5G Enterprise Market Report Scope & Overview:

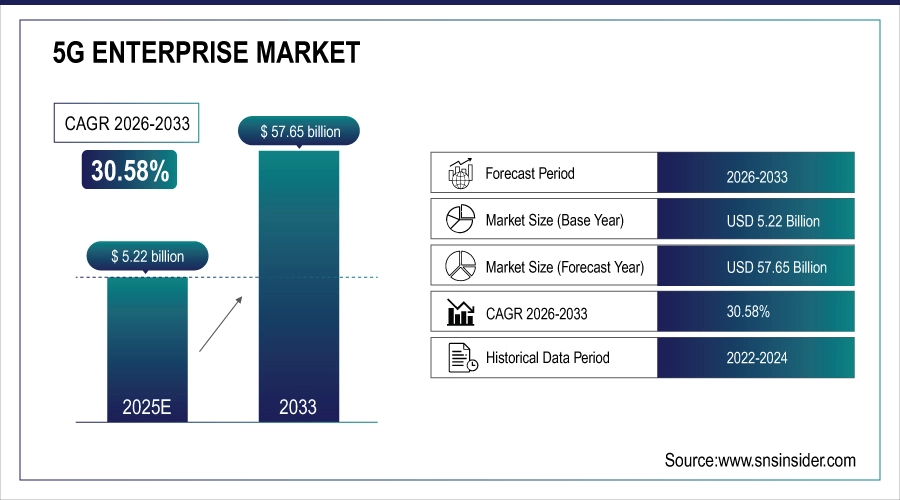

The 5G Enterprise Market was valued at USD 5.22 billion in 2025E and is expected to reach USD 57.65 billion by 2033, growing at a CAGR of 30.58% from 2026-2033.

The 5G Enterprise Market is experiencing rapid growth driven by the increasing demand for high-speed, low-latency connectivity to support digital transformation initiatives across industries. Enterprises are adopting private 5G networks to enhance operational efficiency, enable real-time data processing, and support IoT deployments at scale. The convergence of 5G with edge computing, AI, and cloud technologies is creating new opportunities for innovative applications in manufacturing automation, smart logistics, remote healthcare, and immersive experiences. Global expansion is further accelerated by Industry 4.0 adoption and the need for reliable, secure network infrastructure beyond traditional Wi-Fi limitations.

76% of enterprises piloting private 5G networks reported 45% improvement in operational efficiency and 60% reduction in network latency, enabling real-time IoT deployments and mission-critical applications across manufacturing, logistics, and healthcare sectors.

5G Enterprise Market Size and Forecast

-

Market Size in 2025E: USD 5.22 Billion

-

Market Size by 2033: USD 57.65 Billion

-

CAGR: 30.58% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on 5G Enterprise Market - Request Free Sample Report

5G Enterprise Market Trends

-

Rapid deployment of private 5G networks for industrial automation, enabling real-time control of robotics and autonomous systems in manufacturing environments

-

Increasing integration of 5G with edge computing to support latency-sensitive applications such as AR/VR, remote operations, and real-time analytics

-

Growing adoption of network slicing technology allowing enterprises to create multiple virtual networks with customized performance characteristics

-

Expansion of 5G-enabled IoT deployments across smart factories, warehouses, and logistics hubs for enhanced asset tracking and predictive maintenance

-

Rising implementation of 5G in healthcare for telemedicine, remote surgery, and connected medical devices requiring ultra-reliable low-latency communication

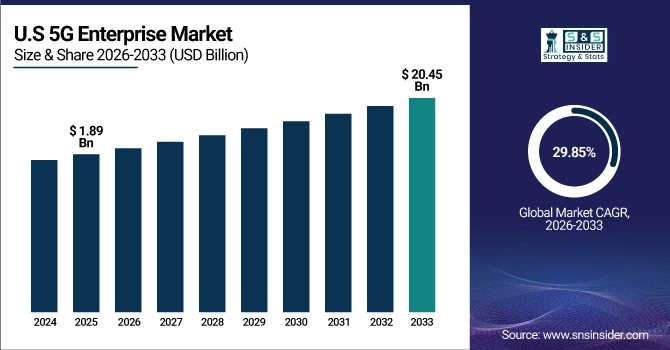

U.S. 5G Enterprise Market is valued at USD 1.89 billion in 2025E and is expected to reach USD 20.45 billion by 2033, growing at a CAGR of 29.85% from 2026-2033.

