Customer Experience Monitoring Market Report Scope & Overview:

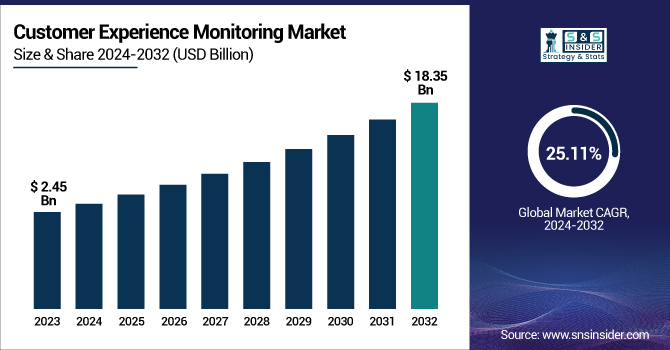

The Customer Experience Monitoring Market was valued at USD 2.45 billion in 2023 and is expected to reach USD 18.35 billion by 2032, growing at a CAGR of 25.11% from 2024-2032.

To Get more information on Customer Experience Monitoring Market - Request Free Sample Report

This report includes detailed analysis of Data Volume Metrics, Tool Usage Statistics, Response Time Improvements, Multi-Channel Monitoring Statistics, and Voice of the Customer (VoC) Integration Rates. The global shift toward digital-first customer interaction, growing investment in real-time analytics tools, and the proliferation of smart applications are driving growth. Organizations are increasingly prioritizing customer-centric strategies, leading to greater deployment of monitoring platforms to enhance satisfaction and loyalty. The rise of omnichannel customer engagement and advancements in machine learning and natural language processing (NLP) are further transforming the way companies monitor and enhance the overall customer journey across platforms.

U.S. Customer Experience Monitoring Market was valued at USD 0.67 billion in 2023 and is expected to reach USD 5.01 billion by 2032, growing at a CAGR of 25.02% from 2024-2032.

The rapid adoption of AI-powered analytics and growing investment in digital infrastructure across key industries such as BFSI, healthcare, and retail are significantly boosting market expansion. Additionally, the focus on hyper-personalized service, multichannel engagement, and advanced feedback systems is encouraging companies to integrate robust monitoring solutions. The demand for real-time insights into customer behavior, voice analysis, and proactive resolution mechanisms continues to grow, especially in a highly competitive service economy. The presence of major technology vendors and favorable compliance frameworks further support growth, making the U.S. a hub for customer experience technology innovation and deployment.

Customer Experience Monitoring Market Dynamics

Drivers

-

Increasing need for personalized customer engagement boosts demand for real-time monitoring and journey optimization platforms across industries.

Growing demand for personalized customer interaction is driving the adoption of customer experience monitoring tools across sectors. As customers engage with brands across various channels web, mobile applications, social media, and in-store businesses are under pressure to provide a seamless and cohesive experience. These tools offer in-depth understanding of behavior, preference, and feedback, allowing timely and customized response. Real-time monitoring helps companies identify areas of friction, enhance responsiveness, and boost satisfaction. As competition gets fiercer, companies are using analytics-driven insights to build loyalty and establish a competitive advantage. Additionally, regulatory pressures surrounding customer care standards are driving the significance of ongoing experience tracking. This customized strategy not only better supports the brand image but also minimizes churn, making customer experience monitoring a strategic initiative in customer-focused digital settings.

Restraints

-

Data privacy concerns and regulatory compliance issues restrict real-time customer tracking and sentiment analysis capabilities.

Data privacy issues and changing regulatory demands like GDPR and CCPA are increasingly limiting the scope of customer experience monitoring solutions. Collection, processing, and real-time storage of user behavior information must adhere to rigorous consent procedures and data treatment practices. Deviation from these could have legal repercussions as well as affect the company's reputation, prompting most organizations to restrict the level of monitoring. Additionally, regulations of cross-border data flow introduce an extra layer of complexity for multinational companies looking for integrated customer knowledge. Firms have to spend on secure systems and regularly update privacy policies to be compliant. Such a requirement for transparency and consent frequently clashes with the objective of real-time data collection, which generates tension between innovation and regulation. Consequently, firms are subjected to operational and legal restrictions that hinder market growth and innovation.

Opportunities

-

Expansion of AI-driven customer analytics creates new avenues for proactive engagement and predictive service optimization.

AI-powered analytics in customer experience monitoring offers business a strong way to actively reach out to customers and enhance delivery of services. AI allows business to move ahead of conventional monitoring by analyzing mood, forecasting need, and offering suggestions. All these sophisticated pieces of information facilitate companies to segment communication, avoid dissatisfaction, and automate support. Predictive analysis also improves decisions, allowing speedier resolution of issues and optimum utilization of resources. By combining AI with chatbots, email support, and self-service platforms, companies can provide a consistent and smart experience. This transition from reactive to predictive monitoring enhances satisfaction and loyalty and lowers operational costs. The scalability and automation potential of AI-driven CXM solutions make them a growth driver for organizations committed to digital transformation and long-term customer relationship management.

