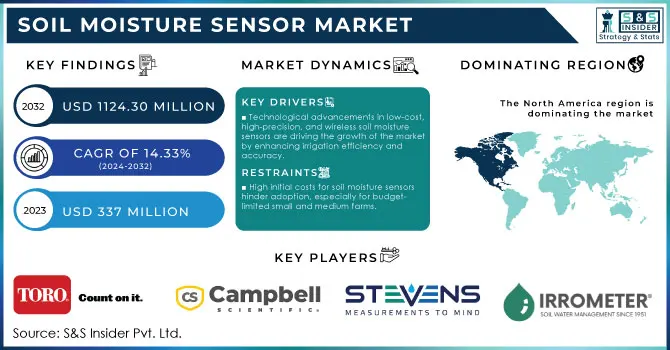

Soil Moisture Sensor Market Key Insights:

The Soil Moisture Sensor Market size was valued at USD 337 Million in 2023 and is expected to reach USD 1124.30 Million by 2032 at a CAGR of 14.33% during the forecast period of 2024-2032.

To Get More Information on Soil Moisture Sensor Market - Request Sample Report

The key factors contributing to the market growth include the rising global population and the need for sustainable agricultural practices, which has heightened the focus on water conservation. Additionally, advancements in sensor technology, such as wireless connectivity, IoT integration, and improved accuracy, have further driven adoption among farmers and agriculturalists.

The agricultural sector, which is highly reliant on irrigation, has become one of the primary applications for soil moisture sensors. These sensors enable automated irrigation systems, reducing human intervention and ensuring that crops receive adequate water. Furthermore, as climate change impacts weather patterns and water availability, these sensors have become integral to water-efficient farming techniques, helping mitigate the risks associated with erratic weather conditions. According to the research, over 25% of global irrigated land uses some form of soil moisture monitoring technology. The agriculture industry is expected to be the largest end-user segment, contributing to more than 60% of the total demand for soil moisture sensors. Moreover, soil moisture sensors are increasingly being used in non-agriculture applications, such as landscaping and environmental monitoring, with the commercial sector accounting for a growing share of the market.

| Type of Soil Moisture Sensor | Description | Commercial Products |

|---|---|---|

| Capacitance-Based Sensors | Uses capacitance to measure the dielectric permittivity of the soil, correlating with moisture content. These sensors are affordable and provide quick measurements. | Decagon EC-5, Vegetronix VH400 |

| Tensiometers | Measures soil water potential by sensing the tension required for plants to extract water from soil. Effective in wet to moderately dry soils. | Irrometer Model T, Watermark 200SS |

| Gypsum Block Sensors | Sensors consist of two electrodes encased in a gypsum block, measuring soil resistance to gauge moisture levels. Suitable for low-cost, long-term monitoring. | Delmhorst GB-1, Soilmoisture Equipment 5201 |

| Time-Domain Reflectometry (TDR) Sensors | Uses the travel time of an electrical pulse along a waveguide to determine moisture levels, offering high accuracy. Common in research and precision agriculture. | Campbell Scientific CS655, Acclima TDR-315L |

| Frequency Domain Reflectometry (FDR) Sensors | Similar to TDR but uses frequency variation for moisture detection. These sensors are ideal for field and laboratory research. | Sentek EnviroSCAN, METER Group 5TE |

| Neutron Probe Sensors | Measures soil moisture by detecting hydrogen atoms, commonly used in deep soil profiling and research. Generally, more complex and regulated. | Hydroprobe DR, Troxler 4301 |

| Thermal Conductivity Sensors | Calculates soil moisture by assessing heat dissipation through soil, offering reliable moisture data across varied soil types. | Soilmoisture Equipment 107 Thermoline |

| Granular Matrix Sensors | Durable, low-maintenance sensors using a granular matrix to measure water tension. Effective for monitoring irrigation needs. | Watermark Model 200SS, Irrometer GMS |

| Optical Sensors | Utilizes light reflection or transmission to assess moisture content, often used in smart farming applications. | Apogee Instruments MO-200, Spectrum FieldScout TDR 350 |

| Wireless Soil Moisture Sensors | Connects to IoT networks for remote monitoring, suitable for large-scale agricultural management. Often includes additional climate data monitoring. | Soil Scout, Pessl Instruments METOS |

| Electrochemical Sensors | Uses electrochemical methods to detect moisture based on ion movement in the soil, typically used for specific crop needs. | IQOV Soil Moisture Sensor, Vegetronix SHT |

