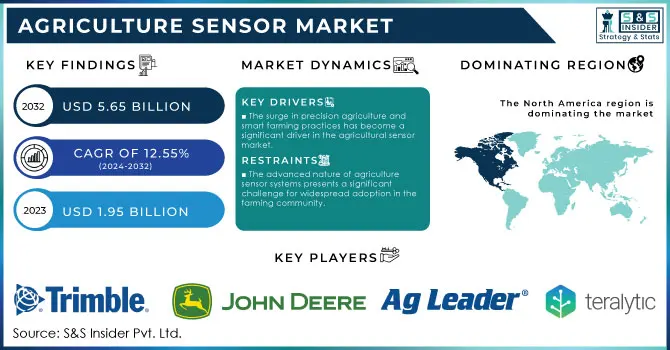

Agriculture Sensor Market Size & Trends:

The Agriculture Sensor Market Size was valued at USD 1.95 Billion in 2023 and is supposed to arrive at USD 5.65 billion by 2032, and grow at a CAGR of 12.55% over the forecast period 2024-2032. The agriculture sensor market analysis highlights that the market is expected to experience robust growth over 2024-2032 owing to the surging demand for agricultural output and the integration of advanced technologies including low-till management and precision farming. These innovations are essential for real-time decision-making in yield monitoring, crop health assessments, and efficient irrigation scheduling, helping farmers tackle modern agricultural challenges. Agri-tech companies are increasingly implementing wireless platforms that empower farmers to improve productivity and manage price volatility.

North America leads the market due to the significant investments in the agricultural technology and environmental regulations, which further encourage sustainable farming practices. Innovations including location sensors for precise positioning in agriculture are also improving the operational efficiency. Agricultural sensors are instrumental in increasing the crop yields and sustainably managing the resources, which further drives the agriculture sensor market growth. With climate change intensifying, the demand for smart agriculture solutions, such as IoT-enabled soil moisture sensors for precision irrigation, is set to rise significantly, especially in areas with declining groundwater levels.

Get More Information on Agriculture Sensor Market - Request Sample Report

Family-operated farms, which make up 95% of the 1.9 million U.S. farms, benefit greatly from these advancements, meeting rising food demands with each farm now feeding about 169 people annually. Environmental stewardship is also prioritized, with many farms adopting renewable energy solutions, resulting in a 167% surge in renewable systems over the past decade. Collectively, these advancements in agricultural sensors support sustainable farming practices and enhance productivity, making them essential tools for the future of agriculture. The market is well positioned to play a vital role in promoting global food security by equipping farmers with technology to meet the demands of a growing population and changing environmental conditions.

Agriculture Sensor Market Dynamics:

Drivers:

-

Surge in Precision Agriculture and Smart Farming Practices Propel Market Growth

As farmers increasingly adopt technology-driven methods to monitor and manage crops at a granular level, sensors play a pivotal role in gathering real-time data on essential factors including soil moisture, nutrient levels, and crop health. This granular approach leads to optimized crop management, reduced input costs, and higher crop yields, ultimately making farming more sustainable and profitable.

According to reports, the adoption of precision farming methods is projected to increase by 12% annually, as farmers look to leverage technology to counteract challenges such as water scarcity and labor shortages. In Texas, for instance, technology in agriculture has been instrumental in overcoming drought conditions, with farmers employing sensors and drones to monitor crop hydration levels. The use of drones for mapping and spraying significantly enhances resource efficiency and reduces water waste by up to 25%.

Additionally, innovations in artificial intelligence (AI) and machine learning allow farmers to predict crop growth and harvest timing accurately. Such advancements in AI-driven autonomous solutions are set to transform traditional farming, enabling farms to operate with greater autonomy and productivity. Precision agriculture practices also significantly reduce environmental impact by ensuring precise resource application.

By utilizing sensors to monitor crop and soil health, farmers can apply only the necessary amount of water and nutrients, reducing waste and environmental strain. Precision agriculture could help reduce agricultural runoff by 30%, thus preserving surrounding ecosystems. With agricultural output critical to global food security, the demand for precision agriculture technologies, particularly sensors, is expected to continue growing. As technology evolves and becomes more accessible, the adoption of precision farming will likely drive substantial growth in the agricultural sensor market over the next decade.

Restraints:

-

Advanced Nature of Agriculture Sensor Systems Can Hamper Their Adoption Globally

These sophisticated technologies require a high level of technical knowledge for effective implementation and operation, which can be a barrier for many farmers, particularly those in family-run or small-scale operations. The integration of advanced sensors, including soil moisture sensors, nutrient sensors, and climate control devices, often necessitates specialized training and expertise that many farmers may lack. As a result, farmers might struggle to fully utilize the capabilities of these technologies, which can lead to suboptimal results and a reluctance to invest in such systems.

