Sales Enablement Platform Market Report Scope & Overview:

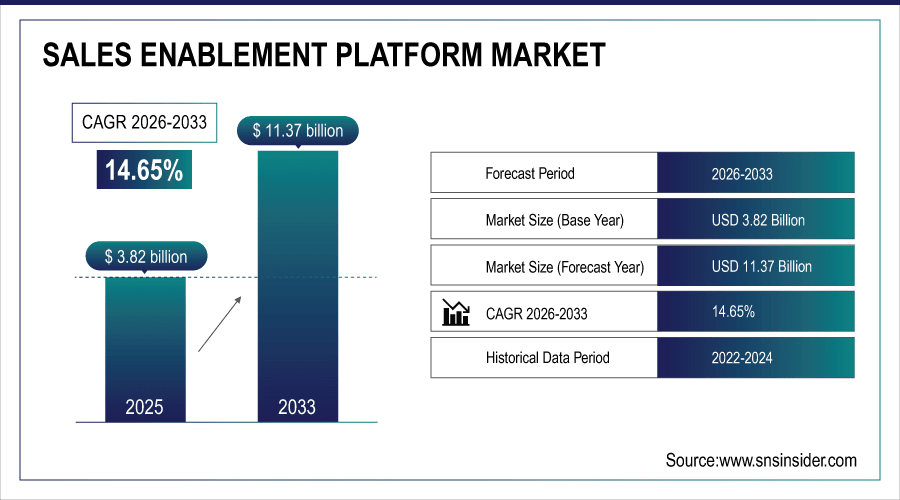

The Sales Enablement Platform Market Size was valued at USD 3.82 Billion in 2025 and is expected to reach USD 14.99 Billion by 2035 and grow at a CAGR of 14.65% over the forecast period 2026-2035.

Sales Enablement Platform Market is growing steadily and is powered by the emerging demand for the tools that design and help in the execution of efficient processes during the entire span of the sales process. With the need for more sales productivity, organizational efficiency, and customer engagement, organizations are increasingly adopting platforms that centralize content management, enhance analytics, and provide AI-powered sales insights. Integrating these platforms with existing Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) systems brings relevant content and insights to the sales teams at the correct time to get deals closed quickly and improve conversion rates. Moreover, increasing focus on customized sales methodologies and data-backed decision making is further propelling the adoption of these solutions in diverse sectors. According to study, Integration with CRM and ERP systems ensures that relevant content is accessed at the right time, increasing content utilization by up to 40%.

To Get More Information On Sales Enablement Platform Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 3.82 Billion

-

Market Size by 2035: USD 14.99 Billion

-

CAGR: 14.65% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Sales Enablement Platform Market Trends

-

Rising adoption of AI-driven analytics to enhance sales decision-making and forecasting.

-

Increasing use of personalized sales content to improve customer engagement and conversions.

-

Expansion of cloud-based solutions for scalable and cost-effective sales enablement.

-

Growing penetration of sales enablement platforms among SMEs to streamline onboarding and training.

-

Integration of sales enablement tools with CRM and ERP systems for real-time insights.

-

Focus on data-driven sales strategies to shorten sales cycles and improve revenue outcomes.

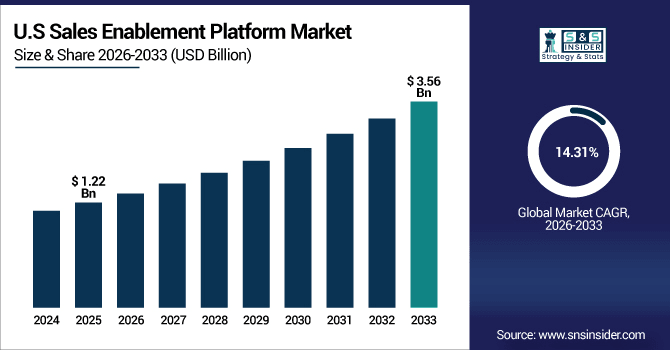

The U.S. Sales Enablement Platform Market size was USD 1.22 Billion in 2025 and is expected to reach USD 3.56 Billion by 2035, growing at a CAGR of 14.31% over the forecast period of 2026-2035, driven by early adoption of advanced technologies such as AI, cloud, and analytics. Organizations across sectors are leveraging these platforms to improve sales productivity, streamline processes, and enhance customer engagement.

