Adiponitrile Market Report Scope & Overview:

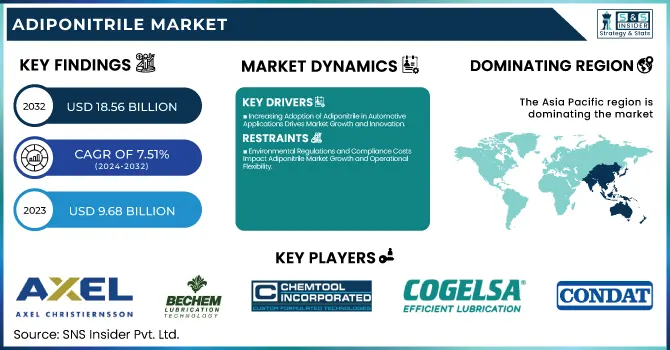

The Adiponitrile Market Size was valued at USD 9.68 Billion in 2023 and is expected to reach USD 18.56 Billion by 2032, growing at a CAGR of 7.51% over the forecast period of 2024-2032.

To Get more information on Adiponitrile Markett - Request Free Sample Report

The Adiponitrile Market is shaped by various factors driving its growth. Government regulations play a significant role, as stricter environmental standards push producers toward sustainable manufacturing methods. Our report examines how these regulations impact production processes. The supply chain analysis uncovers the intricate connections between raw material suppliers and end users, highlighting disruptions' effects on market dynamics. Investment and funding trends are explored, revealing how capital inflows fuel technological advancements and production expansions. The economic impact on Adiponitrile production is also addressed, focusing on inflation, energy costs, and supply chain challenges that influence pricing. Lastly, Corporate Social Responsibility (CSR) efforts are analyzed, showcasing how companies are investing in sustainability to meet consumer demand for environmentally friendly solutions.

Adiponitrile Market Dynamics

Drivers

-

Increasing Adoption of Adiponitrile in Automotive Applications Drives Market Growth and Innovation

The automotive industry is increasingly adopting Adiponitrile due to its essential role in the production of Nylon 6,6, a key material used in various automotive components. Nylon 6,6 offers superior strength, resistance to wear, and high thermal stability, making it ideal for automotive applications such as engine parts, fuel systems, and electrical connectors. With the growing focus on lightweight materials to enhance fuel efficiency and reduce carbon emissions, Adiponitrile has become indispensable in the production of high-performance parts that support these objectives. As the demand for electric vehicles rises, the need for efficient, lightweight, and durable materials becomes more critical. Moreover, automotive manufacturers are under increasing pressure to meet stringent environmental regulations, driving innovation toward more sustainable solutions. As the market for electric and hybrid vehicles grows, the use of Adiponitrile-based materials, which can improve the performance and longevity of automotive components, is expected to see a significant rise, thereby driving the overall growth of the Adiponitrile market.

Restraints

-

Environmental Regulations and Compliance Costs Impact Adiponitrile Market Growth and Operational Flexibility

The Adiponitrile market faces significant restraints from the growing body of environmental regulations that govern chemical production. Manufacturers must comply with increasingly stringent environmental laws related to emissions, waste management, and the use of hazardous chemicals in production processes. These regulations require companies to invest in expensive technologies and operational changes to reduce emissions, minimize waste, and ensure safety. The costs associated with complying with these regulations can be burdensome for smaller players in the market, limiting their ability to compete effectively. Additionally, the complexity of navigating different regulatory environments across regions can increase operational costs and delays in product development or market entry. As regulatory bodies around the world continue to tighten environmental standards, manufacturers are faced with the challenge of balancing profitability with sustainability. The increased compliance costs, along with the need for constant investment in environmental management practices, could restrict the pace of innovation and growth in the Adiponitrile market. As such, companies that fail to adapt to these regulations may face significant competitive disadvantages.

