AI Server Market Report Scope & Overview:

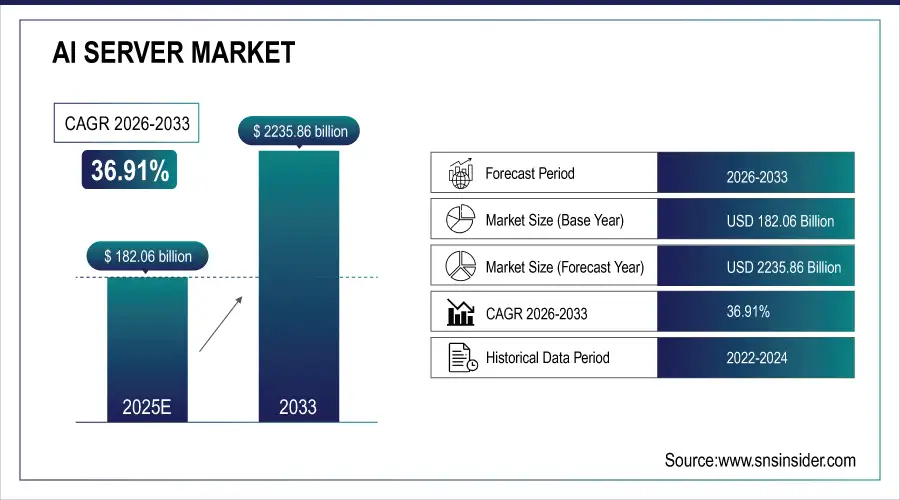

The AI Server Market was valued at USD 182.06 billion in 2025E and is expected to reach USD 2235.86 billion by 2033, growing at a CAGR of 36.91% from 2026-2033.

The AI Server Market is witnessing rapid growth due to surging demand for high-performance computing to support AI, machine learning, and deep learning applications across industries. Increasing adoption of cloud-based AI services, big data analytics, and autonomous technologies is driving the need for powerful, scalable server infrastructure. Advancements in GPU and CPU technologies, coupled with expanding investments in data centers and AI research, are further accelerating market growth, enabling faster processing, real-time insights, and enhanced operational efficiency.

In 2024, over 40% of Fortune 500 companies deployed dedicated AI servers, fueling a 30% increase in data center AI infrastructure spend; GPU-based servers now handle more than 75% of training workloads for large-scale AI models worldwide.

AI Server Market Size and Forecast

-

Market Size in 2025E: USD 182.06 Billion

-

Market Size by 2033: USD 2235.86 Billion

-

CAGR: 36.91% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on AI Server Market - Request Free Sample Report

AI Server Market Trends

-

Rising adoption of AI servers driven by increasing deployment of machine learning and deep learning workloads

-

Growing demand for GPU-accelerated servers to enhance high-performance computing and AI model training efficiency

-

Expansion of edge AI servers enabling real-time analytics and low-latency processing across industries globally

-

Integration of AI servers with cloud infrastructure to support scalable, flexible, and multi-tenant enterprise deployments

-

Increasing focus on energy-efficient and liquid-cooled AI servers to reduce operational costs and environmental impact

-

Rising investments in AI server solutions for autonomous vehicles, robotics, and smart manufacturing applications

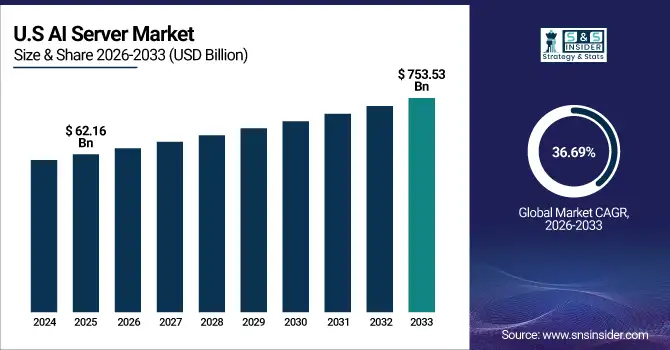

U.S. AI Server Market was valued at USD 62.16 billion in 2025E and is expected to reach USD 753.53 billion by 2033, growing at a CAGR of 36.69% from 2026-2033.