MARKET DYNAMICS

DRIVERS

- Technological advancements in low-cost, high-precision, and wireless soil moisture sensors are driving the growth of the market by enhancing irrigation efficiency and accuracy.

The soil moisture sensor market is experiencing significant growth due to continuous technological advancements in sensor technology. Over the past few years, there has been a surge in the development of low-cost, high-precision, and wireless sensors that provide more accurate readings of soil moisture content. These advancements are driving the adoption of soil moisture sensors in agriculture by offering affordable and reliable solutions that allow farmers to optimize irrigation practices and improve crop yield. The integration of Internet of Things (IoT) technology has led to the development of wireless soil moisture sensors that can transmit real-time data to mobile apps or cloud platforms. This allows farmers to monitor soil conditions remotely, reducing the need for manual labor and enhancing decision-making.

Additionally, modern soil moisture sensors are more durable and easier to install compared to earlier models. With enhanced precision and sensitivity, these sensors provide more accurate readings even in varying soil conditions, which is crucial for ensuring that irrigation is applied only when necessary. The growing demand for efficient water usage, driven by the need to conserve water resources and reduce water waste, has also spurred innovation in the development of soil moisture sensors. With global water scarcity becoming a pressing issue, smart farming solutions like these sensors are critical for sustainable agriculture. According to the research, sensors that accurately measure soil moisture can help increase agricultural efficiency by as much as 30%.

- Soil moisture sensors help optimize irrigation by providing real-time data, reducing water wastage and promoting sustainable farming practices, especially in regions facing water scarcity.

Water conservation has become a critical issue globally, particularly in agricultural regions where water is often used inefficiently. As agriculture consumes approximately 70% of the world’s freshwater, efficient water management is crucial to ensuring long-term sustainability. Soil moisture sensors play a pivotal role in addressing this challenge by providing real-time data on soil moisture levels, which helps farmers optimize irrigation practices. By using these sensors, farmers can avoid over-irrigating, a common practice that leads to water wastage, soil erosion, and plant health issues. Instead, irrigation is applied precisely when and where it’s needed, promoting better water usage efficiency.

According to the research have shown that with the use of soil moisture sensors, farmers can reduce irrigation water use by 20-50%, depending on the crop type and environmental conditions. For instance, using these sensors in conjunction with automated irrigation systems can ensure that crops receive adequate water, without excess, which is especially important in regions with water scarcity. Moreover, the technology supports sustainable farming practices by minimizing the environmental impact of excessive water usage and preserving local water resources. As water scarcity continues to grow, particularly in arid and semi-arid regions, soil moisture sensors are increasingly seen as an essential tool for sustainable farming. According to the research by 2025, nearly two-thirds of the world’s population could face water shortages, making technologies that enhance water efficiency more crucial than ever. This growing emphasis on water conservation is expected to drive further adoption of soil moisture sensors in agriculture.

RESTRAIN

- The high initial investment cost of soil moisture sensors, including purchasing, installation, and maintenance, remains a significant barrier to adoption, especially for small and medium-sized farms with limited budgets.

One of the primary barriers to the widespread adoption of soil moisture sensors in agriculture is the high initial investment cost. While these systems offer significant long-term benefits, such as increased water efficiency and improved crop yields, the upfront cost of purchasing, installing, and maintaining the technology can be prohibitive, especially for small and medium-sized farms. A typical soil moisture sensor system consists of the sensors themselves, data loggers, and associated software, along with installation and calibration costs. These expenses can range from a few hundred to several thousand dollars, depending on the scale and complexity of the system. For small-scale farmers, this cost may represent a substantial portion of their annual budget, making it difficult to justify the investment, particularly when immediate returns are not guaranteed.

