Green Building Materials Market Report Scope & Overview:

The Green Building Materials Market size was USD 415.39 billion in 2025E and is expected to Reach USD 1020.44 billion by 2033 and grow at a CAGR of 11.89% over the forecast period of 2026-2033.

The Green Building Materials market is experiencing significant growth as the demand for sustainable construction practices increases. These materials, derived from renewable resources such as bamboo, wood, hempcrete, mycelium, and recycled plastic, offer an eco-friendlier alternative to traditional building products. Green building materials are gaining traction due to heightened awareness of the environmental consequences of conventional construction materials. Manufacturing, transportation, and disposal of traditional building materials contribute significantly to carbon emissions and environmental degradation.

Market Size and Forecast:

-

Market Size in 2025E – USD 415.39 Billion

-

Market Size by 2033 – USD 1020.53 Billion

-

CAGR (2026–2033) – 11.89%

-

Base Year – 2025

-

Forecast Period – 2026–2033

-

Historical Data – 2022–2024

Get E-PDF Sample Report on Green Building Materials Market - Request Sample Report

The push for sustainability is also being bolstered by governmental and corporate initiatives. The U.S. Department of Energy is funding early-stage carbon capture and storage (CCS) projects, while China’s large-scale carbon trading market is expected to cover 40% of global CO2 emissions by 2023. These efforts reflect a broader commitment to reducing carbon footprints, which in turn boosts the demand for eco-friendly building materials. Furthermore, a significant portion of Fortune 500 companies have set ambitious carbon reduction goals, further emphasizing the market’s momentum. As green building materials continue to evolve, they offer long-term benefits in terms of cost-efficiency and environmental sustainability, making them a growing preference for environmentally conscious construction projects.

Green Building Materials Market Key Trends:

-

Builders increasingly use sustainable materials like bamboo, recycled steel, and low-VOC paints to reduce environmental impact.

-

Integration of energy-saving insulation, smart windows, and reflective coatings is rising to enhance building efficiency.

-

Both residential and commercial construction projects are adopting green materials to meet sustainability goals.

-

Governments and local authorities are enforcing stricter green building codes and certifications.

-

Innovations in materials such as hempcrete, bio-based polymers, and cross-laminated timber are gaining traction.

-

Reuse of construction materials like steel, wood, and concrete is becoming common to reduce waste.

-

Increased awareness among architects, contractors, and consumers is driving the adoption of environmentally responsible building solutions.

The U.S. Green Building Materials market size was valued at an estimated USD 155.20 billion in 2025 and is projected to reach USD 385.60 billion by 2033, growing at a CAGR of 10.47% over the forecast period 2026–2033. Market growth is driven by increasing emphasis on sustainable construction practices, rising awareness of energy efficiency, and stringent environmental regulations aimed at reducing carbon emissions. Growing adoption of eco-friendly materials such as recycled products, low-VOC materials, energy-efficient insulation, and sustainable concrete across residential, commercial, and infrastructure projects is accelerating market expansion. Additionally, government incentives for green buildings, expansion of LEED-certified projects, and continuous innovation in sustainable material technologies further strengthen the growth outlook of the U.S. green building materials market during the forecast period.

Green Building Materials Market Drivers:

-

The green building material market is growing rapidly as environmental awareness and sustainability concerns drive the demand for eco-friendly solutions, energy efficiency, and regulatory compliance in construction.

The green building material market is experiencing significant growth, driven by heightened environmental awareness and sustainability concerns. As climate change and the environmental impact of construction come to the forefront, both consumers and businesses are increasingly prioritizing eco-friendly solutions. Green building materials help reduce carbon footprints, promote energy efficiency, and support sustainable construction practices. This shift in consumer behavior is further fueled by the growing desire to minimize environmental harm, lower energy costs, and meet sustainability goals. Additionally, regulatory frameworks and green building certifications, such as LEED, are encouraging the adoption of these materials in both residential and commercial construction projects. The market is expected to expand as more builders, developers, and architects integrate sustainable practices into their designs. This trend aligns with the global movement towards reducing environmental impact and fostering long-term energy savings, making green building materials a key element of the evolving construction landscape.

