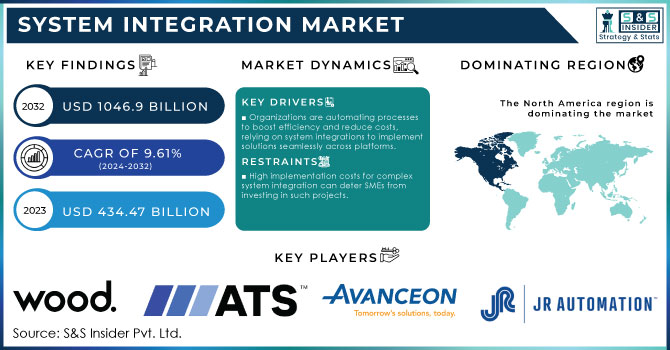

System Integration Market Key Insights:

The System Integration Market size was valued at USD 434.47 Billion in 2023 and is expected to reach USD 1046.9 Billion by 2032 and grow at a CAGR of 9.61% over the forecast period 2024-2032.

To Get More Information on System Integration Market - Request Sample Report

A system Integration is a critical player in the technology landscape, specializing in the consolidation of various subsystems into a cohesive, functioning whole. This role encompasses a wide array of responsibilities, primarily focused on ensuring that disparate technological components operate seamlessly together. System Integrations employ a blend of technical expertise and project management skills to address complex challenges faced by organizations in deploying integrated solutions tailored to their unique needs. The fast-paced business environment, organizations increasingly rely on technology to enhance efficiency, streamline operations, and improve overall productivity. Studies indicate that companies that invest in digital transformation initiatives, which often involve systems integration, can experience up to a 40% increase in productivity. This reliance has led to a growing demand for system Integrations who can navigate the complexities of integrating hardware, software, and networking solutions. System Integrations often assess existing infrastructure and provide recommendations for enhancements or replacements, which may involve selecting appropriate technologies, designing workflows, and implementing solutions that facilitate communication and data exchange across various platforms.

System Integrations work closely with clients to identify their specific needs and develop customized solutions that align with their strategic objectives. This collaboration extends beyond the initial deployment, as ongoing maintenance and support are essential to ensure the integrated systems function effectively over time. Furthermore, it is estimated that effective systems integration can reduce operational costs by approximately 20-30%, making it a vital consideration for organizations aiming to enhance their financial performance.

As technology continues to evolve, system Integrations must stay abreast of emerging trends and advancements, such as cloud computing, the Internet of Things (IoT), and artificial intelligence. In fact, 84% of organizations believe that integrating these technologies is essential for maintaining competitiveness. These innovations are reshaping the integration landscape, enabling more efficient and agile solutions.

MARKET DYNAMICS

DRIVERS

- Organizations are increasingly automating processes to boost efficiency and reduce costs, and System Integrations are essential for seamlessly implementing these automation solutions across various platforms.

The increasing demand for automation is significantly reshaping how organizations operate, as businesses strive to enhance efficiency, reduce operational costs, and improve overall productivity. According to a study, companies that automate can expect to see a 20-30% reduction in operational costs, illustrating the financial benefits of implementing automation technologies. Automation enables companies to streamline their processes, allowing them to perform tasks with minimal human intervention. This shift not only optimizes workflows but also ensures consistency and accuracy in operations, which are vital in today’s competitive market. A survey by the International Federation of Robotics (IFR) found that automation has the potential to increase productivity by 40% across various sectors, providing a crucial advantage for organizations aiming to remain competitive.

System Integrations are essential in this transformation, as they specialize in designing and implementing automation solutions tailored to the unique needs of each organization. They assess existing systems, identify areas ripe for automation, and develop integrated solutions that seamlessly connect disparate technologies. By leveraging their expertise, System Integrations help organizations transition from manual processes to automated ones, facilitating a more agile and responsive business environment.

Moreover, as technology advances, the scope of automation expands to include areas such as artificial intelligence, machine learning, and robotic process automation (RPA). A report indicates that by 2024, organizations will reduce operational costs by 30% by combining RPA with other technologies, emphasizing the importance of integrating automation solutions to achieve substantial cost savings. Additionally, according to a survey, 73% of organizations report that they are already implementing AI and automation technologies to enhance efficiency and decision-making, highlighting a strong trend toward advanced technologies in automation strategies.

-

The shift towards cloud computing has significantly transformed the IT landscape, creating substantial opportunities for System Integration market

RESTRAIN

- High implementation costs for complex system integration can discourage organizations, particularly small and medium-sized enterprises (SMEs), from investing in such projects.

High implementation costs pose a significant barrier to the adoption of system integration projects, particularly for small and medium-sized enterprises (SMEs). The integration of complex systems often requires substantial initial investments in hardware, software, and specialized expertise. The studies indicate that nearly 30% of SMEs report high implementation costs as the primary reason for not pursuing system integration projects. Organizations must consider expenses such as purchasing new technology, upgrading existing infrastructure, and hiring skilled professionals to oversee the integration process. These costs can accumulate quickly, making it difficult for SMEs, which typically operate with tighter budgets, to justify the financial commitment.

