AI Code Tools Market Report Scope & Overview:

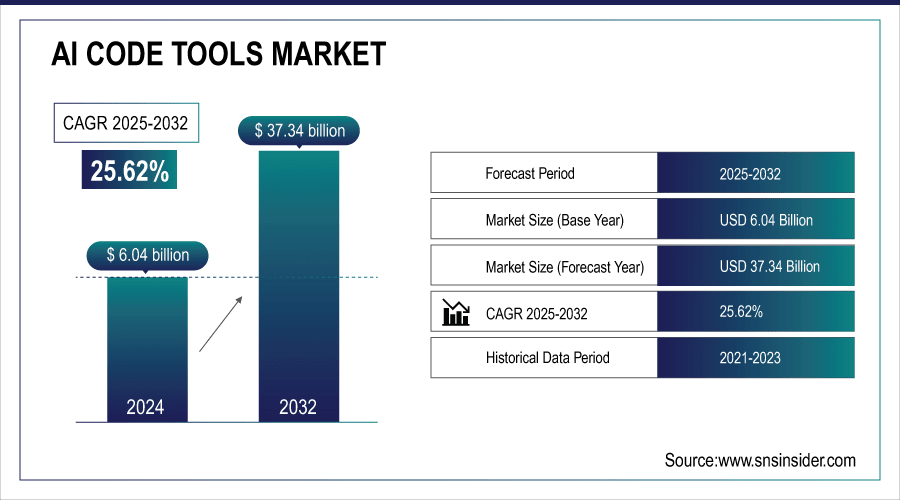

The AI Code Tools Market Size was valued at USD 6.04 billion in 2024 and is expected to reach USD 37.34 billion by 2032 and grow at a CAGR of 25.62% over the forecast period 2025-2032.

The AI Code Tools Market is growing strong due to the increase in demand for automation, efficiency, and accuracy in software development processes. Traditional coding practices requires more time and tends to make human errors, so most of the organizations have started using these AI-powered tools that generally accelerate code generation, detection of bugs and optimization. As businesses remain under pressure to build digital products more quickly, AI code assistants and automated debugging systems are allowing developers to shorten development cycles, provide higher productivity, and maintain better code quality. Machine learning, natural language processing, and generative AI are taking the productivity of these tools to the next level and bringing more value into the development environment, thus becoming] categories for the long run for startups and large enterprises. According to study, 68% of developers save over 10 hours per week using generative AI, up from 46% the prior year.

To Get More Information On AI Code Tools Market - Request Free Sample Report

AI Code Tools Market Trends

-

Rising adoption of AI-assisted coding tools to improve productivity, reduce errors, and accelerate software delivery.

-

Increasing demand for faster, bug-free, and efficient development across enterprises.

-

Generative AI is transforming coding by enabling full-function, module, and application generation from natural language prompts.

-

Growth of low-code and no-code platforms is driving broader adoption among both technical and non-technical users.

-

Emphasis on innovation and rapid prototyping, allowing enterprises to develop creative software solutions faster.

-

AI code tools are becoming essential enablers for modern development teams in digital transformation initiatives.

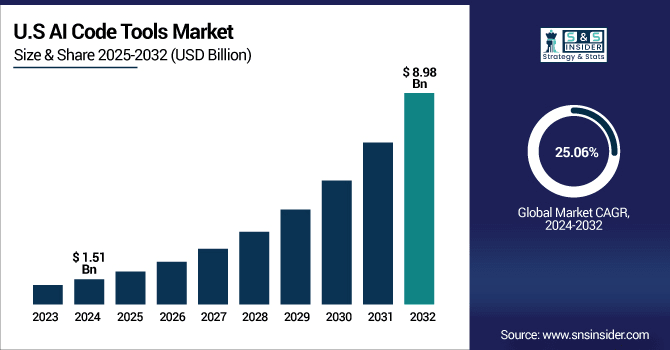

The U.S. AI Code Tools Market size was USD 1.51 billion in 2024 and is expected to reach USD 8.98 billion by 2032, growing at a CAGR of 25.06% over the forecast period of 2025-2032. driven by advanced technological adoption, strong R&D investment, skilled developers, and widespread enterprise use of AI-powered coding platforms for productivity and efficiency.