Sales Enablement Platform Market Growth Drivers:

-

AI-Powered Insights Revolutionize Sales, Boosting Productivity, Personalization, and Conversion Rates Across Industries

Increasing focus on improving sales productivity and efficiency act as a driver for sales enablement platforms market. Contemporary Platforms has embedded AI and analytics to provide many actionable insights, recommend relevant content, and anticipate customer behavior. It allows sales teams to leverage data to make informed decisions in order to shorten the sales cycle and increase the number of conversions. Not only that, organizations can also monitor sales collateral engagement as it happens, and quickly see what content engages with prospects better than others. Integrated analytics with CRM and ERP provide the ability for highly customized sales a make balancing act for companies in developing markets across industries.

Real-time tracking of sales collateral usage can improve content utilization by up to 40%, ensuring reps use the most effective materials.

Sales Enablement Platform Market Restraints:

-

High Implementation and Integration Costs Challenge Adoption, Especially Among Small and Medium Enterprises

Despite the benefits, one significant restraint for the market is the high cost associated with implementing sales enablement platforms. While large-scale deployment has often entailed customisation, integration with existing CRM, ERP and communication systems, and staff training for the enterprise and particularly SME bottom line, this can be expensive. Moreover, in the case of cloud platforms or on-prem solutions, there are usually ongoing subscription fees or maintenance tasks that add up in the long run too. The steep expense platforms may delay adoption among price-responsive markets or smaller-sized organizations, which minimizes the extent of widespread penetration.

Sales Enablement Platform Market Opportunities:

-

SMEs Embrace Scalable Sales Enablement Platforms, Unlocking Growth Through Streamlined Onboarding and Training

A major growth opportunity lies in the increasing adoption of sales enablement platforms by small and medium-sized enterprises (SMEs). Traditionally, SMEs have depended on manual sales processes, but the increase of scalable, cloud-based and affordable systems enables smaller companies to tap into this capability. Sales enablement platforms allow SMEs to increase onboarding, train new sales representatives, and distribute content in a better way, improving their sales performance by default and reducing labour costs in the long-run, giving them an edge against competition. SMEs are anticipated to witness significant growth in the market in this decade owing to the customized solutions coupled with flexibility in pricing and ease of integration.

Cloud-based and scalable solutions can increase employee training completion rates by 20–25%.

Sales Enablement Platform Market Segmentation Analysis:

-

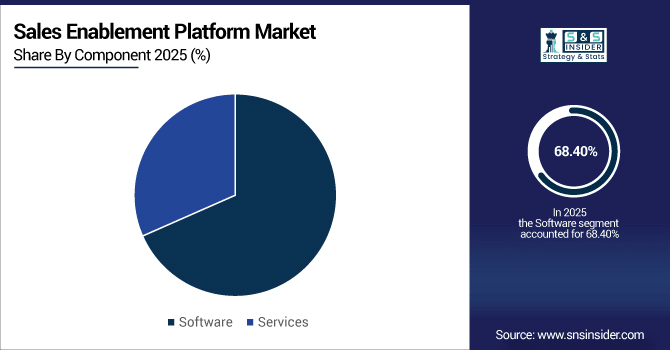

By Component: In 2025, Software led the market with share 68.40%, while Services are the fastest-growing segment with a CAGR 17.89%.

-

By Deployment: In 2025, Cloud-based the market 53.24%, while On-premises fastest-growing segment with a CAGR 17.50%.

-

By Organization Size: In 2025 Large enterprise led the market with share 65.20%, while SMEs the fastest-growing segment with a CAGR 18.10%.

-

By End Use: In 2025, IT & telecom led the market with share 24.60%, while Travel & hospitality is the fastest-growing segment with a CAGR 18.06%.

By Component, Software Leads Market and Services Fastest Growth

Sales Enablement Platform Market is segmented on the basis of Component into Software and Services. In terms of value, the software segment is expected to grow at a larger rate due to the capability of sales enablement platform software to streamline sales processes, view content management, and an AI powered insight that improve productivity and better decision making. On the other hand, Services is the fastest-growing segment owing to the rising demand for implementation support, training, customization, and integration with CRM and ERP. Organizations are increasingly purchasing professional services to facilitate time to deployment and maximize the value received from the platform. The synergy of software and services adoption is helping enterprises and SMEs streamline sales workflows, enhance engagement and drive conversions in an efficient manner.

