5G IoT Market Report Scope & Overview:

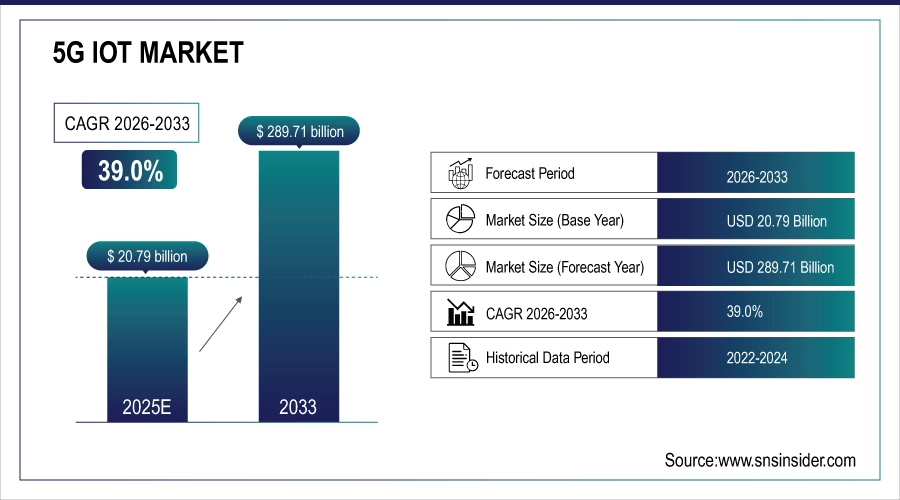

The 5G IoT Market size is valued at USD 20.79 billion in 2025E and is expected to reach USD 289.71 billion by 2033, growing at a CAGR of 39.0% over 2026-2033.

The expansion of low-latency, high-speed connectivity requirements in autonomous systems, smart cities, and industrial automation is propelling the 5G IoT market growth. Scalable and dependable Internet of Things deployments are made possible by the integration of network slicing, edge computing, and mMTC (massive Machine-Type Communications). Supported by investments in 5G infrastructure and spectrum allocations, the rapid adoption of real-time data analytics, remote operations, and predictive maintenance in manufacturing, healthcare, and logistics further increases market potential internationally.

5G IoT Market Size and Forecast:

-

Market Size in 2025E: USD 20.79 Billion

-

Market Size by 2033: USD 289.71 Billion

-

CAGR: 39.0% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on 5G IoT Market - Request Free Sample Report

5G IoT Market Trends:

-

Accelerated deployment of 5G standalone (SA) networks with network slicing for customized IoT applications in industrial, healthcare, and smart city ecosystems

-

Convergence of AI, edge computing, and 5G to enable real-time IoT data processing, autonomous decision-making, and low-latency mission-critical communications

-

Growth of private 5G networks for enterprise IoT in manufacturing, logistics, and energy sectors ensuring security, reliability, and ultra-low latency

-

Rising adoption of 5G RedCap (Reduced Capability) devices for mid-tier IoT applications balancing performance, power efficiency, and cost

-

Expansion of Massive IoT (mMTC) deployments in agriculture, utilities, and environmental monitoring leveraging 5G’s high-density connectivity capabilities

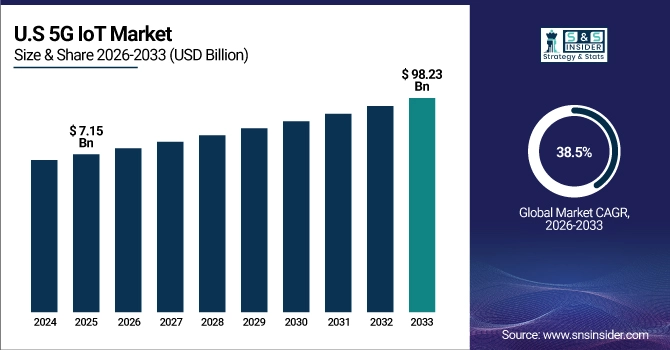

U.S. 5G IoT Market is valued at USD 7.15 billion in 2025E and is expected to reach USD 98.23 billion by 2033, growing at a CAGR of 38.5% from 2026-2033.

The U.S. 5G IoT Market leads due to early 5G spectrum auctions, strong telecom investments, and high adoption across automotive, healthcare, and industrial automation. Government initiatives for smart infrastructure, coupled with collaborations between CSPs and tech giants, accelerate IoT deployments leveraging 5G’s URLLC and network slicing capabilities.

