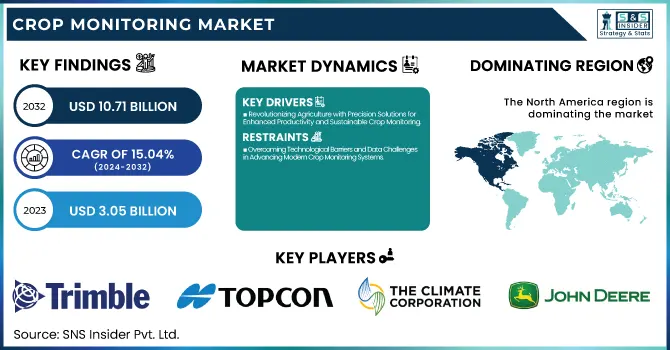

Crop Monitoring Market Size & Growth:

The Crop Monitoring Market Size was valued at USD 3.05 billion in 2023 and is expected to reach USD 10.71 billion by 2032, growing at a CAGR of 15.04% over the forecast period 2024-2032. Crop monitoring is an overall area where the market is changing at a fast pace, thanks to the innovative progress across various parameters. Adoption and Usage Metrics show deploying more sensors, drones, and precision farming tools to improve crop health monitoring. Data and Connectivity Metrics Centers land all the IoT data on a seamless cloud integration platform and facilitate near real-time data abstracted away from the IoT by using cloud computing capabilities for decision-making.

To Get more information on Crop Monitoring Market - Request Free Sample Report

Measuring Farmer Engagement and Satisfaction stresses training, ease of use, and customer service to drive adoption On the other hand, the Operational Efficiency Metrics tracks improvements in coverage in the field, response times to alerts, and predictive analytics for yield management. All of these are contributing towards improved productivity, resource use efficiency, and sustainable agricultural practices.

Crop Monitoring Market Dynamics

Key Drivers:

-

Revolutionizing Agriculture with Precision Solutions for Enhanced Productivity and Sustainable Crop Monitoring

Inspired by the various aspects of modern agriculture, the impenetrable drivers of the crop monitoring market. The growing need for precision farming solutions that can improve productivity and resource utilization is one of the major factors driving the market. As the population increases and food security more critical, farmers more and more are adopting modern monitoring systems to maximize growth, soil health, and water utilization efficiency. Furthermore, the increasing convergence of IoT, AI, and remote sensing technologies has transformed crop monitoring through real-time data availability and actionable insights. Drones, GPS systems, and automated sensors provide farmers with the data necessary to minimize expenses and maximize yield based on information-driven decision-making. Furthermore, market growth is also driven by government initiatives that promote smart farming practices and sustainable concentration of agriculture.

Restrain:

-

Overcoming Technological Barriers and Data Challenges in Advancing Modern Crop Monitoring Systems

A major obstacle is integrating different technologies such as sensors, drones, and data analytics platforms into traditional farming practices. Farmers especially in developing areas of the world may not have the technical know-how to operate and manage these systems properly. This lack of information can be a bottleneck slowing the adoption rate and therefore market growth. Data management problems are also a huge challenge. Crop monitoring systems create massive amounts of data that need to be stored, analyzed, and interpreted effectively. These solutions would lose their significance as insights cannot be extracted without proper data management tools in place.

Opportunity:

-

Unlocking Growth Opportunities in Crop Monitoring with Automation Digital Tech and Precision Farming

The growth opportunities in this market are immense, especially with more and more farmers starting to automate their farming with robots. Autonomous tractors, robotic harvesters, and automated irrigation technologies are finding a footing with large-scale commercial and industrial farming. The growing dependence on paleoclimate for settlement plans also opens up fresh new options in precision farming via satellite imagery, climate forecasting tools, and advanced analytics. Farmers in emerging markets within developing regions also present growth opportunities as the need for efficient solutions to address climate change, erratic weather and a lack of resources affords them opportunities. The agricultural industry is being transformed through digital tech, and so it is likely that the crop monitoring market will continue to grow.

Challenges:

-

Addressing Infrastructure Gaps and Environmental Challenges to Enhance Crop Monitoring System Efficiency

The other major challenge is the lack of infrastructure in remote and rural farming areas. The efficiency of these remote monitoring systems may be inhibited by poor connectivity and/or the limited ability to visually transmit data in real time that are only available on digital networks. On top of that, environmental uncertainties like unpredictable weather, soil variability, and pest infestations further limit the potential of monitoring tools. Such reasons result in inconsistencies in data collection, thereby lowering the dependability of the insights provided by the crop monitoring systems. Addressing these hurdles will demand higher levels of investment to educate farmers, better solutions for connectivity, and a more resilient system against environmental uncertainties.

Crop Monitoring Market Segment Analysis

By Offering

Hardware dominated the crop monitoring market with a 52.8% share in 2023 and is projected to grow at the fastest CAGR from 2024 to 2032. The increase is attributed to the growing uptake of high-tech equipment including sensors, drones, GPS devices, and automated irrigation systems that improve precision agriculture. Using these hardware options, farmers can monitor the productivity of soil, the health of their crops, and weather patterns, all in real-time, guiding their decisions with facts. Moreover, the rise of IoT devices and remote sensing technologies enabled more precise and efficient crop monitoring tools. This increasing demand for capable and long-lasting hardware is also fueled by the use of automation and robotics in large-scale farms, with farms now operating enormous acreages. With the progress of digital transformation over the years and the availability of optimal hardware solutions, it is anticipated that the farming sector will improve productivity and efficient resource utilization, additionally with better harvest efficiency.

