5G Fixed Wireless Access (FWA) Market Report Scope & Overview:

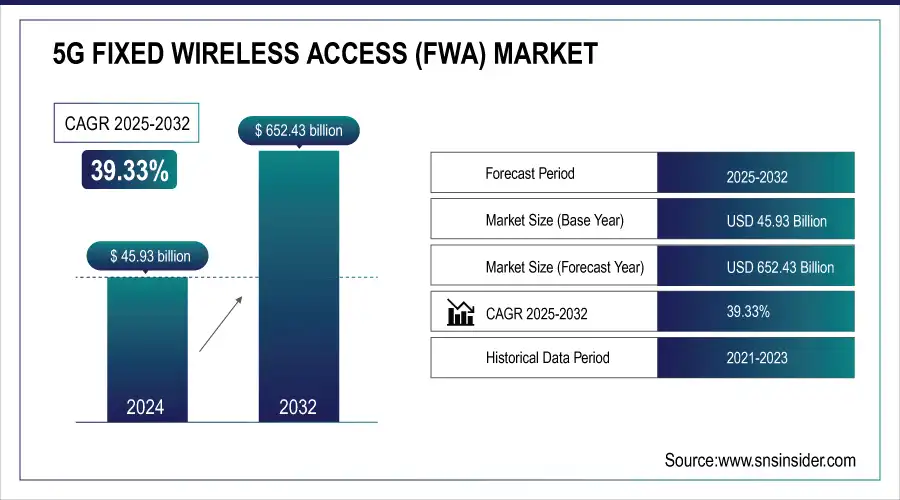

The 5G Fixed Wireless Access Market Share was valued as USD 45.93 Billion by 2024 and expected to reach at USD 652.43 Billion by 2032 and grow at a CAGR of 39.33%over the forecast period 2025-2032.

The 5G Fixed Wireless Access (FWA) market is witnessing remarkable growth as it effectively addresses the rising demand for high-speed broadband, especially in underserved areas. FWA utilizes advanced 5G technology to deliver reliable internet connectivity, presenting a compelling alternative to traditional wired broadband solutions. The FWA is projected to expand substantially, driven by the increasing need for fast and dependable internet access, particularly in rural and remote regions. The expansion of 5G networks is essential for ensuring that FWA can meet the anticipated demand for bandwidth, with estimates suggesting that FWA will account for a significant share of the overall fixed broadband market in the coming years.

Get more information on 5G Fixed Wireless Access (FWA) Market - Request Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 45.93 Billion

-

Market Size by 2032: USD 652.43 Billion

-

CAGR: 39.33% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key 5G Fixed Wireless Access Market Trends

-

Rapid adoption of 5G FWA as an alternative to fiber broadband in urban, suburban, and rural areas.

-

Expansion of high-speed, low-latency broadband connectivity to residential and enterprise customers.

-

Increasing deployment of mmWave and sub-6 GHz spectrum for enhanced coverage and capacity.

-

Growth in enterprise and industrial FWA applications, including smart manufacturing, IoT, and Industry 4.0.

-

Rising investment by telecom operators in CPE devices, antennas, and network infrastructure to support FWA rollout.

-

Focus on network densification and small cell deployment to enhance coverage in dense urban areas.

-

Integration of AI and machine learning for network optimization, predictive maintenance, and quality of service improvement.

5G Fixed Wireless Access Market Growth Drivers

-

The Role of 5G Fixed Wireless Access in Meeting High-Speed Internet Demand

The demand for high-speed internet is rapidly increasing, driven by a growing reliance on online services that require substantial bandwidth. This trend is particularly evident in areas such as streaming video, online gaming, remote work, and educational platforms. Internet service providers (ISPs) are under pressure to offer faster, more reliable connections to meet consumer expectations.

