AI Image Editor Market Report Scope & Overview:

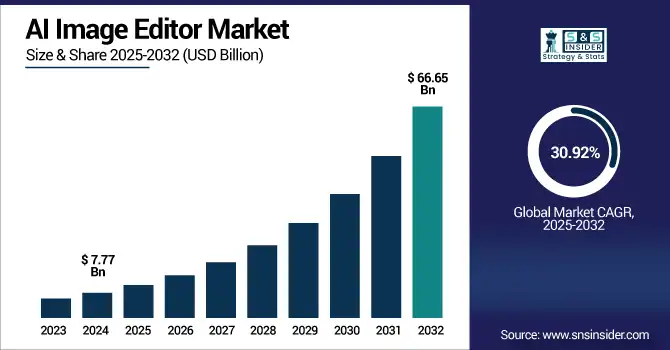

AI Image Editor Market size was valued at USD 7.77 billion in 2024 and is expected to reach USD 66.65 billion by 2032, growing at a CAGR of 30.92% from 2025-2032.

To Get more information on AI Image Editor Market - Request Free Sample Report

The AI Image Editor Market is experiencing rapid growth due to rising demand for automated and user-friendly content creation tools across social media, e-commerce, and digital advertising platforms. Trends such as influencer marketing, remote working, and the rise of visual-first communication are fuelling demands for high-quality, AI-enhanced visual content.

-

According to the U.S. Copyright Office’s 2023 report, millions of Americans are utilizing generative AI systems to produce visual art, highlighting the widespread adoption of AI image tools.

Advancements in computer vision and deep learning have improved editing capabilities, enabling real-time enhancements, background removal, and style transfer.

-

Imgix, a leading image optimization platform, reports that images can account for over 75% of total page weight, and its AI-powered optimization has helped clients like BentoBox reduce image file sizes by over 75%, improving page load speeds by 25% while delivering 18 million image requests monthly with 100% success.

-

Furthermore, a 2025 Barron’s report states that platforms like Meta, Google, and TikTok now account for 75.2% of global digital ad spending,

largely fueled by AI-driven self-serve tools that empower small businesses to efficiently create and manage visual campaigns. Additionally, the integration of AI image editors in mobile apps and SaaS platforms is broadening accessibility, fueling widespread adoption across individual and enterprise users.

U.S. AI Image Editor Market size was valued at USD 2.03 billion in 2024 and is expected to reach USD 16.96 billion by 2032, growing at a CAGR of 30.39% from 2025-2032.

The U.S. AI Image Editor Market is growing due to rising demand for digital content in marketing, social media, and e-commerce, along with advancements in AI-powered editing tools that offer automation, efficiency, and high-quality outputs for both professionals and consumers.

AI Image Editor Market Dynamics

Drivers

-

Expansion of e-commerce and digital marketing is accelerating integration of AI-based image editing for product and brand visual optimization.

Retailers and digital marketers are increasingly turning to AI image editors to generate consistent, appealing visuals that improve engagement and conversions. These tools are useful because they allow us to automate repetitive editing tasks such as resizing, retouching, color correction, and color grading between platforms. Thanks to AI, brand aesthetics can still be preserved, while visuals can be quickly updated to social media, product listings, or tailored to pitches. AI-assisted editors allow businesses to scale their content strategy efficiently and economically, which is especially important for online businesses where the demand for content continues to grow, and the look and feel of imagery can directly influence the consumer.

-

Shinola (via Magento + AWS) reported a 50% reduction in page weight, 15% faster image rendering, and 1-second improvement in page load time, enhancing visual performance on its storefront.

-

Zadig & Voltaire achieved a 66% improvement in page speed, with 70% of user traffic coming from mobile, while preserving premium brand visuals.

-

According to Shopify (via Imgix), 79% of customers will not return to a poorly performing site, and 47% expect pages to load in under 2 seconds. Image compression alone can reduce page size by over 10%, directly boosting conversion rates.

Restraints

-

Data privacy concerns and security risks related to image processing in AI platforms limit user trust and widespread adoption.

Since AI image editors usually operate on a cloud using existing infrastructure to process and save user images, this raises the question of data ownership and whether or not it can be exploited somewhere else. Prominent users, particularly in verticals including healthcare, media, and legal services, are reluctant to use such tools, as this comes with the risk of personal or sensitive visual data being disclosed or abused. Moreover, GDPR-like regulations enforce stringent states of restrictions on image storage and usage compliances. Such privacy-oriented restrictions impose challenges for organizations valuing confidentiality and further prevent the seamless embedding of AI tools into a workflow consisting of strictly private data processing.

Opportunities

-

Integration of generative AI and real-time collaboration tools opens new horizons for creative workflows and design innovation.