By Deployment Mode, Cloud-based Leads Market and On-Premises Fastest Growth

In terms of Deployment, loud-based solutions are the most prevalent due to benefits of scalability, accessibility, and cost-effectiveness, allowing organizations to deploy the platforms within the shortest possible time without heavy initial investment in infrastructure. Moreover, real-time analytics, quick updates, and integration with CRM and ERP systems improve sales productivity and teamwork through cloud solutions. On-Premises deployment continues to be the fastest-growing segment, the need for high-priority low-latency cloud and data security and controllability, and customization pushed firm toward the use of on-premise deployment. Both cloud and on-premises solutions grew together, representing a spectrum of organizational needs ranging from support for very flexible but less mature cloud sales enablement strategies, to the more robust and secure on-premise solutions that have already proven themselves in production environments across industries.

By Organization Size, Large Enterprises Lead Market and SMEs Fastest Growth

In terms of Organization Size, the segment for Large Enterprises accounts for the highest market share in the Sales Enablement Platform Market, as these organizations have extensive sales teams, more complex workflows, and also higher budgets facilitating the adoption of advanced platforms providing AI-powered insights, content management, and analytics. They can achieve all this thanks to centralized deployment, easier integration with CRM and ERP systems, and increased productivity for sales personnel. SMEs, on the other hand, continue to be the most dynamic segment, utilizing scalable, cloud-hosted, price-friendly solutions to simplify the onboarding, training, and sales processes. The growing adoption by SMEs is indicative of the market moving beyond traditional very large enterprises where larger organizations can benefit from modern sales enablement capabilities to enhance efficiency, increase personalization and drive revenue.

By End Use, IT & Telecom Lead Market and Travel & Hospitality Fastest Growth

In terms of End Use, IT & Telecom is leading the market due to the dynamic nature of its selling processes, timely updates of its varied product ranges and selling to a large number of customers makes it imperative to run its sales content asset management system while relying on real-time insights. They use AI-enabled tools and analytics to drive optimal sales productivity, reduce sales cycle time, and enhance customer engagement. On the other hand, Travel & Hospitality is the market segment growing fastest, as organizations increasingly transition to cloud platforms for training employees, managing sales content and providing personalized customer service experiences. Combined growth from IT & Telecom and Travel & Hospitality illustrates market growth across industries driven by process optimization and technology adoption.

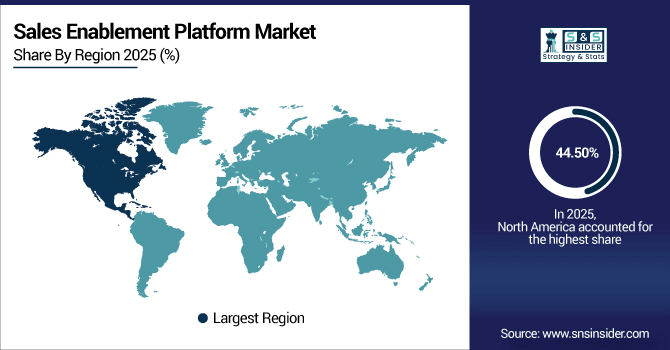

Sales Enablement Platform Market Regional Analysis:

North America Sales Enablement Platform Market Insights:

The Sales Enablement Platform Market in North America held the largest share 44.50% in 2025, owing to the higher deployment rate of advanced sales technologies, presence of a greater pool of large enterprises, and rapid integration of AI and analytics to sales processes across the region. Demand for software solutions and professional services stems from U.S. and Canada organizations' focus on enhancing sales productivity, relevance, and customer engagement. Most devices will be cloud-based, to enable scalability, affordable cost, and remote accessibility. Apart from this, the presence of strong IT infrastructure and supportive regulatory frameworks coupled with high digital maturity boosts adoption in sectors such as IT & Telecom, BFSI, and healthcare. It continues to be one of the key growth markets for cutting-edge sales enablement solutions.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Sales Enablement Platform Market with Advanced Technological Adoption

U.S. dominates the Sales Enablement Platform Market due early adoption of AI-powered tools, cloud-based solutions, and analytics drives sales productivity, personalization, and efficient content management across enterprises and industries.

Asia-Pacific Sales Enablement Platform Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Sales Enablement Platform Market, projected to expand at a CAGR of 16.18%, owing to the increasing growth of digital transformation, growing adoption of cloud-based solutions and growing number of SMEs in the region. Organizations are spending in tools backed by AI, content hub, and analytics to sell more efficiently towards a particular customer and be more personal with their selling strategies. Platform adoption across IT & Telecom, BFSI, and retail is being accelerated by the snowballing emphasis on workforce training, remote collaboration, and process automation in the region. Live real-time scenarios, Flexible Pricing models, Scalable deployments & improved infrastructure are inducing both large enterprises and SMEs in the region to deploy modern sales enablement solution systems fostering persistent growth of the market in the region.

