Product Lifecycle Management (PLM) Market Report Scope & Overview:

Get More Information on Product Life Cycle Management Market - Request Sample Report

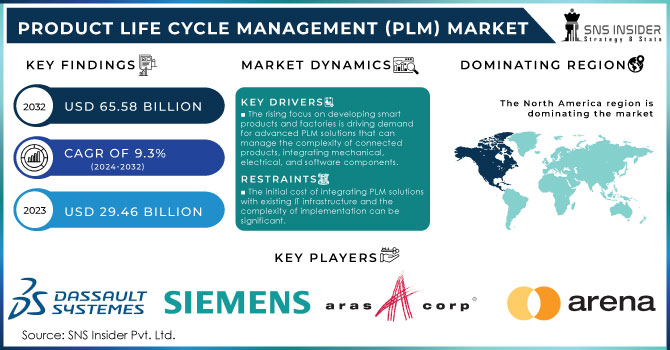

Product Life Cycle Management (PLM) Market size was valued at USD 29.46 Billion in 2023. It is expected to Reach USD 65.58 Billion by 2032 and grow at a CAGR of 9.3% over the forecast period of 2024-2032.

The product lifecycle management (PLM) market is expected to witness considerable growth as businesses continue to shift focus on smart products and factories in addition to transitioning towards cloud-based PLM solutions for more robust IT infrastructure security. Rise in utility of PLM solutions among small and medium enterprises from diverse industrial segments to reduce their manufacturing costs is another factor encouraging market growth. Nevertheless, the concern regarding data security as well as higher cost associated with integration and implementation are expected to hinder market growth.

Additive manufacturing and AR, with the use of IoT in expected to propel market expansion. This AI and ML result in innovations that companies can leverage to enhance their PLM offerings with new Advanced functionality, fuelling demand. One of the major trends is collaboration between IoT and PLM, which has provided extended functionalities in such solutions that ensures real-time performance management & quality. IoT sensors embedded in smart products generate actionable data, such as early failure indicators, which are crucial for maintaining product quality. Our 2023 survey found the approximately 45% of U.S. businesses stated an average integration cost for one PLM system with their specific IT infrastructure ranging from USD300K right through to USD750K This number includes any customization, data migration and integration with other enterprise systems.

Leading companies such as PTC Inc., and Siemens are adopting some of these advanced tools to unlock several growth opportunities in the global market for artificial intelligence engineering, 3D modeling & simulation. Using an example, noted PTC in 2023 acquisition of a Pure-Systems Deal worth around USD 300 million reference to optimizing it plans improving application life-cycle management capabilities indicating increasing investment across enhanced or advanced PLM solutions. Siemens also unstructured its innovation next generation offering called the ELM 7.0 getting AI involved to provide real time insights across engineering data again showing how PLM is adapting latest technologies into their offerings industries. Another growth driver for the PLM market is expected to be significant increase in adoption of IoT coupled with important development technologies such as Blockchain, AI & ML over forecast period.

Drivers

-

The rising focus on developing smart products and factories is driving demand for advanced PLM solutions that can manage the complexity of connected products, integrating mechanical, electrical, and software components.

-

The shift towards cloud-based PLM solutions enables companies to access advanced capabilities with lower upfront costs, facilitating scalability and real-time collaboration across geographically dispersed teams.

-

Companies across various industries are undertaking digital transformation projects, increasing the need for PLM solutions to streamline product development, improve efficiency, and maintain competitiveness.

Demand among enterprises for manufacturing smart products and factories is driving growth of Product Lifecycle Management (PLM) market. The move towards smart manufacturing, there is a growing need for advanced PLM solutions to manage the complexity of connected products. For example, the implementation of Internet of Things (IoT) in manufacturing systems enables real-time tracking and control of product lifecycles that increases productivity and eliminates downtimes. A recent survey found that 47% of manufacturers are already using IoT technology in their operations, with another 29% planning to adopt it within the next two years. The need for data-driven decision-making and automate factories is driving industries towards adoption of PLM solutions as these are integrated with advanced analytics, simulation tools to support enterprises in sailing through smart-factories. with the worldwide drive towards Industry 4.0 encouraging manufacturers to implement smarter methods in production processes smart PLM integrates various technologies such as AR (Augmented Reality), Additive Manufacturing and AI helping improve overall productivity across diverse manufacturing environment. All of these factors together add up to the rising demand for PLM solutions as manufacturers strive to stay competitive in an increasingly connected and automated industrial landscape.

