Shell & Tube Heat Exchanger Market Report Scope & Overview:

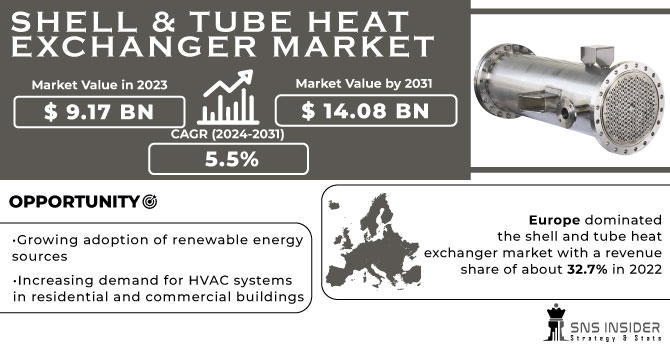

The Shell & Tube Heat Exchanger Market size was valued at USD 9.17 billion in 2023 and is expected to grow to USD 14.84 billion by 2032 with a growing CAGR of 5.5% over the forecast period of 2024-2032.

A shell and tube heat exchanger is used to transfer heat between two fluids. It consists of a shell (a cylindrical vessel) and a bundle of tubes inside the shell. The two fluids flow through the shell and the tubes, respectively, and heat is transferred from one fluid to the other through the tube walls. This type of heat exchanger is commonly used in industrial processes, such as chemical and petrochemical plants, power generation, and HVAC systems. It is efficient, reliable, and can handle a wide range of temperatures and pressures. The design of a shell and tube heat exchanger can vary depending on the specific application and requirements. Factors such as the type of fluids, flow rates, and temperature differentials must be taken into account.

To Get More Information on Shell & Tube Heat Exchanger Market - Request Sample Report

Overall, the shell and tube heat exchanger is a crucial component in many industrial processes, providing efficient and effective heat transfer for a variety of applications. The shell and tube heat exchanger market is expected to experience significant growth in the coming years due to the increasing demand for energy-efficient solutions and the rising need for sustainable energy sources. The market is also driven by the growing demand for heat exchangers in emerging economies, where industrialization is on the rise.

Market Dynamics:

Drivers

-

Rising industrialization and urbanization in the emerging countries

-

Growing demand for energy-efficient solutions across various industries.

With the growing importance of environmental sustainability, companies are actively seeking ways to reduce their carbon footprint and minimize energy consumption. As a result, there has been a significant increase in demand for heat exchangers that can efficiently transfer heat between fluids, ultimately leading to reduced energy consumption and operating costs. This trend has been a major driving force behind the market for shell and tube heat exchangers. In addition to their energy-saving benefits, shell and tube heat exchangers are also highly durable and reliable, making them a cost-effective long-term solution for companies in a variety of industries. With their ability to efficiently transfer heat between fluids, these heat exchangers are an essential component of many industrial processes, from chemical manufacturing to power generation.

Restrain

-

High initial cost of installation and maintenance associated with the shell and tube heat exchanger

-

Presence of other more efficient alternatives such as plate heat exchanger

While shell and tube exchangers have been a popular choice for many years due to their durability and ability to handle high-pressure and temperature applications. But plate heat exchangers also offer several advantages. These include a smaller footprint, higher heat transfer efficiency, and lower maintenance costs. As a result, industries that prioritize efficiency and cost-effectiveness may opt for plate heat exchangers over shell and tube exchangers. This factor is expected to hinder the market for shell and tube exchanger market.

Opportunities

-

Growing adoption of renewable energy sources

-

Increasing demand for HVAC systems in residential and commercial buildings

Challenges

-

Fluctuation in the raw material prices

-

Intense price competition between several market key players

Impact of Russia-Ukraine War:

The heat exchanger industry is heavily dependent on the availability of raw materials, particularly steel and nickel. Russia and Ukraine are major producers of steel, with an annual output of approximately 100 million tons, of which they export around 37 million tons, accounting for 8-9% of global net trade. However, steel prices have risen by 10-15% in recent months, particularly in India, China, and Europe, where the increase has been led by Europe. Russia is also a significant producer and exporter of nickel, accounting for 11% of global production and 15% of world exports. Finland is a major importer of Russian nickel, with an 84% share, while the Netherlands, Ukraine, and China import 34%, 23%, and 13% respectively. Unfortunately, the ongoing conflict between Russia and Ukraine has disrupted the supply chain of these materials, leading to price increases and shortages. As a result, manufacturers of shell and tube heat exchangers are experiencing delays in production and delivery, causing inconvenience and financial losses for both manufacturers and customers. The transportation of heat exchangers has also been affected by the conflict, with certain ports and transportation routes closed, making it difficult to transport heat exchangers to their intended destinations. This has resulted in longer lead times and increased transportation costs. Moreover, the Russia-Ukraine conflict has created uncertainty in the market, leading to a decrease in demand for shell and tube heat exchangers. Companies are hesitant to invest in new equipment due to the unpredictable nature of the market.