Growth in the U.S. AI Server Market is driven by increasing adoption of AI, machine learning, and big data analytics across enterprises. Rising demand for high-performance computing, cloud-based AI services, and advanced GPU/CPU technologies is fueling investments in scalable, efficient server infrastructure.

AI Server Market Growth Drivers:

-

Rapid growth of artificial intelligence applications across industries is driving demand for high-performance AI servers and computing infrastructure

The widespread adoption of AI technologies in sectors like healthcare, finance, automotive, and manufacturing is significantly increasing the need for robust computing infrastructure. AI servers capable of handling intensive computations, real-time analytics, and large-scale data processing are essential to support these applications. Organizations are investing in high-performance servers to accelerate AI model training, improve prediction accuracy, and enhance operational efficiency. The growing reliance on AI for decision-making, automation, and intelligent insights is a key factor fueling demand for advanced AI server solutions globally.

In 2024, over 60% of Fortune 500 companies deployed dedicated AI servers, driving a 38% year-over-year rise in high-performance computing infrastructure investments to support real-time analytics and large-scale model training.

-

Increasing adoption of machine learning, deep learning, and data analytics requires powerful servers capable of handling large-scale AI workloads efficiently

Machine learning, deep learning, and advanced data analytics involve processing massive datasets and performing complex computations. This drives the demand for AI servers with high processing power, advanced GPUs, and optimized architectures to handle such workloads efficiently. Industries are deploying these servers in research, cloud platforms, and enterprise AI applications to accelerate training, reduce latency, and enhance model performance. As data volumes continue to grow exponentially, organizations increasingly rely on specialized AI servers to ensure scalability, speed, and reliability in executing large-scale AI workloads.

AI server compute capacity grew by 40% in 2024, with over 60% of cloud providers expanding GPU-based infrastructure; by 2025, 75% of large-scale AI models will rely on purpose-built servers for training and deployment.

AI Server Market Restraints:

-

High procurement and maintenance costs of AI servers limit adoption, especially among small and medium enterprises with budget constraints

AI servers require significant capital investment for hardware, storage, and networking components, making them expensive for small and medium enterprises (SMEs). Maintenance, upgrades, and ongoing operational costs further increase the financial burden. Many organizations find it challenging to justify such high expenditures, particularly when scaling AI workloads. These cost constraints limit adoption in price-sensitive markets and slow overall market growth. Vendors need to offer flexible pricing models, cloud-based alternatives, or leasing solutions to enable wider deployment across SMEs and emerging businesses.

AI server deployment costs average USD150,000–USD250,000 per unit; over 65% of SMEs cite upfront expenses as a primary barrier, and 58% lack budget for necessary upgrades or maintenance, slowing AI adoption in cost-sensitive markets.

-

Limited availability of skilled AI infrastructure professionals hinders effective deployment, management, and optimization of AI server systems

The deployment and management of AI servers demand specialized skills in machine learning infrastructure, server architecture, and data engineering. A shortage of trained professionals slows implementation, reduces operational efficiency, and increases reliance on third-party support. Companies may struggle to optimize AI workloads, maintain system reliability, and leverage full server capabilities. This talent gap creates a barrier to adoption, particularly for enterprises new to AI infrastructure. Training programs, partnerships, and managed services are critical to overcoming workforce limitations and enabling broader AI server market growth.Top of Form

As of 2024, 72% of enterprises report a critical shortage of AI infrastructure talent, with 65% experiencing delayed AI deployments; 58% rely heavily on third-party vendors for server management and optimization.

