3D-Printed Meat Market Report Scope & Overview:

Get More Information on 3D-printed Meat Market - Request Sample Report

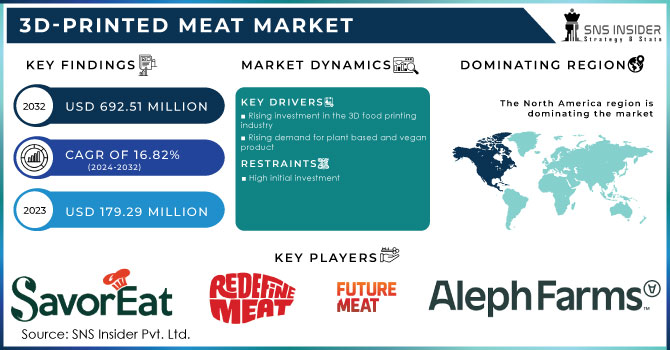

The 3D-printed Meat Market was valued at USD 179.29 million in 2023 and is expected to reach USD 692.51 million by 2032 and grow at a CAGR of 16.82% over the forecast period 2024-2032.

3D-printed meat is created by incubating animal stem cells in a bioreactor for a few weeks, where they grow and develop into muscle and fat cells. This cell filament is subsequently extruded into the shape and texture of meat before it is re-incubated and cooked.

According to the ingredients used to 'print' the meat, 3D-printed meat may or may not be vegetarian. Plant-based components such as soy, beets, pea protein, coconut fat, and chickpeas are used in the production of certain 3D-printed meat. Other types of 3D meat, also known as cultured meat, are created utilizing animal cells.

Based on type, the steak segment is estimated to grow rapidly in the forecast period as it could be used to create unique and innovative steak dishes for restaurants and other foodservice such as steak tartare made from 3D printed beef or steak fajitas made from 3D printed chicken. Steak segments are easily available at grocery stores and other retail outlets for consumers and sold directly to consumers.

MARKET DYNAMICS

KEY DRIVERS

-

Rising investment in the 3D food printing industry

3D printed meat does not require the slaughter of animals. This makes it a more morally responsible option to conventional meat production for customers who care about the treatment of animals. Meat products that are individualized and catered to specific dietary requirements can be produced using 3D printed meat. The development of 3D printed meat products is receiving significant funding from a number of venture capital firms and food companies. The development of 3D-printed meat is being accelerated by this financing. Millions of dollars have been raised by businesses like Aleph Farms and MeaTech 3D to produce and market their 3D printed meat products.

-

Rising demand for plant based and vegan product

RESTRAIN

-

High initial investment

Companies must invest in expensive equipment, such as 3D printers, bioreactors, and cell culture media, to manufacture 3D printed meat. They must also create their own recipes and techniques for growing and molding the meat. Because of the expensive initial expenditure, 3D printed meat companies have found it difficult to scale up their operations and bring their products to market on a wide scale. As a result, 3D printed beef remains a fairly specialized commodity, available only in a few restaurants and food service organizations.

OPPORTUNITY

-

Concern about animal welfare

Traditional meat production necessitates the slaughter of billions of animals each year. Many customers are becoming more aware of the moral ramifications of eating meat because this process can be brutal and immoral. A solution to enjoy the flavor and texture of meat without killing animals is provided by 3D printed meat. Cells from animal muscle tissue are cultured in a lab to create 3D printed meat. This indicates that no animals are killed to produce meat via 3D printing. Additionally, traditional meat production plays a significant role in environmental issues like climate change. The market for 3D printed meat is expanding since it is a more environmentally friendly method of producing meat.

CHALLENGES

-

consumers hesitate to try 3D printed meat

Some individuals may be unaware of the benefits of 3D printed meat. Because it is a new and unknown product. Some customers may be apprehensive to try new things, particularly when it comes to food. The safety and quality of 3D printed meat are currently being debated. Some customers may be apprehensive about the potential health dangers of 3D printed meat, or they may be confused about how it is manufactured. The cost of 3D printed beef remains higher than that of traditional meat. Some customers may be unwilling to pay a higher price for a new and untested product.

-

High cost of 3D printed meat

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine conflict has had an enormous effect on the food supply and the market for 3D printed meat. Global food prices have increased by 20% since the start of the war. The price of soybeans, another key ingredient in meat substitutes, has increased by 30%. Companies are finding it more difficult and expensive to make and market 3D printed meat products as prices rise. According to a recent Barclays analysis, the war might impede the growth of the 3D printed meat market by up to 25% by 2023.