AI Code Tools Market Segment Analysis

-

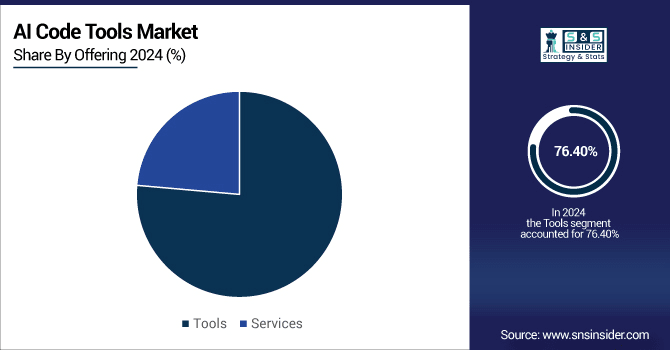

By Offering: In 2024, Tools led the market with share 76.40%, while Services are the fastest-growing segment with a CAGR 22.24%.

-

By Deployment Model: In 2024, Cloud led the market 81.20%, while On-premises fastest-growing segment with a CAGR 22.87%.

-

By Technology: In 2024, Machine learning led the market with share 55.60%, while Generative AI are the fastest-growing segment with a CAGR 24.80%.

-

By Application: In 2024, Data science & machine learning led the market with share 35.20%, while Cloud services & DevOps is the fastest-growing segment with a CAGR 23.19%.

-

By Industry Vertical: In 2024, BFSI led the market with share 22.10%, while Healthcare is the fastest-growing segment with a CAGR 24.94%.

By Offering, Tools Lead Market While Services Fastest Growth

Based on Component, the market is segmented into Tools and Services, where Tool segment dominates the AI Code Tools Market owing to high utilization of AI-powered coding platforms across enterprises and developers for code generation, debugging, and optimization. These tools allow developers to work faster with shorter development cycles and achieve better coding quality. On the other hand, the fastest-growing component is the Services segment, as more and more enterprises explore their needs for support in AI integration, customization, training, and consulting. This has triggered strong growth in the professional services and consulting segment as enterprises invest in professional services to implement AI-assisted coding solutions properly, optimize workflows, and upskill development teams.

By Deployment Model, Cloud Lead Market While On-premises is Fastest Growth

Among Deployment model, Cloud segment is largest and it is mainly attributed to its capability to scale on demand, flexibility and high ease of deployment in enterprise DevOps pipelines as organizations using AI-based coding tools can be set up and integrated without significant investment in infrastructure. Unlike traditional desktop solutions, cloud platforms enable real-time collaboration, continuous updates and access from anywhere in the world and as a result, most enterprises prefer them these days. In contrast, the segment of On-premises is growing fastest, due to organizations with stringent data privacy, security, and compliance mandates progressively acquiring AI code tools hosted on local infrastructure, thus stimulating demand for customized, secure, and enterprise-controlled deployment solutions.

By Technology, Machine learning Lead Market While Generative AI Fastest Growth

The Machine Learning (ML) Segment in the AI Code Tools Market is leading with its early deployments in intelligent code suggestions, debugging, and optimization for reliable and efficient code assistance for developers. Machine Learning (ML)-based tools are closely integrated into the enterprise development environment, so its leading technology. On the other hand, the Generative AI category is the fastest-growing, which can develop entire functions, modules, or apps based on natural language prompts. This technology is enabling both technical and non-technical users, shortening development cycles, and supporting low code and no code adoption and that market is growing rapidly.

By Application, Data science & machine learning Leads Market While Cloud services & DevOps Fastest Growth

The Data Science & Machine Learning segment held the largest share of the AI Code Tools Market as organizations are increasingly adopting AI-assisted coding tools due to the high volume and complexity of algorithms and models that need to be built, optimized, and deployed. Such tools facilitate their workflows, boost the quality of their code and help them to complete analytics projects quickly, thus making them the backbone of data-driven enterprises. On the other hand, the fastest-growing segment, Cloud Services & DevOps, is powered by increasing adoption of cloud-native development, CI/CD and automated infrastructure management which is complemented by AI code tools to increase productivity, collaboration, and rapid software delivery.

By Industry Vertical, BFSI Lead Market While Healthcare is Fastest Growth

The BFSI (Banking, Financial Services, and Insurance) segment is also dominating the segment of the AI code tools market, which is attributed to a high demand for secure, efficient, and error-free software solutions. By automating repetitive tasks, such as bug detection and development cycle acceleration, AI-assisted coding tools aid financial institutions in achieving compliance while maintaining operational efficiency. On the other hand, the Healthcare segment is the fastest-growing because of the growing adoption of AI-based tools for medical software development, predictive analysis, and digital health applications. These tools are utilized by health organizations to increase productivity, eliminate coding errors, and rapidly roll out new patient-centric solutions.