Challenges

-

Lack of skilled workforce hampers effective deployment and utilization of advanced customer experience monitoring technologies.

Shortage of skilled talent with data analytics, AI, and CX platform expertise is a major inhibiting factor for efficient implementation of customer experience monitoring technology. The technology has a lot of value to offer, yet organizations find it difficult to derive relevant insights because of a lack of required talent. Data scientists, customer experience strategists, and technical analysts are crucial for setting up platforms, translating metrics, and making decisions from user data. Without these professionals, organizations struggle to set KPIs, automate processes, and integrate CXM tools into current infrastructure. As customer expectations change, organizations without the right talent risk falling behind in responsiveness and service quality. Internal team training can reduce the gap, but it takes time and money. This shortage retards adoption and reduces the return on investment for most companies.

Customer Experience Monitoring Market Segment Analysis

By Type

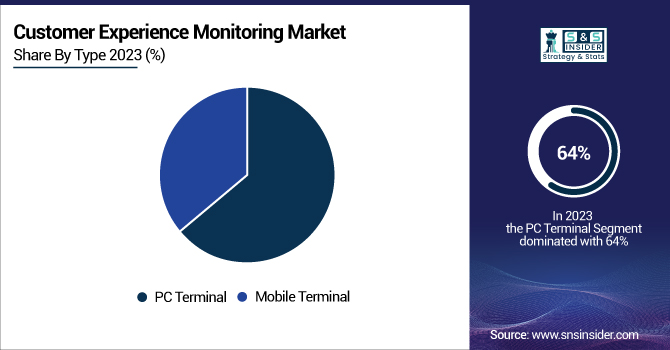

PC Terminal segment led the Customer Experience Monitoring Market with the largest revenue share of nearly 64% in 2023 because of its extensive use across enterprise environments. PC-based monitoring tools are more favored by companies because of their high processing capability, rich dashboards, and easy integration into existing IT setups. These enable deeper analysis and reporting, which is highly useful in sectors such as BFSI and IT services. The need for PC-centric customer support and technical assistance further supports the dependency on PC terminals for complete experience monitoring.

Mobile Terminal segment is expected to grow at the fastest CAGR of approximately 25.91% during 2024–2032 due to enhanced smartphone penetration and mobile-first consumer behavior. With customers spending more time engaging with brands on mobile browsers and apps, companies focus on mobile monitoring to deliver the best, real-time experiences. The move towards digital self-service, app-based interaction, and mobile commerce necessitates consistent monitoring of the mobile experience across industries such as retail, travel, and banking.

By End Use

Retail & E-Commerce segment led the Customer Experience Monitoring Market with the largest revenue share of approximately 27% in 2023 because of its large volume of customer interactions and omnichannel presence. Companies in this industry invest heavily in experience monitoring to monitor customer behavior, sentiment, and engagement on websites, applications, and physical stores. Real-time feedback and journey optimization are essential to conversion and retention strategy. The retail sector's competitive environment also pushes players to embrace sophisticated CX tools to ensure customer loyalty and enhance brand image.

Hospitality segment is expected to grow at the fastest CAGR of around 15.22% during the period 2024–2032 due to increasing focus on customized guest experience. Hotels, resorts, and travel agencies are embracing digital solutions to track guest satisfaction, monitor feedback, and enhance service quality in real-time. With increasing customer expectations for frictionless booking, check-in, and support experiences, hospitality companies are adopting experience monitoring to remain competitive. Technology adoption is also driven by the recovery of the industry post-COVID for restoring customer trust and interaction.

By Solution

Feedback Management segment led the Customer Experience Monitoring Market with the maximum revenue share of around 38% in 2023 because of its core position in customer satisfaction strategies. Organizations rely on structured feedback systems such as surveys, ratings, and reviews to capture customer sentiment and identify service gaps. These tools offer direct insights into customer needs, enabling timely improvements and building brand loyalty. The simplicity of deployment and effectiveness in capturing real-time input make feedback management essential across industries like retail, telecom, and BFSI.

Customer Journey Analytics segment is expected to grow at the fastest CAGR of nearly 28.26% during 2024–2032, attributed to rising demand for end-to-end customer insight. Companies are using journey analytics to track and analyze the entire customer life cycle through various channels. This facilitates proactive intervention, personalization, and predictive engagement. With rising importance of enhancing customer retention and decreasing churn, journey analytics is offering rich context that is not available through conventional feedback systems. The advent of AI and automation makes the influence of journey analytics in providing enhanced experiences even more prominent.