Green Building Materials Market Restraints:

-

The high initial cost of green building materials, despite offering long-term savings, deters builders and developers from adopting them, particularly in markets where sustainability is not yet prioritized.

The high initial cost of green building materials is a significant barrier to their widespread adoption. These materials, such as energy-efficient windows, sustainable insulation, and eco-friendly flooring, typically come at a premium compared to traditional options. While they offer long-term savings through energy efficiency, reduced maintenance, and lower operational costs, the upfront investment can be a deterrent for builders and property developers, especially for those working with tight budgets or looking for immediate returns. Many developers may prioritize cost-effective solutions in the short term, overlooking the long-term financial and environmental benefits that green materials offer. This financial hesitation can be particularly pronounced in markets where green construction practices are not yet the norm, making it harder to justify the initial investment. Despite these challenges, as awareness grows and demand for sustainable buildings increases, the cost of green materials is expected to decrease, driving broader adoption.

Green Building Materials Market Segment Analysis:

By Product

In 2025, the green building materials market is segmented into exterior products, interior products, solar products, building systems, and others. Exterior products, including sustainable facades, roofing, and insulation, dominate the market due to the focus on energy efficiency and thermal performance. Interior products, such as low-VOC paints, reclaimed wood flooring, and eco-friendly finishes, are widely adopted for indoor sustainability. Solar products, including photovoltaic panels and solar roofing systems, are growing rapidly with the shift toward renewable energy. Building systems like energy-efficient HVAC and smart lighting enhance operational efficiency, while other products, including recycled aggregates and green adhesives, support overall eco-friendly construction practices.

By Application

The Roofing segment dominated with the market share over 32% in 2025, due to the growing preference for sustainable roofing solutions. As concerns about energy efficiency, environmental impact, and building longevity increase, eco-friendly roofing options have gained significant traction. Cool roofs, which reflect sunlight and reduce heat absorption, help lower building temperatures, decreasing energy consumption for cooling. Additionally, the integration of solar panels in roofing systems enables buildings to generate renewable energy, further contributing to sustainability goals. These roofing materials not only reduce environmental footprints but also enhance the overall durability of structures by providing weather resistance and improved insulation. The rising adoption of such solutions in both new constructions and retrofitting projects reflects a shift toward environmentally conscious building practices.

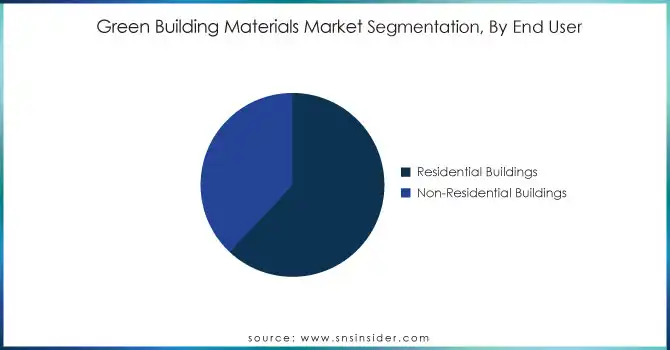

By End User

The Residential Buildings segment dominated with the market share over 62% in 2025, due to a surge in consumer demand for eco-friendly homes and energy-efficient solutions. As awareness of environmental issues rises, homeowners and developers are increasingly prioritizing sustainability in construction. In developed markets, such as North America and Europe, the adoption of green building materials is particularly prominent. These materials, such as energy-efficient windows, insulation, and sustainable flooring, help reduce the carbon footprint of homes, lower energy costs, and improve indoor air quality. Additionally, there is growing recognition of the long-term benefits of green buildings, including reduced maintenance costs and enhanced comfort for occupants. Homebuyers are increasingly seeking properties with environmentally conscious features, driven by both ethical considerations and financial incentives such as tax rebates and lower utility bills.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Green Building Materials Market Regional Analysis

