Roaming Tariff Market Report Scope & Overview:

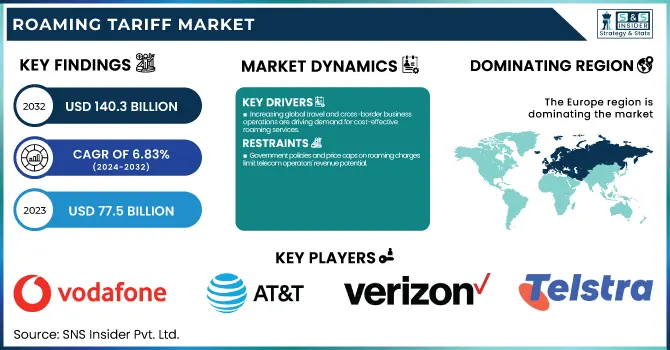

The Roaming Tariff Market was valued at USD 77.5 Billion in 2023 and is expected to reach USD 140.3 Billion by 2032, growing at a CAGR of 6.83% from 2024-2032.

To Get more information on Roaming Tariff Market - Request Free Sample Report

The Roaming Tariff Market is undergoing significant changes due to evolving consumer preferences and regulatory shifts. International roaming revenues vary across regions based on pricing strategies, telecom partnerships, and fluctuating travel patterns. Consumers are increasingly opting for bundled or unlimited roaming plans, driving higher adoption rates. The cost of roaming services, including voice, data, and SMS, is influenced by regional competition and regulatory interventions aimed at reducing excessive charges. Additionally, cross-border roaming traffic is rising, fueled by growing data consumption as global travel rebounds. Emerging trends include the adoption of eSIM technology, strategic alliances among telecom operators for seamless connectivity, and policy-driven reductions in roaming fees to enhance affordability.

Roaming Tariff Market Dynamics

Drivers

-

Increasing global travel and cross-border business operations are driving demand for cost-effective roaming services.

The rising volume of international travellers, business expansions, and globalization directly influence the roaming tariff market. As more people travel for work, leisure, and study, the need for affordable and seamless roaming services is skyrocketing. Further, enterprises engaged in cross-border operations need access to robust and continuously available connectivity, which is fuelling the demand for affordable roaming packages from the telecom operator. With digital nomads and remote work culture booming, roaming services are rising. Additionally, as the travel industry picked up after the pandemic, we are also roaming more and consuming data while roaming, and so are the telecom providers improving their competitive rate plans packages. Collectively, these factors are some of the key enablers that facilitate the growth of roaming tariff market, regionally.

Restraints

-

Government policies and price caps on roaming charges limit telecom operators' revenue potential.

Roaming tariffs are inapplicable through government regulation and international agreements, which remains to be the most serious problem for the telecom operator. Other areas including the European Union have adopted "Roam Like at Home" rules, which mean no additional costs for roaming within the same region. These legal regulations restrict operator revenue potential and force them to find alternative monetization methods. And regulatory authorities are imposing price caps on roaming tariffs and limiting profit margins, making it impossible for telecom providers to continue reaping high revenues. Traditional roaming business unit are being disrupted by the increasing drive from the government for fair tariffs, forcing operator to either reinvent themself by diversifying their offering through data-driven packages, partnerships, and bundle services.

Opportunity

-

The rise of eSIMs and telecom partnerships is enabling seamless, flexible, and cost-efficient roaming services.

With eSIM technology adoption surging globally, there is a large opportunity to unlock in the roaming tariff market. With the support of eSIMs, mobile networks become easy to activate while travelling without purchasing physical SIM cards, as well as any mobile number. Global roaming industry trend offers telecoms flexibility and competitiveness in their roaming plans. Also, MNOs and MVNOs partnerships are increasing global coverage and reducing price. Telecom companies can meet the growing demand for affordable, seamless connectivity through eSIM solutions and strategic partnerships to unlock innovation and revenues in the roaming market.

Challenges

-

Local SIM cards, Wi-Fi hotspots, and OTT communication apps are reducing dependency on traditional roaming services.

Alternative connectivity options, including local SIM cards, Wi-Fi hotspots, and over-the-top communication apps such as WhatsApp, Zoom, and Skype, are straining competition in the roaming tariff market. To avoid exorbitant roaming costs, numerous travelers are purchasing temporary local SIM cards or data-only plans. In addition, the presence of free Wi-Fi in public areas and commercial centers limits the use of traditional roaming services. Competition has ratcheted up even more due to the emergence of travel SIM providers and global connectivity solutions that support flat-rate data plans. To overcome this, telecom operators have to innovate with affordable and flexible roaming options that are designed to enhance customer satisfaction, cost-effectively, and ensure borderless connectivity.

Roaming Tariff Market Segmentation Analysis

By Roaming Type

In 2023, the National roaming segment dominated the market and accounted for 68% of revenue share, owing to high volume of domestic travelers, rural connectivity, and network sharing agreements amongst telecom operators. To broaden coverage in sparsely populated areas, in several countries, telecom suppliers give players accessibility to many networks while within national limitations. The rise of domestic tourism, business travel, and penetration of smart devices also needs seamless national roaming services, which is bridging the gap and further increasing the demand.