Regional Analysis

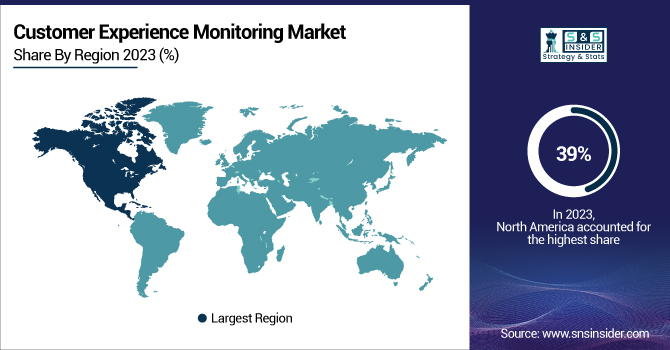

North America dominated the Customer Experience Monitoring Market with the highest revenue share of about 39% in 2023 due to the region's strong technological infrastructure and early adoption of digital experience platforms. Major industries such as retail, BFSI, and telecom in the U.S. and Canada prioritize customer satisfaction and invest heavily in advanced CX tools. The presence of leading market players, combined with high internet penetration and demand for real-time analytics, further reinforces North America’s leadership in the CX monitoring landscape.

Asia Pacific segment is expected to grow at the fastest CAGR of about 27.04% from 2024–2032, driven by rapid digitalization, expanding e-commerce, and increasing smartphone usage across emerging economies. Businesses in countries like China, India, and Southeast Asia are focusing on customer-centric strategies to gain competitive advantages. Rising disposable income, urbanization, and evolving consumer expectations push companies to invest in advanced customer experience solutions, fueling significant market growth across the region during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

RADCOM Ltd. [RADCOM Network Insights, RADCOM ACE]

-

Aternity, Inc. [Aternity Employee Experience, Aternity Mobile Experience]

-

Oracle Corporation [Oracle CX Cloud, Oracle Service Cloud]

-

RadioOpt GmbH [Network Signal Info, Network Quality App]

-

BMC Software, Inc. [BMC Helix Digital Workplace, BMC Helix AIOps]

-

Startek [Startek Interaction Analytics, Startek Speech Analytics]

-

CA Technologies, Inc. [CA Digital Experience Insights, CA Application Performance Management]

-

Comarch SA [Comarch Service Quality Management, Comarch Fault Management]

-

Riverbed Technology, Inc. [Aternity Real User Monitoring, Aternity Synthetic Monitoring]

-

Compuware Corporation [Compuware APM, Compuware Strobe]

-

CorrelSense, Inc. [SharePath Real User Monitoring, SharePath Transaction Tracking]

-

Cisco Systems, Inc. [Cisco ThousandEyes, Cisco AppDynamics]

-

Dynatrace LLC [Dynatrace Digital Experience Monitoring, Dynatrace Real User Monitoring]

-

New Relic, Inc. [New Relic Browser, New Relic Synthetics]

-

SAP SE [SAP Customer Experience, SAP Service Cloud]

-

Qualtrics International Inc. [Qualtrics CustomerXM, Qualtrics Experience iD]

-

Medallia, Inc. [Medallia Experience Cloud, Medallia Agent Connect]

-

NICE Ltd. [NICE Nexidia, NICE Enlighten AI]

-

IBM Corporation [IBM Tealeaf, IBM Customer Experience Analytics]

-

Zoho Corporation [Zoho Desk, Zoho CRM Plus]

-

Adobe Inc. [Adobe Experience Platform, Adobe Customer Journey Analytics]

Recent Developments:

-

In 2023, RADCOM Ltd. announced the acquisition of Continual Ltd., an AI-driven mobility experience analytics company, to enhance its 5G assurance solutions and improve subscriber journey optimization through advanced location and mobility insights.

-

In January 2025, Oracle introduced AI agents to assist sales professionals by automating tasks like updating records and generating reports, aiming to enhance efficiency and customer interactions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.45 Billion |

| Market Size by 2032 | US$ 18.35 Billion |

| CAGR | CAGR of 25.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Feedback Management, Customer Analytics, Customer Journey Analytics, Sentiment Analysis, Real-time Monitoring) • By Type (PC Terminal, Mobile Terminal) • By End Use (BFSI, Retail & E-Commerce, Healthcare, IT & Telecommunications, Government, Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | RADCOM Ltd., Aternity, Inc., Oracle Corporation, RadioOpt GmbH, BMC Software, Inc., Startek, CA Technologies, Inc., Comarch SA, Riverbed Technology, Inc., Compuware Corporation, CorrelSense, Inc., Cisco Systems, Inc., Dynatrace LLC, New Relic, Inc., SAP SE, Qualtrics International Inc., Medallia, Inc., NICE Ltd., IBM Corporation, Zoho Corporation, Adobe Inc. |