Opportunities

-

Emergence of Sustainable and Bio-Based Alternatives for Adiponitrile Production Presents New Market Avenues

The emergence of sustainable and bio-based alternatives for Adiponitrile production presents an exciting opportunity for market growth and innovation. Traditional production methods of Adiponitrile primarily rely on fossil fuels, contributing to environmental concerns and sustainability issues. However, research and development efforts are focused on creating bio-based feedstocks, which are derived from renewable resources such as plant-based oils and waste products. These alternatives have the potential to reduce the carbon footprint of Adiponitrile production, aligning with global sustainability goals and meeting the increasing demand for environmentally friendly solutions. Moreover, the development of green chemistry techniques in the production of Adiponitrile can help reduce energy consumption, waste, and harmful by-products. As governments, industries, and consumers continue to prioritize sustainability, bio-based Adiponitrile is positioned to gain significant traction in the market. Companies that embrace these innovations can differentiate themselves as leaders in the green economy, attracting investment and expanding their market share. Thus, the development and adoption of sustainable production methods will likely become a key driver of growth for the Adiponitrile market.

Challenge

-

Fluctuations in Raw Material Prices Create Uncertainty for Adiponitrile Producers and Their Profitability

The fluctuation in raw material prices, particularly for butadiene and ammonia, is a major challenge for Adiponitrile producers. These materials are essential in the production process of Adiponitrile, and any changes in their prices can have a significant impact on the overall cost structure for manufacturers. Butadiene, being a byproduct of oil and natural gas, is subject to price volatility driven by global supply and demand dynamics, geopolitical issues, and fluctuations in crude oil prices. Similarly, ammonia prices can be influenced by factors such as fertilizer production demands and the energy costs associated with its synthesis. These price fluctuations create uncertainties in cost projections and can erode profit margins for Adiponitrile producers. Moreover, if raw material costs rise sharply, it may become difficult for manufacturers to absorb the increases without raising product prices, which could lead to reduced demand. This unpredictability in raw material prices thus remains a significant challenge for the stability and profitability of companies operating in the Adiponitrile market.

Adiponitrile Market Segmental Analysis

By Thickener Type

In 2023, the Nylon 6,6 synthesis segment dominated the Adiponitrile market, accounting for 48.7% of the total market share. This dominance can be attributed to the high demand for Nylon 6,6 in various industries, including automotive, textiles, and consumer goods. Nylon 6,6 is essential in producing durable, lightweight materials used in automotive components such as engine parts, fuel systems, and electrical connectors, driven by the automotive industry's focus on reducing vehicle weight and improving fuel efficiency. Furthermore, regulatory bodies like the U.S. Environmental Protection Agency (EPA) and European Union have set stringent fuel efficiency standards, pushing for more lightweight components, thus enhancing the demand for Nylon 6,6. As the demand for high-performance materials continues to grow, Nylon 6,6 remains a key driver of the Adiponitrile market, reinforcing its position as the dominant application segment.

By Application

In 2023, the automotive segment dominated the Adiponitrile market, holding a 38.7% share. This can be attributed to the increasing use of Adiponitrile-based Nylon 6,6 in the production of high-strength, lightweight automotive components. With the global automotive industry undergoing significant transformations, including the adoption of electric vehicles (EVs), the demand for durable materials to enhance fuel efficiency, safety, and performance is rapidly growing. For instance, companies like General Motors and Tesla use Nylon 6,6 in automotive parts, contributing to the growth of Adiponitrile usage in this sector. The automotive industry's push towards lightweight materials aligns with regulations such as the U.S. Corporate Average Fuel Economy (CAFE) standards and European Union CO2 emissions regulations, which aim to reduce environmental impact while enhancing vehicle performance. This demand for high-performance materials has solidified automotive as the dominant end-use industry in the Adiponitrile market.

Adiponitrile Market Regional Outlook

The Asia Pacific region held a dominant share of approximately 50.3% in the Adiponitrile market in 2023. This significant share can be attributed to the rapid industrialization and robust demand from key sectors such as automotive, textiles, and electronics across major countries in the region. China, as the largest producer and consumer of chemicals, plays a pivotal role in driving this dominance. The Chinese government’s initiatives to expand its chemical production capabilities, supported by policies like the Made in China 2025 plan, have strengthened the country’s position as a global chemical powerhouse. Additionally, India’s burgeoning manufacturing and automotive industries are driving the demand for materials like Nylon 6,6, which is derived from Adiponitrile. For example, the increasing use of lightweight, high-performance materials in vehicles, as well as the booming textile sector, is further propelling the market. Japan, with its technological advancements and focus on innovation in the automotive industry, also contributes significantly. These factors collectively position Asia Pacific as the dominant region in the Adiponitrile market, with a favorable supply chain and cost-efficient manufacturing infrastructure.