With the popularity of platforms like Netflix, Hulu, and Disney+, media consumption has transformed significantly. High-definition (HD) and ultra-high-definition (UHD) video streaming demand much higher bandwidth than standard-definition content. For example, streaming in 4K can consume up to 25 Mbps, placing significant pressure on existing broadband infrastructures, especially in regions with limited connectivity options The gaming industry also reflects this shift, as more players opt for online multiplayer experiences that necessitate stable, fast internet connections. In gaming, latency is critical; even minor delays can disrupt performance. Therefore, high-speed internet is essential to ensure smooth gameplay and quick response timesFixed Wireless Access (FWA) emerges as a promising solution to these challenges. By harnessing 5G technology, FWA can deliver high-speed internet without the extensive cable installations that traditional broadband requires, making it faster and more cost-effective to deploy. FWA leverages existing cellular networks, enabling ISPs to provide service in areas that may be economically unfeasible for traditional broadband conclusion, the rising demand for high-speed internet driven by services like streaming, gaming, and remote work highlights the need for innovative solutions such as FWA. As ISPs enhance their offerings, FWA presents a practical approach to bridging the digital divide, ensuring that all communities can access reliable and fast internet connections. This growth in FWA adoption is expected to significantly impact the market, driving further investments and advancements in broadband technology

5G Fixed Wireless Access Market Restraints

-

Financial Barriers to Growth in the 5G Fixed Wireless Access Market

The deployment costs associated with 5G Fixed Wireless Access (FWA) create significant barriers for market entry and expansion. While FWA offers the advantage of faster deployment compared to traditional wired solutions, the initial financial investment is substantial, ranging from USD 100,000 to USD 1 Billion, depending on the scale of operations and technology employed.These expenses cover critical components such as base stations, antennas, and subscriber equipment, making it a considerable financial commitment, particularly for smaller providers that may lack the capital resources of larger telecommunications companies.ongoing maintenance and upgrade costs add another layer of complexity to the financial landscape, with maintenance expenses alone estimated to account for 10% to 20% of the initial investment annually. Providers must manage these ongoing financial commitments while also planning for future enhancements to keep pace with technological advancements and evolving customer demands. This perception of high financial risk can deter existing players from expanding their FWA offerings, ultimately slowing the overall growth of the 5G FWA market, especially in competitive regions where profitability remains uncertain.

5G Fixed Wireless Access Market Segment Analysis

By Offering

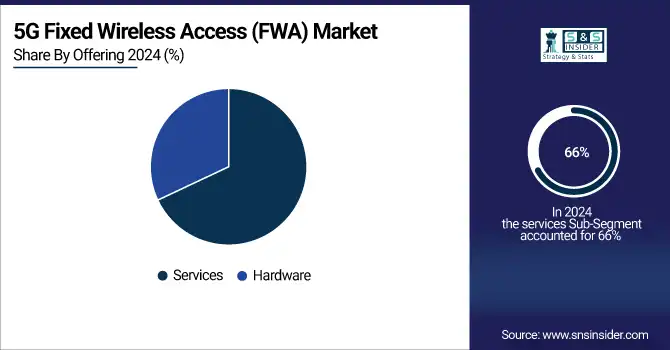

In the 5G Fixed Wireless Access (FWA) market, services accounted for an impressive 66% of total revenue in 2024, reflecting their critical role in meeting the growing demand for connectivity. As consumers and businesses increasingly seek high-speed internet solutions, providers have expanded their service offerings to include tailored options such as installation, maintenance, and customer support, all aimed at enhancing user experience. The rapid advancements in 5G technology have also enabled service providers to introduce innovative solutions that utilize FWA capabilities, resulting in improved reliability, lower latency, and higher bandwidth, making FWA particularly appealing for various 5G Fixed Wireless Accesss. The market has seen the emergence of competitive pricing models, including tiered service plans and bundled options, which cater to a broader audience and facilitate customer acquisition and retention. This adaptability significantly boosts service revenue. Additionally, FWA solutions typically leverage existing cellular infrastructure, enabling providers to offer services in a more cost-effective manner. This efficiency allows for quicker deployments and shifts the focus towards service offerings rather than hardware investments. Overall, these factors underscore the pivotal role of services in the 5G FWA market’s growth and sustainability.