Restraints

-

The initial cost of integrating PLM solutions with existing IT infrastructure and the complexity of implementation can be significant.

-

As PLM solutions increasingly move to the cloud, concerns about data security, including potential breaches and unauthorized access, pose challenges to broader adoption.

-

Managing and analysing the vast amounts of data generated by IoT devices and smart products can be complex, requiring robust data management and analytics capabilities within PLM solutions.

Introduction and Implementation of Product Lifecycle Management (PLM) solutions is at high cost, which can be a major restraining factor to the growth for this market. More costs, which extend beyond the price of purchasing software itself but also encompass system integration, data migration and training for staff. In addition, having to integrate modern PLM systems with the existing IT infrastructure is another problem. The reality is that companies have standard. costs and they cost often as much to implement a solution, or integrate one with your existing legacy systems, leading to additional costs. According to IDC in 2023, there will be a nearly 40% failure rate among enterprise product lifecycle management (PLM) deployments due to rising costs and delays related to integration problems with the new platform. All of these factors make for an exceedingly expensive implementation, which can be a significant barrier, especially for smaller organizations and those with limited budgets.

Segment Analysis

By Component

The software segment held the largest share of 62% of market in 2023. Certainly, as global businesses continue to growing, the need for effective communication and collaboration of various dispersed teams and stakeholders is more prominent than ever. PLM software caters to this need by providing a single, central space for storing all product data including design changes and demands making it easy for team members from different geographical areas to collaborate on the same workspace.

In terms of growth rate, the services segment is expected to grow at fastest CAGR in this market. As more and more companies increasingly adopt PLM solution, the need to train employees effectively. Training programs offered by the service providers enable users to understand and employ all capabilities of PLM tools, making it indispensable for them. This will prepare the employees in such a manner that they can make full use of not only software benefits but also to get highest optimization from business processes.

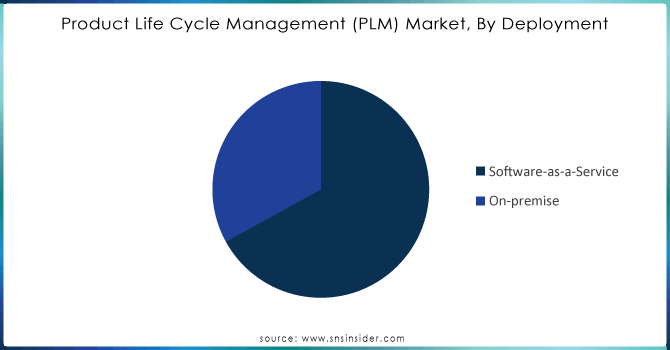

By Deployment

The software-as-a-service (SaaS) segment was a dominated market with capturing revenue share of more than 72% in 2023 and is expected to continue this trend throughout the forecast period. These solutions work on a pricing model that is based on subscriptions, so huge upfront investment in hardware and software are scrubbed. This approach is economic thus enabling organizations of any size have affordable access to advanced product lifecycle management (PLM) capabilities and embracing PLM solutions without the burden of high investments.

However, the on-premise segment is expected to register a growing at significant CAGR during the coming years. On-premises solutions assist businesses with an in-depth analysis of market trends and developments that allows for more targeted marketing as well as manufacturing decisions. By integrating advanced technologies such as the Internet of Things (IoT) and big data, these solutions enhance decision-making processes. Moreover, on-premise deployment - government agencies can decrease their dependence upon internet infrastructure and better protect themselves from online fraud, phishing attacks and loss of data. This result is of special interest for big companies which are expected to Favor on-premises solutions in the coming years.

Need any customization research on Product Life Cycle Management Market - Enquiry Now

By End use

The automotive and transportation segment dominated the market in 2023, contributing to around 23% of revenue share. This market dominance is being propelled by the heightening leverage of digital manufacturing and escalating incorporation of IoT in smart vehicle production. Siemens, as an example, markets with PLM software that is complete for every key technical domain from chip design to full vehicle validation. PLM software solutions prevent multiple instances of shipping errors and, lower product damage good performance with deliveries on time more productivity identification to customers excogitation regulation-demands. Thus, it is estimated that the presence these advantages would drive the consumption of PLM software in automotive and transportation sector.

Healthcare is the fastest growing segment, with an significant CAGR over forecast period. Healthcare is heavily regulated to protect patients and ensure product efficacy. There are many standards such as ISO 13485 and FDA regulations that medical device manufacturers need to follow. PLM solution on the other end helps companies to handle documentation, monitor design changes and assure regulate throughout product lifecycle. This helps in avoiding any non-compliance issues that can lead to fines which is where PLM systems become more effective for the healthcare industry.

