2D Material Beyond Graphene market report scope & overview:

The 2D Material Beyond Graphene Market size is valued at USD 3.07 Billion in 2025 and is expected to reach USD 4.40 Billion by 2035 and grow at a CAGR of 3.67% over the forecast period 2026-2035.

The growth of the 2D Material Beyond Graphene market is being driven by the increasing demand for high-performance materials in next-generation electronics and semiconductor devices, which is boosting the adoption of advanced 2D materials such as phosphorene, MXenes, and TMDs. Accelerated innovation in energy storage, flexible electronics, and sensor technologies is expanding the application scope of these materials. Additionally, rising R&D investments, supportive government initiatives, and the need for miniaturization and enhanced device efficiency are prompting industries to integrate 2D materials beyond graphene into commercial products.

According to industry studies, over 60% of global 2D Material Beyond Graphene adoption is driven by electronics and semiconductor manufacturers, due to demand for high-performance, miniaturized, and energy-efficient devices.

Market Size and Forecast:

-

Market Size in 2025: USD 3.07 Billion

-

Market Size by 2035: USD 4.40 Billion

-

CAGR: 3.67% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On 2D Material Beyond Graphene Market - Request Free Sample Report

2D Material Beyond Graphene Market Trends:

-

Rising Adoption in Electronics & Semiconductors: Increasing use in transistors, flexible electronics, and optoelectronic devices due to superior electrical and mechanical properties.

-

Growing Demand in Energy Storage: Strong focus on batteries and supercapacitors, driven by the need for higher energy density and faster charging.

-

Expansion in Sensor Technology: Wider application in gas sensors, biosensors, and photodetectors owing to high sensitivity and tunable properties.

-

Shift Toward Scalable Production Methods: Increased investment in scalable synthesis techniques such as liquid-phase exfoliation and CVD to enable commercial production.

-

Integration in Composite & Hybrid Materials: Growing use of 2D materials in composites to enhance strength, conductivity, and thermal stability.

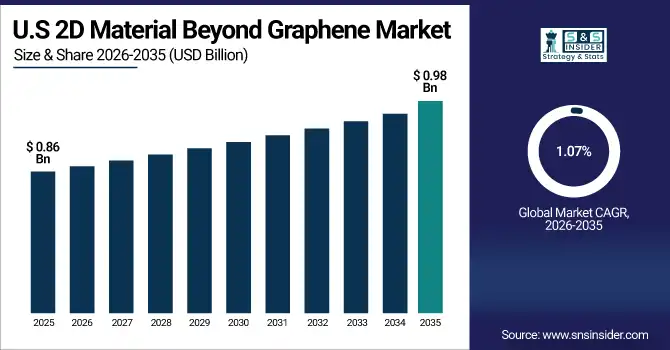

U.S. Specialty 2D Material Beyond Graphene Market Insights:

The U.S. 2D Material Beyond Graphene Market size is USD 0.86 Billion in 2025 and is expected to reach USD 0.98 Billion by 2035, growing at a CAGR of 1.07% over the forecast period of 2026-2035.

The U.S. market is driven by strong semiconductor and defense demand, increased R&D funding, and growing adoption of advanced materials for flexible electronics, sensors, and energy storage. Commercialization is constrained by production scalability and stability challenges, prompting focus on improved synthesis and quality control.

2D Material Beyond Graphene Market Growth Drivers:

-

Rising Demand for Advanced Electronics and Semiconductor Devices

The 2D Material Beyond Graphene market is driven by growing demand for high-performance materials in next-generation electronics and semiconductor devices, where traditional materials face limitations in miniaturization and energy efficiency. Advanced 2D materials such as phosphorene, MXenes, TMDs, and borophene offer superior electrical conductivity, tunable bandgap, and mechanical flexibility, supporting applications in flexible displays, high-speed transistors, photodetectors, and optoelectronics. Increasing adoption of IoT devices and 5G technology is further expanding the need for efficient, lightweight, and scalable materials, boosting market growth.

2D Material Beyond Graphene Market Restraints:

-

High Production Costs and Scalability Challenges

Market growth is restrained by the high cost and complexity of producing high-quality 2D materials beyond graphene at commercial scale. Many synthesis methods, such as chemical vapor deposition and liquid-phase exfoliation, require precise conditions, specialized equipment, and yield limited quantities, making large-scale production expensive. In addition, stability issues—such as oxidation, degradation, and variability in material quality—create integration challenges for end-user industries. Lack of standardization, inconsistent material properties, and limited manufacturing infrastructure also hinder broader adoption across mainstream electronics and energy sectors.

