Waste Management Equipment Market Scope & Overview:

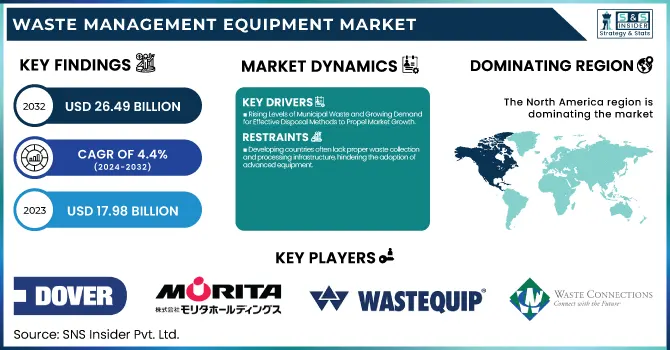

The Waste Management Equipment Market was valued at USD 17.98 billion in 2023, and it is expected to reach USD 26.49 billion by 2032, registering a CAGR of 4.4% during the forecast period of 2024-2032.

To Get more information on Waste Management Equipment Market - Request Free Sample Report

Waste management equipment is crucial for the efficient and proper gathering, handling, and processing of both regular and industrial or hazardous waste. Such equipment is designed to handle solid, liquid, and gaseous waste types. Any individual and modern buildings that praise themselves to be ‘green’, cannot be called sustainable without this type of equipment. Major waste management equipment covers waste disposal equipment and waste recycling and sorting equipment. The first one incorporates dumpers, dumpsters, and trucks, which allow the transportation, loading, and discharging of waste. The second category includes conveyors, shredders, and screeners, designed to treat and separate waste from waste.

In the 2022 Global Waste Index by Sensoneo, Turkey is the least environmentally friendly country. They recycle 47 kg and per person and throw away 176 Kg in illegal dumps each year. The United States is the most wasteful country producing 811 kg of waste per capita with half of waste thrown into landfills.

Furthermore, according to the Food and Agriculture Organization of per United Nations, global food wastage is about 1.6 billion of food produced each year, of which 1.3 billion is still wasted. The carbon footprint is about 3.3 billion tonnes of CO2 equivalent. Home composting could cut household food waste and up to 150 kg per year per household, is likely to be located in the more fertile regions and delivered to local collection authorities. Developing countries experience higher food losses during agricultural production, while in more developed countries, food waste is higher at the retail and consumer levels, leading to an economic loss of about USD 750 billion annually.

MARKET DYNAMICS

DRIVERS

Rising Levels of Municipal Waste and Growing Demand for Effective Disposal Methods to Propel Market Growth.

Among all countries waste generation from municipal, as well as lower industrial sector is a major issue that is prevailing in all most all-over developing countries and in some developed countries. In addition to city population is increasing. As the population increases waste is also increasing in amount so the waste managing equipment are in high demand which helps the transfer the day to a more compact form and reusable form. According to the World Bank Group found that in 2021 globally 1.3 billion ton of waste is generated in which it is expected to increase to 2.2 billion tons of waste by 2025, generating transferring waste into most of the compactors and dumping system.

According to the Global Waste Index 2022, South Korea ranked first, which generated around 400 kg of waste generated. Around 60.8% of the waste is recycled from these countries and they are dumped in the incineration and landfill sectors. This increases the demand for waste recycling and waste equipment. Moreover, there is an increased number of industries around the globe and technological advancements in recycling facilities.

The developments in waste management equipment, such as development of the automated recycling and processing equipment, also benefit the market because they make the process more efficient.

Waste management equipment have been facilitated by advanced technologies include automated sorting systems that use technologies to separate different types of waste through a feature of artificial intelligence and machine learning by which the equipment identifies and separates different types of waste accurately. This different waste separation is free of contamination reducing the disorientation of recyclable materials and improving the recycling process. Another innovation that has risen from the use of advanced technologies in waste management equipment is efficient machinery for processing. This machinery includes the effective use of shredders, compactors and incinerators to reduce the waste volume, hence allowable waste handling.

All these factors may be considered to be the obligation of improving waste management and treatment, as well as making these processes more efficient and less costly. Nevertheless, the solutions are technologically advanced, meaning that the costs of employing staff to operate waste management facilities will be decreased, not increased. Furthermore, this approach will become significantly cost-saving and profitable for waste management companies, as by improving the quality and types of sorting and regular processes with the help of new means of technology, they will be able to decrease the costs of its operations, as mentioned.

