Managed Print Services Market Size & Overview:

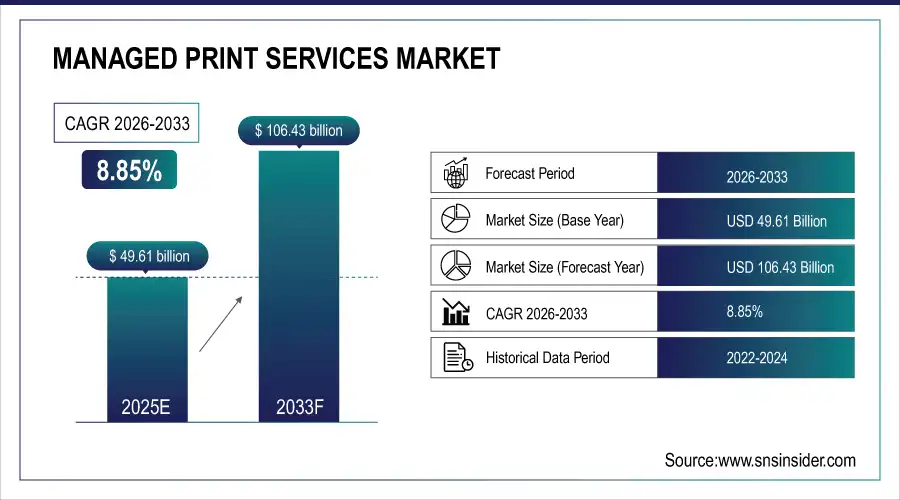

Managed Print Services Market was valued at USD 49.61 billion in 2025E and is expected to reach USD 106.43 billion by 2033, growing at a CAGR of 8.85% from 2026-2033.

The Managed Print Services Market growth is driven by enterprises seeking cost optimization, enhanced operational efficiency, and secure document management. Rising adoption of cloud-based solutions, AI-driven analytics, and IoT-enabled printers enables streamlined workflows and remote monitoring. Increasing regulatory compliance requirements and focus on data security further accelerate MPS adoption. Additionally, demand for sustainable printing practices and support for hybrid work models contribute to the market’s robust expansion.

Managed Print Services Market Size and Forecast

-

Market Size in 2025E: USD 49.61 Billion

-

Market Size by 2033: USD 106.43 Billion

-

CAGR: 8.85% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Managed Print Services Market - Request Sample Report

Managed Print Services Market Trends

-

Rising need to reduce printing costs and optimize document workflows is driving the Managed Print Services (MPS) market.

-

Growing adoption of cloud-managed print environments is boosting flexibility, scalability, and remote monitoring capabilities.

-

Expansion of security-focused print solutions is addressing concerns around data breaches and document compliance.

-

Increasing integration of analytics, automation, and IoT-enabled devices is improving fleet management and operational efficiency.

-

Shift toward hybrid work models is fueling demand for distributed print management and secure mobile printing.

-

Focus on sustainability and reducing paper waste is encouraging adoption of eco-friendly print strategies.

-

Partnerships among printer manufacturers, MPS providers, and IT service firms are accelerating innovation and market expansion.

The U.S. Managed Print Services market size was valued at an estimated USD 19.20 billion in 2025 and is projected to reach USD 41.30 billion by 2033, growing at a CAGR of 8.1% over the forecast period 2026–2033. Market growth is driven by organizations’ increasing focus on cost optimization, workflow efficiency, and document security across enterprises of all sizes. Rising adoption of cloud-based print management solutions, integration with IT and cybersecurity systems, and growing demand for sustainability-driven print reduction strategies are accelerating market expansion. Additionally, the shift toward hybrid work environments, advancements in analytics-driven print monitoring, and strong participation from leading service providers further support the steady growth outlook of the U.S. managed print services market during the forecast period.

Managed Print Services Market Growth Drivers:

-

Rising demand for cost optimization and operational efficiency in enterprises is significantly boosting the Managed Print Services Market globally.

Enterprises are increasingly focusing on reducing printing-related expenses, including maintenance, consumables, and energy costs. Managed Print Services (MPS) allow organizations to monitor and optimize print workflows, streamline document management, and reduce overall operational expenditure. The integration of MPS with IT infrastructure provides enhanced control over document security and fleet management, leading to improved efficiency. Growing adoption of cloud-based MPS solutions further supports scalability and remote monitoring. These factors collectively drive businesses to invest in MPS solutions to achieve cost savings and operational effectiveness.