2D Material Beyond Graphene Market Opportunities:

-

Innovation in Scalable Synthesis and Emerging Application Areas

Significant growth opportunities exist from advances in scalable synthesis methods, such as improved liquid-phase exfoliation, chemical vapor deposition, and hybrid production processes that can deliver higher yield and consistent material quality. Expansion into new application areas like energy storage, sensors, photonics, and biomedical devices is also expected to drive demand. Increasing government funding, industry-academia collaborations, and strategic partnerships are accelerating commercialization. Moreover, rising digitalization and renewable energy adoption in emerging economies are creating new markets for advanced 2D materials beyond graphene, supporting long-term growth.

2D Material Beyond Graphene Market Segment:

-

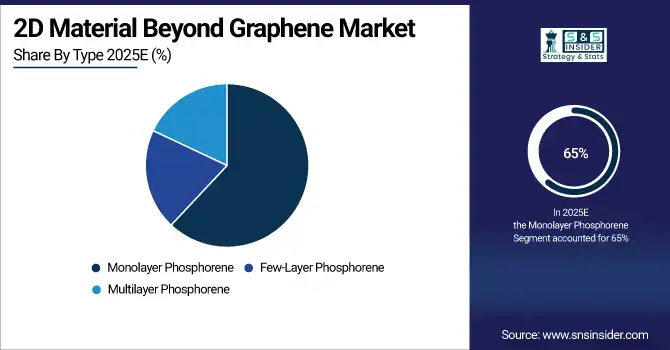

By Type: In 2025, Monolayer Phosphorene dominated with 65% share; Few-Layer Phosphorene is the fastest growing segment during 2026–2035.

-

By Production Method: In 2025, Liquid Phase Exfoliation dominated with 62% share; Chemical Vapor Deposition (CVD) is the fastest growing segment during 2026–2035.

-

By Application: In 2025, Electronics & Semiconductors dominated with 35% share; Energy Storage Systems is the fastest growing segment during 2026–2035.

-

By End-user Industry: In 2025, Electronics & Semiconductor Industry dominated with 40% share; Research & Academic Institutes is the fastest growing segment during 2026–2035.

2D Material Beyond Graphene Market Segment Analysis:

By Type: Monolayer Phosphorene Leads as Few-Layer Phosphorene Emerges as Fastest-Growing Segment

Monolayer phosphorene dominates the 2D Material Beyond Graphene market due to its superior electronic properties, high carrier mobility, and strong potential in high-performance semiconductor and optoelectronic applications. It is widely preferred for advanced transistor technology, photodetectors, and flexible electronics, which drives consistent demand from major electronics manufacturers and research institutions. The stability and performance advantages of monolayer phosphorene contribute significantly to its dominant revenue share across key end-use industries.

Few-layer phosphorene is the fastest growing segment as it offers a balance between performance and improved stability compared to monolayer forms. Its scalable production potential and suitability for energy storage and sensor applications are accelerating adoption. Increasing R&D focus and commercial interest in multi-layered structures are driving rapid growth in this segment.

By Production Method: Liquid Phase Exfoliation Leads as CVD Becomes Fastest-Growing Segment

Liquid phase exfoliation dominates the 2D Material Beyond Graphene market because it enables cost-effective, scalable production of phosphorene and other 2D materials. This method supports mass manufacturing, higher yields, and easier integration into composites and solution-based applications, making it preferred by manufacturers and researchers. The versatility of liquid phase exfoliation across electronics, energy storage, and sensor applications supports consistent market dominance.

Chemical vapor deposition (CVD) is the fastest growing production method due to ongoing advancements that improve film uniformity, layer control, and material quality. As CVD becomes more commercially viable, its adoption is increasing for high-end electronics, optoelectronics, and semiconductor fabrication where precision and consistency are critical.

By Application: Electronics & Semiconductors Lead as Energy Storage Systems Grow Fastest

Electronics and semiconductors dominate the 2D Material Beyond Graphene market due to the high demand for advanced materials in next-generation devices. Phosphorene and other 2D materials are increasingly used in transistors, flexible displays, and photonic devices because of their superior electrical conductivity, tunable bandgap, and lightweight properties. Strong investments in semiconductor R&D, miniaturization, and high-performance computing further strengthen this segment’s market leadership.