By Technology

Sensing & Imagery held the majority share of 44.8% in 2023 propelled by the growing utilization of remote sensing technologies, drones, and satellite imagery. They offer accurate information such as the state of crops or soil, and also the environment, that can be used to take action as necessary promptly. The decision-making process majorly benefits from the ability to collect real-time field data, thus sensing & imagery have become the go-to solution for precision farming practices.

Automation and Robotics are expected to grow at the fastest CAGR from 2024 to 2032. Increasing the adoption of autonomous tractors, robotic harvesters, and automated irrigation systems is forever changing the landscape of industrial farms. It eliminates reliance on labor to a great extent, facilitates faster operations, and improves productivity. Advancements in automation will continue to spur adoption into precision agriculture, where the field is forecast to see robust growth in the next few years.

By Farm Type

In 2023, the crop monitoring market was dominated by medium-sized farms, accounting for 38.7% of the total market share as the adoption of precision farming technologies continues to grow within this segment. Medium to large-scale farmers are now adopting advanced monitoring devices to gain insights leading to better resource efficiency, higher productivity, and reduced crop loss. These farms are adopting sensors, drones, and data analytics platforms to make better decisions and reach higher yields.

Due to growing size, large farms have been projected to grow at the fastest CAGR from 2024 to 2032. This increase is fuelled by the enhanced adoption of automation, robots, and smart IoT-based solutions in the large-scale agricultural industry. Large farms in the field might need complex monitoring systems to measure a huge amount of land successfully. As these farms center around large-scale production, and reduce risk to operational conservancy and sustainability, the demand for high-performance hardware and data-driven insights increases simultaneously.

By Application

The crop monitoring market based on type was dominated by crop scouting and monitoring and it accounted for a share of 24.9% share in 2023, and this is due to the increased demand for real-time field information growing over time. Crop scouting solutions are gaining popularity among farmers, as they help monitor and detect pests, diseases, and nutrient deficiencies early. Disruptive technologies in farm management receive good news from drones and sensors to satellite imagery to ensure crop health monitoring for timely intervention which in turn, results in productivity and loss reduction.

Yield mapping and monitoring is projected to have the highest CAGR from 2024 to 2032. The increasing preference for GPS-based mapping tools and the data analytics solutions that enable farmers to analyze yield variability for a zone within the field is anticipated to bolster this growth. This information can help farmers make better use of their resources, leading to more optimal farm efficiency, and maximizing output from their crops.

Crop Monitoring Market Regional Outlook

In 2023, North America led the crop monitoring market, accounting for a 34.8% share, owing to the high adoption of precision farming technologies and well-established agricultural infrastructure. Market growth has been spurred on by progressive farming practices as well as investments in smart agriculture solutions within the region. As an example, the crop monitoring systems of AgEagle Aerial Systems, Precision Hawk, etc. have been increasingly adopted in the United States, bringing useful data about a field for farmers in real time via drones. Moreover, the increasing emphasis on sustainable agriculture in Canada is supporting the adoption of IoT-based sensors and weather monitoring systems to achieve desired productivity with minimum environmental impact.

Asia Pacific is expected to grow at the fastest CAGR from 2024 to 2032, owing to growing food consumption, increasing pace of agricultural activities, and a surge of government projects for smart farming. So, countries such as India and China are increasingly embracing precision agriculture solutions to enhance crop yields as well as meet food security challenges. As an example, in China XAG is using drones and automation for precise pesticide spraying and mapping fields. Likewise, in India, companies such as Fasal and DeHaat have started providing farmers with data-driven insights so that they can make informed decisions to ensure those crops remain healthy and productive.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Crop Monitoring Market are:

-

Trimble (Guidance Control, Crop Monitoring Software)

-

Topcon Corporation (GNSS Receivers, Crop Sensors)

-

The Climate Corporation (Climate FieldView, Seed Advisor)

-

CropX Technologies (Soil Sensor, Irrigation Optimization Platform)

-

Yara International (AtFarm, YaraIrix)

-

Stenon (Real-Time Soil Analysis Sensor, Soil Health Monitoring System)

-

Instacrops (InstaFrost, InstaWeather)

-

EOS Data Analytics (EOSDA Crop Monitoring, EOS SAT-1)

-

Solinftec (Alice AI Assistant, Solix Ag Robotics)

-

Crop Analytica (IoT-Based Agriculture Monitoring System, AI-Driven Analytics Platform)

-

Pixxel (Hyperspectral Imaging Satellites, Satellite Data Analytics Platform)

-

NatureMetrics (Environmental DNA Monitoring, Biodiversity Assessment Tools)

-

John Deere (See & Spray Technology, Operations Center)

-

Ag Leader Technology (InCommand Displays, AgFiniti Cloud Platform)

-

Raven Industries (Viper 4+ Field Computer, Slingshot Data Management System)

Recent Trends

-

In February 2025, Topcon Agriculture partnered with Bonsai Robotics to enhance precision farming for permanent crops by integrating autonomous navigation and smart implement controls, improving efficiency and sustainability.

-

In January 2025, Pixxel is set to launch India's first private satellite network, aiming to tap into the USD 19 billion satellite data services market. The company's hyperspectral imaging satellites will enhance Earth monitoring for sectors like agriculture, defense, and infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.05 Billion |

| Market Size by 2032 | USD 10.71 Billion |

| CAGR | CAGR of 15.04% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Technology (Sensing and Imagery, Variable Rate Technology, Automation and Robotics) • By Farm Type (Small, Medium, Large) • By Application (Field mapping, Crop scouting and monitoring, Soil monitoring, Yield mapping and monitoring, Variable rate application, Weather tracking and forecasting, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trimble, Topcon Corporation, The Climate Corporation, CropX Technologies, Yara International, Stenon, Instacrops, EOS Data Analytics, Solinftec, Crop Analytica, Pixxel, NatureMetrics, John Deere, Ag Leader Technology, Raven Industries. |