AI Code Tools Market Growth Drivers:

-

Increasing Demand for Faster and Bug-Free Software Development

One of the factors that is driving the AI Code Tools Market is the rising need for quick and steady software delivery. Importantly, traditional coding approaches are tedious, iterative, and error-prone, leading to productivity losses and project delay. AI-based coding tools assist developers through automating repetitive coding tasks, intelligent code suggestions and real-time bug detection. It elevates productivity, shortens development time, and improves software product quality. With organizations speeding up the digital transformation efforts, adoption of AI-assisted coding solution is emerging as the key enabler for Modern Development Teams.

92% of developers have started using AI-assisted coding tools in some capacity.

AI Code Tools Market Restraints:

-

Data Privacy, Security, and Compliance Concerns

Despite the growing adoption, data privacy and security concerns remain as an important restraint despite the growing uptake. Most AI coding tools put use cloud-based models working on huge volumes of code, so developers worry about exposure and access to their intellectual property. Especially enterprises in highly regulated industries, as compliance means they have to strongly control their sensitive data. Some AI-generated code is also less transparent, which makes auditing and accountability difficult. Together, these problems can make businesses cautious about adopting AI coding solutions at scale that ultimately slows market growth for some sectors.

AI Code Tools Market Opportunities:

-

Expanding Role of Generative AI in Code Innovation

Generative AI is another big opportunity for the market, rolling out at a breakneck pace. While the traditional tools suggest relevant code snippets, generative AI can generate entire functions, modules, or even applications based on natural language prompts. This creates the opportunity for an even broader audience, enabling both seasoned developers and non-technical users to write software more intuitively. With the enterprise placing more confidence in low-code and no-code, the generative AI applications into development workflows will open up new avenues for innovation, with faster prototyping at the same time as creative solutions and broader enterprise adoption.

Developers using generative AI can produce up to 55% of code automatically, reducing manual effort.

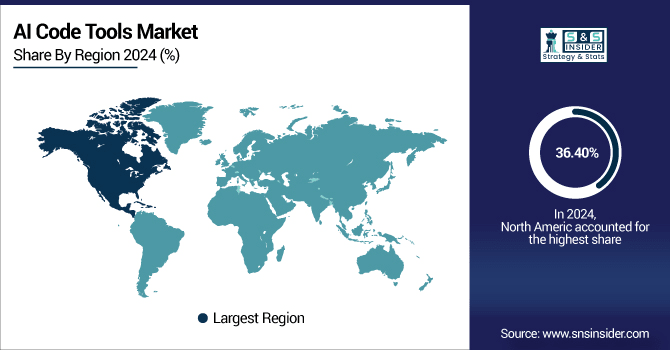

North America AI Code Tools Market Insights:

North America accounted for the largest share 36.40%, of the AI Code Tools Market growth, due to the early adoption of AI-powered development platforms and the high adoption of cloud-based and enterprise-grade coding solution. It is a great place for those that makes up a world class technology eco-system, invest heavily into R&D and have a huge developer population of talented developers who are mobilizing towards AI to improve efficiency and cut development cycles. North America is the highest revenue-generating district in the global AI Code Tools Market, due to the higher adoption rate of AI code tools among industries and a large number of key AI code tool vendors in this region, and the availability of innovation-oriented culture bolster this expansion.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates AI Code Tools Market with Advanced Technological Adoption

The AI Code Tools Market is dominated by the U.S. owing to its high adoption of advanced technologies and a well-established digital ecosystem. AI-powered coding platforms are being used across various software development industries globally, and in the U.S have turned Enterprise Enterprises as early adopters using such platforms for Automating code generation & bug discovery processes to optimize the overall software development processes.

Asia-Pacific AI Code Tools Market Insights

The Asia Pacific is the fastest-growing region with CAGR 22.92%, driven by growing digital transformation initiatives and advancements in AI technology, thereby influencing the software development process. From speeding up code writing and driving productivity, to keeping up with competition, organizations in every industry are leveraging AI-assisted tools. Amid expanding IT infrastructure and growing cloud adoption, the demand for consumer-centric applications, and an increased developer interest towards AI-enabled platforms, contributes to the growth. In addition, the growing trend of low-code solutions and generative AI technologies is leading to greater adoption.