In addition to the high cost of the system, ongoing maintenance and calibration are necessary to ensure optimal performance. Farmers need to regularly check the sensors for accuracy, which adds to the operational cost. Furthermore, the installation of wireless systems and the infrastructure needed for data transmission may require additional investments, particularly in rural areas with limited connectivity. According to research, farmers in the United States noted that the cost of soil moisture sensors and related technologies is one of the most significant barriers to adoption, with only 20-30% of farmers utilizing these technologies on a wide scale. This financial hurdle is especially pronounced in developing regions, where access to funding for such technologies is more limited.

KEY SEGMENTATION ANALYSIS

By Sensor Type

In 2023, tensiometers Segment dominated the market share over 32.06%, driven by their reliability and precision in measuring soil water potential, which is essential for efficient irrigation management. Their widespread use in agriculture is attributed to their ability to provide real-time data on soil moisture, enabling farmers to optimize water usage and enhance crop yields. Moreover, tensiometers are cost-effective and simple to install, making them accessible to a wide range of users, from large-scale agribusinesses to smaller, family-owned farms.

By ConnectivityIn 2023, wired segment dominated the market share over 54.3% share of the market due to their high reliability and accuracy, which make them a top choice for farmers and agricultural professionals. One of their key benefits is their longer lifespan compared to wireless sensors, reducing the need for frequent replacements and maintenance, making them a more cost-effective solution over time. Additionally, wired systems offer strong, stable connectivity, ensuring consistent data transmission, even in harsh agricultural environments. Their resilience to extreme weather conditions, soil variability, and moisture levels contributes to their widespread adoption. Wired sensors also excel in transmitting real-time data with minimal interference, which is crucial for large-scale and precision farming operations where reliable, accurate monitoring is vital for effective water management.

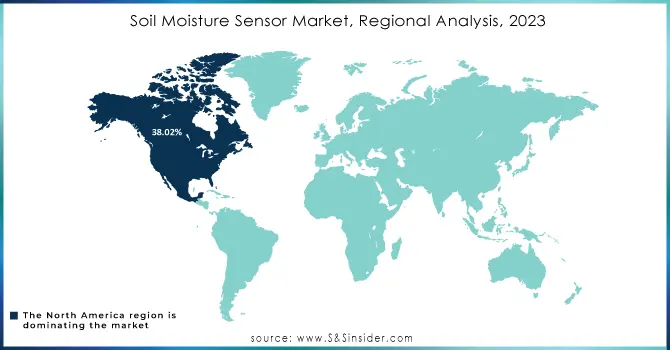

KEY REGIONAL ANALYSIS

In 2023, North America region dominated the market share over 38.02% in 2023, driven by its technologically advanced agricultural sector. Precision farming is widely adopted in the region, addressing challenges such as water scarcity and inefficient irrigation practices. This has spurred an increased demand for soil moisture sensors to optimize water usage. The region also benefits from robust investments in research and development, leading to innovative sensor technologies designed to meet the specific agricultural needs of North American farms. For instance, advancements in sensor accuracy and connectivity are playing a key role in the region's agricultural optimization efforts.

The Asia Pacific region is poised for rapid growth over the forecast period, largely due to government initiatives promoting sustainable farming practices. Additionally, the increasing awareness of climate change's impact on agricultural productivity has further accelerated the shift toward precision farming. With technological advancements and the affordability of sensors, farmers across the region are adopting these tools, contributing to the market's swift expansion. In fact, the number of farmers using advanced irrigation technologies has increased by over 20% in countries like India and China, highlighting the growing trend in the adoption of smart farming solutions.

