Energy Storage Market Report Scope & Overview:

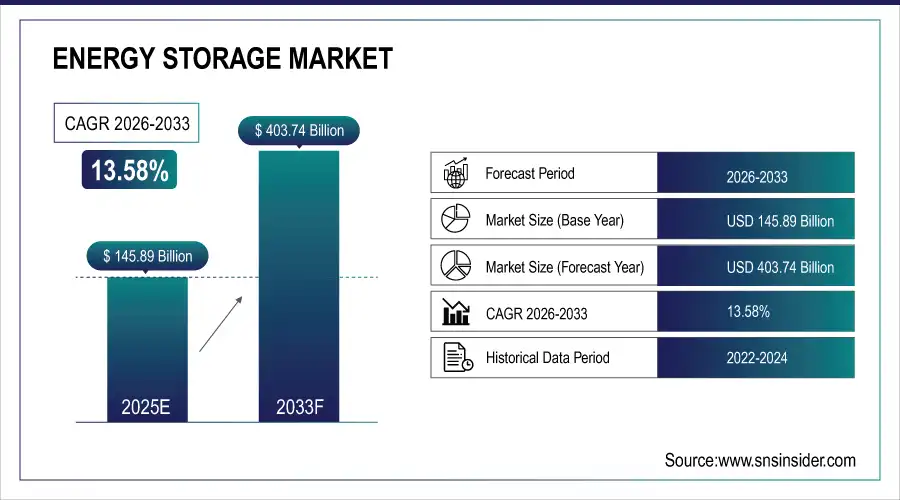

The Energy Storage Market size was valued at USD 145.89 Billion in 2025E and is projected to reach USD 403.74 Billion by 2033, growing at a CAGR of 13.58% during 2026-2033.

The Energy Storage Market Analysis is driven by increasing demand for integration of renewable energy sources and grid stability across the globe. The market benefits from the rise of electric vehicles, falling battery prices and government assistance. By employing technology types like lithium-ion and flow batteries that enhance efficiency and flexibility of storage.

EV Battery Synergy: By 2025, more than 30% of second-life EV batteries were repurposed for stationary storage applications, supporting cost-effective solutions for commercial and residential sectors.

Market Size and Forecast:

-

Market Size in 2025: USD 145.89 Billion

-

Market Size by 2033: USD 403.74 Billion

-

CAGR: 13.58% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Energy Storage Market - Request Free Sample Report

Energy Storage Market Trends

-

Increasing uptake of lithium-ion, flow batteries are improving the efficiency and reliability of energy storage systems.

-

Utilities and commercial business are using mega scale storage to help smooth the grid and reduce demand on it during peak times.

-

Energy Storage is increasingly being integrated with renewable sources such as solar and wind worldwide.

-

Intelligent Energy Management Systems are deployed to minimize storage and reduce OPEX.

-

Additional pent-up demand exists for scalable, modular storage products in residential and C&I markets.

-

Governments and regulators are implementing incentives and policies to drive the deployment of clean energy storage.

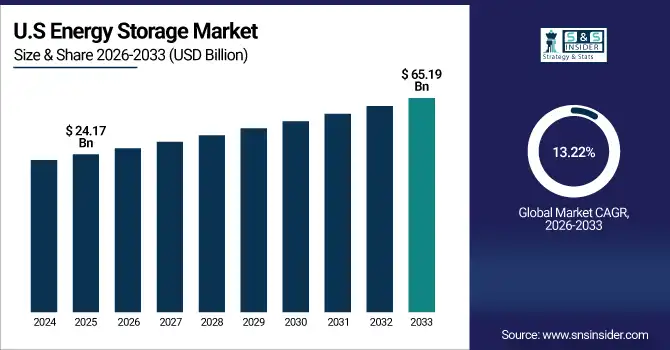

The U.S. Energy Storage Market size was valued at USD 24.17 Billion in 2025E and is projected to reach USD 65.19 Billion by 2033, growing at a CAGR of 13.22% during 2026-2033. The energy sector including utility, commercial, residential and transportation are in demand of a compact and high-capacity storage solution. With increased emphasis on renewable energy integration, grid stability and sustainable power solutions. It will influence the use of high-capacity, long-life storage technologies as they are flexible to deploy the over time.

