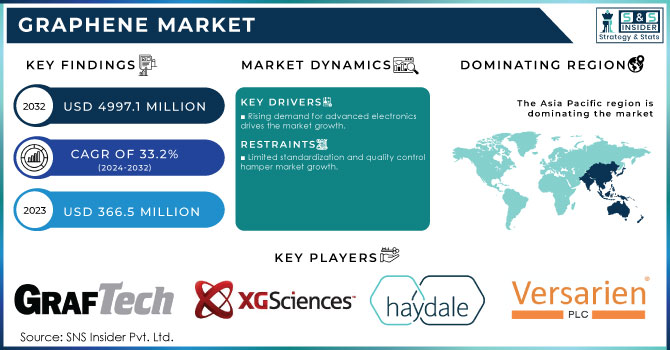

Graphene Market Size Analysis:

The Graphene Market Size was valued at USD 489.94 Million in 2024. It is expected to grow to USD 4997.10 Million by 2032 and grow at a CAGR of 33.68% over the forecast period of 2025-2032.

The rise of electric vehicles (EVs) and the growing need for efficient energy storage solutions are driving the use of graphene in batteries and supercapacitors, where it enhances charge capacity, lifespan, and energy density drives the market growth. Beyond their use in electronics, the biological detection and sensitivity of graphene make it an ideal candidate for biosensors that can detect minute biological changes at early stages of disease conception or continued health monitoring. By wearable medical devices, these innovations allow the very flexible and lightweight properties of graphene to be included in the design of much smarter, non-invasive health monitoring systems. Together, these developments are creating opportunities for the next generation of sophisticated, effective, and individualized health-tech solutions; positioning graphene as a key enabler for the next wave of medical technology.

According to the Canadian Association in 2021 report, the CSA noted that the integration of graphene into concrete could potentially reduce the weight of structures by up to 15% while maintaining strength, contributing to more efficient and sustainable building practices.

Graphene Market Size and Forecast

-

Market Size in 2024: USD 489.94 Million

-

Market Size by 2032: USD 4,997.10 Million

-

CAGR: 33.68% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2020–2022

Get More Information on Graphene Market - Request Sample Report

Graphene Market Trends

-

Rapid adoption of graphene in batteries and supercapacitors to improve energy density, charging speed, and lifespan, driven by the growth of electric vehicles and renewable energy storage systems.

-

Increasing integration of graphene in advanced electronics, flexible displays, sensors, and IoT devices due to its superior electrical conductivity, lightweight structure, and flexibility.

-

Expanding use of graphene in healthcare applications, including biosensors, drug delivery systems, and wearable medical devices for real-time health monitoring and early disease detection.

-

Rising demand for graphene-based composites in automotive and aerospace industries to reduce weight, enhance structural strength, and improve fuel efficiency and performance.

-

Growing investments in scalable graphene production technologies to reduce manufacturing costs and enable wider commercial adoption across industries.

-

Increasing use of graphene in construction materials such as graphene-enhanced concrete to improve durability, reduce structural weight, and support sustainable infrastructure development.

-

Strong government support, research collaborations, and funding initiatives accelerating innovation and commercialization of graphene technologies globally.

Graphene Market Growth Drivers

-

Rising demand for advanced electronics drives the market growth.

The increasing demand for high-end electronics is one of the primary factors fueling the graphene market since it has great electrical conductivity, flexibility, and lightness which are gaining massive traction in the electronics industry. Graphene is expected to disrupt many use cases, such as bendy screens, sensors, and capacitive batteries. These increases also signify the growing need for new materials such as graphene, to satisfy the changing market requirements of the electronics sector. Additionally, the National Renewable Energy Laboratory (NREL) claims that using graphene for battery technology can increase energy density by up to 30% and will lead to greatly reduced charging times. It complements the growth in the use of electric vehicles (EVs) and renewable energy systems, which need effective means to store the generated power. These trends converge to illustrate how the current demand for advanced electronics driven by graphene’s unique properties and efficiencies is not only changing product architectures but also supporting the larger transition towards more sustainable, high-performing technology systems.

Graphene Market Restraints

-

Limited standardization and quality control hamper market growth.

The presence of limited standardization & quality control in the graphene market drastically impedes growth by increasing inconsistencies in material properties as well as performance. Since graphene is fabricated via several methods, the quality, purity, and structure of such graphene can differ widely for example, chemical vapor deposition or liquid-phase exfoliation. This inherent variability makes it difficult for manufacturers and end-users who want reliable performance from the devices they build or depend on, especially in high-competition areas such as electronics where a technology might go into common use, as well as biomedical applications where safety is paramount. The lack of industry standards and certification methods for graphene quality makes it difficult for companies to feel confident enough to invest in graphene products without worrying over their potential failure or underperformance.

