Acrylic Processing Aid Market Report Scope & Overview:

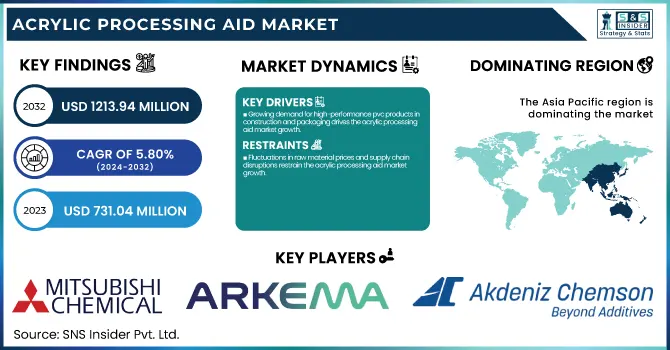

The Acrylic Processing Aid Market size was USD 731.04 million in 2023 and is expected to reach USD 1213.94 million by 2032 and grow at a CAGR of 5.80% over the forecast period of 2024-2032. The Acrylic Processing Aid Market Statistical Insights and Trends Report provides a comprehensive analysis of global production capacity and utilization by region and type in 2023. It examines raw material price fluctuations and supply chain trends across key countries, highlighting cost dynamics. The report delves into regulatory landscapes, assessing compliance standards shaping market growth across regions. Sustainability metrics, including recycling initiatives and environmental impact, are evaluated to understand industry shifts toward greener solutions. Market demand trends are analyzed across key end-use sectors like building & construction, packaging, and automotive, identifying regional variations. Additionally, technological advancements and R&D investments in acrylic processing aids are explored, showcasing innovation-driven market developments. This report equips industry stakeholders with critical data to navigate evolving trends and capitalize on growth opportunities.

To Get more information on Acrylic Processing Aid Market - Request Free Sample Report

The U.S. held a largest market share in North America at around 74% in 2023 and USD 731.04 million market size in 2023. High performance additivated PVC for commercial applications in Big Infrastructure have opened new scopes for growth; these bigger fish include Infrastructure booming projects of the country, where applications are processed through APAs based on efficiency, surface finish and mechanical strength owing to various needs of PVC pipes, profiles and fittings, the products that find end uses in Infrastructure projects driven by the government in the form of the Bipartisan Infrastructure Law (2021). Moreover, the U.S. packaging industry backed from the rise in e-commerce and sustainable packaging trend also increases the usage of APAs in rigid PVC films and sheets. The automotive sector's emphasis is now widely on lightweight and fuel-efficient materials, further driving the demand for acid polyamide (APA) in automotive interiors and components. Major manufacturers, including Dow Inc., Lubrizol Corporation, and Arkema, have been leading the charge on ideal, high-performance, and eco-friendly APA formulations, meeting high sustainability and regulatory requirements imposed by authorities such as the Swedish EPA and U.S. Green Building Council.

Acrylic Processing Aid Market Dynamics

Driver

-

Growing demand for high-performance pvc products in construction and packaging drives the acrylic processing aid market growth.

The Acrylic Processing Aid (APA) Market is experiencing significant growth due to the rising demand for high-performance PVC products in the construction and packaging industries. APAs enhance the processability and mechanical properties of PVC, making them essential for manufacturing pipes, fittings, window profiles, and rigid packaging materials. The building & construction sector, driven by urbanization, infrastructure projects, and housing developments, increasingly adopts high-quality PVC materials, boosting APA consumption. Additionally, sustainability concerns in the packaging industry have led to a shift toward recyclable and durable plastics, where APAs improve product performance without compromising environmental compliance. The Asia-Pacific region, particularly China and India, is witnessing strong growth in construction and industrial packaging, further fueling demand. Moreover, technological advancements in polymer processing have enhanced APA formulations, providing better thermal stability, impact resistance, and flow properties. The growing preference for lightweight, durable, and energy-efficient materials continues to push PVC adoption, directly benefiting the APA market. Government policies supporting sustainable plastic solutions and rising investments in infrastructure development will further propel APA demand in the coming years.

Restrain

-

Fluctuations in raw material prices and supply chain disruptions restrain the acrylic processing aid market growth.

One of the major restraints impacting the Acrylic Processing Aid Market is the fluctuating cost of raw materials and ongoing supply chain disruptions. APAs are primarily derived from methyl methacrylate (MMA) and acrylate monomers, both of which are petroleum-based and highly volatile in pricing due to crude oil price fluctuations, geopolitical tensions, and supply-demand imbalances. The COVID-19 pandemic and recent global economic uncertainties have exacerbated supply chain bottlenecks, affecting raw material availability and logistics costs. Additionally, trade restrictions, import-export regulations, and freight charges have further increased manufacturing expenses, leading to price instability. The Asia-Pacific region, a major supplier of raw materials and finished APAs, has faced logistics constraints, labor shortages, and stringent environmental regulations, impacting production capacities. Moreover, stringent environmental norms are encouraging industries to seek bio-based alternatives, which could shift demand away from traditional APAs.