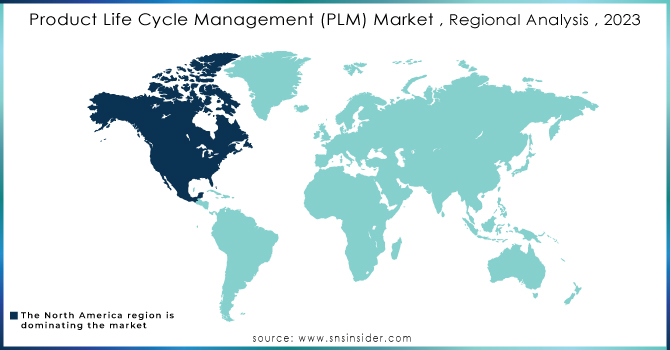

Regional analysis

North America dominated the market with revenue share of more than 34% In 2023. A strong financial position in the region enables sizable investments to be made for advanced technologies such as IoT, connected industries (such Telecommunications including 5G and LTE) additive manufacturing and augmented reality which helps the market competitiveness. In 2023, typical U.S. enterprise spends between $50,000 and $100,000 each year on training & support services to operate PLM systems. In 2023, analysis of PTC indicates that US businesses with the most effective PLM runs have seen productivity improvement of almost 15% to 20% in their products in their product development cycles. Collaboration has improved and the whole process is more streamlined as a result, it also reduces time to market. The large enterprises in North America are adopting upgraded product lifecycle management (PLM) solutions align with the technological progressions, which aids in customer focused product innovation. PTC announced in February 2024 that Texas Instruments broadened its deployment of PTC’s Windchill PLM across the design and manufacturing enterprise. The expansion is aimed to enhance their product development processes and increase collaboration between the Texas facilities and international teams.

Although the Asia Pacific region is expected to witness record growth, with a highest CAGR during forecast period. The increasing digitalization and industrialization in developing economies like India, China are the prime factors for driving PLM solutions. The region is home to numerous large enterprises across various industries including electronics, automotive and telecommunications all intent on re-imagining their approaches to engineering & product development. These companies are massively using preventive maintenance tool as a strategic component of their growth strategy to increase the productivity and improve competitiveness in global market.

Key Players:

The major players are Dassault Systèmes, Siemens AG, Hewlett-Packard Company, Aras Corporation, Arena Solutions, Inc., ANSYS Inc., SAP SE, Oracle Corporation, AUTODESK, INC., PTC Inc., Synopsys Inc., BigLever Software Inc., and others.

Recent development

-

Quadrant Knowledge Solutions provides a detailed SPARK Matrix™ analysis of global SD-WAN market in July 2023. Insights collated in this analysis will help businesses decide on the right PLM software and vendors.

-

PTC also acquired Pure-Systems in October 2023, adding application lifecycle management capabilities to its portfolio and marking the company's fourth acquisition within just an 18-month span a total of USD1.8. Bn. This included notable purchases such as ServiceMax and Intland Software.

-

Centric Software also partnered ALDI SOUTH to drive the retailer's digital transformation in September 2023. The deal is intended to facilitate collaboration and data-based decision-making, while making use of Centric Software's PLM knowledge as a strategic tool for growth and efficiency at ALDI SOUTH.

| Report Attributes | Details |

| Market Size in 2023 | US$ 29.46 Bn |

| Market Size by 2032 | US$ 65.58 Bn |

| CAGR | CAGR of 9.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (On-premise, Software-as-a-Service) • By End-use (Aerospace & Defence, Automotive & Transportation, Healthcare, IT & Telecom, Industrial Equipment & Heavy Machinery, Retail, Semiconductor & Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Dassault Systèmes, Siemens AG, Hewlett-Packard Company, Aras Corporation, Arena Solutions, Inc., ANSYS Inc., SAP SE, Oracle Corporation, AUTODESK, INC., PTC Inc., Synopsys Inc., BigLever Software Inc. |

| Key Drivers | • Increasing use of integrated IoT solutions in PLM systems. • Smart factories and networked gadgets are evolving. |

| Market Restraints | • Low adoption by small and medium-sized firms (SMEs) is likely to limit development in the worldwide product lifecycle management (PLM) market. • Interoperability issues are projected to stymie worldwide lifecycle management (PLM) market expansion throughout the forecast period. |