AI In Asset Management Market Report Scope & Overview:

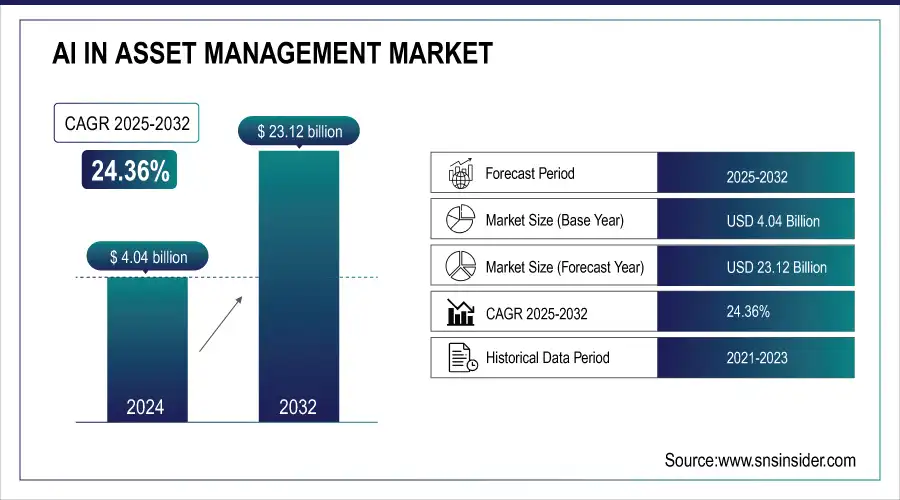

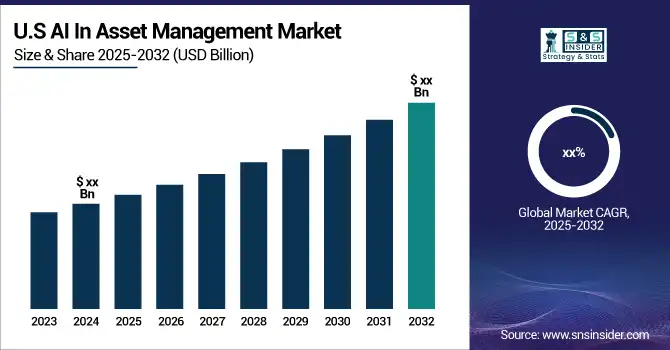

The AI In Asset Management Market was valued at USD 4.04 billion in 2024 and is expected to reach USD 23.12 billion by 2032, growing at a CAGR of 24.36% from 2025-2032.

To Get more information on AI In Asset Management Market - Request Free Sample Report

This report includes an analysis of adoption rates, investment and funding trends, cost-benefit factors, regulatory and compliance developments, and customer sentiment. The adoption of AI-driven solutions is rising as firms prioritize automation and data-driven decision-making, while investments and funding surge due to advancements in predictive analytics and risk management. Cost-benefit analysis highlights AI’s role in enhancing efficiency and reducing operational costs, while regulatory trends emphasize data security and ethical AI use. Customer sentiment remains positive, with growing trust in AI for portfolio management and asset optimization.

AI In Asset Management Market Size and Forecast:

-

Market Size in 2024: USD 4.04 Billion

-

Market Size by 2032: USD 23.12 Billion

-

CAGR: 24.36% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

AI In Asset Management Market Highlights:

-

AI-powered analytics enhance decision-making, optimize portfolios, predict market trends, and minimize investment risks.

-

Machine learning enables real-time data analysis, reducing human bias and improving investment accuracy.

-

High implementation costs, infrastructure demands, and skilled workforce shortages limit widespread AI adoption.

-

Continuous AI system updates and specialized expertise requirements increase operational and training expenses.

-

AI supports ESG investing by analyzing sustainability data, detecting greenwashing, and optimizing ethical investment decisions.

-

Growing demand for data-driven, transparent, and sustainable investment strategies drives market growth and competitive advantage.

AI In Asset Management Market Drivers:

-

AI-powered analytics revolutionize asset management by enhancing decision-making, optimizing portfolios, predicting market trends, and minimizing risks.