Additionally, the rapid pace of technological advancements can make it difficult for farmers to keep up, and creating a knowledge gap that can hinder their ability to adopt innovative farming practices. This complexity not only affects individual farmers but can also slow down the overall growth of the agriculture sensor market, as potential users may hesitate to invest in technology that they do not fully understand or feel confident in managing. Consequently, addressing this restraint requires comprehensive training programs and support systems to empower farmers, ensuring they can effectively leverage agriculture sensor technology to enhance productivity and sustainability in their operations. By simplifying technology and improving accessibility, the agriculture sensor market can unlock its full potential and drive greater adoption across diverse farming sectors.

Agriculture Sensor Market Segmentation Analysis:

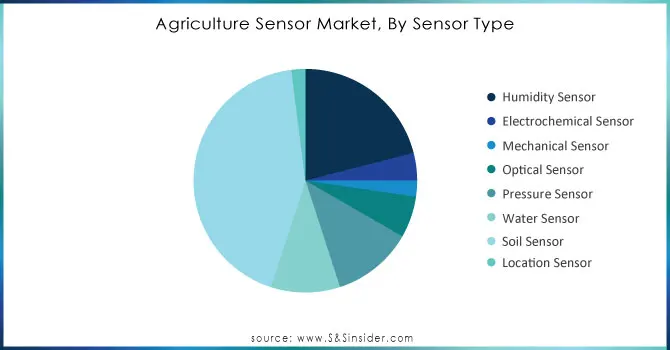

By Sensor Type

The soil sensor segment has established itself as a leading player in the agriculture sensor market, capturing around 43% of total revenue in 2023. This notable share emphasizes the vital role of soil health and moisture management in optimizing agricultural output. Soil sensors are engineered to deliver real-time insights into key soil parameters, such as moisture levels, pH, nutrient availability, and temperature, empowering farmers to make informed decisions that enhance crop yields and resource management. A substantial benefit of soil sensors is their support for precision agriculture, enabling farmers to monitor soil conditions closely.

This level of precision allows for targeted irrigation and fertilization, ensuring crops receive the exact amount of water and nutrients when needed, which is particularly beneficial in drought-prone regions. The rising focus on sustainable farming practices further propels the demand for soil sensors, as they help reduce chemical runoff and improve soil health, which are essential factors for meeting the needs of a projected global population of 9.7 billion by 2050. With the integration of IoT technology, soil sensors also offer enhanced connectivity and analytics, providing farmers with a comprehensive view of their operations. As digital solutions gain traction, soil sensors will continue to play a critical role in advancing agricultural productivity and sustainability.

Need Any Customization Research On Agriculture Sensor market - Inquiry Now

By Application

The soil monitoring application has dominated with approximately 42% agriculture sensor market share in 2023 due to the essential role of soil health and management in farming practices. By utilizing advanced sensor technologies, soil monitoring assesses critical parameters including moisture levels, temperature, nutrient content, and pH. These sensors provide real-time data, empowering farmers to make informed decisions that enhance crop yields and optimize resource efficiency.

A major advantage of soil monitoring is its contribution to precision farming. With accurate insights into soil conditions, farmers can tailor irrigation and fertilization strategies to meet the specific needs of their crops. This targeted approach not only increases productivity but also reduces waste, especially in water-scarce regions where efficient resource management is crucial. Leading companies in the sector are actively launching innovative products and upgrading existing solutions, emphasizing IoT integration and smart soil sensors that enable real-time data transmission. This enhanced connectivity improves decision-making and allows farmers to remotely monitor soil conditions.

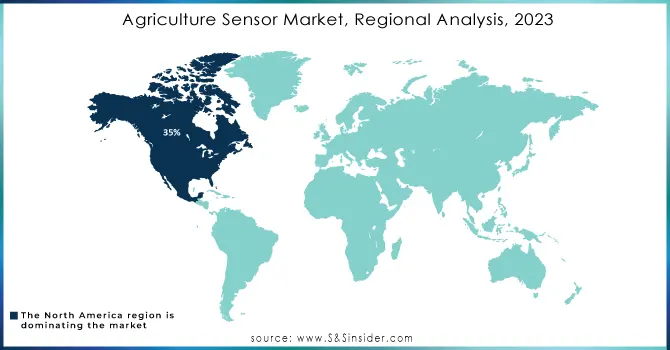

Agriculture Sensor Market Regional Insights:

North America dominates the agriculture sensor market, representing approximately 35% of total revenue in 2023. This leading position stems from substantial investments in smart agriculture technologies, a strong emphasis on precision agriculture, and the presence of major industry players. The U.S. and Canada are at the forefront of adopting advanced agricultural technologies, driven by the need for enhanced productivity and sustainability. In the U.S., the agricultural sector is increasingly utilizing sensor-based solutions to tackle challenges including climate variability and labor shortages, supported by government initiatives promoting innovative technologies and sustainable practices. The integration of IoT technology enables real-time data collection, improving operational efficiency and encouraging data-driven decision-making among farmers. Canada is also advancing in the agriculture sensor market, focusing on sustainable practices and innovative crop management solutions.