Strong telecommunications infrastructure, massive R&D investments, and early enterprise 5G deployments in manufacturing, healthcare, and logistics are driving U.S. 5G Enterprise Market Leadership and the changing dynamics of global 5G enterprise market adoption. The initiatives by the government for the deployment of 5G, growing demand from enterprises for reliable connectivity solutions are fast the market growth. Leading tech enterprises and factory producers are blazing private 5G trailways to competitive differentiations through improved operational leverage.

5G Enterprise Market Growth Drivers:

-

Increasing Demand for Ultra-Reliable Low-Latency Communication (URLLC) In Industrial Automation and Mission-Critical Applications Drives Enterprise 5G Adoption

These solutions must be equal parts high speed and reliable because industrial enterprises are implementing real-time control systems, advanced robotics, and precision manufacturing processes that require sub-10ms latency and 99.999% reliability. Due to these peculiar requirements, traditional wireless technologies are not capable of meeting the needs, and hence private 5G networks are required for Industry 4.0 transformation. 5G provides consistent, deterministic performance across a large factory and underpins applications such as predictive maintenance, quality assurance through computer vision, and production lines operating in a synchronized way.

In 2025, 68% of manufacturing enterprises deployed private 5G networks reducing production downtime by 40% and enabling real-time quality monitoring through high-definition video analytics across factory floors.

5G Enterprise Market Restraints:

-

High initial deployment costs and complexity of 5G infrastructure integration with existing enterprise systems limit adoption among small and medium enterprises

Implementing private 5G networks requires significant capital investment in spectrum licenses, radio equipment, core network infrastructure, and specialized integration services. The total cost of ownership, including ongoing maintenance and skilled personnel, presents a substantial barrier for organizations with limited IT budgets. Additionally, integrating 5G with legacy operational technology systems, enterprise applications, and security frameworks adds technical complexity that many organizations are unprepared to manage, slowing adoption particularly among mid-market companies.

62% of medium-sized enterprises cited deployment costs exceeding $500,000 and integration complexity as primary barriers delaying 5G adoption despite recognizing potential operational benefits.

5G Enterprise Market Opportunities:

-

Emerging Demand for 5G in Vertical-specific Applications Creates Opportunities for Customized Solutions in Healthcare, Education, and Public Safety

Beyond industrial applications, specialized vertical markets present significant growth opportunities for 5G enterprise solutions. In healthcare, 5G enables remote patient monitoring, telemedicine with AR/VR capabilities, and connected ambulance systems. Educational institutions are exploring 5G for immersive learning experiences and campus connectivity. Public safety agencies require reliable communications for emergency response and smart city applications. These diverse use cases drive demand for tailored 5G solutions with specific performance, security, and compliance characteristics, creating opportunities for solution providers with vertical expertise.

In 2025, healthcare organizations increased 5G investments by 65% for remote surgery platforms and connected medical devices, while educational institutions allocated 40% of IT infrastructure budgets to 5G-enabled immersive learning environments.

5G Enterprise Market Segment Highlights

-

By Spectrum: Licensed spectrum led with 61.4% share, while Shared spectrum is the fastest-growing segment with CAGR of 34.2%.

-

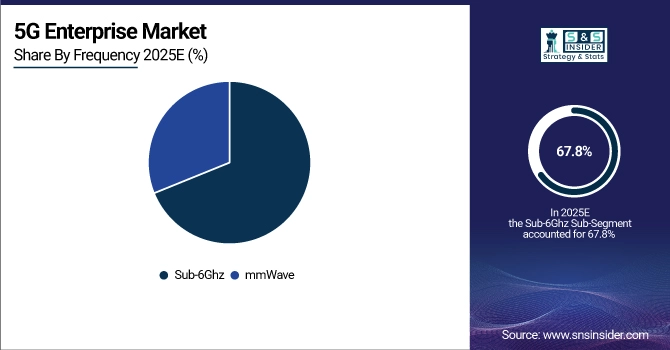

By Frequency: Sub-6Ghz led with 67.8% share, while mmWave is the fastest-growing segment with CAGR of 38.5%.

-

By Organization Size: Large enterprises led with 58.9% share, while Small and medium-sized enterprises is the fastest-growing segment with CAGR of 33.7%.

-

By Vertical: Manufacturing led with 24.6% share, while Healthcare is the fastest-growing segment with CAGR of 36.4%.

