AD Network Software Market Report Scope & Overview:

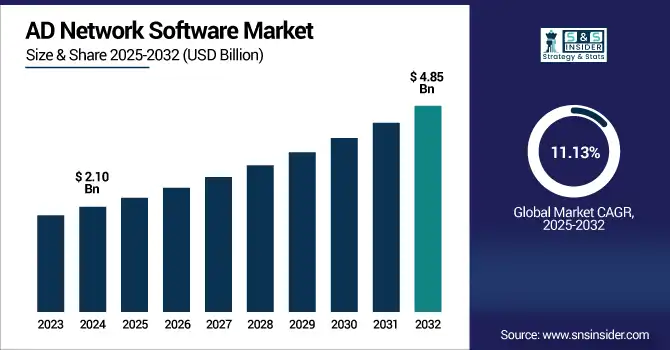

AD Network Software Market size was valued at USD 2.10 billion in 2024 and is expected to reach USD 4.85 billion by 2032, growing at a CAGR of 11.13% from 2025-2032.

To Get more information on AD Network Software Market - Request Free Sample Report

The AD Network Software Market growth is driven by the rising adoption of programmatic advertising, increasing demand for targeted and personalized ads, and the rapid expansion of digital content consumption across platforms. As businesses focus more on ROI-driven campaigns and data-driven strategies, ad networks are evolving with AI, automation, and analytics capabilities. Additionally, the surge in mobile and video advertising further propels market expansion globally.

InMobi, high-attention placements delivered up to 5× higher click-through rates (CTR) and 50% higher view-through rates.

In early 2024, Google Ads launched the "Ads Power Pair" initiative, combining Search and Performance Max AI-powered tools to enhance campaign bidding, targeting, and creative asset generation through machine learning and first-party data.

A case study from AdMob highlights that CookApps, a mobile gaming publisher, increased its ad revenue by 86% and achieved a 4%+ rise in ARPDAU by leveraging rewarded video ads and mediation strategies.

U.S. AD Network Software Market size was valued at USD 0.63 billion in 2024 and is expected to reach USD 1.44 billion by 2032, growing at a CAGR of 10.91% from 2025-2032.

The U.S. AD Network Software Market is growing due to increased digital ad spending, widespread adoption of programmatic advertising, and rising demand for real-time audience targeting. The growth of e-commerce, mobile usage, and data-driven marketing strategies further accelerates market expansion across industries.

A U.S. survey by the IAB revealed that 85% of advertisers and 72% of publishers currently use programmatic auction strategies, with expectations rising to 91% of advertisers and 83% of publishers over the next two years.

According to IAB's “State of Data 2025” report, 30% of U.S. agencies, brands, and publishers have fully integrated AI across the campaign lifecycle.

Market Dynamics

Drivers

-

Programmatic advertising adoption accelerates demand for automation, real-time bidding, and AI optimization in ad network software ecosystems globally.

The rapid shift toward programmatic advertising is significantly increasing the demand for automated tools that streamline ad placement, targeting, and ROI tracking. Ad network software enables real-time bidding, personalized ad delivery, and performance monitoring, which aligns well with the programmatic model. Businesses are embracing AI-powered features that optimize bidding strategies and consumer targeting, boosting campaign efficiency. This driver is particularly influential in sectors heavily invested in digital transformation, such as e-commerce and media. As digital ad budgets rise, programmatic methods supported by intelligent ad network solutions become indispensable to advertisers seeking competitive performance metrics.

In 2024, a striking 88.2% of all display ads in the U.S. are purchased programmatically, reflecting a 15.9% year-over-year growth in programmatic digital display spend. However, according to IAB's State of Data 2025, only 30% of agencies, brands, and publishers have fully integrated AI across the full media campaign lifecycle, indicating significant potential for further optimization.

Restraints

-

Rising ad fraud and invalid traffic undermine advertiser confidence and strain the reliability of ad network performance metrics.

Ad fraud including click fraud, bot traffic, and domain spoofing—continues to plague the ad network ecosystem, inflating ad spend without real engagement. This issue not only wastes advertiser budgets but also skews performance analytics, reducing trust in reported outcomes. Sophisticated fraud tactics make detection harder and necessitate constant software upgrades and third-party verification tools. For advertisers, the presence of high invalid traffic devalues ad impressions and raises concerns about ROI. Consequently, market growth is restrained by persistent skepticism and the ongoing need for enhanced fraud prevention infrastructure in ad network solutions.

