Software Consulting Market Report Scope & Overview:

Get more information on Software Consulting Market - Request Free Sample Report

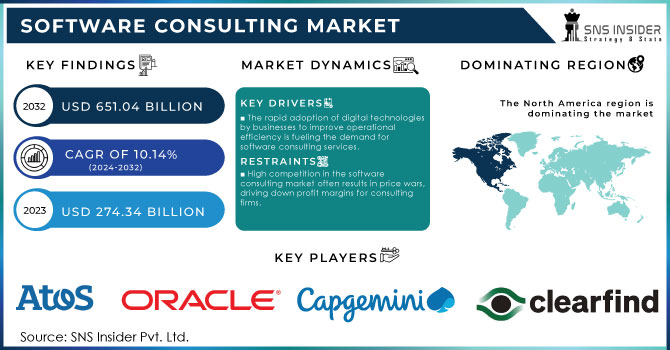

The Software Consulting Market Size was valued at USD 274.34 billion in 2023 and is predicted to expand to USD 651.04 billion by 2032, growing at a CAGR of 10.14% from 2024 to 2032.

The Software Consulting Market has emerged as a pivotal force driving digital transformation across various industries. With organizations increasingly relying on technology to enhance operational efficiency, software consulting services have gained significant traction. These services encompass a range of activities, including strategic IT planning, software development lifecycle management, and project management, aimed at optimizing software solutions to meet specific business needs. As businesses face growing pressure to adapt to rapid technological advancements, software consulting firms play a crucial role in identifying the right tools and technologies that align with organizational goals. In recent years, the demand for software consulting has surged, with a notable shift towards cloud-based solutions. According to research, around 70% of organizations are expected to migrate to the cloud by 2025, highlighting the need for expert guidance in navigating this complex transition. Moreover, companies are increasingly adopting agile methodologies, with 70% of organizations indicating that they are embracing agile practices to enhance collaboration and improve project outcomes.

The landscape of software consulting is also influenced by the rising emphasis on cybersecurity. As cyber threats become more sophisticated, businesses are prioritizing security measures, and nearly 60% of organizations reported that they seek consulting services to strengthen their cybersecurity posture. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in software solutions is gaining momentum, with about 80% of companies considering AI-driven solutions to enhance decision-making processes and operational efficiency. Furthermore, software consulting firms are expanding their service offerings to include end-to-end solutions, from initial consulting and planning to implementation and support. This comprehensive approach allows organizations to streamline their processes and improve ROI on technology investments.

Software Consulting Market Dynamic

DRIVERS

-

The rapid adoption of digital technologies by businesses to improve operational efficiency is fueling the demand for software consulting services.

The Software Consulting Market is experiencing a notable surge due to the increased demand for digital transformation across various industries. As businesses recognize the necessity of integrating advanced technologies into their operations, software consulting services play a crucial role in guiding this transition. Organizations are increasingly turning to software consultants for their expertise in developing customized software solutions that align with their unique business needs. The rapid shift to remote work and the growing reliance on cloud-based solutions have further accelerated this trend, prompting companies to reevaluate their existing systems and processes.

Furthermore, the rising competition in the digital landscape compels businesses to adopt innovative software solutions that enhance operational efficiency and improve customer experiences. Software consultants help organizations navigate the complexities of digital transformation by providing strategic insights, technology assessments, and implementation support. According to recent research, approximately 70% of organizations are actively pursuing digital transformation initiatives, with a significant percentage indicating that they plan to invest in software consulting services to achieve their goals. This growing focus on digital technologies is evident across sectors such as finance, healthcare, and retail, where businesses seek to leverage data analytics, automation, and artificial intelligence to stay ahead of the curve. As a result, the Software Consulting Market is set to thrive, driven by the critical role of consul

-

The rise of new technologies like AI, machine learning, and cloud computing is driving demand for consultants to assist organizations in integrating and optimizing these advanced solutions.

The emergence of new technologies has significantly reshaped the Software Consulting Market, driving an increasing demand for specialized expertise. Innovations such as artificial intelligence (AI), machine learning (ML), and cloud computing are at the forefront of this transformation. Organizations across various industries are seeking consultants to assist with the integration and optimization of these advanced technologies, ensuring they can harness their full potential. AI and ML are particularly influential, enabling businesses to analyze vast amounts of data, enhance decision-making processes, and automate routine tasks. According to a research, AI can improve their cash flow by up to 122% by 2022. Meanwhile, the cloud computing sector is expected to see continued growth, with the cloud services market anticipated to exceed USD 832 billion by 2025, driven by the increasing need for scalability, flexibility, and cost efficiency.

RESTRAIN

-

High competition in the software consulting market often results in price wars, driving down profit margins for consulting firms.