5G IoT Market Growth Drivers:

-

Demand For Ultra-Reliable Low-Latency Communication (URLLC) And Massive Machine-Type Communications (Mmtc) In Industry 4.0, Autonomous Vehicles, And Remote Healthcare Drives 5G Iot Adoption

The growing need for ultra-reliable low-latency communication (URLLC) and massive machine-type communications (mMTC) is driving 5G IoT adoption across Industry 4.0, autonomous vehicles, and remote healthcare. 5G enables real-time automation, precise machine coordination, and large-scale device connectivity. These capabilities support smart manufacturing, vehicle-to-everything (V2X) communication, and continuous remote patient monitoring, positioning 5G as a critical enabler of next-generation IoT ecosystems.

81% of manufacturers adopted 5G IoT for industrial automation achieving 70% faster data throughput and 80% lower latency, enabling real-time digital twins and robotic fleet synchronization.

5G IoT Market Restraints:

-

High Initial Deployment Costs Of 5G Infrastructure, Compatible Iot Devices, and Spectrum Licensing Hinder Adoption, Especially in Developing Regions and SMEs

Implementing 5G IoT necessitates a large investment in core network upgrades, RAN infrastructure, and more expensive 5G-enabled IoT devices per unit. In many markets, spectrum auction costs are still too high, and enterprise private 5G networks require specialist hardware and knowledge. Despite obvious ROI forecasts, adoption is slowed by budgetary constraints faced by small and medium-sized businesses. These financial obstacles impede the mainstream adoption of 5G IoT, especially in emerging nations with sparse 5G coverage and price-sensitive industries.

67% of SMEs delayed 5G IoT adoption due to 40-50% higher upfront costs compared to 4G/LTE alternatives, despite projected 3-year ROI improvements.

5G IoT Market Opportunities:

-

Emergence Of 5G Advanced and 6G Research Enhances Capabilities for Holographic Communications, Tactile Internet, and AI-Native Iot Networks, Opening New Vertical Applications

Advanced IoT applications, such as distributed AI inference, centimeter-level positioning for drones and robotics, and sustainable large IoT are made possible by 5G Advanced (3GPP Release 18+), which brings AI/ML integration, better positioning, and increased energy efficiency. Sub-terahertz frequency, quantum-safe security, and integrated sensing-communication for ambient IoT are the main areas of concurrent 6G research. These developments propel next-generation IoT innovation beyond current 5G capabilities by opening up possibilities in digital twins, autonomous swarm systems, and immersive industrial metaverse applications.

In 2025, 58% of R&D investments in 5G Advanced targeted AI-native IoT networks, aiming for 90% energy reduction in massive IoT and sub-10cm positioning accuracy for industrial automation.

5G IoT Market Segment Highlights:

-

By Component: Hardware led with 38.4% share, while Platform is the fastest-growing segment with CAGR of 42.7%.

-

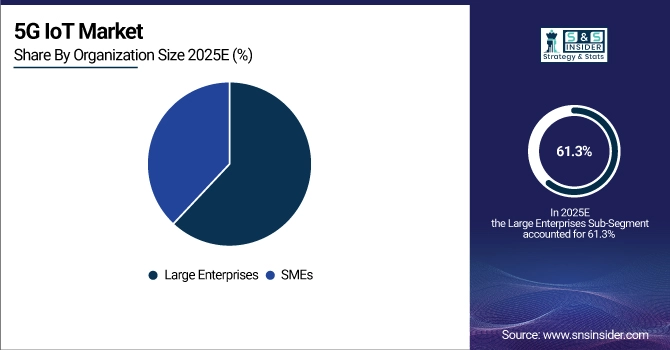

By Organization Size: Large Enterprises led with 61.3% share, while SMEs is the fastest-growing segment with CAGR of 44.2%.

-

By Network Type: 5G Non-Standalone led with 56.8% share, while 5G Standalone is the fastest-growing segment with CAGR of 47.3%.

-

By Type: Short-range IoT Devices led with 53.1% share, while Wide-range IoT Devices is the fastest-growing segment with CAGR of 41.5%.

-

By End User: Manufacturing led with 24.7% share, while Healthcare is the fastest-growing segment with CAGR of 46.8%.

5G IoT Market Segment Analysis

By Organization Size: Large Enterprises Segment Led the Market, while SMEs is the Fastest-growing Segment in the Market

Large Enterprises lead 5G IoT adoption due to substantial capital for private 5G networks, strategic digital transformation initiatives, and complex use cases across global operations. Manufacturing giants, automotive leaders, and utility corporations deploy 5G IoT for factory automation, supply chain visibility, and predictive maintenance at scale. These organizations leverage partnerships with telecom operators and system integrators to deploy customized solutions, driving early market dominance and establishing best practices for industrial 5G IoT implementation.