Generative AI functionality in inpainting, text to image and style mixing has changed traditional image editing. These technologies, when combined with real time collaboration tools, make it possible for a team to co-create and iterate at a rate never seen before. This synergy opens up a huge possibility in the marketing, publishing, game design, and film production industry where they need the fastest ideation and visualization process, better known as a swift visualization technique. AI image editors are also moving to mobile and cloud platforms for creative output. This convergence of features is fertile ground for product development, platform differentiation, and market expansion.

-

Adobe reports that over 13 billion images have been generated via Firefly since its launch in March 2023. With recent updates, image generation is now 4× faster, and a video model beta has been integrated into Premiere Pro and other Adobe Creative Cloud apps.

-

In April 2025, Adobe also introduced Firefly Boards, an infinite canvas that supports real-time team collaboration, commenting, and AI-assisted image remixing—making it ideal for rapid creative iteration and multi-user workflows.

Challenges

-

Complex integration with legacy systems and traditional design tools hinders enterprise-level adoption of AI image editing solutions.

Most enterprises utilize proven workflows that are established with products like Adobe Photoshop or proprietary software that are not basis compatible with new AI editors. The greatest challenge though is finding a way to make AI part of the workflow that does not make productivity drop or require extensive retraining of entire teams. Deployment delays due to compatibility problems, arduous migration of data, and no API standardization. Creative professionals may also be hesitant to shift from manual methods to AI-assisted automation due to losing control over creative elements. Such integration obstacles also constrain the approach of organizations towards scalability of AI image editors particularly in an industry which are very choosy towards designs such as media, publishing, and advertising.

AI Image Editor Market Segmentation Analysis

By Application

Social media segment dominated the AI image editor market in 2024 with a 30% revenue share, as an increasing need for immediate and visually engaging content was driving businesses to adopt AI image editors. More and more influencers and day-to-day users have started using AI tools to improve images for posts, reels, and stories. With a surge in mobile-first content creation and instantaneous sharing on platforms like Instagram and TikTok, the demand for AI-based editing apps on social platforms also increased rapidly.

E-commerce segment is projected to grow at the fastest CAGR of 34.04% from 2025 to 2032, owing to the requirement for optimized visuals of products to enhance online sales. Introduced AI editors to automate repetitive editing tasks like background removal, color correction and image resizing, allowing for consistent and quality listings. Again, as more and more businesses go digital, especially small sellers, the demand will be for scalable, efficient solutions that enable the process of visual merchandising and selling images, respectively.

By End User

Artists/Individuals segment held the highest revenue share of 45% in 2024, reflecting the increasing use of AI tools for personal creative expression and freelance work. AI editors offer user-friendly interfaces and automated effects like filters, facial retouching, and background enhancements that appeal to creators without advanced technical skills. This accessibility supports growing demand for high-quality content among portfolio builders, hobbyists, and content-driven professionals.

Enterprise users segment is expected to grow at a CAGR of 32.55% from 2025 to 2032 as businesses adopt AI editors to streamline high-volume image processing. Sectors like media, advertising, and real estate require consistent, brand-aligned visuals at scale. AI-powered editing platforms reduce manual workload and turnaround time, integrating into enterprise workflows through APIs and cloud solutions, making them ideal for collaborative, on-demand content production across departments.

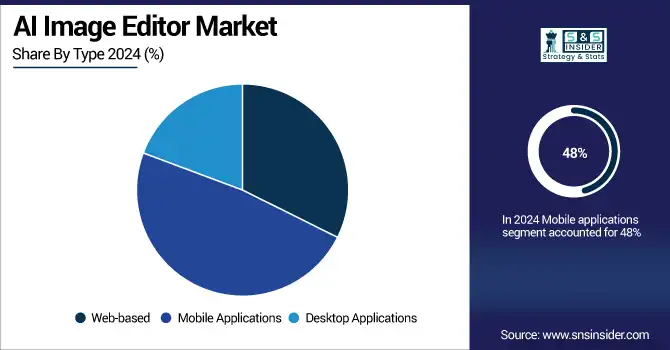

By Type

Mobile applications led the market in 2024 with a 48% revenue share due to their ease of use, portability, and growing smartphone user base. AI image editors in mobile apps cater to real-time editing needs with intuitive tools for filters, effects, and enhancements. These apps are especially popular among social media users and casual content creators, offering quick, high-quality editing without requiring desktop software or technical expertise.

Web-based segment is expected to expand at the fastest CAGR of 32.58% from 2025 to 2032, fueled by demand for device-independent, collaborative editing solutions. Browser-based platforms offer flexibility, cloud storage, and easy access across operating systems. As remote work and distributed creative teams increase, users prefer tools that enable seamless real-time collaboration without installing software. Web-based AI editors also attract businesses seeking scalable, multi-user content production capabilities.

By Platform

Android segment accounted for the highest revenue share of about 38% in the AI image editor market in 2024 and is projected to grow at the fastest CAGR of 32.44% from 2025 to 2032. This dominance and growth are driven by the massive number of Android users worldwide, especially in developing countries, comes from the cheapness and the easy availability of Android devices. High spreadability among casual users and content creators drives developers to choose Android platforms for AI image editing apps due to its open ecosystem, licensing flexibility, distribution and monetization channels, and ease of integration by AI SDKs.