5G Enterprise Market Segment Analysis:

By Frequency: Sub-6Ghz Led the Market, while mmWave is the Fastest-growing Segment

Due to their coverage, capacity, and penetration capabilities, the Sub-6Ghz frequencies prevailed in the market. These bands offer firm indoor and outdoor coverage on big enterprise campuses while also providing enough bandwidth for the average user. That makes sub-6Ghz 5G networks particularly well-suited for industrial IoT applications, campus-wide connectivity and environments where wall penetration and area coverage are higher priorities than throughput or lower latency.

mmWave (millimeter wave) is the fastest growing frequency segment driven by the need for extreme bandwidth for niche applications. Multi-gigabit speeds provided by mmWave frequencies are suitable for high-definition video use cases, augmented reality, and data-intensive industrial applications. Despite range limitations and penetration issues, mmWave is being deployed when ultra-high bandwidth is needed in dense use cases, such as stadiums, conference centers, manufacturing quality control stations, and research facilities.

By Spectrum: Licensed Spectrum Led, while Shared Spectrum is the Fastest-growing Segment

Licensed spectrum dominates the 5G enterprise market, as it offers assured throughput, no interference, and total control over performance. Industries, such as manufacturing, energy and transportation choose licensed spectrum for mission-critical applications that require predictable low latency and availability. Some telecommunications providers provide private network agreements that offer enterprises an option to use dedicated licensed spectrum that delivers carrier-grade quality of service and security capabilities necessary for 5G.

The shared spectrum is the fastest-growing segment in the market, led by low cost and regulatory/flexibility. With shared spectrum models such as Citizens Broadband Radio Service (CBRS) in the United States, enterprises can access spectrum without the high cost of a licensed spectrum and get captured QoS. This decreases deployment costs by an order of magnitude and opens 5G to small and medium enterprises and other organizations with less stringent performance needs.

By Organization Size: Large Enterprises Led, while Small and Medium-sized Enterprises is the Fastest-growing Segment

Large enterprises dominate the market due to their complex connectivity requirements, significant IT budgets, and early recognition of 5G's strategic value. Industrial manufacturers, global logistics companies, and multinational corporations are pioneering private 5G deployments to gain competitive advantages through enhanced operational capabilities. These organizations have the resources to navigate implementation complexity, secure spectrum rights, and develop custom applications that leverage 5G's unique capabilities.

Small and medium-sized enterprises represent the fastest-growing segment as solution providers develop more accessible deployment models and shared infrastructure approaches. Managed service offerings, network-as-a-service models, and spectrum-sharing arrangements are reducing barriers to entry for smaller organizations. Industry-specific solution packages tailored to common use cases in manufacturing, retail, and healthcare are making 5G more approachable for organizations with limited technical expertise.

By Vertical: Manufacturing Led the Market, while Healthcare is the Fastest-growing Segment

Due to the broader digital transformation efforts, the manufacturing segment is dominating the market, which helps drive the 5G enterprise adoption in this sector. Owing to the automated mobile robots, AR-based maintenance, real-time quality inspection, synchronized production lines, the smart factories rely on wireless connectivity to ensure that their processes work smoothly. Across large industrial facilities, these applications are not only the deterministic performance but also the security and scale that private 5G networks offer.

As the digital health initiatives of the healthcare industry ramps up along with facility modernization, the healthcare segment grows the fastest. As per 5G technology, telemedicine with immersive capabilities, remote patient monitoring (RPM) with real-time analytics, connected ambulance systems for pre-hospital care, and many advanced medical imaging applications. The COVID-19 pandemic provided a jumpstart for adopting remote solutions which increased the demand of seamless high-bandwidth connectivity.

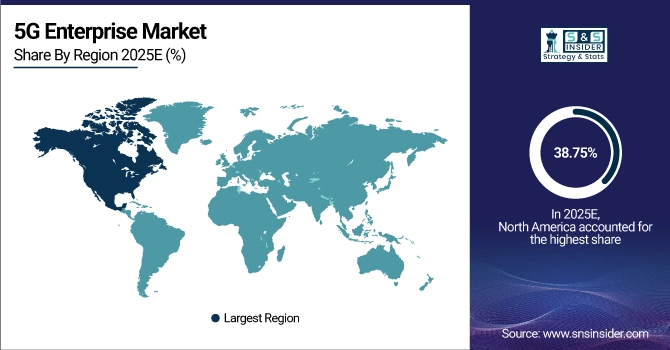

5G Enterprise Market Regional Analysis

North America 5G Enterprise Market Insights:

North America led the 5G Enterprise Market in 2025 with a 38.75% share owing to the spectrum allocation (particularly CBRS), along with stringent telecommunications infrastructure, and aggressive enterprise digital transformation initiatives. This dominance is driven by the region’s technology innovation, presence of major 5G equipment vendors, and significant investments from industrial manufacturers in private networks reinforcing the dominance across manufacturing, logistics, and technology sectors globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific 5G Enterprise Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 34.20% from 2026–2033, driven by massive manufacturing base modernization, government-led 5G initiatives, and rapid adoption of Industry 4.0 technologies. Countries like China, Japan, South Korea, and Singapore are implementing national strategies to leverage 5G for industrial competitiveness, supported by significant investments in smart factories, ports, and logistics infrastructure across the region.