SMEs represent the fastest-growing segment in the market as 5G infrastructure becomes more accessible through network-sharing agreements and managed service offerings. Solution providers now offer scalable, cost-effective 5G IoT packages addressing SME needs in retail, agriculture, and logistics. Government subsidies for digitalization, alongside plug-and-play 5G IoT solutions from cloud hyperscalers, lower entry barriers.

By Component: Hardware Segment Led the Market, while Platform is the Fastest-Growing Segment in the Market

Hardware dominates the 5G IoT market, comprising 5G-enabled sensors, modules, gateways, and devices essential for connectivity. Growth is driven by increasing deployments of industrial IoT devices, smart meters, connected vehicles, and healthcare monitors requiring embedded 5G NR (New Radio) capabilities. Chipset advancements reducing power consumption and costs, alongside government mandates for smart infrastructure, further accelerate hardware adoption.

Platform is the fastest-growing segment due to rising demand for IoT application enablement, device management, and data analytics solutions. 5G IoT platforms provide critical functionalities, such as network slicing orchestration, edge computing management, and AI/ML integration for real-time insights. Cloud providers and telecom operators offer integrated platforms simplifying 5G IoT deployment across verticals.

By Network Type: 5G Non-Standalone Segment Led the Market, while 5G Standalone is the Fastest-growing Segment in the Market

5G Non-Standalone (NSA) currently leads as it leverages existing 4G LTE core networks for faster deployment, providing enhanced mobile broadband while transitioning to full 5G capabilities. Many early 5G IoT deployments utilize NSA architecture for applications not requiring ultra-low latency, benefiting from improved speeds without immediate core network overhaul.

5G Standalone (SA) is the fastest-growing segment in the market as it delivers complete 5G capabilities including network slicing, URLLC, and mMTC essential for advanced IoT applications. Industrial automation, autonomous systems, and critical communications require SA's end-to-end 5G architecture. Telecom operators globally are accelerating SA deployments, with 2025-2027 marked as the transition period.

By Type: Short-range IoT Devices led, while Wide-range IoT Devices is the fastest-growing segment.

Short-range IoT Devices segment holds the largest market share due to massive deployments in smart homes, wearables, retail beacons, and industrial sensors utilizing 5G for high-density, low-power connectivity. 5G's support for massive device density (1 million devices/km²) enables smart city applications like environmental monitoring, smart lighting, and parking sensors.

Wide-range IoT Devices grow fastest as 5G enables reliable long-distance connectivity for drones, connected vehicles, rural agriculture sensors, and logistics tracking. Previously dependent on satellite or LPWAN with limitations in bandwidth/latency, these applications now leverage 5G's extended range through infrastructure sharing and improved propagation.

By End-User: Manufacturing led, while Healthcare is the fastest-growing segment.

Manufacturing dominates 5G IoT adoption through Industry 4.0 implementations requiring real-time machine control, AR-assisted maintenance, and autonomous mobile robots. 5G's URLLC enables synchronized production lines, while network slicing creates secure isolated networks for different factory zones. Predictive maintenance via vibration/thermal sensors and digital twin implementations drives substantial ROI, making manufacturing the largest investment sector.

Healthcare segment grows fastest as 5G enables mission-critical applications like remote surgery, ambulance connectivity, and real-time patient monitoring. The pandemic accelerated telemedicine adoption, now enhanced through 5G's HD video capabilities and reliable connectivity for rural healthcare. Medical IoT devices transmitting high-resolution imaging, continuous vital signs, and emergency alerts benefit from 5G's guaranteed bandwidth.

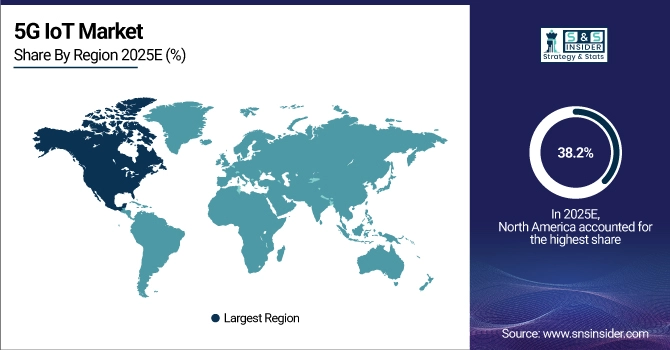

5G IoT Market Regional Analysis

North America 5G IoT Market Insights:

Due to early 5G spectrum auctions, significant telecom investments, and quick adoption in the automotive, manufacturing, and healthcare sectors, North America held a dominant 38.2% share in 2025. Innovation in private 5G networks and edge computing integrations is driven by collaborative ecosystems involving tech giants, CSPs, and businesses. These ecosystems are bolstered by supportive legislative frameworks and significant R&D funding for next-generation IoT applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific 5G IoT Market Insights

Due to large smart city projects, manufacturing digitization, and government 5G regulations in China, South Korea, and Japan, Asia Pacific is growing at the quickest rate of around 43.6% CAGR (2026–2033). Massive IoT deployments are accelerated by high population density, while infrastructure investments are driven by competitive telecom markets. With the help of international technology collaborations, emerging Southeast Asian markets embrace 5G IoT for industrial automation and agricultural modernization.