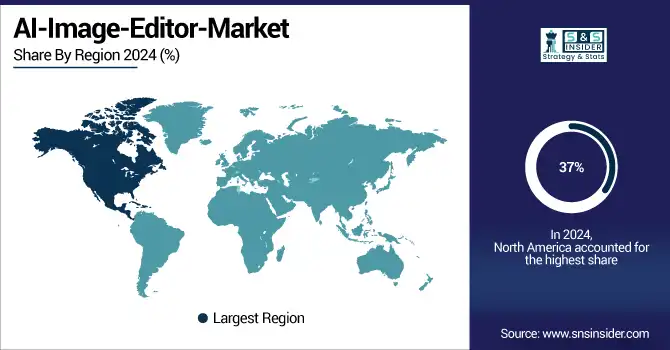

AI Image Editor Market Regional Outlook

North America held the largest revenue share of 37% in the AI image editor market in 2024 owing to the presence of an advanced digital infrastructure, extensive smartphone adoption, and the early integration of AI image editors. This growth can be attributed to the presence of major market players, increased adoption of social media influencers as well as creative professionals and marketing agencies. Moreover, the region enjoys increased consumer expenditure on digital platforms, high end-editing software which adds to overall valuation of the market.

The United States is dominating the AI image editor market in North America due to strong tech infrastructure, high adoption rates, and leading industry players.

Asia Pacific is projected to grow at the fastest CAGR of 33.30% from 2025 to 2032, owing to increasing smartphone penetration, social media consumption and growing creator economy. More internet penetration and rising e-commerce in nations like India, China, and Indonesia are raising demand for the image-editing tools enabled with AI. A big population in the region, an even bigger number of youth this is tech-savvy and local virtual policies make a contribution to the swift market increase and virtual innovation adoption.

China is dominating the AI image editor market in Asia Pacific due to massive smartphone usage, strong tech ecosystem, and rapidly growing digital content creation sector.

Europe’s AI image editor market is growing steadily, driven by rising demand for creative tools in marketing, e-commerce, and media sectors. The region benefits from strong digital infrastructure, increasing social media usage, and a vibrant ecosystem of AI innovation.

The UK is dominating the AI image editor market in Europe, driven by advanced digital adoption, strong creative industries, and high social media engagement.

The AI image editor market in the Middle East & Africa and Latin America is expanding due to rising smartphone adoption, increased digital content creation, social media engagement, and growing interest in cost-effective AI-powered editing solutions across emerging digital economies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Adobe Inc., Canva Pty Ltd, Fotor (Chengdu Everimaging), Pixlr (Inmagine Group), Skylum Software, BeFunky Inc., Remove.bg (Kaleido AI GmbH), PhotoRoom (Artizans SAS), Runway AI, Inc., Picsart Inc., ClipDrop (Stability AI), DeepArt.io, Prisma Labs, Inc., FaceApp Technology Ltd., Lightricks Ltd., VanceAI, Let's Enhance Inc., Designify (SmartPhotoEdit), Remove Objects (BgEraser), RetouchPro.AI (Baseten Inc.) and others.

Recent Developments:

-

2025: Adobe released the standalone Firefly web application, allowing users to generate AI-powered images, vectors, and videos in public beta, bundled with new subscription options for broader creative access.

-

2025: Runway introduced Gen-4 a cutting-edge AI model designed to generate consistent characters, objects, and scenes using reference inputs, enabling high-fidelity storytelling across visual content creation workflows.

-

2024: Adobe unveiled next-generation generative AI in Photoshop (beta), introducing powerful Text-to-Image generation and an enhanced Generative Fill feature powered by the advanced Firefly Image Model 3.

-

2023: Canva launched its AI-powered Assistant tool in March 2023, offering intelligent design suggestions that adapt to users’ styles, layouts, and branding, significantly enhancing productivity and creativity across the Canva platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.77 Billion |

| Market Size by 2032 | USD 66.65 Billion |

| CAGR | CAGR of 30.92% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Android, iOS, Windows, Others) • By End User (Artists/Individuals, Enterprise Users, Educational Users) • By Type (Web-based, Mobile Applications, Desktop Applications) • By Application (Social Media, Photography, E-commerce, Advertising, Graphic Design) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Adobe Inc., Canva Pty Ltd, Fotor (Chengdu Everimaging), Pixlr (Inmagine Group), Skylum Software, BeFunky Inc., Remove.bg (Kaleido AI GmbH), PhotoRoom (Artizans SAS), Runway AI, Inc., Picsart Inc., ClipDrop (Stability AI), DeepArt.io, Prisma Labs, Inc., FaceApp Technology Ltd., Lightricks Ltd., VanceAI, Let's Enhance Inc., Designify (SmartPhotoEdit), Remove Objects (BgEraser), RetouchPro.AI (Baseten Inc.) |