Managed Print Services Market Restraints:

-

Limited awareness about advanced Managed Print Services capabilities is hindering market expansion in certain regions and sectors.

Many organizations, especially in developing markets, are unaware of the full range of benefits offered by MPS, such as workflow optimization, cloud integration, and document security enhancements. Misconceptions about the complexity of implementation and concerns over IT compatibility also reduce adoption rates. Enterprises may continue relying on traditional printing methods due to lack of knowledge or resistance to change. This limited awareness and understanding of MPS potential prevent market penetration, especially among small and medium businesses, thereby restraining the overall growth trajectory of the Managed Print Services Market.

Managed Print Services Market Opportunities:

-

Integration of cloud-based solutions and digital transformation initiatives presents significant growth opportunities for Managed Print Services Market.

The adoption of cloud technology enables centralized print management, remote monitoring, and seamless integration with enterprise IT systems. Organizations undergoing digital transformation can leverage MPS solutions to improve document workflow efficiency, reduce costs, and enhance security. Cloud-based MPS also facilitates scalability and supports hybrid work models, allowing employees to print securely from any location. Rising adoption of IoT-enabled printers and AI-driven analytics further expands the potential for optimized fleet management. These advancements present lucrative opportunities for MPS providers to offer innovative solutions and capture new customer segments worldwide.

Managed Print Services Market Segment Analysis

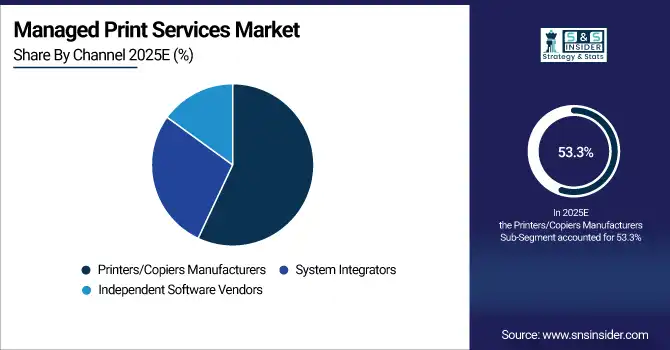

By Channel, Printers & Copiers Manufacturers dominated the Market, while Independent Software Vendors are expected to register the highest CAGR

The printers and copiers manufacturers segment dominated the market and represented the largest share of market revenue, reaching 53.3% in 2025. In the Managed Print Services (MPS) market, enhanced security features are essential for printer and copier manufacturers due to the increasing risks associated with data breaches and cyber threats, which drive the demand for secure printing solutions. To address these challenges, manufacturers are integrating advanced security measures into their devices, including secure print release, user authentication, encryption, and secure boot technology. These features aim to safeguard sensitive information, ensure compliance with data protection regulations, and reduce the risk of unauthorized access. By focusing on security, manufacturers can alleviate business concerns and position their products as trustworthy and secure choices in the market.

Conversely, the independent software vendors segment is expected to experience the highest CAGR during the forecast period. Organizations have varied print management needs influenced by their size, industry, and operational processes. Independent software vendors provide highly customizable solutions tailored to these specific requirements, offering personalized print management workflows, user interfaces, and reporting capabilities.

By Deployment, On-Premises segment led the Market, with Cloud-Based deployments projected to grow at the fastest CAGR

In 2025, the on-premises segment accounted for the largest revenue market share. This is especially true for organizations with heightened data protection requirements such as those in healthcare, finance and legal sectors, who opt for on-premises solutions to maintain tighter control over sensitive data. The print management infrastructure is located in the company’s own data centers, which means that extensive security measures such as firewalls, encryption and access controls can be implemented to protect against data breaches and unauthorized access. Such privacy and security concerns are pushing the demand for on-premise deployments.

On the other hand, cloud-based segment is anticipated to have highest CAGR for entire forecast period. Cost-effectiveness and flexibility are some of the key attributes that scope factors driving cloud-based deployments. Cloud-based MPS solutions eliminate the need to make significant upfront investments in hardware and infrastructure, enabling organizations to only pay for what they use. Also, cloud solutions allow employees to use print services from any location and can utilize their laptops, tablets, or smartphones.