Artificial intelligence analytics are transforming the world of asset management by improving decision-making. Using machine learning and sophisticated data processing, AI is capable of discerning complex market patterns and trends that conventional approaches tend to miss. This allows asset managers to make better investment decisions, optimize portfolio allocations, and forecast market movements more accurately. Data analysis in real-time facilitates quick response to market changes, minimizing risks, and maximizing returns. Secondly, AI insights assist in reducing human bias, providing more objective and data-driven solutions. As financial markets become more complex, AI capability to analyze large volumes of information and create actionable intelligence is turning into an asset manager's game-changer to find a competitive advantage in an ever-changing investment environment.

AI In Asset Management Market Restraints:

-

High AI implementation costs, infrastructure demands, and skilled workforce shortages hinder adoption in asset management, limiting its widespread integration.

Implementation and integration of AI solutions into asset management require large amounts of financial investment, which becomes a hurdle for most companies. High expenses involved in sophisticated AI models, stable infrastructure, and trained experts are likely to force limitations on accessibility, especially for small asset management companies. The need for ongoing updates to AI systems also drives operational costs, deterring full-scale adoption. For most firms, balancing the advantages of AI with its cost scares them off at a slower rate. The requirement of specialized knowledge increases the complexity of implementation since companies have to incur costs for training or recruiting individuals with expertise in both AI and finance. Under-resourced organizations might not effectively utilize AI potential, postponing its integration in asset management planning.

AI In Asset Management Market Opportunities:

-

AI enhances ESG investing by analyzing sustainability data, improving transparency, detecting greenwashing, and optimizing sustainable investment decisions for asset managers.

AI is revolutionizing environmental, social, and governance (ESG) investing by facilitating more accurate analysis of sustainability data. Conventional ESG evaluation tends to depend on disjointed or unreliable sources of data, but AI-powered analytics can handle large volumes of structured and unstructured data such as company filings, news sentiment, and satellite imagery to reveal richer insights. This improves transparency, assists asset managers in locating high-potential sustainable investments, and enforces compliance with changing ESG regulations. AI’s ability to detect greenwashing misleading sustainability claims further strengthens investor confidence in ethical investments. As demand for responsible investing grows, AI-powered ESG strategies provide asset managers with a competitive edge, enabling them to align portfolios with long-term sustainability goals while optimizing financial performance.

AI In Asset Management Market Segment Analysis:

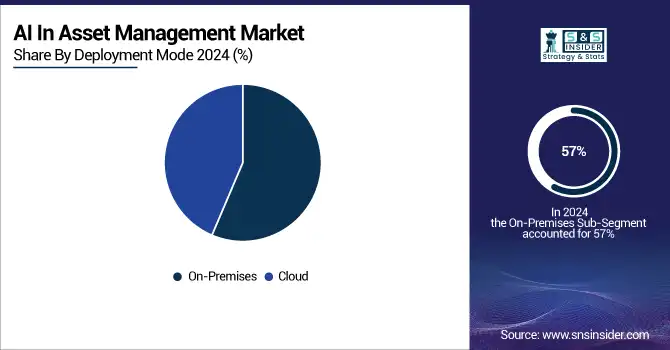

By Deployment Mode

The On-Premises segment led the AI in Asset Management Market with the largest revenue share of around 57% in 2024. The demand for stronger data security, compliance, and complete control over sensitive financial data fuels the growth. Financial institutions and asset management companies favor on-premises AI to prevent cybersecurity threats and guarantee adherence to stringent data protection policies. Moreover, on-premises infrastructure supports tailorable AI models, providing smoother integration with mature systems and greater performance optimization in sophisticated investment programs.

The Cloud segment is predicted to grow with the fastest CAGR of 25.96% from 2025 to 2032. The growing adoption of scalable, affordable, and adaptable AI technology drives it. Cloud-based AI supports real-time processing of data, easy integration with sophisticated analytics platforms, and remote access, which makes it the perfect choice for contemporary asset managers. Furthermore, advancements in cloud security and compliance platforms are nudging financial institutions to implement cloud AI solutions, driving the segment's growth over the next few years.

By Application

The Process Automation segment led the AI in Asset Management Market with the largest revenue share of nearly 29% in 2024. This is attributed to the growing demand for asset management operations efficiency, minimizing human errors, and increasing workflow automation. Automation with AI reduces redundant processes like trade processing, portfolio rebalancing, and compliance monitoring, which results in high cost savings and operational precision. Financial institutions depend on process automation to maximize resource utilization, enhance decision-making pace, and maximize overall investment management performance.