Opportunity

-

Rising demand for sustainable and bio-based acrylic processing aids creates lucrative market opportunities.

With increasing global sustainability concerns and regulatory pressure, the demand for bio-based and eco-friendly acrylic processing aids presents a major growth opportunity. Traditional APAs are petroleum-derived, raising concerns about carbon footprint, plastic waste, and long-term environmental impact. As a result, leading chemical manufacturers are investing in bio-based alternatives, derived from renewable sources such as plant-based resins and biodegradable polymers. Government bodies, particularly in Europe and North America, are implementing strict environmental policies that encourage the use of low-emission, non-toxic additives in plastic manufacturing. Additionally, consumer awareness and corporate sustainability goals are pushing industries to adopt greener solutions, driving demand for high-performance, biodegradable APAs. Innovations in polymer chemistry and material engineering have enabled the development of next-generation APAs, offering comparable or superior processing efficiency while being environmentally friendly.

Challange

-

Intense competition and price sensitivity among manufacturers pose a significant challenge to market growth.

The Acrylic Processing Aid Market is highly competitive, with numerous global and regional players vying for market share, leading to intense pricing pressure. Low-cost manufacturers in China and India dominate the market, offering affordable APA solutions, making it challenging for premium manufacturers to compete on pricing while maintaining profitability. The presence of multiple suppliers has increased price wars, forcing companies to optimize costs and differentiate their offerings through product innovation, value-added services, and strategic collaborations. However, the shift toward high-quality, specialized APAs requires significant R&D investment, which not all manufacturers can sustain in a highly price-sensitive environment. Furthermore, fluctuations in raw material prices and production costs make it difficult for APA manufacturers to maintain stable pricing, affecting market stability. Additionally, stringent regulatory requirements and quality certifications in regions like Europe and North America impose compliance costs, further challenging market penetration for smaller players.

Acrylic Processing Aid Market Segmentation Analysis

By Polymer Type

The PVC segment accounted for the largest revenue share of 75.00% in 2023 due to its extensive application in construction, packaging, automotive, and consumer goods. PVC is widely preferred for its durability, cost-effectiveness, and ease of processing, making it an ideal material for pipes, profiles, sheets, and films. The increasing adoption of Acrylic Processing Aids (APAs) in PVC processing has enhanced melt strength, surface finish, and impact resistance, improving product quality. In 2023, Mitsubishi Chemical Corporation introduced a new high-performance APA for rigid PVC applications, optimizing extrusion efficiency. The growth in the PVC segment directly fuels APA demand as manufacturers seek advanced additives to improve processing speed, product consistency, and energy efficiency in high-volume production.

By Fabrication Process

The largest market share of around 52 % is held by the extrusion segment and is projected to continue owing to the widespread use of extrusion in the manufacturing of PVC pipes, sheets, profiles, and films. Due to its unique combination of excellent cost efficiency, fast production, and accurate size control, extrusion is critical to the large-scale production of PVC. The increased demand for extruded PVC products from the booming construction industry especially in Asia-pacific and North America, is driving the acrylic processing aid (APA) market. Dow Inc., in 2023, an advanced APA helped extrusion-grade PVC by offering improvements to melt homogeneity and a reduction in die buildup. Similarly, LG Chem launched a sustainable APA for quality and surface properties oriented to high-speed extrusion applications.

By End-Use Industry

The acrylic processing aid segment is expected to dominate the acrylic processing aid market, with around 32% market share based on application, owing to rising infrastructure and real estate development across the globe. In construction, PVC is widely used in the form of building materials such as pipes, window profiles, siding, and roofing sheets, owing to their low cost, durability, and weather resistance. Enhanced impact strength, extrusion efficiency, and consistency have been integrated into construction-grade PVC applications with the growing adoption of Acrylic Processing Aids (APAs) for significantly improved structural performance. Kaneka Corporation introduced a new formulation of APA in 2023 for rigid PVC construction profiles, providing both greater thermal stability and higher durability. Shandong Rike Chemical Co., Ltd., for example, has also developed its APA series products focusing on the high NM3B Elans seventh season of construction materials.