North America Green Building Materials Market Insights

North America region dominated with the market share over 38% in 2025. The region benefits from stringent environmental regulations and numerous government incentives aimed at promoting sustainability in construction. Both the U.S. and Canada have been at the forefront of adopting energy-efficient materials, such as insulated concrete forms, green roofs, and sustainable insulation, due to a growing emphasis on reducing carbon footprints and energy consumption. Additionally, increasing demand for eco-friendly buildings from commercial, residential, and institutional sectors has further propelled market growth. Governments have introduced various initiatives like tax credits, rebates, and grants to encourage the use of green materials in construction, strengthening the region's position.

Aisa Pacific Green Building Materials Market Insights

Asia-Pacific is witnessing rapid growth in the Green Building Materials Market, driven by the region’s accelerated urbanization and booming construction activities. Countries such as China, India, and Japan are focusing on developing sustainable infrastructure to support their expanding urban populations. The adoption of green building materials is further encouraged by government policies and regulations aimed at reducing carbon emissions and promoting energy-efficient construction practices. In addition to governmental support, the rising awareness of environmental issues among consumers and developers has significantly contributed to the demand for eco-friendly building materials. The push for energy-efficient buildings, improved indoor air quality, and the reduction of resource consumption are key drivers in this region's transition to greener construction methods.

Europe Green Building Materials Market Insights

Europe is at the forefront of sustainable construction, with countries like Germany implementing policies to decarbonize industries. Germany's economy ministry has unveiled a plan to foster a market for climate-friendly products, including low-emission building materials. This initiative is part of Germany's effort to achieve carbon neutrality by 2025.

Middle East & Africa (MEA) Green Building Materials Market Insights

The MEA region is witnessing a growing demand for green building materials, driven by urban development and environmental awareness. In the GCC countries, the market is expected to grow at a CAGR of 10.7% from 2026 to 2033, reaching USD 28.8 billion by 2033.

Latin America Green Building Materials Market Insights

Latin America is gradually adopting sustainable building practices, with countries like Brazil and Mexico leading the way. Government incentives and international partnerships are facilitating the transition to green building materials in the region.

Green Building Materials Market Key Players:

-

BASF (Green building insulation, energy-efficient building materials)

-

DuPont (Building insulation, energy-efficient roofing materials)

-

Holcim (Sustainable cement, eco-friendly construction solutions)

-

Kingspan Group (High-performance insulation systems, green roofing materials)

-

Green Building Solutions (Sustainable construction products, eco-friendly insulation)

-

Lhoist (Lime-based building materials, sustainable mortars)

-

Lafarge (Low-carbon cement, eco-friendly construction solutions)

-

Kingspan Group plc (Insulation systems, sustainable facades)

-

RedBuilt LLC (Sustainable wood and engineered products for construction)

-

Binderholz GmbH (Sustainable timber products, wood-based construction materials)

-

Alumasc Group Plc (Eco-friendly roofing systems, sustainable rainwater management)

-

Bauder Limited (Green roofs, sustainable roofing solutions)

-

PPG Industries (Eco-friendly coatings, low-VOC paints)

-

CertainTeed Corporation (Sustainable insulation, roofing, and siding products)

-

Interface, Inc. (Sustainable carpet tiles, flooring solutions)

-

Saint-Gobain (Eco-friendly building materials, sustainable insulation solutions)

-

Armstrong World Industries (Sustainable ceiling and wall systems)

-

Tata Steel (Green steel, sustainable construction materials)

-

USG Corporation (Sustainable gypsum products, drywall systems)

-

CSR Limited (Eco-friendly insulation, sustainable walling and flooring systems)

Suppliers for (Sustainable building solutions like energy-efficient windows, energy-efficient insulation, coatings, sealants) of Green Building Materials Market

-

Saint-Gobain

-

BASF SE

-

Dow Chemical Company

-

Kingspan Group

-

LafargeHolcim

-

Interface, Inc.