Energy Storage Market Growth Drivers:

-

Rapid Adoption of Renewable Energy Sources and the Growing Need for Reliable Energy Storage Solutions

The energy storage market growth is prospect of harnessing a variety of renewable, but intermittent energy sources like solar and wind power are the leading factors contributing to this market. Utilities and industries require scalable storage for overproduction except consumption later when demand grows, so to maintain the electricity grid functionality and ensure secure energy supply. This burgeoning need for trustworthy storage is spurring investment in advanced battery tech, and pushing energy storage applications energized by renewable generation deeper into residential, commercial and utility projects across the globe.

Renewable Curtailment Reduction: By 2025, regions with advanced storage integration—like California and South Australia—reduced renewable energy curtailment by up to 45%, maximizing clean energy utilization and grid efficiency.

Energy Storage Market Restraints:

-

High Capital Investment and Installation Costs for Large-Scale Energy Storage Systems Limit Market Adoption

The expensive initial cost of buying and installing a grid-scale storage system is a main challenge of the energy storage market. These capital-cost-intensive investments such as advanced batteries, inverters and grid-integration system can make utilities, commercial and residential customers reluctant to deploy energy storage systems. High initial investment, creating a long payback period, is still strong obstacle especially for smaller and developing regions and projects slowing down the acceptance of the technology in market.

Energy Storage Market Opportunities:

-

Global Expansion of Renewable Energy Projects Driving Increased Demand for Scalable Energy Storage Solutions

The market is increasing in renewable projects such as solar & wind which are intermittent will be the main opportunity for Energy Storage Market. With an increasing penetration of these sporadic power sources, we also have the challenge to provide appropriate storage resources to balance out supply and demand. Efficient energy storage systems also contribute to grid stability, lower energy loss, and increase the percentage of renewable power integration across residential, commercial as well as utility sectors globally.

Grid Stability Enhancement: Over 70% of system operators in 2025 reported using battery storage to provide frequency regulation and voltage support, significantly improving grid resilience amid rising solar and wind integration.

Energy Storage Market Segment Analysis

-

By Product, Battery Energy Storage Systems (BESS) dominated the market, accounting for 52.34% share in 2025, while Electrochemical Capacitors are the fastest-growing segment, projected to expand at a CAGR of 7.20%.

-

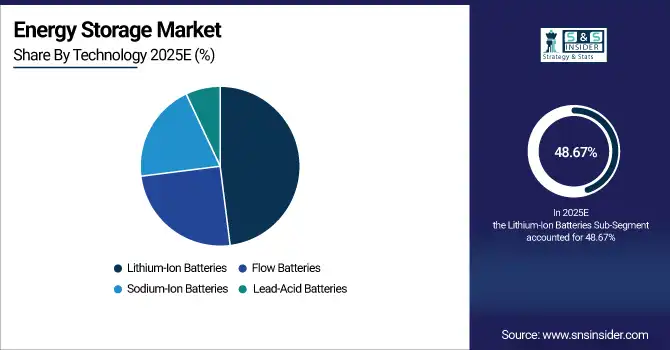

By Technology, Lithium-Ion Batteries dominated the market, holding 48.67% share in 2025, while Flow Batteries are the fastest-growing segment, projected to expand at a CAGR of 8.14%.

-

By Application, Utility-Scale Storage dominated the market, accounting for 50.21% share in 2025, while Residential Storage is the fastest-growing segment, projected to expand at a CAGR of 7.50%.

-

By Ownership, Utility-Owned systems dominated the market, holding 55.62% share in 2025, while Third-Party-Owned solutions are the fastest-growing segment, projected to grow at a CAGR of 7.80%.