Europe 5G IoT Market Insights

Due to a significant industrial IoT concentration, especially in German manufacturing, Nordic logistics, and French smart city initiatives, Europe held a 28.7% share in 2025. Secure, compliant 5G IoT installations are fueled by EU financing for 5G corridors, standardized spectrum regulations, and a focus on data sovereignty through the Gaia-X program. Leveraging Europe's leadership in Industry 4.0 standards and green technology integration, the automotive and energy sectors are at the forefront of adoption.

Middle East & Africa and Latin America 5G IoT Market Insights

These regions show accelerating growth through smart infrastructure projects, oil/gas digitalization, and agricultural modernization. Middle East investments in smart cities (NEOM, Smart Dubai) drive early adoption, while Latin American focus on mining automation and agritech expands 5G IoT deployments. African mobile-first economies leapfrog to 5G for telemedicine and financial inclusion, supported by infrastructure partnerships with global technology providers.

5G IoT Market Competitive Landscape:

Ericsson

Founded in 1876, Ericsson is a multinational networking and telecommunications firm based in Sweden that is leading the world in 5G infrastructure. It offers complete 5G IoT solutions, including industrial alliances, IoT Accelerator platforms, and network equipment. Ericsson is a global leader in 5G standalone deployments, network slicing automation, and vital IoT communications for the manufacturing, transportation, and utility industries.

-

February 2025, Ericsson launched IoT Native platform integrating AI-driven network slicing for automated industrial IoT management across 5G standalone networks.

Nokia Corporation

Nokia is a Finnish telecoms, IT, and consumer electronics company that was founded in 1865 and offers complete 5G IoT solutions. 5G RAN, core networks, IoT platforms, and private wireless solutions are all part of its offering. With a strong emphasis on incredibly dependable low-latency communications and network security, Nokia is a leader in industrial-grade private 5G networks for manufacturing, logistics, and energy.

-

January 2025, Nokia expanded its MX Industrial Edge ecosystem with 5G IoT capabilities for real-time automation and digital twin applications in partnership with leading cloud providers.

Qualcomm Incorporated

Qualcomm, an American semiconductor and telecommunications equipment business founded in 1985, is advancing 5G IoT through reference designs, chipsets, and modules. With advancements in 5G RedCap for mid-tier IoT and edge AI integration, its Snapdragon platforms power most 5G IoT devices worldwide. Massive IoT deployments, industrial robots, and cellular-V2X are made possible by Qualcomm's technologies.

-

March 2025, Qualcomm introduced next-gen 5G AI processors for IoT with integrated hardware security and 50% improved energy efficiency for battery-powered industrial devices.

5G IoT Market Key Players:

-

Ericsson

-

Qualcomm Incorporated

-

Huawei Technologies Co., Ltd.

-

Siemens AG

-

Verizon Communications Inc.

-

Cisco Systems, Inc.

-

AT&T Inc.

-

Deutsche Telekom AG

-

Intel Corporation

-

Samsung Electronics Co., Ltd.

-

ZTE Corporation

-

Thales Group

-

Telefonaktiebolaget LM Ericsson

-

Fujitsu Limited

-

Honeywell International Inc.

-

Microsoft Corporation

-

Amazon Web Services, Inc.

-

IBM Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 20.79 Billion |

| Market Size by 2033 | USD 289.71 Billion |

| CAGR | CAGR of 39.0% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Platform, Connectivity, Services (Consulting Services, Deployment and Integration Services, Support and Maintenance Services)) • By Organization Size (Large Enterprises, SMEs) • By Network Type (5G Standalone, 5G non-standalone) • By Type (Short-range IoT Devices, Wide-range IoT Devices) • By End-User (Manufacturing, Healthcare, Energy & Utilities, Automotive and Transportation, Supply Chain & Logistics, Agriculture, Government & Public Safety, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ericsson,Nokia Corporation,Qualcomm Incorporated,Huawei Technologies Co., Ltd.,Siemens AG,Verizon Communications Inc.,Cisco Systems, Inc.,AT&T Inc.,Deutsche Telekom AG,Intel Corporation,Samsung Electronics Co., Ltd.,NEC Corporation,ZTE Corporation,Thales Group,Telefonaktiebolaget LM Ericsson,Fujitsu Limited,Honeywell International Inc.,Microsoft Corporation,Amazon Web Services, Inc.,IBM Corporation |