Graphene Market Segment Analysis

-

By Product

The market was led by graphene oxide, which captured 47.0% of the total revenue in 2024. It can be used as electrode material for capacitors, batteries, and solar cells. It is used with various polymers and other materials to improve composite material properties like elasticity, conductivity, and tensile strength. It is very thin moldable, foldable, crinkle-able structure such structures are of more and more interest as applications such as ion conductors, hydrogen storage, and nanofiltration membranes.

Further, its fluorescence renders graphene oxide applicable for use in bio-sensing and disease detection, antibacterial materials, and drug carriers. Moreover, electronic devices including graphene oxide-based field effect transistors (GFET) are fabricated using it. Increasing application of graphene oxide across different end-use industries is expected to boost demand for the market.

Need Any Customization Research On Graphene Market - Inquiry Now

-

By Application

In 2023, the electronic component application held the most significant share of revenue in the market. Due to its high permeability & strength, as well as low weight. Its characteristics, like how it is thin and conductive, over the last few years have greatly increased encouraging its use in semiconductor development. Devices made of graphene have a low cost of fabrication. Therefore, they are becoming more and more common in the field of IoT networks, wearable medical devices for health monitoring systems, electric vehicles, etc.

-

By End-Use

The automotive industry accounted for the largest market share around 38% in 2024. It is due to the properties of graphene, which satisfy the requirements of the automotive sector i.e., high-performance materials lightweight and less weight. Automotive applications for graphene are expanding by the day as the material provides manufacturers the ability to create lighter and stronger parts that can lower overall weight to improve fuel economy and performance. Examples include the lightweight component where graphene can cut the mass of composite vehicle body parts by 30%, drastically improving energy use and emissions. Moreover, because of its excellent electrical conductivity, graphene is used in electric vehicles (EVs) for batteries which increases energy density and shortens charging times.

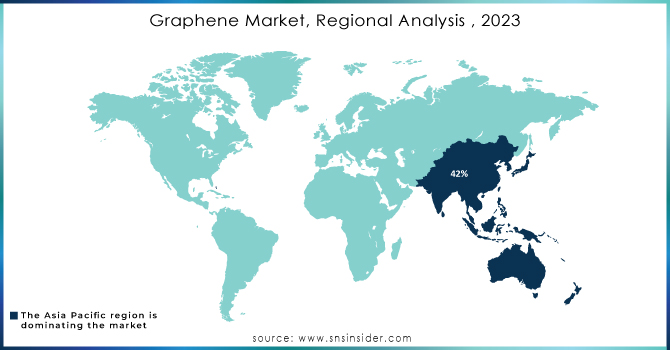

Graphene Market Regional Insights

Asia Pacific Graphene Market Insights

Asia Pacific held the largest market share around 42% in 2024. The Asia-Pacific region is the leading segment of the graphene market share, driven by a confluence of factors that drive the innovation and adoption of this advanced material. Among them, the presence of top graphene companies and research institutes in countries such as China, Japan, and South Korea that have invested heavily in graphene R&D is one of the main drivers. The Chinese government will continue to implement initiatives supporting the push for advanced materials technology under programs such as "Made in China 2025" to strengthen China's role in high-tech manufacturing sectors. This has resulted in ramped-up production capabilities and improved graphene-based applications in electronics, automotive & energy storage. Furthermore, the booming industrialization and urbanization in the Asia-Pacific region along with increasing construction, automotive, and electronics industries which demand advanced materials will drive growth. Among these factors, increasing applications in the automotive sector due to higher performance and sustainability of vehicles are driving the growth of the market for graphene from an end-use industry perspective as well in countries including Japan & South Korea. In addition, the government policies supporting green technologies and renewable energy solutions in general create favorable conditions for graphene applications in energy storage and efficiency.

North America Graphene Market Insights

North America continues to be a healthy participant in the graphene market through 2024 on account of spurring applications in electronics, energy storage and aerospace. United States dominates the region on the back of high investments in R&D, and collaboration between university, research institutes, and private industry to commercialize products employing graphene. Increasing need for lightweight materials, high-performance batteries, & next-generation composites will augment the industry growth. North America benefits from government assistance combined with strong existing technological infrastructure has provided North America an edge when it comes to scaling up graphene development.

Europe Graphene Market Insights

Europe remains at the vanguard of graphene industry till 2024, mainly owing to high demand from automotive, aerospace and renewable energy applications. Countries like the UK, Germany and Spain are driving innovation with state-of-the-art R&D programs and large collaborations, funded by the EU. Stringent sustainability targets in the region, coupled with the focus on lowering carbon emissions, have led to an increased use of graphene in composites, coatings and energy storage devices. With Europe’s well-established industrial network and early commercialization activities, the continent has a strong lead in the global graphene market.