RESTRAIN

Developing countries often lack proper waste collection and processing infrastructure, hindering the adoption of advanced equipment.

A waste-inefficient infrastructure is one of the main obstacles to the successful implementation of advanced waste management equipment in many developing countries. On the one hand, these countries lack appropriate waste collection and processing facilities. On the other hand, such countries are characterized by the poor availability of financial, human, and legislative resources. As a result, solid waste collection and disposal are usually very ineffective. In many undeveloped areas waste is not collected altogether and it is not an unusual occurrence to find open-air dumps which contaminate drinking water sources and the grounds near them. In the majority of the cases, the required infrastructure, such as a landfill or an appropriate waste processing plant, has to be put in place before the advanced equipment can be imported. However, these countries are more focused on solving the existing issues with waste which pose threat to the public health rather on the arrangement of advanced long-term engineering methods. This, however, leads to the development of a vicious circle the absence of infrastructure doesn’t allow for the implementation of advanced equipment, while the unsophisticated equipment does not contribute to the efficiency of waste management.

KEY MARKET SEGMENTATION

By Product Type

-

Waste Disposal Equipment

-

Dumpsters

-

Compactors

-

Trucks

-

Others (Drum Crushers and Others)

-

Waste Recycling & Sorting Equipment

-

Conveyors

-

Screeners

-

Shredder

-

Others

By Waste Type

-

Hazardous

-

Non-hazardous

The hazardous waste segment primarily generated by the pharmaceuticals, chemicals, and medical industries is expected to hold the highest market share approx. 56% in 2023. This category of waste with high capacities of risks, which can have a negative impact to public health as well as the environment. Some types of such waste include toxic, reactive or sometimes infectious waste.

By Application

-

Industrial Waste

-

Municipal Waste

-

Others

The industrial waste segment dominates the market and is expected to exhibit a significant growth of approx. 45% in 2023, during the forecast period. This is due to the increasing waste generation from the construction, oil & gas waste, and manufacturing sectors.

The municipal waste segment is expected to register moderate growth. This is due to rising public awareness regarding sustainable waste management techniques, which creates the demand for more waste equipment for handling and disposing of waste generated from municipal sectors.

REGIONAL ANALYSES

North America currently dominating with 34.48% share in 2023, during the forecast period owing to the presence of several key players in the region along with good product offerings. Additionally, huge amount of waste generated in the U.S., Canada and Mexico create demand for waste equipment to manage waste properly.

In 2023, the fastest growing is going to be the Asia Pacific, because countries like Japan, India and China, have more production of garbage. In every year India produces more than 60 million tonnes of garbage.

Get Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the waste management equipment Dover Corporation, Morita Holdings Corporation, Wast equip LLC, Oshkosh Corporation, Sierra International Machinery LLC,, JCB, Kirch off Group, Waste Connections, Enerpat Group UK Ltd. Caterpillar Inc. and other players.

RECENT DEVELOPMENT

In May 2023: Wastequip announced the all-new Compactor Service Solutions from its Wastequip WRX service division. These solutions are the industry’s first end-to-end service offering, providing waste management compactor customers a hub for quickly scheduling preventative maintenance, installation, repair, or service from Wastequip WRX’s robust network of technicians.

| Report Attributes | Details |

| Market Size in 2023 | US$ 17.98 Bn |

| Market Size by 2032 | US$ 26.49 Bn |

| CAGR | CAGR of 4.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type(Waste Disposal Equipment, Dumpsters, Compactors, Trucks, Others (Drum Crushers and Others), Waste Recycling & Sorting Equipment, Conveyors, Screeners, Shredder, Others) •By Waste Type(Hazardous, Non-hazardous) •By Application (Industrial Waste, Municipal Waste, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dover Corporation, Morita Holdings Corporation, Wast equip LLC, Oshkosh Corporation, Sierra International Machinery LLC, JCB, Kirch off Group, Waste Connections, Enerpat Group UK Ltd.Caterpillar Inc |

| Key Drivers |

• Rising Levels of Municipal Waste and Growing Demand for Effective Disposal Methods to Propel Market Growth. • The developments in waste management equipment, such as development of the automated recycling and processing equipment, also benefit the market because they make the process more efficient. |

| Market Restraints | • Developing countries often lack proper waste collection and processing infrastructure, hindering the adoption of advanced equipment. |