The Data Analysis segment is anticipated to grow at the fastest CAGR of 27.07% over 2025-2032. This increased growth is driven by the growing significance of AI-driven insights for informed investment decisions. Asset managers increasingly rely on AI-based data analytics to study market patterns, forecast investment risks, and maximize portfolio returns. The expanding use of big data and machine learning in making financial decisions and rising demand for real-time analysis are fueling the growth of this segment.

By Technology

The Machine Learning segment dominated the AI in Asset Management Market with the highest revenue share of about 61% in 2023. This dominance is driven by its ability to analyze vast datasets, identify market patterns, and enhance predictive analytics for investment strategies. Machine learning algorithms enable asset managers to optimize portfolio management, automate risk assessment, and improve decision-making accuracy. The increasing reliance on AI-driven quantitative analysis, fraud detection, and algorithmic trading further solidifies machine learning’s leadership in transforming asset management operations.

The Natural Language Processing (NLP) segment is expected to grow at the fastest CAGR of about 26.03% from 2024 to 2032. This rapid growth is fueled by the increasing need for AI-driven sentiment analysis, automated report generation, and real-time processing of financial news. NLP enhances investment decision-making by analyzing unstructured data from news sources, earnings reports, and market sentiments. As asset managers seek deeper insights from textual data, the demand for NLP solutions in financial analysis and risk assessment continues to rise.

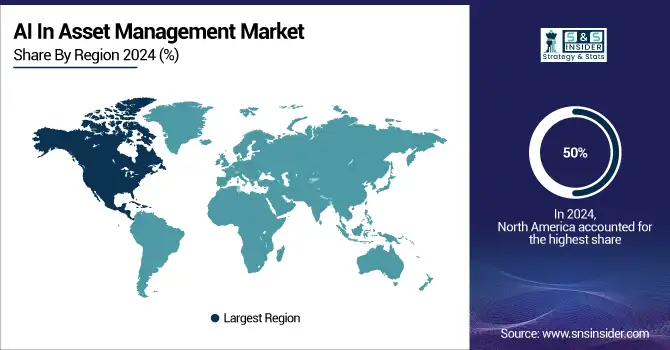

AI In Asset Management Market Regional Analysis:

North America AI In Asset Management Market Trends:

North America dominated the AI in Asset Management Market with the highest revenue share of about 50% in 2024. This dominance is driven by the strong presence of leading financial institutions, early adoption of AI technologies, and a well-established regulatory framework supporting AI integration. The region's advanced infrastructure, high investment in AI-driven financial services, and increasing demand for automation in asset management contribute to its leadership. Additionally, the growing use of machine learning and predictive analytics in portfolio management strengthens North America’s position.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific AI In Asset Management Market Trends:

Asia Pacific is expected to grow at the fastest CAGR of about 27.11% from 2025 to 2032. This rapid growth is fueled by the rising adoption of AI in financial services, increasing digital transformation, and expanding asset management firms in emerging economies. Countries like China, India, and Japan are investing heavily in AI-powered financial technologies to enhance investment strategies and risk management. Additionally, the growing number of retail investors and the shift toward cloud-based AI solutions drive the market expansion in the region.

Europe AI in Asset Management Market Trends:

Europe is witnessing steady growth in AI adoption within asset management, driven by stringent regulatory frameworks, advanced technological infrastructure, and increasing focus on data-driven investment strategies. Countries like the UK, Germany, and France are investing in AI-powered tools for portfolio optimization, risk management, and compliance automation. Additionally, collaboration between fintech startups and established financial institutions is accelerating innovation and enhancing efficiency in the region.

Latin America AI in Asset Management Market Trends:

Latin America is showing moderate growth in AI adoption for asset management, fueled by the digitalization of financial services, expanding fintech ecosystems, and increasing interest from retail and institutional investors. Brazil, Mexico, and Chile are key markets where AI technologies are being implemented for risk assessment, portfolio management, and algorithmic trading. Rising demand for efficient financial decision-making tools and cloud-based AI platforms is further supporting market growth.

Middle East & Africa (MEA) AI in Asset Management Market Trends:

The MEA region is gradually adopting AI in asset management, with growth supported by government initiatives, digital transformation strategies, and increasing investments in financial technologies. The presence of emerging fintech hubs in the UAE, Saudi Arabia, and South Africa drives innovation in AI-powered investment solutions. Furthermore, the region’s focus on wealth management, automation, and predictive analytics is boosting the AI market adoption.