The software consulting market is characterized by intense competition among numerous players, each vying for a share of the growing demand for technology solutions. This competitive landscape often results in price wars, as firms lower their rates to attract clients, thereby impacting overall profitability. In such an environment, consulting firms must differentiate themselves through specialization, innovation, and the quality of their services. The presence of both established players and new entrants intensifies this competition, leading to a diverse array of offerings, from bespoke software development to implementation and support services.

Additionally, the rapid pace of technological advancement means that firms must continuously update their skills and knowledge to remain relevant. The need for expertise in emerging technologies like artificial intelligence, machine learning, and cloud computing further drives competition, as firms race to recruit and retain top talent. Moreover, client expectations are evolving, with organizations increasingly seeking agile and scalable solutions tailored to their specific needs. This shift requires consulting firms to be more responsive and adaptable, adding another layer of pressure in a saturated market. According to research, 73% of organizations cite the ability to innovate quickly as a critical factor when selecting a consulting partner, underscoring the importance of agility in this highly competitive landscape. As firms navigate these challenges, they must balance competitive pricing with the delivery of high-value services to maintain their market position and ensure sustainable profitability.

Software Consulting Market Segmentation Analysis

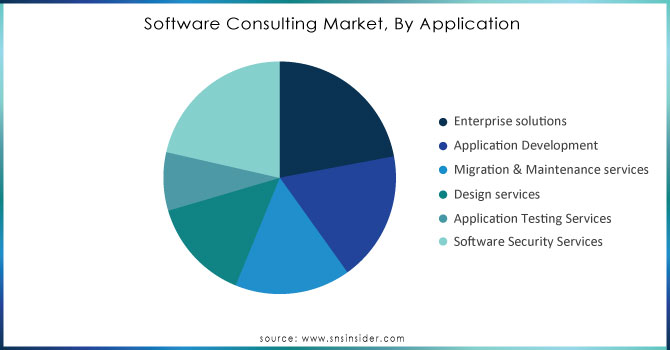

By Application

In 2023, the enterprise solutions segment dominated the market share over 22.06%. The escalating demand for essential software solutions, including Enterprise Content Management (ECM), Enterprise Resource Planning (ERP), and Customer Relationship Management (CRM), is expected to drive the need for consulting services in this area significantly. The shift toward customer-centric strategies is reshaping businesses' approach to CRM, making customer engagement more critical than ever. Companies are increasingly focusing on dedicated solutions for social listening and engagement, reflecting the growing importance of real-time customer feedback and interaction. This trend highlights the necessity for robust management and monitoring tools to enhance customer relationships

Need any customization research on Software Consulting Market - Enquiry Now

By End-use

In 2023, the Banking, Financial Services, and Insurance (BFSI) segment dominated the market share over 22.08%. Financial services firms are increasingly leveraging consulting services to enhance their capabilities, streamline operations, and integrate advanced technologies into their data management processes. The rise of digital payments, projected to reach over USD 6 trillion in transaction volume by 2024, is driving the adoption of innovative solutions like blockchain technology within the banking sector. Additionally, the proliferation of fintech companies over 26,000 globally has spurred the adoption of digital wallets, with users expected to surpass 2 billion by 2024. This trend not only facilitates more secure transactions but also enables better customer experiences.

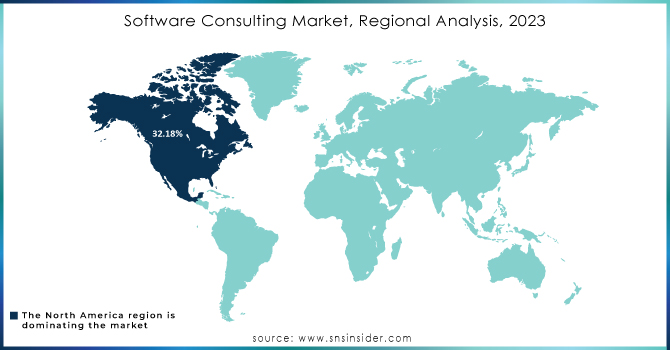

Software Consulting Market Regiona Analysis

In 2023, North America region the market share over 32.18%, This region is experiencing a significant influx of investments in technological research and development across various sectors. As companies increasingly focus on the Internet of Things (IoT) and big data technologies, the demand for IT and software solutions is anticipated to surge. The rising trend of digital transformation is also fueling the need for software consulting services, which are particularly in high demand in the United States compared to other North American countries. The U.S. software consulting market has seen a year-on-year growth of approximately 12%, highlighting the urgent need for expert guidance in navigating complex software solutions. Additionally, North America's market growth will be bolstered by a thriving ecosystem of technology start-ups that continue to innovate and challenge traditional business models.

The Asia Pacific region is on the brink of significant growth in the coming years, largely propelled by strategic government initiatives aimed at encouraging the development of Free and Open-Source Software (FOSS) for Software as a Service (SaaS), mobile applications, and Service-Oriented Architecture (SOA). This proactive governmental support is set to boost the adoption of software consulting services, as businesses seek expert insights to navigate the evolving digital landscape.