On the other hand, The North American region emerged as the fastest-growing market for Adiponitrile, with a significant CAGR during the forecast period. This growth is driven by a combination of rising demand for high-performance materials in industries such as automotive, electronics, and textiles. In particular, the United States is experiencing a shift towards the adoption of lightweight materials, particularly Nylon 6,6, due to stricter fuel efficiency standards and environmental regulations like the Corporate Average Fuel Economy (CAFE) standards. These regulations are encouraging automakers such as Ford, General Motors, and Tesla to incorporate high-performance materials into their vehicle components, boosting the demand for Adiponitrile. Additionally, advancements in the electric vehicle (EV) sector are further contributing to this demand. The EV market requires durable, lightweight components for battery systems, chassis, and interiors, all of which use materials derived from Nylon 6,6. Furthermore, Canada’s growing automotive sector is also playing a crucial role in this regional expansion. These developments, combined with strong investments in manufacturing and technological innovations, position North America as the fastest-growing region in the Adiponitrile market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Axel Christiernsson (Axel Longlife Grease, Axel Biodegradable Grease, Axel Calcium Sulfonate Grease)

-

BECHEM Lubrication Technology LLC (Berulub FR 43, Berutox VPT 64-2, Berulit GA 250)

-

Battenfeld-Grease & Oil Corporation of New York (Lithoplex MP2, Litholine HD2, Battenplex EP2)

-

Carl Bechem GmbH (Berulub KR EP 2, Beruto njx FH 28 EPK, Berulub FK 164-2)

-

Chemtool Incorporated (Paragon 3000, Omniguard 220, Lubricast 90)

-

COGELSA Efficient Lubrication (Lubgel Complex EP 2, Lubgel LT 1, Lubgel Bioceramic 2)

-

CONDAT Group (Condat Biogrease EP2, Condat Grease TP, Condat Extreme Pressure Grease)

-

Daubert Chemical Company (Tectyl 891D, Tectyl 846, Nox-Rust 5400)

-

D-A Lubricant Company (D-A Reliant, D-A Syn-Xtreme HD2, D-A Lubricast 50)

-

Eastern Oil Company (EOC Moly Grease, EOC Lithium Complex Grease, EOC Synthetic Grease)

-

FUCHS Petrolub SE (Renolit CX-EP 2, Renolit Duraplex EP, Renolit Extreme)

-

Interflon (Interflon Grease MP2, Interflon Grease OG, Interflon Grease LS2)

-

JAX Incorporated (JAX Poly-Guard FG2, JAX Magna-Plate 8, JAX Halo-Guard FG2)

-

Klüber Lubrication (Klüberplex BEM 41-141, Klüberlub BE 41-1501, Klübersynth BHP 72-102)

-

Lubriplate Lubricants Company (Lubriplate 630-2, Lubriplate SFL-1, Lubriplate Low Temp Grease)

-

NYCO (Nyco Grease GN 148, Nyco Grease GN 3058, Nyco Grease GN 25013)

-

Orlen Oil Ltd (Orlen Greasen Complex EP, Orlen Litol 24, Orlen Graphite Grease)

-

Primrose Oil Company, Inc. (Primrose 357 Moly EP, Primrose 405 Amber, Primrose Syn-O-Gel 680)

-

RichardsApex, Inc. (RichardsApex Draw Grease 705, RichardsApex Copper Grease 90, RichardsApex Forge Grease)

-

Royal High-Performance Oil & Adiponitrile (Royal Ultra 865 EP, Royal Ultra 8800, Royal Purple Ultra-Performance)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.68 Billion |

| Market Size by 2032 | USD 18.56 Billion |

| CAGR | CAGR of 7.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Nylon 6,6 Synthesis, Hexamethylene Diisocyanate (HDI) Production, Electrolyte Solutions, Chemical Intermediates, Others) •By End-Use Industry (Automotive, Electrical & Electronics, Textile, Chemical Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ascend Performance Materials, INVISTA, BASF SE, Butachimie, Asahi Kasei Corp., Merck KGaA, Kishida Chemical Co., Ltd., Zhejiang Huafon New Materials Corp., Ltd., Lanxess AG, Solvay SA and other key players |