By Demography

In 2024, the 5G Fixed Wireless Access (FWA) market saw urban areas holding a significant revenue share of 56%, highlighting the demographic's pivotal role in the market's growth. Urban environments are characterized by high population densities and increased demand for reliable, high-speed internet to support various activities, such as remote work, streaming, and online gaming. This demographic trend has prompted companies like Verizon and T-Mobile to expand their FWA offerings, launching tailored services designed to meet the unique connectivity needs of urban consumers. For instance, Verizon's 5G Home service provides high-speed internet options specifically for urban residents, while T-Mobile's FWA solutions leverage their extensive 5G network to offer competitive pricing and enhanced customer experiences. Additionally, companies are investing in product development to cater to urban demography, focusing on features like improved network reliability and lower latency. As urban areas continue to embrace digital transformation, the emphasis on enhancing FWA services is likely to increase, reinforcing the segment's dominance in the overall market. This strategic focus on urban demography is crucial for capturing new customers and driving sustained growth in the 5G FWA sector

5G Fixed Wireless Access Market Regional Analysis

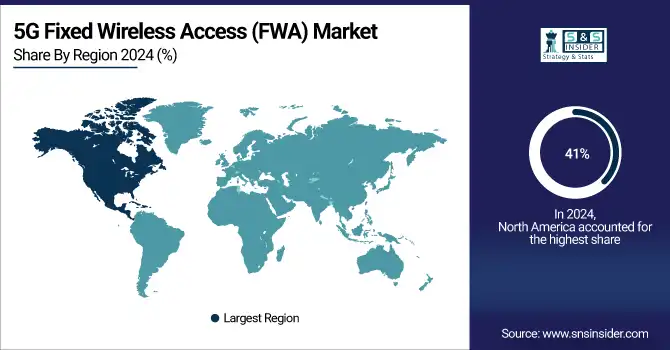

North America 5G Fixed Wireless Access Market Insights

In 2024, North America emerged as a dominant player in the 5G Fixed Wireless Access (FWA) market, capturing a significant 41% of the total revenue. This impressive share is primarily driven by the rapid deployment of 5G networks and the increasing demand for high-speed internet across urban and suburban areas. Major telecommunications providers like Verizon and AT&T have been pivotal in this growth, actively launching FWA services that cater to both residential and business customers. For instance, Verizon's 5G Home Internet has gained traction in several metropolitan areas, offering competitive pricing and robust performance, while AT&T's FWA solutions are being tailored to support remote work and educational needs. Additionally, T-Mobile has expanded its FWA footprint by leveraging its nationwide 5G network, providing flexible service plans to meet diverse consumer requirements. This focus on innovation and customer-centric solutions is expected to drive further growth in the North American FWA market as providers continue to invest in infrastructure and technology to enhance service offerings.

Need any customization research on 5G Fixed Wireless Access (FWA) Market - Enquiry Now

Asia Pacific5G Fixed Wireless Access Market Insights

In 2024, the Asia-Pacific region emerged as the fastest-growing market for 5G Fixed Wireless Access (FWA), driven by rapid urbanization, increasing internet penetration, and significant investments in telecommunications infrastructure. Countries like India and China are leading this growth, with major telecom operators rolling out innovative FWA solutions to meet the burgeoning demand for high-speed internet access. For instance, Reliance Jio in India has been aggressively expanding its FWA services, leveraging its extensive 4G network while transitioning to 5G, enabling users in remote and underserved areas to access reliable broadband. Similarly, China Mobile has launched its 5G FWA initiatives, focusing on urban and semi-urban regions to improve connectivity for businesses and households alike. Furthermore, market entrants like Vodafone and Optus are also making strides by introducing competitive pricing models and bundled services tailored to local demographics. The government's push for digital infrastructure and initiatives to bridge the digital divide further propels the FWA market's expansion. As a result, the Asia-Pacific region is expected to witness continued investment and technological advancements in FWA, solidifying its position as a pivotal area for growth in the global telecommunications landscape.

Europe 5G Fixed Wireless Access Market Insights

Europe holds a significant share in the 5G Fixed Wireless Access Market in 2024, driven by rapid adoption of next-generation broadband solutions, government support for 5G deployment, and increasing demand for high-speed connectivity in urban and suburban areas. Countries such as Germany, the U.K., and France are witnessing growing deployment of FWA for residential, enterprise, and industrial applications. Telecom operators are investing in advanced network infrastructure, while innovations in CPE devices and mmWave technology are accelerating market growth across the region.