Asia Pacific is emerging as the fastest-growing region in the agriculture sensor market, driven by rapid technological advancements and rising agricultural demands. Countries including China and India are heavily investing in advanced technologies to enhance crop yields and ensure food security, supported by government policies promoting precision agriculture. The increasing adoption of IoT-enabled sensors and drones is enabling farmers to make informed decisions on irrigation, fertilization, and pest management. Companies, such as Drone deploy and Trimble are leading product innovations, launching advanced sensor systems to optimize farming practices. Overall, this region's growth trajectory reflects its critical role in the global agricultural technology landscape.

Agriculture Sensor Companies with their product:

-

Trimble Inc. (Soil moisture sensors, Yield monitoring systems)

-

John Deere (Precision ag technology, Crop sensors)

-

AG Leader Technology (Yield monitoring systems, Soil sensors)

-

Teralytic (Soil health sensors, Wireless soil sensors)

-

Sentera (Crop health sensors, Drone technology)

-

Sierra Wireless (IoT solutions for agriculture, Environmental sensors)

-

The Climate Corporation (FieldView platform, Climate Pro)

-

Raven Industries (Raven SCS, Smart Sensor Technology)

-

Valley Irrigation (FieldNet, Irrigation management sensors)

-

Decagon Devices (Soil moisture sensors, Environmental monitoring)

-

Aker Technologies (Harvest sensors, Crop monitoring systems)

-

Yara International (N-sensor, Precision nutrient management)

-

Farmers Edge (Precision agriculture software, Soil and weather sensors)

-

EcoCare (Water quality sensors, Environmental monitoring)

-

Dahua Technology (Smart agriculture solutions, IoT devices)

-

Lindsay Corporation (FieldNET, Precision irrigation sensors)

-

AgJunction (Guidance and steering solutions, Crop sensors)

-

Ag Leader Technology (Planter monitors, Yield mapping tools)

-

Netafim (Drip irrigation systems, Soil moisture sensors)

-

Smart Fertilizer Management (Nutrient management solutions, Soil nutrient sensors)

List of companies are integral to the agriculture sector, providing the necessary sensor technology to enhance precision farming, optimize resource use, and improve crop yields.

-

Decagon Devices (METER Group)

-

Teralytic

-

Sentera

-

Sierra Wireless

-

Ag Leader Technology

-

Yara International

-

Aker Technologies

-

Farmers Edge

-

EcoCare

-

Heliotrope Technologies

-

Netafim

-

Trimble Inc.

-

John Deere

-

Raven Industries

-

Valley Irrigation

-

Dahua Technology

-

AgJunction

-

Lindsay Corporation

-

InstaPro International

-

The Climate Corporation

Recent Development

-

On June 13, 2024, advancements in Variable Rate Technology (VRT) were highlighted, emphasizing its role in precision agriculture. New mapping tools are enabling farmers to utilize real-time soil data for tailored applications of seeds and fertilizers, maximizing crop yields while minimizing resource waste. This innovation represents a significant step toward sustainable farming practices.

-

On November 1, 2024, a near-zero power gas sensor designed for agricultural IoT applications during the ECE Seminar. This innovative sensor consumes less than 100 pW while in sleep mode and activates upon detecting target gas molecules, significantly extending battery life and enabling effective monitoring in resource-limited farm settings.

-

On August 7, 2024, a partnership among NC State University’s Institute for Connected Sensor Systems, the N.C. Plant Sciences Initiative, and the Kenan Institute was announced to fund two agricultural sensor projects. One project focuses on enhancing solar energy generation on crop fields, while the other utilizes field robots and sensors for underground vegetable detection and measurement.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.95 Billion |

| Market Size by 2032 | USD 5.65 Billion |

| CAGR | CAGR of 12.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type: Humidity Sensor, Electrochemical Sensor, Mechanical Sensor, Optical Sensor, Pressure Sensor, Water Sensor, Soil Sensor, Location Sensor • By Application: Soil Monitoring, Yield Mapping and Monitoring, Disease Detection and Control, Weed Mapping, Other Applications |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trimble Inc., John Deere, AG Leader Technology, Teralytic, Sentera, Sierra Wireless, The Climate Corporation, Raven Industries, Valley Irrigation, Decagon Devices, Aker Technologies, Yara International, Farmers Edge, EcoCare, Dahua Technology, Lindsay Corporation, AgJunction, Netafim, and Smart Fertilizer Management are key players in the agriculture sensor market. |

| Key Drivers | • The surge in precision agriculture and smart farming practices has become a significant driver in the agricultural sensor market. |

| Restraints | • The advanced nature of agriculture sensor systems presents a significant challenge for widespread adoption in the farming community. |