Impact of Recession:

The current economic recession significantly affected demand for Shell and Tube Heat Exchangers. Many industries have reduced their production and energy consumption, leading to a decrease in demand for these products. The downturn has also caused a decline in the price of iron ore by 32%, while nickel and copper prices have dropped in 2022 due to the economic downturn and mounting recessionary fears. Despite supply tightness and low stockpiles, nickel prices fell nearly 31% to $23,994.50/t on June 23 from $33,876.00/t on April 21. As a result, companies operating in this market have experienced a decline in sales and revenue. Furthermore, the supply chain has been disrupted, causing delays in the delivery of materials and components needed for the production of these heat exchangers.

However, the recession has also presented opportunities for companies in the Shell and Tube Heat Exchanger market. As energy prices have fallen, some industries have taken advantage of this by investing in energy-efficient technologies, including heat exchangers. This has led to an increase in demand for more efficient and cost-effective heat exchangers, which has benefited companies that specialize in this area. These companies have been able to capitalize on the current market conditions by offering innovative solutions that help their clients reduce energy consumption and costs.

Key Market Segmentation

By Material

-

Tantalum

-

Haste Alloy

-

Nickel & Nickel Alloys

-

Steel

-

Titanium

-

Others

By End-User

-

Food & Beverages

-

Chemicals

-

HVAC & Refrigerators

-

Petrochemicals

-

Pulp & Paper

-

Others

Regional Analysis

Europe dominated the shell and tube heat exchanger market with a revenue share of about 32.7% in 2022 and is expected to be the leading region in the shell and tube heat exchanger market in the upcoming years. Europe's dominance in the shell and tube heat exchanger market is mainly attributed to the region’s well-established industrial base that demands high-quality heat exchangers for various applications and a strong focus on energy efficiency and sustainability, which has led to the adoption of advanced heat exchanger technologies. Moreover, Europe has a highly skilled workforce and a robust research and development infrastructure that enables the development of innovative heat exchanger designs. This has resulted in the production of highly efficient and reliable heat exchangers that meet the stringent requirements of various industries. In addition, Europe has a favorable regulatory environment that encourages the adoption of energy-efficient technologies. The region has implemented several policies and initiatives to promote the use of renewable energy sources and reduce carbon emissions. This has created a significant demand for heat exchangers that can help achieve these goals.

North America is expected to experience significant growth in the CAGR during the forecast period for Shell & Tube Heat Exchangers. This is owing to the increasing demand for energy-efficient solutions and the growing adoption of renewable energy sources. Additionally, the region's robust industrial sector and the presence of key market players are contributing to the anticipated growth. As a result, North America is poised to become a major player in the global Shell & Tube Heat Exchanger market.

Do You Need any Customization Research on Shell & Tube Heat Exchanger Market - Enquire Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are HRS Heat Exchangers, Alfa Laval, Xylem Inc., Kelvion Holding GmbH, API Heat Transfer, Koch Heat Transfer Company, Southern Heat Exchanger Corporation, Manning and Lewis, Elanco, Inc., Mersen, Thermex and other key players mentioned in the final report.

Xylem inc-Company Financial Analysis

Recent Development:

In March of 2023, Alfa Laval introduced the AlfaNova GL50, which is the world's first heat exchanger that has been designed specifically for fuel cell systems. This innovative product is set to revolutionize the industry by providing a more efficient and reliable solution for fuel cell systems. With the AlfaNova GL50, users can expect to experience improved performance and reduced maintenance costs.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.17 Bn |

| Market Size by 2032 | US$ 14.84 Bn |

| CAGR | CAGR of 5.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Tantalum, Haste Alloy, Nickel & Nickel Alloys, Steel, Titanium, and Others) • By End-user (Food & Beverages, Power Generation, Chemical, HVAC & Refrigerators, Petrochemicals, Pulp & Paper, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | HRS Heat Exchangers, Alfa Laval, Xylem Inc., Kelvion Holding GmbH, API Heat Transfer, Koch Heat Transfer Company, Southern Heat Exchanger Corporation, Manning and Lewis, Elanco, Inc., Mersen, Thermex, and other key players mentioned in the final report. |

| Key Drivers | • Rising industrialization and urbanization in the emerging countries • Growing demand for energy-efficient solutions across various industries |

| Market Opportunities | • Growing adoption of renewable energy sources • Increasing demand for HVAC systems in residential and commercial buildings |