AI Server Market Opportunities:

-

Expansion of cloud computing and data centers provides opportunities for AI server deployment to handle large-scale AI workloads efficiently

The rapid growth of cloud computing and hyperscale data centers is driving demand for AI servers capable of managing massive AI and machine learning workloads. Businesses and cloud providers require high-performance servers to support training, inference, and analytics at scale. AI server deployment in these environments ensures efficient resource utilization, reduced latency, and scalability for enterprise applications. This trend opens significant opportunities for server manufacturers to provide optimized hardware, integrated software solutions, and energy-efficient designs tailored for large-scale AI operations.

AI servers now represent nearly 25% of total data center infrastructure spending globally; over 70% of new hyperscale facilities deployed in 2024 are optimized specifically for AI training and inference workloads.

-

Rising investments in autonomous vehicles, robotics, and smart manufacturing drive the need for specialized AI servers with low-latency processing

The increasing adoption of autonomous vehicles, industrial robots, and smart manufacturing systems demands real-time data processing and decision-making capabilities. Low-latency AI servers are essential to handle complex computations, machine learning algorithms, and sensor data in milliseconds. Companies investing in these technologies require high-performance, reliable AI servers to ensure operational safety, efficiency, and productivity. This creates substantial growth opportunities for AI server providers to develop specialized hardware, edge computing solutions, and optimized architectures that meet the stringent performance requirements of autonomous and industrial AI applications.

Global AI server shipments for autonomous systems and smart manufacturing reached 2.1 million units in 2024, with low-latency AI server demand projected to grow 32% annually through 2025.

AI Server Market Segment Highlights

-

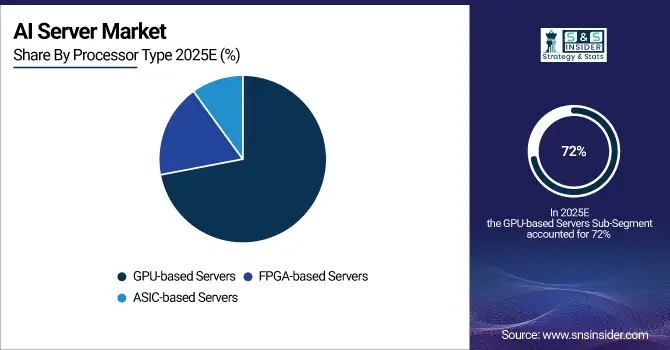

By Processor Type: In 2025, GPU-based Servers led the AI Server Market with 72% share and is also the fastest-growing segment (2026–2033)

-

By Cooling Technology: In 2025, Air Cooling led the market with 53% share, while Liquid Cooling is the fastest-growing segment (2026–2033)

-

By Form Factor: In 2025, Rack-mounted Servers led the market with 81% share and is also the fastest-growing segment (2026–2033)

-

By End Use: In 2025, IT & Telecommunication led the market with 34% share, while Automotive is the fastest-growing segment (2026–2033)

AI Server Market Segment Analysis

By Processor Type, GPU-based Servers segment led in 2025; GPU-based Servers segment expected fastest growth

GPU-based Servers segment dominated the AI Server Market with the highest revenue share of about 72% in 2025 and is expected to grow at the fastest CAGR from 2026-2033 due to their superior parallel processing capabilities, high computational power, and efficiency in handling AI workloads such as deep learning, machine learning, and data analytics. Increasing adoption of AI applications across industries, cloud computing expansion, and rising demand for accelerated AI model training continue to drive both dominance and rapid growth of GPU-based server solutions globally.

By Cooling Technology, Air Cooling segment led in 2025; Liquid Cooling segment expected fastest growth

Air Cooling segment dominated the AI Server Market with the highest revenue share of about 53% in 2025 due to its cost-effectiveness, simplicity, and widespread adoption in existing data centers for maintaining optimal server temperatures.