By Product, Battery Energy Storage Systems (BESS) lead, Electrochemical Capacitors grow fastest

On the basis of Product, Battery energy storage systems (BESS) hold the largest share as battery costs have been decreasing and due to its scalability and high efficiency with renewable integration and grid stabilization. BESS system is typically used in utility, commercial and residential for peak shaving, load balancing and backup power. Electrochemical Capacitors is growing faster, due to the increasing need for fast charge–discharge in electric mobility, grid frequency regulation and power industry applications. High power eco-friendly battery system options significantly reduce C02 and cost Due to their longer life cycle, low maintenance and high energy density

By Technology, Lithium-Ion Batteries dominate, Flow Batteries expand fastest

On the basis of Technology, Lithium-Ion Batteries are projected to lead Energy Storage Market share owing to its high energy density, efficiency and cost reduction as a result of declining cost. Their widespread deployment in utility, residential and electric transportation applications has established them as the technology of choice for modern energy storage systems. Flow Batteries are growing at the highest rate, attributed to its long-duration energy storage, flexible scalability and ability to incorporate renewable energy integration. The ability to generate stable power on a reliable basis over long periods without degradation suit them for large-scale generation and utility applications.

By Application, Utility-Scale Storage leads, Residential Storage grows fastest

The Utility-Scale Storage dominating market in 2025, with rising need of renewable sources integration, grid stabilization, and peak load management. Projects at this scale store power that utilities use to balance supply and demand, enhance reliability of the grid and achieve aspirations of decarbonization. They are suitable for high-capacity long-duration applications that can fit around economies of scale. The Residential Storage segment is growing fastest, driven by falling BOS costs, growing penetration of rooftop solar and consumers desire for energy independence. Home energy management systems and behind-the-meter storage are additionally stimulated through intelligent homes and incentives.

By Ownership, Utility-Owned systems dominate, Third-Party-Owned expand fastest

The Utility-Owned Systems continue their dominance in the energy storage market, with utilities investing in grid-scale projects to balance offers, integrate renewables, and comply with regulations. This type of systems has centralized management, professional maintenance and operation experience so they are suitable for large capacity scenarios. Third-Party-Owned Systems is growing fastest due to moving the swiftest as leasing, energy-as-a-service, shared storage business models take hold. These systems reduce upfront costs for commercial, industrial and residential users which makes implementation faster and gives it wider availability.

Energy Storage Market Regional Analysis:

North America Energy Storage Market Insights:

North America is also a major market, with strong penetration by renewable energy and technology progress for grid resiliency again led by the U.S. followed closely by Canada. Federal and state incentives promote large storage projects. Increasing attention to clean energy transition supports deployment of lithium-ion and other advanced flow batteries. The market has been boosted by established players such as Tesla, Fluence and GE. The growth of EV networks also boosts the demand. North America is demonstrating solid growth potential. Grid modernization programs support long-term market adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Energy Storage Market Insights:

Utility-scale projects in the U.S. are widespread and it is the leading country in the North American energy storage market. Federal income tax credits and state-level renewable goals provide a shove. Leading firms such as Tesla and Fluence grow their total large-scale BESS deployments. EV demand is continuing to drive residential and commercial storage. The US still leads in innovation and deployment capabilities. Battery recycling investment is sustainability. Policy and market roles hand-in-hand associated with growth of the market.

Asia-Pacific Energy Storage Market Insights:

Asia-Pacific dominates the global Energy Storage Market, accounting 41.38% share in 2025E and projected to grow at a CAGR of 14.01% from 2026–2033, to become the fastest growing and largest region. Backed by integration of large-scale renewable source, rapid urbanization and industrial growth are driving adoption in countries like China, Japan, South Korea and India. Government-financed investments and subsidies are rapidly deploying lithium-ion and flow batteries. There are already strong manufacturing and innovation in the area. Growing EV demand only adds to the amount of storage we need. Leading authority will continue to be reserved for the Asia-Pacific with grid upgrading.

China Energy Storage Market Insights:

China leads the APAC region, which represents a good chunk of global energy storage installations. Enormous renewable energy projects and robust EV uptake are driving demand. It’s the government’s recently announced carbon neutrality targets that are driving investment and deployment of storage.

Europe Energy Storage Market Insights:

Europe is a big market, backed by the EU’s goals of carbon neutrality and renewable energy policies. Adoption is driven by countries such as Germany, the U.K., France and Spain. Strong demand for grid stability in the face of renewables drives expansion. Europe has long been an innovation driver in hydrogen and advanced flow batteries. Emphasis on sustainability accelerates deployment. Large-scale installations are backed by companies such as Siemens and Wartsila.

Germany Energy Storage Market Insights:

Europe’s power storage market is dominated by Germany, with the country being fierce in implementing renewable adoption and fossil fuels disuse. The residential sector is led by robust government backing for solar-plus-storage options. Utility-scale projects grow to help balance renewable-heavy grids.