By End-Use, BFSI sector held the largest revenue share, while Retail & Consumer Goods is anticipated to grow at the highest CAGR

The BFSI sector accounted for the highest revenue share in 2025. The BFSI sector is a highly regulated industry that handles sensitive and confidential data. So, MPS providers help organizations in this sector by offering advanced security features like secure print release, user authentication, and data encryption to protect documents from unauthorized access & breaches. Moreover, MPS offers a full document management solution including digital archiving, storage and retrieval systems. MPS helps BFSI organizations streamline workflows, decrease the requirement of physical storage space, and make critical information more accessible by digitizing and organizing documents.

On the other hand, retail and consumer goods segment is anticipated to exhibit fastest CAGR during the forecast period. By minimizing non-essential print volumes, and optimizing device use while automating supply replenishment, MPS make the print operations much simpler. These approaches enable production costs to soar on consumables like paper, toner, and maintenance expenses. In addition, for organizations that need to manage print across a wide distribution network with many locations, MPS allows centralized oversight of print spending that can help companies stay on budget and have more predictable financials.

By Organization Size, Large Enterprises dominated the Market, whereas SMEs are expected to experience the fastest CAGR during the forecast period

The large enterprises segment accounted for the largest market revenue share in 2025. Large organizations typically operate across multiple locations, departments, and business units, leading to fragmented and inefficient print management. MPS solutions offer centralized control that allows these organizations to standardize print policies, monitor usage, and ensure compliance across all sites. This centralized approach enhances oversight, optimizes resource allocation, and fosters consistent printing practices. By implementing a unified print management strategy, large enterprises can improve operational control and maintain uniformity.

Conversely, the SMEs segment is projected to experience the fastest CAGR during the forecast period. MPS providers manage the print infrastructure, including monitoring, maintenance, and supply replenishment. This streamlined management process ensures that print services are always available and functioning optimally, thus enhancing overall operational efficiency. Additionally, MPS solutions feature proactive monitoring and support, which reduce downtime and decrease the time employees spend troubleshooting printer problems. Automated supply management ensures that printers are consistently stocked with necessary consumables, preventing workflow interruptions. Collectively, these factors are fueling the increasing demand for MPS among SMEs.

Managed Print Services Market Regional Analysis

North America Managed Print Services Market Insights

In 2025, North America accounted for the largest share of the MPS market. Here, MPS providers use sophisticated printing technologies along with cloud computing to provide print management services that are efficient, secure and scalable. With IoT-enabled printers and clever real-time monitoring, proactive maintenance is possible which decreases downtime and improves operational efficiency significantly. Cloud-based MPS solutions also help travel and accessibility, in this way organizations can easily manage their print environments at different locations.

Do You Need any Customization Research on Managed Print Services Market - Enquire Now

Asia Pacific Managed Print Services Market Insights

Asia Pacific MPS market is expected to grow at fastest CAGR during the forecast period. Rising tendency for MPS solutions majorly attributable to the speedy economic development and industrialization in this region. With expansion of businesses and industrial activities, the demand for economical and efficient printing solution grows additional essential. With MPS, organizations are able to lower expenses, increase efficiency and decrease wasteland essential for staying competitive in these rapidly growing economies. An increasing number of SMEs in the region is also boosting MPS demand.

Europe Managed Print Services Market Insights

Europe’s Managed Print Services Market is expanding due to increasing enterprise focus on cost reduction, workflow optimization, and secure document management. Growing adoption of cloud-based MPS solutions, AI-driven print analytics, and IoT-enabled printers enhances operational efficiency. Strict regulatory compliance and data security requirements drive demand further. Additionally, emphasis on sustainable printing practices and the rise of hybrid work models are supporting market growth across key European countries.

Middle East & Africa and Latin America Managed Print Services Market Insights

The Middle East & Africa and Latin America Managed Print Services Market is growing as organizations focus on reducing printing costs and improving workflow efficiency. Rising adoption of cloud-based MPS solutions and secure document management drives demand. Increasing awareness of data security, regulatory compliance, and the need for operational optimization further support market expansion. Additionally, businesses are embracing sustainable printing practices, boosting MPS adoption across these regions.