Energy storage systems are the fastest growing application segment due to the rising demand for high-energy-density batteries and supercapacitors. 2D materials enhance electrode performance, charge storage capacity, and cycling stability, driving adoption in EVs, renewable energy storage, and portable electronics.

By End-user Industry: Electronics & Semiconductor Industry Leads as Research & Academic Institutes Expand Rapidly

The electronics and semiconductor industry leads the 2D Material Beyond Graphene market due to significant investments in next-generation materials for chips, sensors, and flexible electronics. Strong demand for high-speed, low-power devices and continuous innovation cycles drive sustained adoption. Leading semiconductor manufacturers and electronic component suppliers are actively integrating advanced 2D materials to improve performance, efficiency, and miniaturization, supporting this segment’s dominant market share.

Research and academic institutes are the fastest growing end-user segment as global R&D activities increase. Growing government funding, collaboration with industry partners, and expanded research in materials science are accelerating innovation and application development. This trend is driving rapid adoption of 2D materials beyond graphene in laboratories and pilot-scale production, creating long-term growth potential.

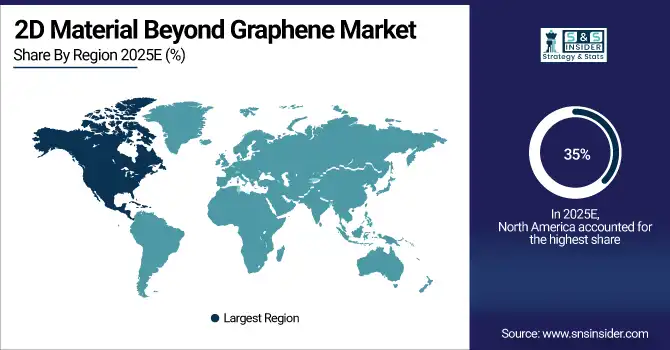

2D Material Beyond Graphene Market Regional Analysis:

North America 2D Material Beyond Graphene Market Insights:

In 2025, North America’s 2D Material Beyond Graphene Market accounting for the highest regional revenue share of approximately 35% in 2025. North America’s dominance in the 2D Material Beyond Graphene market is driven by strong presence of leading semiconductor and advanced materials manufacturers, extensive R&D infrastructure, and significant government and private funding for innovation. The region’s mature electronics ecosystem, high adoption of next-generation devices, and rapid commercialization of 2D materials support early market leadership. Additionally, strong collaboration between universities and industry, advanced manufacturing capabilities, and robust supply chain networks further reinforce North America’s leading position in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. and Canada 2D Material Beyond Graphene Market insights:

The U.S. and Canada market is driven by strong semiconductor manufacturing, defense applications, and high R&D investments in advanced materials. Increased focus on next-generation electronics, flexible devices, and energy storage solutions is accelerating adoption. Major universities and research institutions are actively developing scalable production methods and commercial applications. However, high production costs and stability challenges remain barriers, prompting investments in improved synthesis techniques and quality control. Strong government support and industry collaborations are expected to sustain growth through 2035.

Asia Pacific 2D Material Beyond Graphene Market Insights:

Asia Pacific represents a fast-growth region for the 2D Material Beyond Graphene market, registering a CAGR of 6.90% during 2026–2035. Rapid industrialization, a strong electronics manufacturing base, and rising demand for next-generation semiconductor and consumer devices are driving adoption. Increasing R&D investments, government initiatives supporting advanced materials, and expanding production capabilities are accelerating commercialization. Growing renewable energy deployment and energy storage requirements are further fueling demand for high-performance 2D materials in batteries and supercapacitors.

Europe 2D Material Beyond Graphene Market Insights:

Europe is witnessing steady growth in the 2D Material Beyond Graphene market driven by strong automotive, aerospace, and industrial manufacturing sectors. Increasing focus on advanced materials for lightweight components, high-performance sensors, and energy-efficient devices is boosting adoption. The region’s strong research ecosystem, supportive government funding, and collaborative innovation initiatives are accelerating commercialization. However, stringent regulatory standards and high production costs may slow large-scale deployment. Continued investment in scalable manufacturing and material standardization is expected to sustain growth through 2035.