Europe 5G Enterprise Market Insights

Europe held a significant share in the 5G Enterprise Market in 2025, supported by strong industrial base, regulatory frameworks promoting private networks, and coordinated initiatives through the European Commission's 5G Action Plan. The region's focus on manufacturing excellence, combined with investments from automotive, aerospace, and pharmaceutical sectors in private 5G for research and production, drives steady market growth across both Western and Eastern European countries.

Middle East & Africa and Latin America 5G Enterprise Market Insights

The Middle East & Africa and Latin America together showed accelerating growth in the 5G Enterprise Market in 2025, driven by economic diversification initiatives, smart city projects, and investments in critical infrastructure modernization. Oil and gas operations in the Middle East, mining automation in Africa, and manufacturing growth in Latin America are adopting 5G to improve operational efficiency and enable remote operations in challenging environments, supported by partnerships with global technology providers.

5G Enterprise Market Competitive Landscape:

Ericsson AB

Ericsson AB is a global leader in telecommunications equipment and services, headquartered in Sweden, with comprehensive 5G enterprise solutions spanning network infrastructure, management platforms, and industry applications. The company's Private 5G solutions offer dedicated network capabilities for industrial environments, combining radio access networks, core network functions, and edge computing platforms.

-

March 2025, Ericsson launched its enhanced Private 5G solution with integrated AI-driven network optimization and expanded industry-specific application ecosystem for manufacturing and logistics sectors.

Nokia Corporation

Nokia Corporation, headquartered in Finland, provides end-to-end 5G enterprise solutions through its Digital Automation Cloud and Modular Private Wireless offerings. The company focuses on industrial-grade connectivity with deterministic performance, supporting mission-critical applications across manufacturing, energy, transportation, and public sector verticals.

-

January 2025, Nokia expanded its MX Industrial Edge platform with new 5G-enabled applications for predictive maintenance and autonomous mobile robots, strengthening its industrial IoT ecosystem.

Huawei Technologies Co., Ltd.

Huawei Technologies Co., Ltd., headquartered in China, offers comprehensive 5G enterprise solutions through its One5G product portfolio, including wireless access, core network, and industry applications. The company emphasizes all-scenario 5G coverage, simplified operations through autonomous networks, and deep integration with vertical industry requirements.

-

October 2024, Huawei introduced its 5GtoB Suite 2.0 solution with enhanced network slicing capabilities and industry application templates, accelerating enterprise digital transformation across Asia and emerging markets.

5G Enterprise Companies are:

-

Ericsson AB

-

Huawei Technologies Co., Ltd.

-

Cisco Systems, Inc.

-

Samsung Electronics Co., Ltd.

-

NEC Corporation

-

ZTE Corporation

-

Fujitsu Limited

-

Juniper Networks, Inc.

-

CommScope Holding Company, Inc.

-

Airspan Networks Holdings Inc.

-

Mavenir Systems, Inc.

-

Affirmed Networks, Inc.

-

Altiostar Networks, Inc.

-

Deutsche Telekom AG

-

Verizon Communications Inc.

-

AT&T Inc.

-

Vodafone Group Plc

-

Telefónica S.A.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2025E |

USD 5.22 Billion |

|

Market Size by 2033 |

USD 57.65 Billion |

|

CAGR |

CAGR of 30.58% From 2026 to 2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2033 |

|

Historical Data |

2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Spectrum ( Licensed, Unlicensed, Shared.) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Ericsson AB,,Nokia Corporation,,Huawei Technologies Co., Ltd.,,Cisco Systems, Inc.,,Samsung Electronics Co., Ltd.,,NEC Corporation,,ZTE Corporation,,Fujitsu Limited,,Juniper Networks, Inc.,,CommScope Holding Company, Inc.,,Airspan Networks Holdings Inc.,,Mavenir Systems, Inc.,,Affirmed Networks, Inc.,,Altiostar Networks, Inc.,,Celona, Inc.,,Deutsche Telekom AG,,Verizon Communications Inc.,,AT&T Inc.,,Vodafone Group Plc,,Telefónica S.A. |