China and India Propel Rapid Growth in Sales Enablement Platform Market

China and India propel rapid growth in the Sales Enablement Platform Market due to increasing digital adoption, rising SMEs, cloud-based solution integration, AI-powered sales tools, and focus on enhancing productivity, personalized selling, and customer engagement across diverse industries.

Europe Sales Enablement Platform Market Insights

The Sales Enablement Platform Market in Europe is expected to grow at the fastest rate due to adoption of AI-driven sales tools and services among enterprises as a part of digital transformation and process optimization. Sales intelligence Software enables organizations to improve sales productivity, content management, and customer engagement, using both cloud-based and on-premises platforms. IT & Telecom, BFSI and manufacturing use case: These industries are actively deploying these solutions to enable data-driven decision-making and personalized sales. In addition to this, favorable regulatory frameworks, elevated digital maturity and growing investments in professional services for platform implementation, are aiding the market size growth. Europe remains a leading region for the adoption of new innovative sales enablement techniques.

Germany and U.K. Lead Sales Enablement Platform Market Expansion Across Europe

Germany and the U.K. lead Sales Enablement Platform Market expansion across Europe, driven by high digital maturity, early adoption of AI and cloud-based tools, strong enterprise presence, and increasing demand for sales productivity, personalization, and data-driven decision-making.

Latin America (LATAM) and Middle East & Africa (MEA) Sales Enablement Platform Market Insights

the growth of Latin America (LATAM) and Middle East & Africa (MEA) sales Enablement Platform Market is expected to witness moderate growth with emerging markets rapidly adapting to digital and processes for the sales. Businesses in these locations are catching onto cloud-based and AI-powered platforms that help increase sales productivity, generate faster onboarding, and add more value for customers. Scalable and cost-efficient solutions are empowering SME and large enterprise to adopt data-driven sales processes. Increasing consciousness, upskilling of workforce, personalized selling solution demand are speeding up platform adoption despite challenges such as limited infrastructure & budget constraints, creates lucrative growth opportunities within the countries such as LATAM & MEA markets.

Sales Enablement Platform Market Competitive Landscape

Seismic's Enablement Cloud is an AI-powered platform that empowers customer-facing teams with tools for content management, training, and analytics. It enables personalized buyer engagement, streamlines onboarding, and provides real-time insights to drive revenue growth.

-

In October 2024, Seismic was recognized as a leader in the Forrester Wave™: Revenue Enablement Platforms, earning top scores in 26 of 32 criteria.

Highspot offers a unified sales enablement platform that integrates content management, training, coaching, and analytics. It leverages AI to provide real-time guidance, optimize sales strategies, and enhance buyer engagement, aiming to drive predictable revenue growth.

-

In October 2024, Highspot launched an AI-powered GTM Enablement Platform, introducing always-on coaching, real-time personalized recommendations, and scalable skills assessments.

Pitcher provides an AI-driven sales enablement platform designed to streamline sales processes. It offers tools for content management, coaching, analytics, and engagement, enabling sales teams to deliver personalized experiences and improve productivity across various industries.

-

In October 2024, Pitcher announced AI-driven enhancements to its MedTech Sales Suite to drive unmatched seller effectiveness and efficiency.

Sales Enablement Platform Market Key Players:

Some of the Sales Enablement Platform Market Companies are:

-

Seismic

-

Highspot

-

Showpad

-

Mediafly

-

Pitcher

-

Guru

-

Whatfix

-

Brainshark

-

Allego

-

ClearSlide

-

Mindtickle

-

SalesLoft

-

Outreach

-

Pipedrive

-

HubSpot

-

iSpring Learn

-

ClientPoint

-

Momentum

-

WizCommerce

-

Aurasell.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.82 Billion |

| Market Size by 2035 | USD 14.99 Billion |

| CAGR | CAGR of 14.65% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (Cloud-based, On-premises, Hybrid) • By Organization Size (Large enterprise, SMEs) • By End Use (BFSI, Healthcare & life sciences, IT & telecom, Manufacturing, Media & entertainment, Consumer goods and retail, Education, Travel & hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Seismic, Highspot, Showpad, Mediafly, Pitcher, Guru, Whatfix, Brainshark, Allego, ClearSlide, Mindtickle, SalesLoft, Outreach, Pipedrive, HubSpot, iSpring Learn, ClientPoint, Momentum, WizCommerce, Aurasell, and Others. |