Latin America 2D Material Beyond Graphene Market Insights:

Latin America is emerging as a growing market for 2D Material Beyond Graphene, driven by increasing industrialization and rising demand for advanced electronics and energy storage solutions. Growing investments in research and innovation, along with expanding manufacturing capabilities in key countries, are supporting market development. However, adoption remains limited due to high production costs, lack of advanced manufacturing infrastructure, and low awareness. Continued government support, technology partnerships, and increasing applications in renewable energy and electronics are expected to drive growth in the region.

Middle East and Africa 2D Material Beyond Graphene Market Insights:

Middle East and Africa is a developing market for 2D Material Beyond Graphene, driven by growing investments in advanced technology, renewable energy, and industrial modernization. Increasing focus on energy storage, smart infrastructure, and research collaborations is supporting gradual adoption. However, limited manufacturing infrastructure, high production costs, and low market awareness continue to restrain growth. Ongoing government initiatives, rising funding for innovation, and strategic partnerships with global technology providers are expected to create new opportunities and support market expansion over the forecast period.

2D Material Beyond Graphene Market Competitive Landscape:

ACS Material LLC is a leading supplier of advanced nanomaterials, including high-purity black phosphorus and phosphorene flakes, serving research institutions, semiconductor developers, and industrial partners with customized 2D materials and solutions. The company’s portfolio supports applications in electronics, energy storage, and sensing, with a strong focus on material purity, repeatable synthesis, and quality control to address environmental stability challenges in 2D materials beyond graphene.

-

October, 2025, ACS Material was featured in 2D material optoelectronics market reports for its involvement in expanding the use of 2D materials in next-generation optoelectronic devices, reflecting growing industry engagement.

2D Semiconductors Inc. is an advanced materials company specializing in monolayer and few-layer black phosphorus (phosphorene) crystals and related 2D semiconductor materials used in prototyping high-performance transistors, photodetectors, and other semiconductor devices. Its products emphasize controlled growth and minimal defect density, enabling research and commercialization of ultra-thin 2D components.

-

In 2025, the company announced the commercial rollout of wafer-scale transition metal dichalcogenide (TMD) films tailored for 5G transistors and high-frequency flexible electronics, marking a key step toward real-world deployment of advanced 2D materials.

American Elements is a global advanced materials manufacturer offering a broad range of 2D material products, including black phosphorus, phosphorene derivatives, and other nanomaterials used for research, electronics, and industrial applications. The company’s portfolio supports academic and commercial development of emerging 2D materials, with high-purity materials tailored to cutting-edge research environments.

-

In 2024, American Elements expanded the availability of high-purity black phosphorus materials to meet rising demand from research institutions and emerging industrial applications, reflecting continued commercial interest in 2D material adoption.

2D Material Beyond Graphene Market Key Players:

-

ACS Material LLC

-

2D Semiconductors Inc.

-

Nanochemazone

-

HQ Graphene BV

-

Manchester Nanomaterials

-

6Carbon Technology

-

Taizhou Sunano Energy

-

Shandong Ruifeng Chemical

-

Mophos

-

Iris Light Technologies Inc.

-

SAE

-

Accumet Materials Co.

-

Mil-Spec Industries Corp.

-

Nichia Corporation

-

STREM Chemicals

-

Noah Technologies

-

Espicorp Inc.

-

BariteWorld

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2035 | USD 4.40 Billion |

| CAGR | CAGR of 3.67% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type: (Monolayer Phosphorene, Few-Layer Phosphorene, Multilayer Phosphorene) •By Production Method: (Mechanical Exfoliation, Liquid Phase Exfoliation, Chemical Vapor Deposition (CVD)) •By Application: (Electronics & Semiconductors, Energy Storage Systems, Sensors & Photodetectors) •By End-user Industry: (Electronics & Semiconductor Industry, Energy & Power Industry, Research & Academic Institutes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | ACS Material LLC, 2D Semiconductors Inc., American Elements, Nanochemazone, HQ Graphene BV, Manchester Nanomaterials, 6Carbon Technology, Taizhou Sunano Energy, Shandong Ruifeng Chemical, Mophos, Iris Light Technologies Inc., Inorganic Ventures, SAE, Accumet Materials Co., Mil-Spec Industries Corp., Nichia Corporation, STREM Chemicals, Noah Technologies, Espicorp Inc., BariteWorld |