The international roaming segment is expected to boast the fastest CAGR throughout the forecast period. Due to the increase of global travelling and the rise of digital nomad culture along with the tendency to use eSIM technology, as businesses ease into a post-covid world, expanding their reach to different markets, and tourism again flourishing, the need for effortless connections across borders is rising. In response to these trends, telecom operators are rolling out inexpensive roaming packages, unlimited data plans, and forming collaborations to improve global coverage. With 5G networks and IoT-driven applications, data usage while roaming is only going to increase. Furthermore, the regulatory framework for the standardization of multinational roaming prices will further boost the market.

By Distribution Channel

In 2023, the retail roaming segment dominated the market and holds the largest share in the market owing to the increasing individual consumer requirement, coupled with business travelers and tourists who travel frequently for work and leisure purposes, by needing a smooth mobile connectivity. Adoption has been fuelled by the growing number of inexpensive roaming plans, bundled services, and unlimited data packages. In a phased manner, telecom operators have started using these strategic alliances to provide better coverage and in most cases, a cheaper rate for retail roaming as well.

The wholesale roaming is expected to register the fastest CAGR during the forecast period, which is driven by the upper level of inter-operator agreements and sharing network. Telecom operators are joining forces to improve coverage, cut down costs, and help others gain access to services, especially in under-served regions. Additional wholesale roaming demand is being driven by the growth in IoT devices, connected cars, and industrial IoT applications as well. Moreover, the deployment of 5G networks and the growth of Mobile Virtual Network Operators are boosting wholesale traffic.

By Service

The data segment dominated the market and accounted for significant revenue share in 2023, due to the rapid subscription of 5G, continued rise in cloud-based services, and usage of video conferencing platforms. As travelers rely more on data-heavy apps, such as social media, video calls, and online entertainment, telecom players are aiming at providing unlimited and affordable roaming data plans.

The voice segment is anticipated to register the fastest CAGR during the forecast period, due to the demand for reliable international calling services, especially for business travelers and expatriates. Voice calls, the original way of communicating over the phone, have been brought down by the VoIP services, and therefore telecom operators are implementing high-definition voice technology and competitive roaming tariffs to catch users. The wide reach of 5G networks is improving the quality of calls, and it is reducing latency, thus providing a better user experience. Telecom providers are also giving incentives for usage with bundled packages of voice and data.

Regional Landscape

Europe dominated the market and accounted for 43% of revenue share in 2023, owing to stringent regulatory conditions, higher frequency of travels, and established telecom infrastructure in the region. The implementation of “ Roam Like at Home ” policy in the European Union has eliminated extra charges for intra-regional roaming, thereby encouraging more users to consider the service. Europe also has major telecom operators, extensive deployment of 5G and wider adoption of eSIM.

Asia-Pacific is expected to register the fastest CAGR during the forecast period. The rapidly increasing level of digitalization, a growing number of international travels, and increasing penetration of mobile phones are expected to act as major propellant for tariff roaming. Increasing business travels, tourism, and cross-border trade are other factors which are accelerating this demand. China, India, and ASEAN nations are witnessing a high level of international travel, which is resulting in a high adaptation of roaming services. Wider deployment of 5G, slumping price of smartphones and increasing adoption of eSIM coupled with various government initiatives to control the charges levied on roaming are expected to drive the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players along with their products are

-

Vodafone Group – Vodafone Roaming Services

-

AT&T Inc. – International Day Pass

-

Verizon Communications – TravelPass

-

T-Mobile US, Inc. – Magenta Max Roaming

-

Orange S.A. – Orange Travel Pass

-

Telefónica S.A. – Movistar Roaming Plans

-

Deutsche Telekom AG – Global Roaming Plus

-

China Mobile Limited – GoTone Roaming Packages

-

China Telecom Corporation – 5G Global Roaming Plan

-

China Unicom – International Roaming Service

-

Reliance Jio – Jio International Roaming Packs

-

Bharti Airtel – Airtel World Pass

-

Singtel – ReadyRoam

-

Telstra – International Roaming Day Pass

-

NTT Docomo – World Wing Roaming

Recent Developments

-

October 2024: Ofcom Regulation Implemented new rules requiring UK mobile providers to alert customers when they start roaming in the EU or other regions, aiming to protect holidaymakers from unexpected charges.

|

Report Attributes |

Details |

|

Market Size in 2023 |

USD 77.5 Billion |

|

Market Size by 2032 |

USD 140.3 Billion |

|

CAGR |

CAGR of 6.83% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Roaming Type (National, International) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Vodafone Group, AT&T Inc., Verizon Communications, T-Mobile US, Inc., Orange S.A., Telefónica S.A., Deutsche Telekom AG, China Mobile Limited, China Telecom Corporation, China Unicom, Reliance Jio, Bharti Airtel, Singtel, Telstra, NTT Docomo |