Managed Print Services Market Competitive Landscape:

HP Inc.

HP Inc. is a leading global provider of printing, imaging, and computing solutions, delivering innovative hardware, software, and services. The company focuses on Managed Print Services (MPS), workflow automation, and cloud-connected solutions to optimize office productivity and reduce operational costs. HP emphasizes flexible subscription models, remote printing capabilities, and integrated software management to enhance fleet efficiency and enable seamless printing-from-anywhere experiences for enterprises and SMBs.

-

2024: HP expanded its MPS offering with a flexible “MPS Subscription” model, enabling printing-from-anywhere for customers. The company enhanced its print-service portfolio with software integration, multi-country deal support, and improved fleet management.

Ricoh Company, Ltd.

Ricoh is a global technology provider specializing in managed print and document services, workflow automation, and cloud-enabled productivity solutions. The company delivers secure, IoT-enabled printing infrastructure and AI-driven workflow optimization across enterprises. Ricoh’s Intelligent Managed Print Services (MPS) program emphasizes efficiency, cost reduction, and cloud-based print/document management, helping organizations streamline operations, improve governance, and enable seamless document collaboration across multiple locations.

Konica Minolta, Inc.

Konica Minolta is a leading provider of intelligent workplace solutions, including Managed Print Services (MPS), AI-powered workflow automation, and secure document management. The company focuses on helping SMBs and enterprises improve productivity, reduce costs, and enhance print security through cloud-enabled, connected office solutions. Konica Minolta leverages AI and IoT technologies to enable smart workplaces, automate document processes, and optimize print-fleet efficiency for global customers.

Key Players

The major key players are

-

Xerox Corporation - Xerox Versalink Series

-

HP Inc. - HP LaserJet Pro

-

Canon Inc. - Canon imageRUNNER ADVANCE

-

Ricoh Company, Ltd. - Ricoh MP Series

-

Konica Minolta, Inc. - Konica Minolta bizhub Series

-

Lexmark International, Inc. - Lexmark MX Series

-

Epson America, Inc. - Epson WorkForce Pro

-

Sharp Electronics Corporation - Sharp MX Series

-

Samsung Electronics Co., Ltd. - Samsung Xpress Series

-

Brother Industries, Ltd. - Brother MFC Series

-

Dell Technologies Inc. - Dell Color Laser Series

-

Pitney Bowes Inc. - Pitney Bowes SendPro Series

-

Datacard Group - Datacard CP80 Plus

-

Nuance Communications, Inc. - Nuance Equitrac

-

Print Audit - Print Audit 6

-

MPS Monitor - MPS Monitor Cloud

-

Synnex Corporation - Synnex Managed Print Services

-

Toshiba Corporation - Toshiba e-STUDIO Series

-

Cisco Systems, Inc. - Cisco Print Services

-

Alcove Technology - Alcove MPS Solutions

B2B User

-

Wells Fargo

-

Coca-Cola

-

U.S. Department of Defense

-

Toyota

-

Nippon Steel

-

AT&T

-

Kinkos (FedEx Office)

-

American Red Cross

-

Nestlé

-

Beckman Coulter

-

University of Texas

-

Staples

-

Chase Bank

-

CVS Health

-

University of Michigan

-

Tamarind Media

-

Xerox

-

Nikon

-

IBM

-

Harvard University

| Report Attributes | Details |

| Market Size in 2025E | USD 49.61 billion |

| Market Size by 2033 | USD 106.43 Billion |

| CAGR | CAGR of 8.85% from 2026-2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On- Premise, Cloud-Based) • By Channel (Printers/Copiers Manufacturers, System Integrators, Independent Software Vendors) • By Organization Size (Small and Medium-Sized Businesses, Large Enterprises) • By End-Use (BFSI, Education, Government, Healthcare, Industrial Manufacturing, Retail & Consumer Goods, Telecom & IT, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Canon UK Limited, Toshiba Corporation, Kyocera Corporation, Systems Technology Inc., ARC Document Solutions Inc., HCL Technologies, Samsung Electronics Co. Ltd., HP Development Company L.P., Acrodex Inc., Ricoh Company Ltd. |