Swarm Intelligence Market Report Scope & Overview:

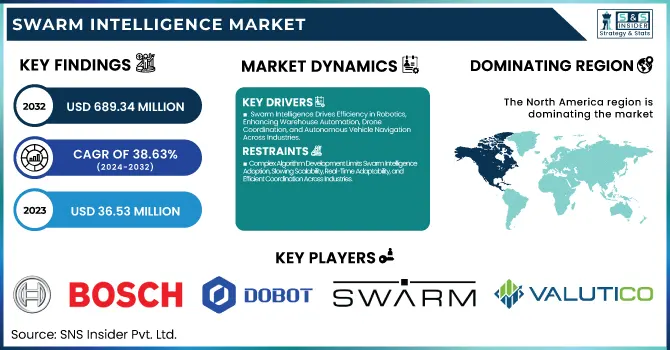

The Swarm Intelligence Market was valued at USD 36.53 million in 2023 and is expected to reach USD 689.34 million by 2032, growing at a CAGR of 38.63% from 2024-2032. This report includes insights into energy consumption & sustainability metrics, investment & funding trends, algorithmic efficiency, cybersecurity & threat detection, and scalability & network effects.

To Get more information on Swarm Intelligence Market - Request Free Sample Report

The market's rapid growth is driven by advancements in AI, increased demand for decentralized decision-making, and enhanced automation across industries. Investments are surging as businesses recognize its potential in optimization, logistics, and security applications. Algorithmic efficiency and sustainability are key focus areas, ensuring energy-conscious AI deployment. Additionally, cybersecurity remains critical as interconnected systems expand. Scalability and network effects further boost adoption, reinforcing swarm intelligence’s role in dynamic, real-time problem-solving across sectors such as defense, finance, and robotics.

U.S. Swarm Intelligence Market was valued at USD 9.89 million in 2023 and is expected to reach USD 188.51 million by 2032, growing at a CAGR of 38.75% from 2024-2032.

The U.S. Swarm Intelligence Market is growing rapidly due to rising adoption in defense, robotics, and autonomous systems. Increased investment in AI-driven optimization, logistics, and cybersecurity boosts expansion. Industries like finance and healthcare leverage swarm intelligence for decentralized decision-making. Advancements in algorithmic efficiency enhance scalability and sustainability, making adoption more feasible. Additionally, swarm-based systems improve threat detection, strengthening cybersecurity. With applications in smart cities, supply chains, and industrial automation, the market benefits from strong network effects, driving sustained growth.

Swarm Intelligence Market Dynamics

Drivers

-

Swarm Intelligence Drives Efficiency in Robotics, Enhancing Warehouse Automation, Drone Coordination, and Autonomous Vehicle Navigation Across Industries.

Growing dependency on autonomous robotic systems is also driving swarm intelligence implementation across various sectors. At warehouse automation, swarm-instruction robots work in harmony to optimize inventory tracking and order picking. Decentralized swarm intelligence enhances drone coordination, particularly in logistics, aerial surveillance, and disaster response. Autonomous vehicles also use swarm algorithms for optimal navigation, traffic signal control, and collision detection. These developments enhance efficiency, scalability, and responsiveness, making swarm intelligence an essential facilitator for future-proof automation. As economies keep onboarding AI-enabled robots, swarm intelligence is at the center of performance enhancement, cost reduction in operations, and in real-time decision-making. The large-scale adoption of self-organizing robotic networks highlights the increasing role of swarm intelligence in setting the tone for the future of automation.

Restraints

-

Complex Algorithm Development Limits Swarm Intelligence Adoption, Slowing Scalability, Real-Time Adaptability, and Efficient Coordination Across Industries.

Developing efficient and scalable swarm intelligence algorithms is a challenging task, delaying adoption across industries. The algorithms need to manage decentralized decision-making, real-time adaptability, and complex problem-solving effectively while being scalable in large-scale applications. Seamless coordination among multiple autonomous agents is only possible with sophisticated computational models that can operate without performance loss in unpredictable environments. Further, refining swarm behavior for multiple applications across robotics, logistics, and defense requires ongoing algorithm tuning and rigorous testing. Lack of across-the-board accepted frameworks also hinders implementation, resulting in higher development costs and timelines. As companies aim to tap swarm intelligence for live applications, overcoming these algorithmic hurdles becomes a major challenge, impeding innovation and delaying market expansion.

Opportunities

-

Swarm Intelligence Enhances Smart Cities by Optimizing Traffic, Energy Distribution, and Urban Planning Through IoT-Driven Autonomous Systems.

