Agentic AI Market Analysis & Overview:

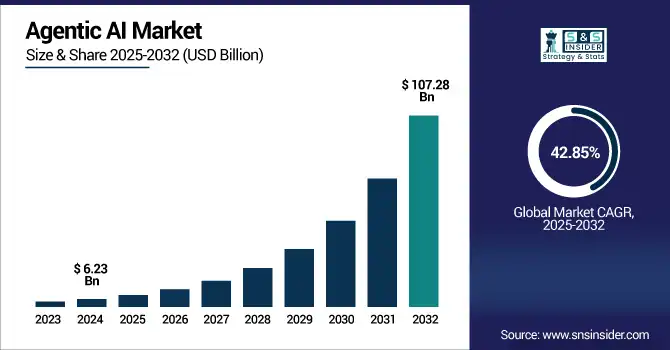

Agentic AI Market size was valued at USD 6.23 billion in 2024 and is expected to reach USD 107.28 billion by 2032, growing at a CAGR of 42.85% from 2025-2032.

To Get more information on Agentic AI Market - Request Free Sample Report

The Agentic AI market is experiencing rapid growth due to increasing demand for autonomous, goal-driven systems that can perform complex tasks with minimal human intervention. These AI agents, capable of reasoning, decision-making, and tool usage, are being widely adopted across sectors such as finance, healthcare, logistics, and software development.

Advancements in large language models (LLMs), multimodal capabilities, and real-time contextual learning are fueling innovation. These breakthroughs have expanded the capabilities of agentic systems from basic task execution to advanced problem-solving, planning, and collaboration. Reflecting this trend, 39% of U.S. adults adopted AI within just two years nearly double the 20% adoption rate of the internet in the same timeframe demonstrating the unprecedented speed and scale of AI uptake among consumers and enterprises alike.

Organizations embracing agentic AI are reaping measurable benefits, including 1.5× faster revenue growth, 1.6× higher shareholder returns, and 1.4× improved return on invested capital compared to less advanced peers. These figures highlight the growing competitive advantage that AI-powered autonomy brings to early adopters across industries.

Further driving momentum, Amazon’s 2024 launch of Amazon Q Business and enhancements to its Bedrock platform introduced multi-agent collaboration features that improved task completion rates by approximately 40%, showcasing the tangible impact of coordinated agentic systems on enterprise productivity. These innovations demonstrate how agentic AI is evolving from a support function to a core driver of business transformation, capable of handling everything from internal automation to external customer interactions. As major players continue to invest and deploy agent-based frameworks, the market is set to witness exponential growth in the coming years.

U.S. Agentic AI Market size was valued at USD 1.67 billion in 2024 and is expected to reach USD 28.33 billion by 2032, growing at a CAGR of 42.49% from 2025-2032.

The U.S. Agentic AI market is growing rapidly due to strong technological infrastructure, high R&D investments, and early adoption by enterprises. Demand for intelligent automation in customer service, finance, and legal sectors further accelerates market expansion across industries.

In 2025, UiPath Inc. released an Agentic AI report revealing that 90% of U.S. IT executives recognize significant opportunities in agentic AI to enhance and streamline business workflows.

Agentic AI Market Dynamics

Drivers

-

Autonomous decision-making systems are transforming industries through task execution, reducing human intervention, and enabling continuous real-time adaptation

Autonomous decision-making by agentic AI is revolutionising industries, including healthcare and defence, logistics and finance. Such systems, using complex data algorithms, behave by interpreting huge amounts of data and not only adapting in real-time but actually performing actions independently of humans. They are a must-have in high-stakes situations due to their self-correcting abilities and capacity to adjust in the face of dynamic conditions. Agentic AI operational independence supports efficiency, predictive capability, and cost savings as organizations turn to automation for operations and strategic decisions. It sees agentic intelligence as a critical component of next-gen intelligent systems that will spur innovation and resilience in key industries.

According to the FDA, only 0.5% of medical device incidents are currently reported, prompting tighter real-time AI monitoring and post-market surveillance.

The U.S. Department of Energy (DOE) identified 16 federal sites in April 2025 for co-located data centers and agentic AI infrastructure, supporting autonomous data processing and system optimization.

Furthermore, a NIH-backed ROI study found that deploying an AI platform across a hospital costs approximately USD 1.78 million over five years, delivering a 451% return on investment, and still yielding 335% ROI in year one even with long deployment periods.