Do You Need any Customization Research on Soil Moisture Sensor Market - Inquire Now

KEY PLAYERS

Some of the major key players of Soil Moisture Sensor Market

-

The Toro Company (Turf Guard Wireless Soil Monitoring System)

-

METER Group, Inc. USA (TEROS 10, TEROS 11, and TEROS 12 Soil Moisture Sensors)

-

Campbell Scientific, Inc. (CS655 and CS616 Soil Water Content Reflectometers)

-

Stevens Water Monitoring Systems Inc. (Pogo Portable Soil Sensor, HydraProbe)

-

IMKO Micromodultechnik GmbH (TRIME-PICO 32 Soil Moisture Sensor)

-

Irrometer Company, Inc. (Watermark Soil Moisture Sensors)

-

Delta-T Devices Ltd (PR2 Profile Probe, SM150T Soil Moisture Sensor)

-

GroPoint (GroPoint Profile and GroPoint Lite Soil Moisture Sensors)

-

Sentek (Drill & Drop Soil Moisture Probe, EnviroSCAN Probe)

-

Spectrum Technologies, Inc. (FieldScout TDR 350, TDR 150 Soil Moisture Meters)

-

Acclima, Inc. (TDT Soil Moisture Sensor, Digital TDT Soil Moisture Sensor)

-

Smartrek Technologies Inc (Soil Moisture Sensor)

-

Caipos GmbH (Caipos Soil Moisture Monitoring System)

-

Spiio (SP-110 Wireless Soil Moisture Sensor)

-

Plaid Systems LLC (Rachio Wireless Soil Moisture Sensor)

-

Decagon Devices (now part of METER Group) (5TE, 10HS Soil Moisture Sensors)

-

AquaCheck USA (AquaCheck Sub-surface Soil Moisture Probe)

-

Husqvarna Group (Soil Moisture Sensor for Smart Garden System)

-

Soil Scout Ltd. (Soil Scout Sensor)

-

Gardena (Gardena Smart Sensor Soil Moisture)

Suppliers for soil moisture sensors for precision agriculture applications of Soil Moisture Sensor Market:

-

The Toro Company

-

METER Group, Inc. USA

-

Campbell Scientific, Inc.

-

Stevens Water Monitoring Systems Inc.

-

IMKO Micromodultechnik GmbH

-

Irrometer Company, Inc.

-

Delta-T Devices Ltd

-

Spectrum Technologies, Inc.

-

Sentek Technologies

-

Acclima, Inc.

RECENT DEVELOPMENTS

-

In November 2023: Delta-T Devices teamed up with SAF Tehnika (Aranet) to integrate its WET150 soil sensor into Aranet’s wireless network, enabling real-time remote monitoring of horticultural conditions for improved yields and water efficiency.

-

in October 2023: Delta-T collaborated with the UK’s National Physical Laboratory (NPL) to develop a new multi-parameter soil sensor, blending NPL’s advanced measurement technologies to create an affordable, research-grade solution for enhancing crop yields and minimizing water waste in commercial horticulture.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 337 Million |

| Market Size by 2032 | USD 1124.30 Million |

| CAGR | CAGR of 14.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Capacitance sensors, Probes, Time Domain Transmissometry (TDT) Sensors, Gypsum blocks, Tensiometers, Granular matrix sensors) • By Connectivity (Wired, Wireless) • By Application (Agriculture, Construction and Mining, Residential, Forestry, Landscaping and Ground Care, Research Studies, Sports, Weather Forecasting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The Toro Company, METER Group, Inc. USA, Campbell Scientific, Inc., Stevens Water Monitoring Systems Inc., IMKO Micromodultechnik GmbH, Irrometer Company, Inc., Delta-T Devices Ltd, GroPoint, Sentek, Spectrum Technologies, Inc., Acclima, Inc., Smartrek Technologies Inc, Caipos GmbH, Spiio, Plaid Systems LLC, Decagon Devices (now part of METER Group), AquaCheck USA, Husqvarna Group, Soil Scout Ltd., Gardena. |

| Key Drivers | • Farmers are adopting soil moisture sensors to efficiently manage water usage, reduce wastage, and promote sustainable agriculture in response to global water scarcity. • Technological advancements in low-cost, high-precision, and wireless soil moisture sensors are driving the growth of the market by enhancing irrigation efficiency and accuracy. |

| RESTRAINTS | • Limited connectivity in rural areas can hinder the performance of wireless soil moisture sensors, as they rely on stable internet or cellular networks to transmit accurate data. |