Latin America (LATAM) 5G Fixed Wireless Access Market Insights

The LATAM 5G Fixed Wireless Access Market is gradually expanding due to increasing investments in 5G networks, rising demand for broadband in underserved areas, and growing awareness of FWA as a reliable alternative to fiber. Brazil, Mexico, and Argentina are emerging as key markets, with telecom operators launching pilot and commercial FWA projects. Partnerships between network providers and technology vendors, along with supportive regulatory frameworks, are facilitating adoption across both residential and enterprise segments.

Middle East & Africa (MEA) 5G Fixed Wireless Access Market Insights

The MEA region is witnessing growing interest in 5G Fixed Wireless Access, driven by urbanization, demand for high-speed internet, and infrastructure modernization initiatives. Countries such as the UAE, Saudi Arabia, and South Africa are investing in advanced 5G FWA deployments for residential, enterprise, and smart city applications. Government incentives, network operator collaborations, and the rollout of mmWave and sub-6 GHz spectrum are expected to enhance market penetration across the region.

5G Fixed Wireless Access Market Competitive Landscape

Spirent Communications

Spirent Communications is a global provider of testing, assurance, and analytics solutions for next-generation networks, focusing on 5G and broadband technologies.

-

In October 2024, Spirent Communications announced the launch of its new 5G Fixed Wireless Access (FWA) testing services, offering lab-based 5G/Wi-Fi gateway testing alongside live network competitive benchmarking. These solutions aim to help communications service providers (CSPs) and device manufacturers optimize quality of experience (QoE) and enhance market differentiation in the increasingly competitive 5G FWA landscape.

Kyung Mun

Kyung Mun is an industry thought leader and commentator on broadband and wireless network technologies.

-

In October 2024, Kyung Mun highlighted in an op-ed how Fixed Wireless Access (FWA) has evolved from a last-resort technology to a mainstream broadband solution, now accounting for most broadband net adds in the U.S. T-Mobile's goal of reaching 12 billion FWA subscribers by 2028 underscores the growing significance of FWA in the 5G ecosystem.

5G Fixed Wireless Access Market Key Players

-

Qualcomm Technologies (5G chipsets and modems)

-

Nokia Corporation (AirScale FWA solutions)

-

Samsung Electronics (5G FWA devices and infrastructure)

-

Huawei (5G CPE products)

-

Ericsson (Ericsson Radio System for FWA)

-

Mimosa Networks Inc. (fixed wireless solutions)

-

Cohere Technologies Inc. (5G wireless technology)

-

Siklu Communication Ltd. (millimeter-wave solutions for FWA)

-

AT&T Inc. (FWA services and network solutions)

-

Verizon Communications Inc. (5G Home Internet service)

-

ZTE Corporation (5G FWA solutions)

-

Cisco Systems, Inc. (network infrastructure and FWA technology)

-

T-Mobile US, Inc. (FWA and broadband offerings)

-

Fujitsu (5G solutions for telecommunications)

-

Clearfield, Inc. (fiber and wireless solutions)

-

CommScope Holding Company, Inc. (network infrastructure products)

-

FiberTower Corporation (fixed wireless network services)

-

Cedar Communications, LLC (wireless broadband services)

-

CityFibre (FWA initiatives in the UK)

-

Altice USA (telecom services including FWA)

-

Others

| Report Attributes | Details |

| Market Size in 2024 | US$ 45.93 Bn |

| Market Size by 2032 | US$ 652.43 Bn |

| CAGR | CAGR of 39.33% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware and Services) • By Demography (Urban, Semi-Urban, and Rural) • By Application (Residential, Commercial, Industrial, Government) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Qualcomm Technologies, Nokia Corporation, Samsung Electronics, Huawei, Ericsson, Mimosa Networks Inc., Cohere Technologies Inc., Siklu Communication Ltd., AT&T Inc., Verizon Communications Inc. |