Restraints

-

Lack of reliability, explainability, and alignment with human values poses major barriers to agentic AI trust and adoption

Reliability, process transparency, and value alignment issues obstruct agentic AI adoption. These systems, which are less likely to give a clear rationalization behind their actions, may therefore pose an ethical and safety risk. They are reluctant to deploy them especially in high-stakes areas like law, health and finance due to their non-interpretable nature, and more importantly the inability to be sure they align with user intent. Users and regulators want predictability and explainability in behavior, but those models still seem to fall short of the mark. Business are still sceptical of trusting agentic AI on matters that demand critical decision making until such time as sound frameworks for oversight and ethical assurance become more widely available.

Opportunities

-

Rising demand for AI copilots, personal assistants, and multi-agent collaboration tools drives rapid adoption of agent-based systems across applications

The trend of Agentic AI is gaining speed as more AI copilots, productivity assistants, and collaborative digital agents become more widely adopted. They streamline the process of delegating tasks, managing schedules, and engaging in context-aware interactions with cross-platforms, improving user experience and productivity. The capability of pursuing multiple objectives and functioning on different software platforms attracts industries such as education, software development and customer service. Agentic AI, which is contextually aware, can recall past conversations and reasoning has become vital for both personal and enterprise use cases and continuously expands throughout digital ecosystems.

Microsoft’s research found that 70% of Copilot users reported being more productive, and 68% said it improved work quality. Users completed tasks 29% faster, caught up on missed meetings nearly 4× faster, and 64% spent less time processing emails.

A ZoomInfo study involving over 400 developers revealed a 33% suggestion acceptance rate and 72% developer satisfaction.

Additionally, real-world deployments have shown 50% time savings in code documentation and autocompletion, and 30–40% time saved on repetitive tasks, testing, and debugging projecting 33–36% overall time reduction in software development.Top of FormBottom of Form

Challenges

-

Maintaining long-term memory, context retention, and task continuity remains a major technical barrier to scalable agentic AI performance

One of the biggest technical hurdles in agentic AI is context retention, memory management, and task resumption over the long term. In contrast to trivial chatbots, such systems need to remember history, understand transitions and plan across steps. Existing constraints in memory management and contextual interpretation hamper trustworthiness and scalability. That fragility makes it hard to expose agentic AI to real enterprise level business environments where continuous and stable systems are important. These are important steps towards creating systems that can operate continuously and independently over prolonged periods in complicated real-world environments.

Agentic AI Market Segmentation Analysis

By Product Type

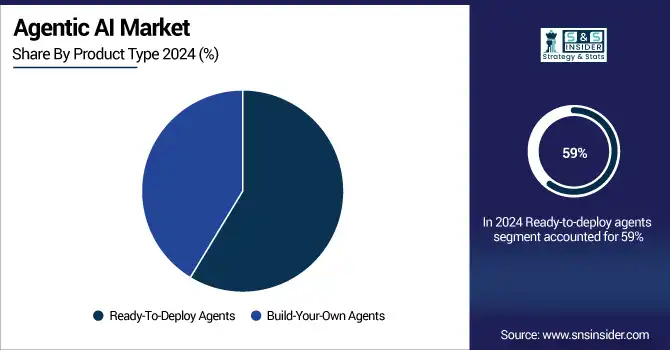

Ready-to-deploy agents dominated the Agentic AI market share in 2024 with a 59%, due to fewer implementations complexities and offering delivered value across the workflows. These plug-and-play agents are favoured by enterprises to speed up deployment, minimise tech barriers, and remove the need for in-house AI knowledge. They have become highly scalable especially in high-demand sectors that need fast AI integration and low-cost automation like customer support, IT operations and workflow automation.

Build-your-own agents are expected to grow at the fastest CAGR of 44.19% from 2025 to 2032, due to increased enterprise interest in bespoke, domain-specific solutions. These agents also provide flexibility, modularity and control, allowing organizations to create and customize AI systems based on internal tools and specific workflows. Open-source frameworks and developer-friendly platforms encourage customizable and scalable platforms that are appealing to companies who want to focus on innovation, differentiation, and data privacy in competitive, quickly-evolving industries.