Moreover, the potential for unforeseen expenses during the implementation phase can further deter organizations from proceeding with integration projects. Around 50% of companies fear disruptions to their operations during system integration, which can lead to additional costs or extended downtime, impacting productivity and revenue. Consequently, some companies may choose to postpone or abandon integration initiatives altogether, opting to maintain their existing systems rather than investing in new technologies.

KEY SEGMENTATION ANALYSIS

By Services

In 2023, the infrastructure integration segment dominated the market share over 38.12%. This segment is projected to experience robust growth in the coming years, driven by the increasing demand for a unified IT infrastructure that is resilient, agile, and secure while remaining cost-effective. Additionally, the complexities of the business environment have compelled organizations to continually adapt and evolve their IT infrastructures, further fueling the need for effective infrastructure integration solutions.

By End-Use

In 2023, the Banking, Financial Services, and Insurance (BFSI) segment dominated the market share over 22.08%. System integration plays a crucial role in facilitating secure, efficient, and seamless banking operations by developing an IT infrastructure tailored to the specific needs of the banking industry. As a result, numerous BFSI companies’ partner with System Integrations to enhance their banking services and strengthen their brand presence, leading to increased demand for system integration within the sector.

Additionally, the rise of neo-banking services, the emergence of fintech startups, the growing popularity of banking-as-a-service (BaaS), and various governments' emphasis on promoting a digital economy are significant factors driving the growth of the system integration market in BFSI.

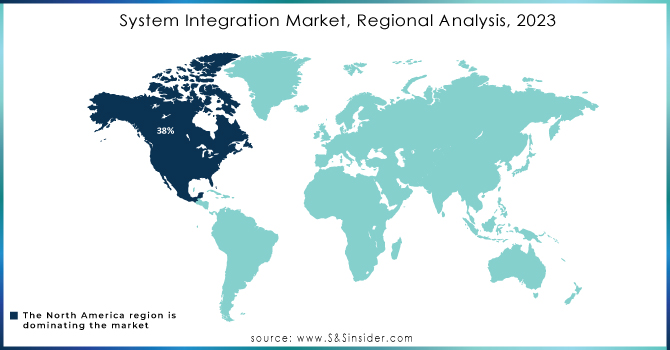

REGIONAL ANALYSIS

In 2023, North America region dominated the market share over 38%, driven primarily by the rising integration of the Internet of Things (IoT) in industrial automation and the growing adoption of cloud-based services among large organizations. The IoT enhances operational efficiency, enabling real-time monitoring and data-driven decision-making, which increases the demand for system integration services. Meanwhile, as companies transition to cloud computing for its flexibility and cost-effectiveness, they require integration of existing systems with cloud platforms. Additionally, the Banking, Financial Services, and Insurance (BFSI) sector is increasingly adopting advanced technologies to improve customer experiences and streamline operations, further fueling the demand for system integration solutions as banks strive to meet diverse client needs.

The Asia Pacific region anticipated to witness significant growth from 2024 to 2032. This growth is driven by several key factors, including rapid economic expansion in countries like India, Singapore, South Korea, and China, which has led to increased investments in technology and infrastructure, particularly in system integration services. As businesses strive to modernize and enhance operational efficiency, they increasingly seek integration solutions. Additionally, the expanding IT and telecom sectors in the region are fueling a heightened demand for network integration services, as companies require seamless connectivity to support their operations.

Do You Need any Customization Research on System Integration Market - Inquire Now

KEY PLAYERS

Some of the major key players of System Integration Market

-

John Wood Group (Automation and control systems, process safety, and technical services)

-

ATS Automation (Automation systems, custom automation solutions)

-

Avanceon Limited (Industrial automation solutions, control systems)

-

JR Automation (Custom automation, robotics integration)

-

Tesco Controls, Inc. (Water and wastewater SCADA systems, electrical controls)

-

Burrow Global LLC (Automation systems, control engineering, and project management)

-

Prime Controls LP (Control systems, automation solutions for utilities and energy)

-

MAVERICK Technologies (Industrial automation and digital transformation services)

-

Barry-Wehmiller (Packaging automation, production lines, and process solutions)

-

INTECH Process Automation (Automation engineering, control systems, and cybersecurity)

-

Siemens AG (Automation and digitalization systems for industries)

-

Schneider Electric (Energy management and automation solutions)

-

Emerson Electric Co. (Industrial automation products, control systems)

-

Honeywell International Inc. (Automation control systems, cybersecurity solutions)

-

ABB Ltd (Robotics, industrial automation, and motion control)

-

Rockwell Automation, Inc. (Industrial automation, information solutions)

-

Yokogawa Electric Corporation (Control systems, test and measurement solutions)

-

Wunderlich-Malec Engineering, Inc. (Automation, control systems, engineering services)

-

Deloitte (Technology integration, digital solutions, and automation consulting)

-

Baker Hughes (Oil & gas automation, digital transformation products)

RECENT DEVELOPMENTS

-

In January 2024: Coalesce recognized top System Integrations for their contribution to data innovation. Notable winners include Hakkoda in North America for expertise in Snowflake Data Cloud solutions and Scalefree in EMEA for innovative use of Data Vault 2.0.

-

In 2023: Pavion completed a major project integrating life safety systems, fire alarms, and flame detection across 15 facilities in a global electric vehicle manufacturing plant. This large-scale project involved extensive networking with fiber optics and covered over 5,000 alarm devices.