Growing IoT and smart city infrastructure integration is driving the implementation of swarm intelligence for improved urban governance. Swarm-based coordination is helping traffic optimization by allowing real-time management of traffic lights, minimizing congestion, and enhancing overall mobility. Energy distribution grids utilize swarm intelligence to efficiently manage power loads, stabilizing the grid and reducing energy losses. Urban planning also becomes increasingly data-driven, with self-organizing networks processing sensor information to optimize resource utilization and infrastructure construction. Swarm intelligence's capability to handle large-scale, decentralized data in real-time positions it as a major driver of intelligent city solutions. As cities grow, the need for autonomous, self-improving systems will increase, and smart city ecosystems will continue to drive innovation.

Challenges

-

Scalability Issues in Swarm Intelligence Limit Efficiency, Coordination, and Real-Time Performance in Large-Scale Deployments Across Various Industries.

With the growth of swarm intelligence into big-scale deployments, it is becoming more difficult to sustain efficiency, coordination, and real-time responsiveness. Scaling up swarm-based systems necessitates enormous computational power, interference-free communication, and efficient decision-making to provide stability over thousands of independent agents. Handling an enormous number of interdependent nodes with low latency, resource usage, and operational inefficiencies presents major challenges. Moreover, with increasing deployment sizes, data congestion, synchronization latency, and decentralized control mechanism problems become more evident. Without properly designed algorithms and strong infrastructure, scalability can result in performance bottlenecks, constraining the efficacy of swarm intelligence in applications like logistics, defense, and autonomous mobility. Overcoming these challenges is essential to realizing the full potential of swarm intelligence in large-scale, real-world applications.

Swarm Intelligence Market Segment Analysis

By End-use

The Transportation & Logistics sector had the largest revenue share of approximately 35% in 2023 due to the increased use of swarm intelligence in route optimization, fleet management, and autonomous delivery systems. Swarm-based algorithms improve warehouse automation, real-time decision-making, and traffic management, which lowers operational expenses and increases efficiency. Swarm intelligence's capability to manage autonomous drones, robot warehouses, and autonomous fleets has positioned it at the center of logistics as a technology that accelerates delivery and enhances supply chain resilience.

The Retail & E-commerce segment is expected to expand at the fastest CAGR of 43.14% during 2024-2032, driven by growing demand for AI-based inventory management, warehouse automation, and optimizing last-mile delivery. Swarm intelligence improves personalized shopping, dynamic pricing, and demand forecasting, enhancing operational efficiency. The growth of autonomous delivery drones, intelligent warehouses, and AI-based supply chain systems is also driving adoption, allowing retailers to efficiently meet consumer needs and scale operations seamlessly.

By Model

The Ant Colony Optimization (ACO) category had the highest revenue share of 46% in 2023, mainly because it is efficient in solving intricate optimization problems like network routing, logistics planning, and resource allocation. ACO's natural foraging behavior imitation capability enables industries to enhance pathfinding, scheduling, and combinatorial problem-solving with high efficiency. Its widespread usage across transportation, robotics, and logistics management has led to its domination since companies utilize ACO for increased operation effectiveness and reducing computation complexity for optimization in extensive operations.

The Particle Swarm Optimization (PSO) is also anticipated to witness the fastest growth of CAGR of 40.15% from 2024-2032, propelled by its expanded utilization across machine learning, artificial intelligence, and real-time decision-making. PSO finds extensive application in training neural networks, financial modeling, and predictive analytics, thus being the choice of businesses that require adaptive and high-speed optimization. Its ability to solve continuous, multi-dimensional problems at a low computational cost is driving demand, especially in healthcare, automation, and AI-based industries.

By Application

The Robotics business commanded the highest revenue share of 46% in 2023 on account of the growing use of swarm-based autonomous robots in industries like logistics, manufacturing, and defense. Swarm intelligence improves multi-robot coordination, task allocation, and real-time decision-making, enhancing operational efficiency. Robotics applications derive advantages from self-organizing, decentralized systems to enable scalable and adaptive automation. The need for warehouse automation, disaster relief, and exploration missions in swarm robotics further reinforced its dominance in the market as industries move towards cost-saving, intelligent robots.

The Human Swarming application is expected to advance at the fastest CAGR of 41.78% during 2024-2032, supported by developments in collective intelligence frameworks, decision assistance, and in-time group problem-solving. The human-swarm interactions are becoming increasingly used for market forecasting, medical diagnosis, and AI-backed decision-making. Human Swarming facilitates deeper collaboration and decision-making by consensus in areas such as finance, research, and governance. Increased demand for supercharged intelligence platforms that integrate human knowledge with swarm-based decision patterns is driving it across various sectors.