Liquid Cooling segment is expected to grow at the fastest CAGR from 2026-2033 owing to superior heat dissipation, energy efficiency, and suitability for high-performance AI workloads that generate significant thermal output, making it ideal for next-generation server infrastructure.

By Form Factor, Rack-mounted Servers segment led in 2025; Rack-mounted Servers segment expected fastest growth

Rack-mounted Servers segment dominated the AI Server Market with the highest revenue share of about 81% in 2025 and is expected to grow at the fastest CAGR from 2026-2033 because they offer space optimization, ease of scalability, and centralized management for high-density computing environments. Their compatibility with advanced cooling systems and integration into enterprise and hyperscale data centers ensures efficient handling of AI workloads, driving both market dominance and rapid adoption across diverse industries investing in AI infrastructure.

By End Use, IT & Telecommunication segment led in 2025; Automotive segment expected fastest growth

IT & Telecommunication segment dominated the AI Server Market with the highest revenue share of about 34% in 2025 due to high demand for AI-driven network optimization, cloud services, and large-scale data processing.

Automotive segment is expected to grow at the fastest CAGR from 2026-2033 owing to increasing deployment of AI for autonomous driving, connected vehicles, and advanced driver-assistance systems (ADAS), driving demand for high-performance AI server infrastructure in the automotive industry.

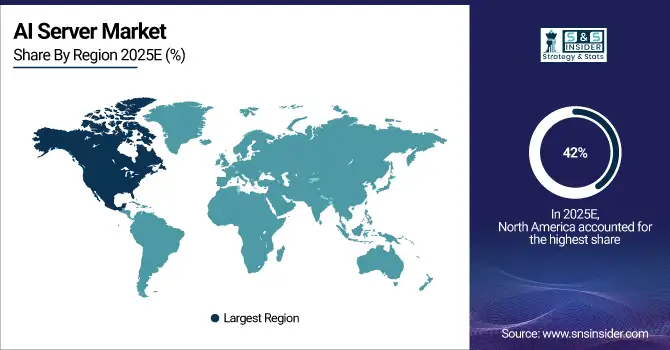

AI Server Market Regional Analysis

North America AI Server Market Insights

North America dominated the AI Server Market with a 42% share in 2025 due to advanced data center infrastructure, high adoption of AI technologies across enterprises, and strong presence of leading server manufacturers. Significant investments in cloud computing, machine learning, and deep learning applications further reinforced the region’s leadership in AI server deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific AI Server Market Insights

Asia Pacific is expected to grow at the fastest CAGR of about 39.06% from 2026–2033, driven by rapid digital transformation, increasing AI adoption across industries, and expanding cloud infrastructure. Growing investments in smart cities, IoT, and high-performance computing, along with rising demand for AI-powered analytics and enterprise solutions, are accelerating the region’s market growth.

Europe AI Server Market Insights

Europe held a significant share in the AI Server Market in 2025, supported by its advanced IT infrastructure, strong enterprise adoption of AI and machine learning technologies, and presence of leading server manufacturers. Growing investments in data centers, cloud computing, and AI-driven industrial applications further strengthened Europe’s position in the market.

Middle East & Africa and Latin America AI Server Market Insights

The Middle East & Africa and Latin America together showed steady growth in the AI Server Market in 2025, driven by increasing adoption of AI technologies across industries, rising investments in cloud and data center infrastructure, and growing digitalization initiatives. Expanding enterprise AI projects and government support for technology development further strengthened the regions’ market presence.

AI Server Market Competitive Landscape:

Oracle Corporation

Oracle Corporation, headquartered in Redwood Shores, California, is a leading global technology company providing cloud infrastructure, software, and hardware solutions. In the AI server market, Oracle offers high-performance computing platforms, cloud-based AI training and inference solutions, and optimized storage and networking for AI workloads. Its servers support enterprise-scale AI applications, machine learning models, and big data analytics. With strong R&D capabilities and global enterprise adoption, Oracle is a key player driving AI infrastructure innovation worldwide.

