanced transformer analytics and real-time monitoring systems, positioning it as the primary driver of smart transformer adoption across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is the Fastest-Growing Region in the Smart Transformers Market in 2025E

Asia-Pacific is projected to grow at an estimated CAGR of 14.5% in 2025E, supported by rapid industrialization, major grid digitalization initiatives, and large-scale integration of solar, wind, and EV infrastructure. Massive urbanization and rising electricity demand push utilities toward smart transformer technologies to enhance grid stability and efficiency.

China dominates the Asia-Pacific Smart Transformers Market due to its aggressive smart grid rollout, extensive renewable energy build-out, and government-driven modernization mandates. With strong domestic manufacturing capabilities and world-leading investments in ultra-high-voltage transmission, China deploys intelligent transformers at scale across its rapidly expanding power networks. Its booming EV charging ecosystem, industrial automation growth, and smart city developments further solidify China’s leadership and make it the largest adopter of smart transformer technologies in the region.

Europe Smart Transformers Market Insights, 2025

Europe held a meaningful share of the Smart Transformers Market in 2025, driven by strict energy-efficiency regulations, rapid adoption of renewable energy sources, and widespread modernization of outdated grid infrastructure. The region continues to invest heavily in digital substations, advanced grid automation, and real-time monitoring technologies to improve operational efficiency and grid resilience. Germany dominates the European market, supported by its strong renewable energy penetration, advanced smart grid initiatives, and significant investment in high-voltage infrastructure upgrades. Germany’s renewable energy expansion increases grid complexity, creating strong demand for smart transformers that optimize power flow, stability, and automated grid management.

Middle East & Africa Smart Transformers Market Insights, 2025

In 2025, the Middle East & Africa region saw steady momentum in the Smart Transformers Market, driven by rising electrification projects, expansion of solar power, and modernization of transmission and distribution infrastructure. Gulf countries invested in digital substations to enhance grid reliability, while African nations focused on improving grid access and reducing losses through intelligent transformer solutions. Growing industrial activity and national energy diversification plans further strengthened regional adoption.

Latin America Smart Transformers Market Insights, 2025

Latin America experienced stable growth in the Smart Transformers Market in 2024, supported by increasing urbanization, expanding renewable energy projects, and efforts to upgrade aging power grids. Countries like Brazil, Chile, and Mexico accelerated smart grid deployments to reduce transmission losses and integrate solar and wind capacity more efficiently. Government-led digital transformation initiatives and rising electricity demand across industrial and commercial sectors contributed to the region’s ongoing shift toward intelligent transformer technologies.

Competitive Landscape of the Smart Transformers Market:

ABB

ABB is a global leader in smart grid and power transformer technologies, delivering digitally enabled transformer solutions designed to enhance grid reliability, improve energy efficiency, and support real-time monitoring. The company’s portfolio integrates advanced sensors, automation, and analytics to optimize transformer performance and reduce operational downtime. Its role in the Smart Transformers Market is pivotal, enabling utilities to modernize infrastructure and shift toward intelligent, self-regulating power networks.

-

In recent years, ABB introduced enhanced digital transformer solutions equipped with advanced condition-monitoring systems to support large-scale smart grid deployments.

GE

GE is a prominent provider of digital substation and grid automation technologies, offering smart transformer solutions that integrate seamlessly with advanced protection, monitoring, and control systems. The company focuses on delivering improved grid visibility, predictive maintenance, and enhanced operational safety. Its role in the Smart Transformers Market is significant, supporting utilities in modernizing grid assets and optimizing energy distribution.

-

In 2025, GE expanded its grid automation portfolio with next-generation digital monitoring tools designed to enhance real-time transformer diagnostics and system efficiency.

Siemens

Siemens is a global leader in digital grid solutions and high-voltage electrical systems, incorporating smart functionalities into transformers to improve grid resilience and operational control. With advanced analytics, automation, and high-voltage engineering, Siemens enables utilities to manage increasing energy demands and integrate renewable power efficiently. Its role in the Smart Transformers Market is substantial, accelerating digital transformation across power networks.

-

In 2025, Siemens introduced upgraded intelligent grid tools that strengthened transformer lifecycle management and enhanced grid decision-making capabilities.

Schneider Electric

Schneider Electric is a major provider of energy management and smart grid automation solutions, offering digitally connected transformer technologies through its EcoStruxure for Grid platform. The company emphasizes efficiency, reliability, and integration of distributed energy resources, allowing utilities to benefit from predictive maintenance and improved power flow control. Its role in the Smart Transformers Market is essential, supporting the shift toward decentralized and digitally optimized power systems.

In 2025, Schneider Electric enhanced its EcoStruxure Grid automation suite with updated monitoring and control features tailored for modern smart transformer applications.

Smart Transformers Companies are:

-

GE

-

Siemens

-

Schneider Electric

-

Eaton

-

Wilson Transformer

-

Mitsubishi Electric

-

CG Power

-

Howard Industries

-

SPX Transformer

-

Bharat Heavy Electricals Limited

-

Emerson Electric

-

Nexans

-

Xian Electric Engineering

-

S and C Electric Company

-

Honeywell

-

Hitachi

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.17 Billion |

| Market Size by 2033 | USD 8.04 Billion |

| CAGR | CAGR of 12.35% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Power Transformers, Distribution Transformers, Specialty Transformers, Instrument Transformers) • By Application (Traction Locomotive, Smart Grid, Electric Vehicle Charging, Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ABB, GE, Siemens, Schneider Electric, Eaton, Wilson Transformer, Mitsubishi Electric, CG Power, Howard Industries, SPX Transformer, Toshiba, Bharat Heavy Electricals Limited (BHEL), Emerson Electric, Nexans, Xian Electric Engineering, S and C Electric Company, Honeywell, Hitachi. |