By Capability

The Optimization segment held the largest revenue share of 39% in 2023, driven by the increasing need for efficient problem-solving in logistics, manufacturing, and AI-driven decision-making. Swarm intelligence enhances resource allocation, scheduling, and predictive analytics, making it essential for industries seeking cost-effective and scalable solutions. Its ability to solve complex combinatorial problems with decentralized intelligence has led to widespread adoption in supply chain management, finance, and industrial automation, solidifying its dominance in the market.

The Routing segment is projected to grow at the fastest CAGR of 42.05% from 2024-2032, fueled by rising demand for intelligent traffic management, telecommunications, and network optimization. Swarm intelligence enables dynamic routing, congestion control, and adaptive network configurations, improving efficiency in data transmission and logistics. With the increasing adoption of autonomous vehicles, IoT networks, and smart city infrastructure, swarm-based routing solutions are becoming crucial for real-time navigation and efficient communication, driving their rapid growth.

Regional Analysis

North America captured the highest revenue share of 38% in 2023 due to early adoption of AI technologies, robust investment in autonomous systems, and sophisticated research in swarm intelligence. The region is supported by an established robotics, defense, and smart city ecosystem, facilitating mass deployment of swarm-based solutions. Top technology players, government initiatives, and rising demand for automation further enhance its dominance. The availability of prominent players in AI, communications, and logistics has helped speed up the use of swarm intelligence in numerous sectors.

The Asia Pacific region is expected to grow at the fastest CAGR of 40.86% between 2024 and 2032, driven by swift advancements in industrial automation, smart manufacturing, and autonomous transport. The e-commerce growth of the region, growing government backing for AI innovation, and rising investments in swarm robotics are major drivers of growth. With a thriving telecommunications network and rising IoT and smart city initiatives adoption, swarm intelligence solutions are in increasing demand, leading to enormous market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ConvergentAI, Inc: [AI-Driven Process Optimization Platform, Predictive Maintenance Solutions]

-

Robert Bosch GmbH: [Bosch IoT Suite, Bosch Smart Home System]

-

DoBots: [Swarm Robot Control Software, Autonomous Drone Coordination System]

-

Swarm Technology: [Swarm Intelligence Middleware, Collaborative Robotics Platform]

-

Valutico: [Valuation Platform, Financial Analysis Tools]

-

PowerBlox: [Modular Energy Storage Systems, Intelligent Energy Management Solutions]

-

Mobileye: [Advanced Driver Assistance Systems (ADAS), Autonomous Vehicle Technology]

-

Continental AG: [Automated Driving Systems, Intelligent Transportation Solutions]

-

Apium Swarm Robotics: [Swarm Robotic Platforms, Autonomous Underwater Vehicles]

-

Kim Technologies: [AI-Powered Legal Process Automation, Intelligent Document Management]

-

Hydromea: [Underwater Wireless Communication Systems, Autonomous Underwater Drones]

-

Sentien Robotics: [Collaborative Robotic Systems, Industrial Automation Solutions]

-

Axon Enterprise, Inc: [TASER Devices, Body-Worn Cameras]

-

SSI Schäfer - Fritz Schäfer: [Automated Storage and Retrieval Systems, Warehouse Management Software]

-

Enswarm: [Collaborative Decision-Making Platform, Team Communication Tools]

Recent Developments:

-

2024 – Red Cat Holdings and Sentien Robotics announced a partnership to enhance multi-domain drone-swarming capabilities for defense applications. Their collaboration integrates AI-driven autonomous systems for coordinated operations across land, air, and sea.

-

2023 – EY and IBM launched an AI-powered solution aimed at enhancing productivity and efficiency in HR processes. The collaboration integrates advanced AI-driven automation to streamline workforce management, talent acquisition, and operational decision-making.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 36.53 Million |

| Market Size by 2032 | USD 689.34 Million |

| CAGR | CAGR of 38.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Model (Ant Colony Optimization, Particle Swarm Optimization, Others) • By Capability (Optimization, Clustering, Scheduling, Routing) • By Application (Robotics, Drones, Human Swarming) • By End-use (Transportation & Logistics, Robotics & Automation, Healthcare, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ConvergentAI, Inc, Robert Bosch GmbH, DoBots, Swarm Technology, Valutico, PowerBlox, Mobileye, Continental AG, Apium Swarm Robotics, Kim Technologies, Hydromea, Sentien Robotics, Axon Enterprise, Inc, SSI Schäfer - Fritz Schäfer, Enswarm |