The e-commerce sector in Asia Pacific is experiencing a remarkable surge, resulting in an escalating demand for web and mobile app design consulting services. Online businesses, striving to enhance user experiences and optimize operations, are increasingly turning to specialists to create visually appealing and functionally robust digital platforms. It is projected that the number of digital buyers in the region will surpass 500 million, reflecting the growing consumer base engaging in online shopping.

KEY PLAYERS

Some of the major key players of Software Consulting Market

-

Atos SE (Atos Digital Transformation, Atos Codex)

-

Oracle Corp. (Oracle Cloud Applications, Oracle E-Business Suite)

-

SAP SE (SAP S/4HANA, SAP Business Technology Platform)

-

Capgemini (Capgemini Cloud Services, Capgemini Digital Customer Experience)

-

CGI Group, Inc. (CGI Advantage, CGI Digital Services)

-

International Business Machines Corp. (IBM) (IBM Cloud, IBM Watson)

-

Clearfind (Clearfind Software Management Platform)

-

Accenture PLC (Accenture Cloud, Accenture AI)

-

Cognizant (Cognizant Digital Business, Cognizant Intelligent Process Automation)

-

Deloitte Touche Tohmatsu Ltd. (Deloitte Cloud, Deloitte Analytics)

-

Rapport IT (Rapport IT Digital Solutions)

-

Ernst & Young LLP (EY) (EY Digital Transformation, EY Data Analytics)

-

PricewaterhouseCoopers B.V. (PwC) (PwC Cloud Services, PwC Cybersecurity Solutions)

-

Infosys Limited (Infosys Consulting Services, Infosys Cobalt)

-

Tata Consultancy Services (TCS) (TCS BaNCS, TCS iON)

-

Wipro Limited (Wipro Holmes, Wipro FullStride Cloud Services)

-

HCL Technologies (HCL Digital Transformation Services, HCL Cloud Native Services)

-

Fujitsu Ltd. (Fujitsu Digital Transformation Services, Fujitsu Cloud Services)

-

LTI (Larsen & Toubro Infotech) (LTI Mosaic, LTI Cloud Services)

-

NTT Data Corporation (NTT Data Digital Transformation, NTT Data Cloud Solutions)

Suppliers for Offers consulting, technology, and outsourcing services, with a focus on digital transformation of Software Consulting Market

-

Accenture

-

Deloitte

-

Capgemini

-

Cognizant

-

IBM Global Business Services

-

Tata Consultancy Services (TCS)

-

Infosys

-

Wipro

-

SAP Consulting

-

McKinsey & Company

RECENT DEVELOPMENT

-

In 2024: Atos has appointed Philippe Salle as its new Chairman and CEO, aiming to rejuvenate the company as it navigates a challenging landscape marked by financial struggles and a significant workforce reduction. Salle brings extensive experience, having previously held leadership roles at major firms including a stint as CEO of a major telecommunications company.

-

In 2024: The software and platforms industry are at a pivotal moment, driven by macro shifts and technological advancements, creating significant opportunities for growth. A projected USD 3.5 trillion revenue opportunity exists for platforms that can fully capitalize on the evolving market landscape.

-

In January 2023: Infosys acquired Cobalt Software, a company specializing in club management software solutions. This acquisition will enable Infosys to expand its cloud-based products tailored for the manufacturing industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 274.34 billion |

| Market Size by 2032 | USD 651.04 billion |

| CAGR | CAGR of 10.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application, (Enterprise solutions, Application Development, Migration & Maintenance services, Design services, Application Testing Services, Software Security Services) • By Enterprise Size (Large Enterprise, Small & Medium Enterprise) • By End-user (Automotive, BFSI, Education, Government, Healthcare, IT & Telecom, Manufacturing, Retail, and others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Atos SE, Oracle Corp., SAP SE, Capgemini, CGI Group Inc., International Business Machines Corp. (IBM), Clearfind, Accenture PLC, Cognizant, Deloitte Touche Tohmatsu Ltd., Rapport IT, Ernst & Young LLP (EY), PricewaterhouseCoopers B.V. (PwC), Infosys Limited, Tata Consultancy Services (TCS), Wipro Limited, HCL Technologies, Fujitsu Ltd., LTI (Larsen & Toubro Infotech), NTT Data Corporation. |

| Key Drivers | • The rapid adoption of digital technologies by businesses to improve operational efficiency is fueling the demand for software consulting services. • The rise of new technologies like AI, machine learning, and cloud computing is driving demand for consultants to assist organizations in integrating and optimizing these advanced solutions. |

| RESTRAINTS | • High competition in the software consulting market often results in price wars, driving down profit margins for consulting firms. |