Latin America (LATAM) and Middle East and Africa (MEA) Graphene Market Insights

The graphene market in LATAM and MEA is anticipated to grow at a modest pace through 2024 owing to the increasing demand for advanced materials to facilitate industrialization and the goal of becoming a sustainable economy. In LATAM, Countries such as Brazil and Mexico are looking at applications for graphene in construction, automotive and electronics, to enhance durability and efficiency. It added that it's MEA markets – including Saudi Arabia, the UAE and South Africa – that are positioning themselves to lead the way in the deployment of graphene in renewable energy, desalination and infrastructure projects as part of long-term economic diversity. While still at a nascence in commercialization, rising investment, government led research, and industrial needs is placing LATAM and MEA as next potential destination for growth in global graphene market.

Competitive Landscape for Graphene Market

NanoXplore

NanoXplore is a leading graphene producer, recognized for its large-scale manufacturing capabilities and focus on advanced material solutions for the automotive and energy sectors.

-

In 2023, NanoXplore expanded its production capacity with the opening of a new commercial graphene powder facility in Québec, making it one of the largest graphene production sites in North America. This expansion was aimed at meeting the rising demand for graphene in automotive and energy storage applications.

Haydale

Haydale specializes in advanced graphene and nanomaterial technologies, delivering innovative solutions across energy, infrastructure, and industrial sectors.

-

In 2023, Haydale collaborated with Cadent Gas, the UK’s largest gas distribution network, to develop graphene-enhanced gas pipes. This project focused on improving durability and corrosion resistance, strengthening the long-term reliability of gas infrastructure.

First Graphene

First Graphene is a prominent player in graphene materials, offering high-performance solutions for industrial applications such as construction, mining, and composites.

-

In 2023, First Graphene launched its PureGRAPH product line designed for use in fire retardants and composites. The new range enhanced safety and performance in construction and mining industries, underlining the company’s commitment to industrial-grade graphene innovation.

Graphene Market Key Players

-

GrafTech International (Graphene Nano Powder, Graphene-Enhanced Batteries)

-

Graphene NanoChem Plc (PlatDrill, PlatSurf)

-

XG Sciences, Inc. (xGnP Graphene Nanoplatelets, Graphene Conductive Inks)

-

Applied Graphene Materials plc (Graphene Dispersions, Genable)

-

Haydale Graphene Industries Plc (HDPlas Functionalised Graphene, Graphene-Based Inks)

-

Versarien Plc (Graphene-Wrapped Silicon, Nanene)

-

Talga Resources Ltd (Talphene, Graphene Composite Materials)

-

First Graphene Ltd (PureGRAPH Graphene Powders, PureGRAPH Masterbatch)

-

G6 Materials Corp. (Graphene Supercapacitors, Conductive Graphene Composites)

-

Thomas Swan & Co. Ltd. (Elicarb Graphene Powders, Graphene Oxide)

-

Graphenea S.A. (Graphene Oxide, CVD Graphene)

-

CVD Equipment Corporation (CVD graphene, Graphene Synthesis Tools)

-

Directa Plus S.p.A. (G+ Graphene, Graphene-Based Textiles)

-

Angstron Materials, Inc. (Graphene Nanoplatelets, Graphene Inks)

-

Lomiko Metals Inc. (Graphene-Based Lithium-Ion Batteries, Graphene-Enhanced Rubber)

-

Ad-Nano Technologies Pvt. Ltd. (Graphene Nano-Flakes, Graphene Quantum Dots)

-

AMO GmbH (Graphene Electronics, Graphene-Based Sensors)

-

CealTech AS (Graphene Nano-Particles, Graphene-Based Coatings)

-

Nanotech Energy Inc. (Graphene Supercapacitors, Graphene Battery Cells)

-

Global Graphene Group (Graphene-Enhanced Battery Electrodes, G-Nano)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 489.94 Million |

| Market Size by 2032 | USD 4997.1 Million |

| CAGR | CAGR of 33.68% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Graphene Nanoplatelets, Graphene Oxide, Reduced Graphene Oxide, Monolayer Graphene, Bulk Graphene, and Others) • By Application (Paints & Coatings, Electronic Components, Composites, Batteries, Solar Panels, and Others) • By End-Use (Automotive, Medical, Aerospace, Defense, Concrete Industry, Tires, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | GrafTech International, Graphene NanoChem Plc, XG Sciences, Inc., Applied Graphene Materials plc, Haydale Graphene Industries Plc, Versarien Plc, Talga Resources Ltd, First Graphene Ltd, G6 Materials Corp., Thomas Swan & Co. Ltd., Graphenea S.A., CVD Equipment Corporation, Directa Plus S.p.A., Angstron Materials, Inc., Lomiko Metals Inc., Ad-Nano Technologies Pvt. Ltd., AMO GmbH, CealTech AS, Nanotech Energy Inc., Global Graphene Group, and Others |