By Organization Size

Large enterprises dominated the Agentic AI market in 2024 with a 65% revenue share due to their more matured digital infrastructure, higher R&D capacity, and higher inclination to employ autonomous systems. They have other individuals and departments with adequate budgets and expertise to prepare agentic technologies for business processes. Early Adapters and Major Revenue Contribution in AI-based Enterprise Ecosystem Enterprises maintain a strategic edge with their use of agents for decision-making, operational automations, and augmenting customer experience.

Small and medium enterprises (SMEs) are projected to grow at the fastest CAGR of 44.45% from 2025 to 2032 due to democratized access to AI solutions as well as mass availability of low-code agentic platforms These enterprises are turning to agentic AI solutions to handle hundreds or thousands of operations while providing more efficient assistance or freeing up workforce capacity without having to hire a lot of IT teams. Affordable, scalable, and easy-to-use agent development tools allow SMEs to roll out AI-based solutions which can, in their niches, spur new innovation and competitiveness.

By End Users

The BFSI sector held the highest revenue share of 26% in the Agentic AI market in 2024 due to the considerable demand for automation in the areas of fraud detection, customer onboarding, and risk assessment. Financial institutions deal with absolute precision, speed and compliance, and agentic AI remains table stakes in real-time decisioning and process optimization. The data-driven nature of the sector, combined with regulatory pressures to improve digital resilience, also accelerate adoption of autonomous agents throughout banking, insurance and investment processes.

Healthcare is expected to grow at the fastest CAGR of 44.95% from 2025 to 2032, as reliance on AI agents for diagnostics, patient engagement, and administrative support increases. Increasing data volumes, lack of physician availability, and the demand for personalized care drive attraction of agentic solutions. Such agents could help handle med. records, automate triage, and help treatment recommendations thus enhancing care quality while alleviating burnout and operational bottlenecks across hospitals and health systems.

By Agent Role

Customer service and virtual assistants dominated the Agentic AI market in 2024 with a 33% revenue share as businesses continued to seek 24/7 support and personalized user experiences. Automation via agentic systems was immediately implemented to manage complex queries, escalation, and continuity across channels to minimize human workload and response time. They were also indispensable in telecom, e-commerce, and service-heavy industries in which immediate, automatic, unmediated communication became a battleground for competitive differentiation, due to the maturity and high ROI of the technology.

Sales and marketing are projected to grow at the fastest CAGR of 46.21% from 2025 to 2032, due to the requirement for intelligent lead generation, campaign optimization and customer journey personalization. Agentic AI flows to mend content, predict behavior, and enables multichannel engagement that brings data to life actionably. With brands realizing the significant benefits of automation and personalization, businesses are investing in agents that automate outreach, personalize messaging, and enhance conversion and such agents are quickly becoming the cornerstone of next-generation marketing stacks designed for scale, speed, and relevance.

By Agent System

Multi-agent systems dominated the Agentic AI market in 2024 with a 43.66% revenue share and are projected to grow at the fastest CAGR of 15.22% from 2025 to 2032 due to their ability of combined collaboration, scalability and streamlined efficiency for modelling of distributed complex tasks. Such agents can be functioning individually or in collaboration in dynamic environments, which makes them suitable for deployment in logistics, robotics, simulations, and enterprise automation. With more industries becoming autonomous and inter-operable, industries need the flexibility and coordination associated with multi-agent architectures for next-gen intelligent operation.

In May 2025, Amazon launched the general availability of Amazon Bedrock for multi-agent collaboration, allowing developers to build and orchestrate complex, multi-step workflows using generative AI agents.

Agentic AI Market Regional Analysis

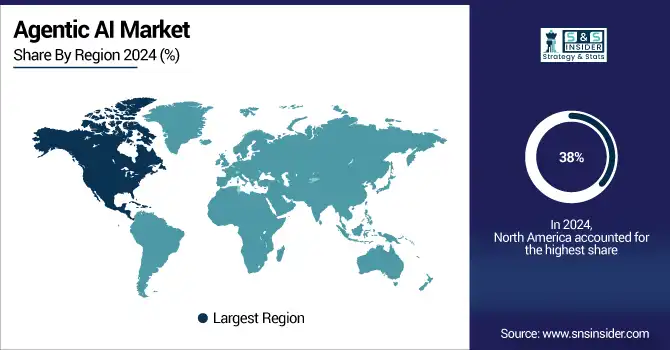

North America dominated the Agentic AI market in 2024 with a 38% revenue share, attributed to key factors such as an established AI ecosystem, a large number of tech giants, and early technology adoption in domains such as finance, healthcare and defense. Great investment in R&D, government support and skilled workforce strengthen regional leadership. Agentic systems are being deployed at scale in commercial applications as they continue to be built out with ever-more complex capabilities across numerous enterprise functions in the U.S. and Canada spanning automation, decision support and personalized experience.