AI In Asset Management Market Key Players:

-

Amazon Web Services, Inc. (Amazon SageMaker, AWS AI Services)

-

BlackRock, Inc. (Aladdin, FutureAdvisor)

-

CapitalG (Investments in AI-focused companies, Strategic AI partnerships)

-

Charles Schwab & Co., Inc. (Schwab Intelligent Portfolios, AI-driven financial advice tools)

-

Genpact (Cora Finance Analytics, AI-powered asset management solutions)

-

Infosys Limited (Infosys Nia, AI-driven financial services solutions)

-

International Business Machines Corporation (IBM Watson, IBM Cloud Pak for Data)

-

IPsoft Inc. (Amelia, 1Desk)

-

Lexalytics (Salience, Lexalytics Intelligence Platform)

-

Microsoft (Azure AI, Microsoft Power BI)

-

TABLEAU SOFTWARE, LLC (Tableau Desktop, Tableau Server)

-

Next IT Corp. (Alme, AI-powered virtual assistants)

-

S&P Global (Market Intelligence Platform, Kensho AI)

-

Salesforce, Inc. (Einstein Analytics, AI-driven CRM solutions)

-

FIS (FIS Asset Management Solutions, FIS Data Integrity Manager)

-

ION Group (ION Treasury, ION Analytics)

-

Synechron (Neo AI Platform, AI Data Science Accelerators)

-

SAP SE (SAP Cash Application, SAP Leonardo)

-

HighRadius (Autonomous Receivables, AI-powered Treasury Management)

-

Axyon AI (Axyon IRIS, AI Investment Strategies)

-

Upstart (AI-powered Lending Platform, Upstart Auto Retail)

-

Capgemini SE (AI in Wealth Management Solutions, AI-powered Financial Services)

-

BayCurrent Inc. (AI Consulting Services, AI-driven Financial Solutions)

-

MGX Fund Management Limited (AI Investment Fund, Global AI Infrastructure Investment Partnership)

AI In Asset Management Market Competitive Landscape:

Amazon Web Services (AWS) Founded in 2006 is a leading cloud computing subsidiary of Amazon. It provides on-demand infrastructure, storage, databases, analytics, AI, and machine learning solutions to businesses globally. AWS enables enterprises to scale operations efficiently, drive innovation, and accelerate digital transformation across industries, supporting startups, SMEs, and large organizations with secure and reliable cloud services.

-

2025: AWS is expanding its AI efforts in asset management and financial services, working with firms like JPMorgan and Bridgewater. The company is investing heavily in AI-powered security, governance, and compliance tools while improving generative AI reliability through AWS Bedrock.

IBM (International Business Machines Corporation) Founded in 1911is a global technology and consulting company. It offers cloud computing, AI, blockchain, data analytics, and enterprise software solutions. IBM helps businesses enhance operational efficiency, drive innovation, and implement digital transformation strategies across industries, serving large enterprises, governments, and technology partners worldwide.

-

In 2025, IBM focuses on AI-powered automation to achieve sustainability goals in asset management. AI-driven observability, resource management, and lifecycle management will help optimize energy consumption, reduce data center strain, and enhance asset performance.

SAP Founded in 1972 is a global enterprise software company headquartered in Germany. It provides solutions for ERP, cloud computing, analytics, AI, and supply chain management. SAP helps organizations optimize business processes, improve efficiency, and drive digital transformation across industries, serving enterprises of all sizes worldwide with integrated, scalable software solutions.

-

In 2024, SAP integrated AI and IoT into its Intelligent Asset Management solutions, enhancing predictive maintenance, resource optimization, and sustainability. The platform now enables proactive asset decision-making through a unified data thread, reducing downtime and improving efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.04 Billion |

| Market Size by 2032 | USD 23.12 Billion |

| CAGR | CAGR of 24.36% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 205-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Machine Learning, Natural Language Processing (NLP), Others) • By Deployment Mode (On-Premises, Cloud) • By Application (Portfolio Optimization, Conversational Platform, Risk & Compliance, Data Analysis, Process Automation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., BlackRock, Inc., CapitalG, Charles Schwab & Co., Inc., Genpact, Infosys Limited, International Business Machines Corporation, IPsoft Inc., Lexalytics, Microsoft, TABLEAU SOFTWARE, LLC, Next IT Corp., S&P Global, Salesforce, Inc., FIS, ION Group, Synechron, SAP SE, HighRadius, Axyon AI, Upstart, Capgemini SE, BayCurrent Inc., MGX Fund Management Limited |