Acrylic Processing Aid Market Regional Analysis

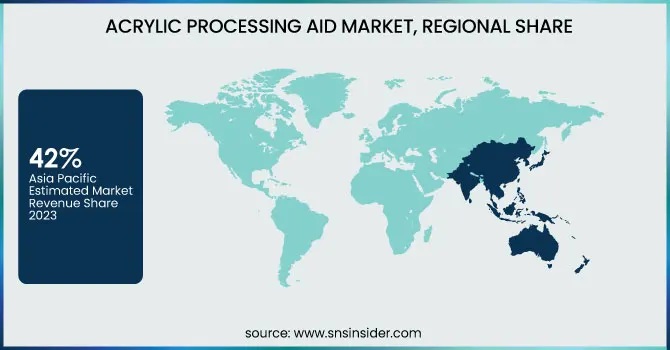

Asia Pacific held the largest market share, around 42% in 2023. It is due to the emerging economies, including China, India, and Southeast Asian countries, that are experiencing considerable industrialization and urbanization, leading to increased demand for PVC-based products on which Acrylic Processing Aids (APAs) greatly contribute towards improving processing, strength, and surface properties. Government efforts (for instance, China's 14th Five-Year Plan and India's Smart Cities Mission) are fast-tracking infrastructure development, which, in turn, is propelling demand for PVC pipes, profiles, and fittings. Moreover, the packaging sector in the region has flourished due to e-commerce and increased uptake of sustainable material, improving the uptake of APA in rigid PVC films and sheets. In addition, some key manufacturers, such as Kaneka Corporation, Arkema, and Shandong Rike Chemical, increased production capacity and investment in R&D in the region by launching high-performance APAs for high-speed extrusion and green formulations, further facilitating market penetration.

Europe held a significant market share in the acrylic processing aid market. It is due to a combination of strict environmental regulations, well-established industrial infrastructure, and increasing demand for high-quality PVC applications in the region. Stringent carbon emission reduction and sustainable material policies in the region, such as the European Green Deal and REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, have pushed manufacturers to produce low-material and eco-friendly APAs to improve PVC processing efficiency with a lower environmental footprint (Yoganathan et al. Advanced APAs are widely used in pipe systems (PVC pipes), window profiles, and flooring materials used in energy-efficient buildings in the building & construction sector, especially in Germany, France, and the U.K. Moreover, the European automotive industry has improved standards for quality production and the lightweight material penetration has enhanced APA demand in automotive interiors and parts. Major stakeholders, including Arkema and Evonik Industries, have been driving product innovation by introducing high-performance APAs with improved thermal stability, faster processing time, and recyclability.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Mitsubishi Chemical Corporation: (Metablen P Series, Metablen C Series)

-

Arkema SA: (Plastistrength PPA, Durastrength Impact Modifiers)

-

Akdeniz Chemson: (Akdeniz ACR Series, Akdeniz PVC Stabilizers)

-

The Dow Chemical Company: (PARALOID K-120ND, PARALOID K-175)

-

Kaneka Corporation: (Kane Ace PA, Kane Ace MX)

-

WSD Chemical Limited: (WSD-PA01, WSD-PA02)

-

Indofil Industries Limited: (Indofil ACR 201, Indofil ACR 301)

-

Novista Group: (Novista ACR-401, Novista ACR-402)

-

LG Chem Ltd.: (LUPOY GP1000, LUPOY GP2000)

-

3M Company: (Dynamar PPA 1112, Dynamar PPA 1113)

-

BASF SE: (Tinuvin 770, Tinuvin 123)

-

Akdeniz Kimya A.S.: (Akdeniz ACR Series, Akdeniz PVC Stabilizers)

-

Pau Tai Industrial Corporation: (PAU ACR-301, PAU ACR-401)

-

Sundow Polymers Co., Ltd.: (Sundow ACR-201, Sundow ACR-202)

-

En-Door: (En-Door ACR-100, En-Door ACR-200)

-

Shandong Ruifeng Chemical Co., Ltd.: (RFA Series, RFB Series)

Recent Development:

-

In May 2024, Arkema announced its agreement to acquire Dow's flexible packaging laminating adhesives business for $150 million. This acquisition is aimed at strengthening Arkema's presence in the flexible packaging industry, particularly within the food and medical sectors.

-

In May 2024, H.B. Fuller completed the acquisition of ND Industries Inc., a prominent provider of specialty adhesives and fastener locking/sealing solutions. This acquisition aligns with H.B. Fuller's growth strategy, expanding its portfolio in the functional coatings, adhesives, sealants, and elastomers (CASE) market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 731.04 Million |

| Market Size by 2032 | USD 1213.94 Million |

| CAGR | CAGR of 5.80% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Polymer Type (PVC, Others) • By Fabrication Process (Extrusion, Injection Molding, Others) • By End-Use Industry (Building & Construction, Packaging, Automotive, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mitsubishi Chemical Corporation, Arkema SA, Akdeniz Chemson, The Dow Chemical Company, Kaneka Corporation, WSD Chemical Limited, Indofil Industries Limited, Novista Group, LG Chem Ltd., 3M Company, BASF SE, Akdeniz Kimya A.S., Pau Tai Industrial Corporation, Sundow Polymers Co., Ltd., En-Door, Shandong Ruifeng Chemical Co., Ltd. |