The U.S. Department of Defense, via its Joint Artificial Intelligence Center (JAIC), has been integrating AI systems into defense operations since 2018. As of April 2024, it achieved a viable deployment capability (CJADC2) for decision-making across domains.

The U.S. dominated Agentic AI market trends due to its advanced AI infrastructure, early enterprise adoption, and strong investment in autonomous systems and R&D. This leadership is further underscored by growing enterprise interest in agentic solutions. In 2025, UiPath Inc. released a report revealing that 90% of U.S. IT executives recognize significant opportunities in agentic AI to enhance and streamline business workflows, reflecting the technology’s rising strategic importance across corporate operations.

Asia Pacific is expected to grow at the fastest CAGR of 45.20% from 2025 to 2032, owing to increase in digitalization along with growing infrastructure for AI supported by favorable government initiatives across the countries such as China, India, Japan, South Korea, etc. Robust demand for agentic AI capabilities is fueled by the region's expansive consumer base, vibrant tech startup ecosystem, and rising investment in AI within smart cities, manufacturing, and education. Market Growth is Accentuated by Local Innovation and Inter-sector Experimentation.

China is dominating the Agentic AI market in Asia Pacific due to massive government investment, AI-driven industrial growth, and rapid enterprise adoption across sectors. As of 2023, the country had built 250 AI-focused data centres either operational or under construction equipped with a total of 230 EFLOPS of computing power, of which 70 EFLOPS are specifically allocated for intelligent tasks.

Europe is becoming a key player in the Agentic AI market, driven by strong regulation, rising AI investment, and adoption in manufacturing, automotive, and healthcare. Germany leads with Deutsche Telekom and Nvidia’s AI cloud project, powered by 10,000 chips and set to launch by 2026. France is advancing with a 2025 national healthcare AI initiative, aiming to train 100,000 professionals annually and build Europe’s largest AI data centre to support diagnostic innovation, strengthening regional AI infrastructure and deployment leadership.

Germany is dominating the Agentic AI market in Europe due to its strong industrial base, advanced automation adoption, and robust AI research and funding.

The Middle East & Africa are witnessing growing interest in the Agentic AI market, driven by digital transformation, smart city initiatives, and increased AI investments. The UAE’s AI Strategy 2031 includes appointing 22 chief AI officers and launching 200+ AI-powered public services. Saudi Arabia’s Vision 2030 supports agentic AI through the USD 500 million NEOM project, 83 data centres, and a National Data Bank integrating 80+ datasets. These efforts reflect the region’s push toward AI-led public service, infrastructure, and security enhancement.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Agentic AI market companies are Microsoft Corporation, Amazon.com, Inc., Google LLC, The AnyLogic Company, Ampcome Technologies Private Limited, UiPath Inc., Epicor Software Corporation, Coupa Software Inc., Zycus Inc., Oracle Corporation

Recent Developments:

-

2025: Amazon launched the general availability of Bedrock for multi-agent collaboration, enabling developers to orchestrate complex, multi-step workflows across various enterprise and AI systems.

-

2025: Oracle Corporation Launched AI agents for sales professionals, automating tasks like report generation, record updates, and multilingual data integration free of charge.

-

2024: Microsoft Corporation Launched new autonomous agents via Copilot Studio (public preview), integrating 10 agents across Dynamics 365 for sales, service, finance, and supply‑chain workflows part of scaling AI-first business processes.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.23 Billion |

| Market Size by 2032 | USD 107.28 Billion |

| CAGR | CAGR of 42.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Ready-To-Deploy Agents, Build-Your-Own Agents) • By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises) • By Agent System (Single Agent, Multi Agent) • By Agent Role (Customer Service and Virtual Assistants, Sales and Marketing, Human Resources, Legal and Compliance, Financial Services, Other Applications) • By End Users (Healthcare, BFSI, IT & Telecom, Manufacturing, Government & Public Sector, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Microsoft Corporation, Amazon.com, Inc., Google LLC, The AnyLogic Company, Ampcome Technologies Private Limited, UiPath Inc., Epicor Software Corporation, Coupa Software Inc., Zycus Inc., Oracle Corporation |