IMPACT OF ONGOING RECESSION

The market for 3D printed meat has been hampered by the recession. The global market for meat replacements is likely to increase further as the vegan and vegetarian population grows. The rising awareness of the health benefits of 3D printed meat has fueled the 3D printed meat market. The technology for making 3D printed meat is quickly developing. In the following years, the cost of making 3D printed beef is likely to fall. According to a recent Barclays analysis, a recession might restrict the growth of the 3D printed meat market by up to 50% in 2023. Plant-based meat and cultured meat, which are normally less expensive than 3D printed meat, may become more competitive during a recession.

MARKET SEGMENTATION

By Product Type

-

Beef

-

Pork

-

Poultry

-

Seafood

-

Exotic Meats

-

Blended Products

By Source

-

Plant-Based

-

Animal Cell-Based

By End User

-

Restaurants & Hotels

-

Fast-Food Chains

-

Specialty Stores

-

Institutions

-

Bakeries & Confectionaries

REGIONAL ANALYSIS

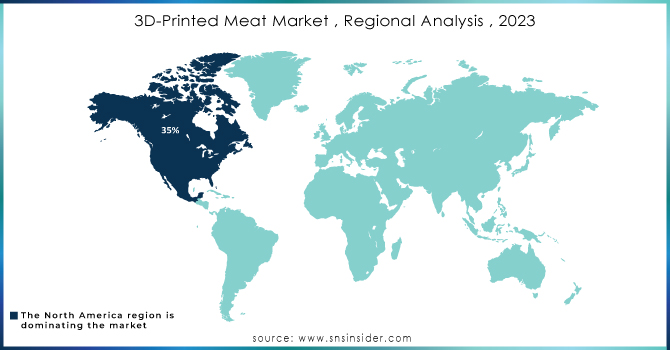

North America dominates the global 3D printed meat market in terms of a market share of 35% during the forecast period. Many companies in the area are engaged in the research & development and marketing of 3D-printed meat products. The market in North America is expanding as a result of rising consumer awareness of the advantages of 3D-printed meat, including its high nutritional content and capacity to meet the needs of vegetarians and vegans.

Europe's 3D-printed meat market accounts for 27% market share. The consumers in these regions have high disposable income and an increased demand for nutritious and environmentally friendly food products has driven the market growth. Furthermore, the presence of strong laws and regulations for the food business is encouraging market expansion in Europe.

Asia Pacific is predicted to be the fastest-growing market for 3D-printed meat. The region with a large growing population in countries like India and China and the rising disposable income and the increasing awareness about the benefits of 3D-printed meat are elevating the growth of the market. Consumers in this region prefer fresh meat and consumers hesitate to try 3D printed meat.

Need any customization research on 3D-printed Meat Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the 3D-printed Meat Market are Redefine Meat, SavorEat, Future Meat, Aleph Farms, Shiok Meats, CellX., Meat-Tech 3D, Novameat, BlueNalu, Fork & Goode, Novameat, Believer Meats, and other key players.

RECENT DEVELOPMENTS

In September 2023, Steakholder Foods Ltd., an international deep-tech food firm, is excited to introduce SH Beef Steak Ink, a breakthrough that will change the future of sustainable 3D printed meat manufacturing. The food technology industry is well-established in the region, and the market for alternative protein products is already very well-established. This ground-breaking ink, designed for use with the firm's fusion printer technology, aims to bring cultured meat to new heights of realism and gastronomic diversity.

In April 2023, Aleph Farms, an Israeli produced meat company, is set to introduce its first commercial product, a cultivated steak. The company has already secured a regulatory license for selling its product in Singapore and Israel, and both markets are slated to open later this year.

In January 2022, SavorEat announced a collaboration with the Israeli food company Osem to offer a new line of 3D-printed meat products made from plant-based materials. The items created with SavorEat's patented technology are intended to replicate the flavor and texture of genuine meat.

| Report Attributes | Details |

| Market Size in 2023 | US$ 179.29 Million |

| Market Size by 2032 | US$ 629.51 Million |

| CAGR | CAGR of 16.82 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Beef, Pork, Poultry, Seafood, Exotic Meats, Blended Products) • By Source (Plant-Based, Animal Cell-Based) •By End User (Restaurants & Hotels, Fast-Food Chains, Specialty Stores, Institutions, Bakeries & Confectionaries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Redefine Meat, SavorEat, Future Meat, Aleph Farms, Shiok Meats, CellX., Meat-Tech 3D, Novameat, BlueNalu, Fork & Goode, Novameat, Believer Meats |

| Key Drivers | • Rising investment in the 3D food printing industry • Rising demand for plant based and vegan product |

| Market Restrain | • High initial investment |