Middle East & Africa (MEA) and Latin America Energy Storage Market Insights:

Middle East & Africa and Latin America are emerging energy storage markets with high growth potential. Solar-plus-storage, through the adoption by renewable-rich nations like Brazil, Chile and Mexico, proves its worth in Latin America. Middle East & Africa including UAE and Saudi Arabia drive investments to support integration of renewables. Opportunities for off-grid storage Due to grid constraint, off-grid storage opportunities exist. The governments are also putting more emphasis on clean energy.

Energy Storage Market Competitive Landscape:

Tesla Energy is a major international player in battery energy storage, with the Powerwall, Powerpack and Megapack being key products. The company is targeting both utility and residential storage for renewable integration and grid stabilization. Supported by strong R&D and new gigafactories, Tesla is leading innovations in lithium-ion batteries with global clean energy transformation strategy.

-

In September 2025, Tesla introduced its new utility-scale storage system “Megablock,” designed to cut construction costs and speed up installations, with claims of 23% faster setup and 40% lower construction costs.

Chinese firm, Contemporary Amperex Technology Co. Ltd (CATL) is the number one lithium-ion battery manufacturer and a major player in both EV and stationary storage markets globally. The company provides utility-scale projects, renewable integration and smart grid solutions. The emphasis on next-generation chemistries, such as sodium-ion batteries, enhances competitiveness. CATL's huge production capacity, the key to its place in the global energy storage supply chain.

-

In May 2025, CATL unveiled the TENER Stack, a mass-producible 9 MWh ultra-large capacity energy storage system, which improves volume utilization and energy density significantly compared to previous systems.

LG Energy Solution is one of South Korea’s top energy solution leaders, providing advanced lithium-ion battery and ESS solutions for a broad range of energy needs – from small IT devices to electric vehicles, residential and commercial ESS, and utility-grade ESS. The organization focuses on maintaining high standards of safety, performance and sustainability. The firm’s solutions are readily compatible with renewable developments and electric vehicle infrastructure.

-

In April 2025, LG Energy Solution's U.S. unit acquired the assets of its Michigan electric vehicle (EV) battery venture with General Motors (GM) for $2 billion. This acquisition is part of LG's strategy to strengthen its position in the ESS market by repurposing existing facilities for ESS production.

Energy Storage Market Key Players:

Some of the Energy Storage Market Companies are:

-

Tesla Energy

-

Contemporary Amperex Technology Co. Ltd. (CATL)

-

LG Energy Solution Ltd.

-

BYD Co. Ltd.

-

Fluence Energy Inc.

-

Wärtsilä Energy

-

Siemens Gamesa Renewable Energy

-

GS Yuasa Corporation

-

NGK Insulators Ltd.

-

Samsung SDI Co. Ltd.

-

General Electric (GE Vernova)

-

ABB Ltd.

-

Hitachi Energy Ltd.

-

Eaton Corporation

-

Mitsubishi Power Americas

-

AES Corporation

-

Voith Hydro GmbH

-

ANDRITZ AG

-

Form Energy

-

EnerVenue

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 145.89 Billion |

| Market Size by 2033 | USD 403.74 Billion |

| CAGR | CAGR of 13.58 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Battery Energy Storage Systems (BESS), Mechanical Storage, Thermal Storage and Electrochemical Capacitors) •By Technology (Lithium-Ion Batteries, Flow Batteries, Sodium-Ion Batteries and Lead-Acid Batteries) •By Application (Utility-Scale Storage, Commercial & Industrial (C&I) Storage, Residential Storage and Transportation) •By Ownership (Utility-Owned, Third-Party-Owned and Customer-Owned) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Tesla Energy, Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., BYD Co. Ltd., Fluence Energy Inc., Wärtsilä Energy, Siemens Gamesa Renewable Energy, GS Yuasa Corporation, NGK Insulators Ltd., Samsung SDI Co. Ltd., General Electric (GE Vernova), ABB Ltd., Hitachi Energy Ltd., Eaton Corporation, Mitsubishi Power Americas, AES Corporation, Voith Hydro GmbH, ANDRITZ AG, Form Energy, EnerVenue. |