Opportunities

-

Integration of AI and machine learning enables predictive targeting, budget optimization, and automated campaign performance enhancement.

Artificial intelligence is revolutionizing how ad networks operate by providing deeper consumer insights and smarter automation capabilities. Machine learning algorithms analyze behavioral data in real time to fine-tune audience targeting, dynamically allocate ad spend, and forecast campaign outcomes. These capabilities reduce manual effort, increase campaign efficiency, and support decision-making with actionable insights. As advertisers demand more intelligent, performance-driven solutions, ad networks incorporating AI features gain competitive advantage. This technological advancement positions providers to deliver greater ROI and customization, attracting tech-savvy clients seeking agile, adaptive, and cost-efficient digital advertising strategies.

Google Ads Smart Bidding results show that over 80% of Google advertisers now leverage automated bidding strategies, with those switching from Target CPA to Target ROAS reporting an average 14% more conversion value while maintaining similar ad spend effectiveness.

Additionally, Reddit introduced Conversation Summary Add-ons and Reddit Community Intelligence, AI-powered tools that surface positive community commentary under ads and enable real-time social listening from over 22 billion posts and comments, further illustrating the growing role of AI in driving ad relevance and performance.

Challenges

-

Fragmentation of digital advertising channels complicates cross-platform campaign management and data consistency for ad network providers.

The explosion of platforms ranging from mobile apps and OTT services to social media and gaming makes unified ad delivery more complex. Ad networks must integrate with diverse ecosystems, ensure ad format compatibility, and maintain coherent user tracking across devices. This fragmentation leads to data silos, inconsistent reporting, and measurement difficulties that hinder campaign optimization. As advertisers demand omnichannel strategies, ad network providers face increasing technical and operational complexity. Ensuring seamless, scalable solutions across fragmented digital environments remains a major challenge to delivering reliable performance and client satisfaction in a competitive market.

Segment Analysis

By End-User

Retail and e-commerce segment dominated the AD Network Software Market with a 29% revenue share in 2024 due to its higher dependence on performance-driven digital marketing, extensive product assortment, and competitive customer data analytics. And this drive to push online conversions, retarget customers, and result in optimized dynamic ad placements via programmatic platforms has continued to make ad networks indispensable for retail players especially during seasonal campaigns, flash sales, and personalized promotions across multiple digital channels.

Media and entertainment segment is expected to grow at the fastest CAGR of 13.06% from 2025–2032, due to high consumption of digital content over OTT platforms, social media and online gaming. Media companies are turning to ad networks to leverage their reach and make it more personable as growing demand for customized content discovery, monetization of user-generated-content, and increasing global streaming audiences drive the need for immersive and contextually rich experiences across diverse formats, increasing targeted ad delivery and ultimate engagement rates.

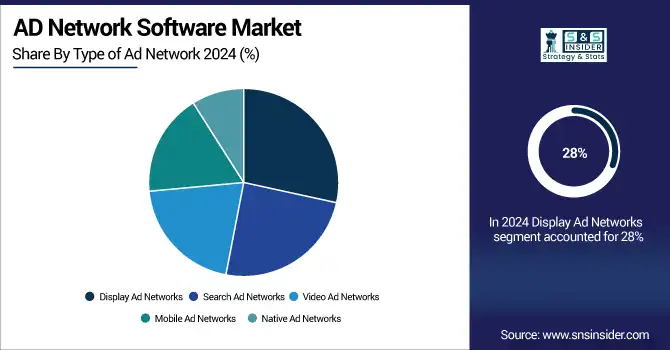

By Type of Ad Network

Display Ad Networks segment led the AD Network Software Market with a 28% revenue share in 2024 due to its growing adoption in various industries as a scalable and cost-efficient advertising tool. With expansive inventory coverage on websites and apps, these networks allow businesses to expose mass audiences via banner and image ads. They are the best option for running brand awareness ad and traffic acquisition as they support retargeting, contextual placements and programmatic buying at relatively low costs.

Video Ad Networks segment is expected to grow at the fastest CAGR of 13.54% from 2025–2032 due to surging video consumption on platforms like YouTube, TikTok, and OTT services. Brands are progressively reallocating advertising from traditional platforms to video formats to increase engagement, storytelling, and emotional attachment with consumers. As part of a strategic channel to reach users in lucrative moments, video ad networks incorporate features such as advanced targeting, skippable and interactive formats, and measurable performance.