-

USG Corporation

-

Armstrong World Industries

-

CSR Limited

-

Ecolab Inc.

Green Building Materials Market Competitive Landscape:

Armstrong World Industries, Inc. (AWI), headquartered in Lancaster, Pennsylvania, is a leading designer and manufacturer of ceiling and wall system solutions in the Americas. With a legacy dating back to 1860, the company has evolved into a trusted name in the building materials industry. AWI offers a broad product portfolio that includes mineral fiber, fiberglass, metal, and wood-based solutions, catering to both commercial and residential markets. The company emphasizes sustainability and innovation, aiming to create spaces that enhance aesthetics, acoustics, and environmental performance. AWI's commitment to quality and design excellence has solidified its position as an industry leader.

-

In April 18, 2024: Armstrong World Industries has launched Ultima LEC ceiling panels, made from 54% recycled content, offering a 43% reduction in embodied carbon. The use of sustainably sourced wood-generated biochar supports the company’s commitment to sustainable building products and aligns with growing demand for low-carbon solutions in construction.

DuPont de Nemours, Inc., commonly known as DuPont, is an American multinational chemical and materials science company headquartered in Wilmington, Delaware. Founded in 1802 by Éleuthère Irénée du Pont, the company has a rich history of innovation, developing iconic materials such as Teflon, Kevlar, and Nomex. As of 2024, DuPont operates in over 50 countries and employs approximately 24,000 people. The company focuses on specialty products across electronics, industrial solutions, and water & protection sectors. In May 2024, DuPont announced plans to separate its electronics business into a standalone entity by November 2025

-

In November 7, 2024: DuPont has launched Tyvek with Renewable Attribution, a sustainable healthcare packaging solution that reduces carbon footprint by replacing fossil fuel feedstocks with certified bio-circular materials. This innovation aligns with the growing demand for eco-friendly solutions in the green building market, supporting sustainability goals while maintaining Tyvek superior performance.

Holcim Ltd. is a Swiss multinational building materials company headquartered in Zug, Switzerland. As of 2024, Holcim reported net sales of CHF 16.2 billion and employs over 48,000 people across 45 countries. The company offers a wide range of products, including decarbonized cement, circular aggregates, energy-efficient building systems, and high-performance concrete. In June 2025, Holcim completed the spin-off of its North American operations into a separate entity named Amrize, which is now listed on the Zurich and New York stock exchanges

-

In 2023 Holcim: Holcim launched ECOCycle, a technology platform designed to transform recycled demolition materials into new building solutions. Using ECOCycle, Holcim can recycle 100% of construction and demolition waste, starting with decarbonized raw materials for low-carbon cement formulations.

-

In 2023 Holcim: Holcim acquired PASA, a global leader in innovation, sustainability, and quality, which enhances Holcim's roofing and waterproofing portfolio and expands its regional business presence.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 415.39 billion |

| Market Size by 2033 | USD 1020.53 billion |

| CAGR | CAGR of 11.89% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Interior Product, Exterior Products, Solar Products, Building Systems, Other) • By Application (Roofing, Framing, Insulation, Exterior Sliding, Interior Finishing) • By End User (Residential Buildings, Non-Residential Buildings) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BASF, DuPont, Holcim, Kingspan Group, Green Building Solutions, Lhoist, Lafarge, Kingspan Group plc, RedBuilt LLC, Binderholz GmbH, Alumasc Group Plc, Bauder Limited, PPG Industries, CertainTeed Corporation, Interface, Inc., Saint-Gobain, Armstrong World Industries, Tata Steel, USG Corporation, CSR Limited. |