China and India Propel Rapid Growth in AI Code Tools Market

Rapid development in the Asia Pacific region stimulated by China and India is leading this area to be the fastest-growing region for AI Code Tools. Demand for AI-assisted development platforms that accelerate and optimize coding to foster rapid innovation is growing rapidly among enterprises in these countries.

Europe AI Code Tools Market Insights

The Europe AI Code Tools Market is driven by rise in adoption of AI-powered development platforms across enterprises to remove bug detection and solution management process. Companies using AI code tools to boost productivity and to minimize coding efforts using AI-based automations to deliver quality software as a solution to the problem. Interest in generative AI, low-code options, and cloud deployments is sustaining adoption momentum. Though growth pales in comparison with North America and Asia Pacific, regulatory compliance, data privacy, and renewed focus on innovation in AI-assisted coding will keep Europe as a key contributor to the market unit.

Germany and U.K. Lead AI Code Tools Market Expansion Across Europe

Germany and the U.K. lead AI Code Tools market expansion in Europe, driven by strong technological adoption, enterprise digital transformation, and investment in AI-assisted development platforms. Their focus on productivity, automation, and high-quality software delivery positions them as key contributors to Europe’s growing AI code tools market.

Latin America (LATAM) and Middle East & Africa (MEA) AI Code Tools Market Insights

The AI Code Tools Market in Latin America (LATAM) and Middle East & Africa (MEA) is experiencing gradual growth, driven by increasing digitalization and adoption of AI-powered software development solutions among enterprises. Organizations are leveraging AI code tools to automate coding tasks, enhance productivity, and reduce development cycles, particularly in IT, telecom, and BFSI sectors. Cloud-based deployment and generative AI adoption are supporting market penetration, although growth is moderated by infrastructure challenges and limited skilled developer availability. Despite these constraints, both regions present opportunities for vendors to expand offerings, invest in local talent, and drive adoption of AI-assisted coding platforms.

AI Code Tools Market Competitive Landscape

Google develops AI-powered platforms and solutions to enhance developer productivity and software innovation. Its tools support code generation, debugging, and AI-assisted development, enabling organizations to build efficient and intelligent applications.

-

In February 2025, Google launched Gemini 2.0 Pro as an experimental model, offering enhanced capabilities for developers in AI Studio and Vertex AI.

Amazon Web Services (AWS) provides scalable cloud infrastructure and AI solutions to Meta provides AI models and platforms that accelerate software development and automate coding workflows. Its solutions support multiple programming languages and enterprise-level projects, improving efficiency and productivity.

-

In January 2024, Meta released Code Llama 70B, an open-source AI model fine-tuned for code generation, supporting various programming languages and enhancing developer productivity.

xAI offers AI-driven coding solutions designed for speed and affordability, targeting developers seeking fast and efficient code generation. Its tools simplify application development through intelligent suggestions and automated processes.

-

In August 2025, xAI launched Grok-Code-Fast-1, an agentic coding model designed for swift and cost-effective coding tasks, aiming to compete with existing AI coding tools.

AI Code Tools Market Key Players

Some of the AI Code Tools Market Companies are:

-

Microsoft

-

OpenAI

-

Amazon Web Services (AWS)

-

Google

-

IBM

-

Meta

-

xAI

-

JetBrains

-

Replit

-

Tabnine

-

Sourcegraph

-

Salesforce

-

Datadog

-

Lightning AI

-

Moolya

-

Qodo

-

Anthropic

-

Hugging Face

-

Diffblue

-

CodiumAI

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.04 Billion |

| Market Size by 2032 | USD 37.34 Billion |

| CAGR | CAGR of 25.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Offering (Tools, Services) •By Deployment Model (On-Premises, Cloud) •By Technology (Machine Learning, Deep Learning, Natural Language Processing, Generative AI) •By Application (Data Science & Machine Learning, Cloud Services & DevOps, Web Development, Mobile App Development, Gaming Development, Embedded Systems, Others) •By Industry Vertical (BFSI, IT & Telecom, Healthcare, Manufacturing, Retail & E-Commerce, Government, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft, OpenAI, Amazon Web Services (AWS), Google, IBM, Meta, xAI, JetBrains, Replit, Tabnine, Sourcegraph, Salesforce, Datadog, Lightning AI, Moolya, Qodo, Anthropic, Hugging Face, Diffblue, CodiumAI, and Others. |