By Deployment Model

Programmatic Ad Networks segment dominated the AD Network Software Market with a 69% revenue share in 2024 and is projected to grow at the fastest CAGR of 11.71% from 2025–2032 due to their efficient ad buying, automated processes, and real-time bidding capabilities. Allowing for data-driven targeting, better ROI, and scale across channel (or across channels), these networks can be a critical ingredient for advertisers looking for personalization and for performance. With the proliferation of AI, dynamic creatives, and omnichannel campaigns, adoption will only continue to increase, establishing programmatic solutions as the connective tissue of modern digital advertising strategies across industries.

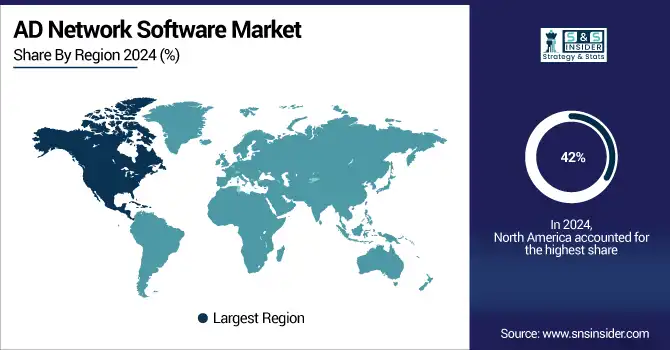

Regional Analysis

North America dominated the AD Network Software Market with a 42% revenue share in 2024 due to its mature digital infrastructure, high ad-tech investment, and presence of major advertising platforms and tech giants. The region benefits from early adoption of programmatic advertising, advanced data analytics, and strong regulatory frameworks. High digital ad spending by enterprises and continuous innovation in targeting and personalization tools further reinforce North America’s leadership in the global market.

The US dominated the AD Network Software Market due to high digital ad spending, advanced programmatic infrastructure, and strong presence of major tech companies.

Asia Pacific is expected to grow at the fastest CAGR of 12.87% from 2025–2032, driven by rapid digitalization, smartphone penetration, and expanding internet access across emerging economies. Rising e-commerce activity, mobile-first consumer behavior, and increasing investments from global brands in local markets are fueling demand for ad network software. Countries like India, China, and Southeast Asian nations are witnessing accelerated growth in digital advertising, making the region a hotspot for future market expansion.

China is dominating the AD Network Software Market in Asia Pacific due to its massive online user base, strong e-commerce ecosystem, and advanced digital advertising infrastructure.

Europe is experiencing robust growth in the AD Network Software Market due to rising digital transformation, expanding online retail, and increasing use of data-driven advertising. The region benefits from mature internet infrastructure, growing programmatic adoption, and compliance-focused innovation supporting targeted, privacy-conscious ad delivery across industries.

Germany is dominating the AD Network Software Market in Europe due to its strong digital economy, high ad-tech adoption, and large base of advertising-driven enterprises.

Middle East & Africa and Latin America are emerging markets in the AD Network Software space, driven by increasing internet penetration, growing mobile usage, and rising investments in digital advertising. Expanding e-commerce and social media engagement are further fueling regional market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

AD Network Software Market companies are Google AdSense, Amazon Publisher Services, SmartyAds SSP, AppLovin, Equativ, PubMatic, Smaato, InMobi, Media.net, Criteo, Sharethrough, AdSupply, CJ Affiliate, MaxBounty, Switch, Tradedoubler, AdJug, Clickbooth, Convert2Media, Intent Media, Jebbit

Recent Developments:

-

In 2025, Equativ fully integrates Sharethrough, unifying operations and brand after the 2024 acquisition. The merger expands global reach and reinforces its position as an end‑to‑end media platform

-

In January 2025, Equativ launched its AI-powered programmatic platform “Maestro by Equativ,” developed following feedback from over 500 clients to enhance campaign performance, automation, and user experience.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.10 Billion |

| Market Size by 2032 | USD 4.85 Billion |

| CAGR | CAGR of 11.13% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Display Ad Networks, Search Ad Networks, Video Ad Networks, Mobile Ad Networks, Native Ad Networks) • By Deployment Model (Programmatic Ad Networks, Direct Ad Networks) • By End-User (BFSI, Healthcare, Retail and E-commerce, Media and Entertainment, IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Google AdSense, Amazon Publisher Services, SmartyAds SSP, AppLovin, Equativ, PubMatic, Smaato, InMobi, Media.net, Criteo, Sharethrough, AdSupply, CJ Affiliate, MaxBounty, Switch, Tradedoubler, AdJug, Clickbooth, Convert2Media, Intent Media, Jebbit |