-

2025, Oracle and NVIDIA launched a deeper integration: NVIDIA AI Enterprise is now available natively on OCI, along with GB200 NVL72 systems for large-scale AI inference

Amazon Web Services (AWS)

Amazon Web Services (AWS) is a subsidiary of Amazon.com, headquartered in Seattle, Washington, and a global leader in cloud computing services. AWS provides AI servers and high-performance computing solutions through its cloud platform, supporting machine learning, deep learning, and large-scale AI inference workloads. Its EC2 instances, GPU-accelerated solutions, and scalable infrastructure enable enterprises and researchers to deploy AI applications efficiently. AWS’s broad global presence and continuous innovation make it a major force in AI server and cloud infrastructure markets.

-

2025, AWS announced a multi-year, USD38 billion deal with OpenAI to provide large-scale GPU infrastructure, including EC2 Ultra Servers, for training and inference.

Microsoft Corporation

Microsoft Corporation, headquartered in Redmond, Washington, is a multinational technology company providing software, hardware, and cloud services. In AI servers, Microsoft leverages Azure cloud infrastructure with GPU-accelerated servers, high-performance computing clusters, and AI-focused solutions for enterprises. Its platforms support machine learning, AI model training, and inference applications across industries. Microsoft combines software expertise with powerful server infrastructure, enabling scalable and efficient AI workloads. Azure AI and its global network of data centers position Microsoft as a leading AI infrastructure provider.

-

2025, Microsoft and NVIDIA announced integration of NVIDIA Blackwell GPUs and NIM microservices into Azure AI Foundry, making it easier to deploy generative AI applications.

Cerebras Systems

Cerebras Systems, based in Los Altos, California, is a pioneer in AI-focused hardware, designing specialized AI servers and wafer-scale processors for high-performance computing. Its products, including the Cerebras Wafer Scale Engine, accelerate deep learning model training and inference at massive scales. Cerebras servers are used by research institutions, AI startups, and large enterprises for complex AI workloads. The company emphasizes efficiency, speed, and scalability, positioning itself as a key innovator in the AI server market and high-performance AI computing ecosystem.

-

2025, Cerebras launched six new AI inference datacenters across North America and Europe, powered by its CS‑3 systems to scale inference capacity by 20×.

Key Players

Some of the AI Server Market Companies

-

Nvidia Corporation

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

IBM Corporation

-

Inspur Systems

-

Lenovo Group Limited

-

Super Micro Computer, Inc. (Supermicro)

-

Huawei Technologies

-

Fujitsu Limited

-

Cisco Systems, Inc.

-

H3C Technologies

-

ADLINK Technology

-

Lambda Labs

-

GIGABYTE Technology

-

PhoenixNAP

-

AIME

-

Oracle Corporation

-

Amazon Web Services (AWS)

-

Microsoft Corporation

-

Cerebras Systems

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 182.06 Billion |

| Market Size by 2033 | USD 2235.86 Billion |

| CAGR | CAGR of 36.91% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Processor Type (GPU-based Servers, FPGA-based Servers, ASIC-based Servers) • By Cooling Technology (Air Cooling, Liquid Cooling, Hybrid Cooling) • By Form Factor (Rack-mounted Servers, Blade Servers, Tower Servers) • By End Use (IT & Telecommunication, BFSI, Retail & E-commerce, Healthcare & Pharmaceutical, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Nvidia Corporation, Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, Inspur Systems, Lenovo Group Limited, Super Micro Computer Inc. (Supermicro), Huawei Technologies Co. Ltd., Fujitsu Limited, Cisco Systems Inc., H3C Technologies, ADLINK Technology Inc., Lambda Labs, GIGABYTE Technology, PhoenixNAP, AIME (Advanced Intelligent Machines), Oracle Corporation, Amazon Web Services (AWS), Microsoft Corporation, Cerebras Systems |