Air Fryer Market Report Scope & Overview:

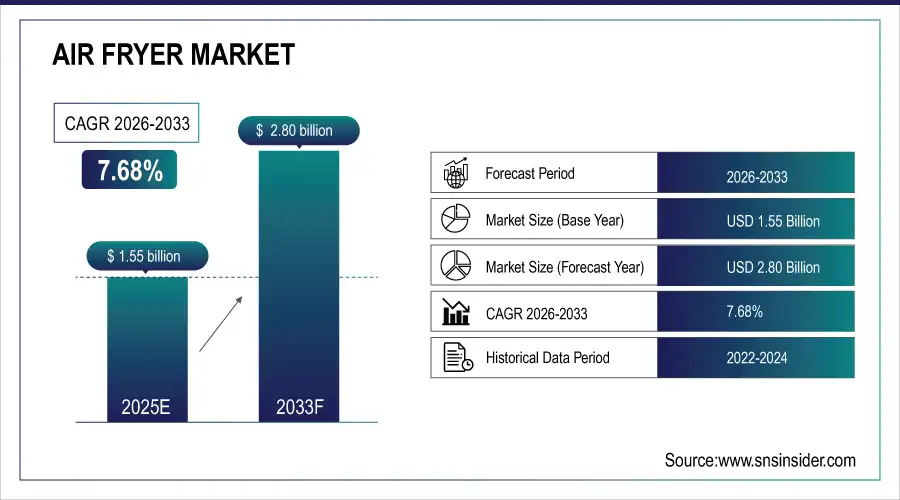

The Air Fryer Market was valued at USD 1.55 Billion in 2025E and is projected to reach USD 2.80 Billion by 2033, growing at a CAGR of 7.68% during the forecast period 2026–2033.

The Air Fryer Market analysis provides comprehensive data which enhances the understanding, scope and application of this report. It splits the market by type, by capacity, by application, by distribution channel and by region. Increasing consumption of easy and healthy cooking to grow market.

Over 12 million air fryers were sold globally in 2025, driven by rising consumer demand for convenient and healthy cooking appliances.

Market Size and Forecast:

-

Market Size in 2025: USD 1.55 Billion

-

Market Size by 2033: USD 2.80 Billion

-

CAGR: 7.68% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Air Fryer Market - Request Free Sample Report

Air Fryer Market Trends:

-

Increasing health awareness and preference for “less-oil” alternatives are creating a shift toward air fryers globally in households and the food service industry.

-

Rising-unit web-remote and digital cooking are adding convenience, safety, energy savings; driving purchase.

-

Growing accessibility through proliferation of online retail channels and e-commerce portals, particularly in the emerging markets.

-

The product innovation, which includes multi-purpose air fryers with the ability to bake, grill and roast is expanding application and consumer coverage support for digestion.

-

Emergence of urbanization, high-paced lifestyle and inclination toward convenient cooking options are promoting market prospects globally.

U.S. Air Fryer Market Insights:

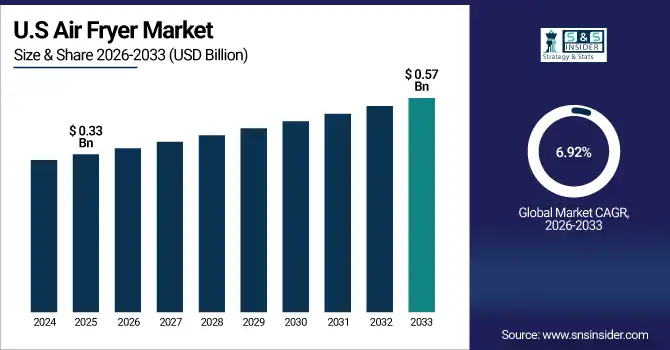

The U.S. Air Fryer Market is projected to grow from USD 0.33 Billion in 2025E to USD 0.57 Billion by 2033 at a CAGR of 6.92%. Led by digital air fryers, the market is driven by increasing health consciousness, low oil cooking preference, smart appliances penetration and robust retail and e-commerce infrastructure.

Air Fryer Market Growth Drivers:

-

Rising consumer preference for healthy, low-oil cooking solutions is accelerating air fryer adoption globally.

Demand for healthier, low-oil cooking solutions is fueling Air Fryer Market growth, driven by increasing consumer health awareness and convenience. The Air fryer had a massive shipment of more than 12 million units by 2025, gaining popularity in North America, Europe, and Asia-Pacific. The U.S, Germany and China are seeing high levels of household penetration. On the other hand, with digital and multi-functional air fryers innovation in full swing, it is assisting market growth and product upgrades.

Rising health awareness and demand for convenient cooking appliances contributed to air fryer sales of over 12 million units in 2025, driven by household and commercial adoption.

Air Fryer Market Restraints:

-

High product prices and limited consumer awareness are constraining widespread adoption of air fryers globally.

The Air Fryer Market is constrained by high product prices and low consumer awareness. 40% of the latent emerging market household purchase air fryers in 2025 due to that they found them too expensive and were not aware of their existence. Smaller vendors have a hard time competing against such established brands with features and economies of scale. Inconsistent marketing, competing energy-efficiency ratings and limited availability in rural areas have also hampered wider adoption, even as consumers increasingly express interest in easy and healthful cooking appliances.

Air Fryer Market Opportunities:

-

Growing demand for smart, multi-functional, and energy-efficient air fryers presents lucrative opportunities for product innovation.

Rising preference for smart and multifunctional air fryers are being observed in the market. More than 12 million cars were sold globally in 2025, with sales projected to reach over 22 million units by 2033. Busy families and eating establishments are looking for easy, criteria-effective, green options for cooking. Technological advances such as digital controls, app connectivity and multi-cooking features are rendering air fryers a more appealing, lucrative product for manufacturers and retailers.

Smart and multi-functional air fryers accounted for over 35% of new air fryer sales in 2025, driven by household and commercial adoption.

Air Fryer Market Segmentation Analysis:

-

By Product Type, Digital Air Fryers held the largest market share of 42.75% in 2025, while Smart Air Fryers are expected to grow at the fastest CAGR of 9.14%.

-

By Capacity, 3–5 L segment dominated with a 39.47% share in 2025, while 1–2 L air fryers are projected to expand at the fastest CAGR of 8.97%.

-

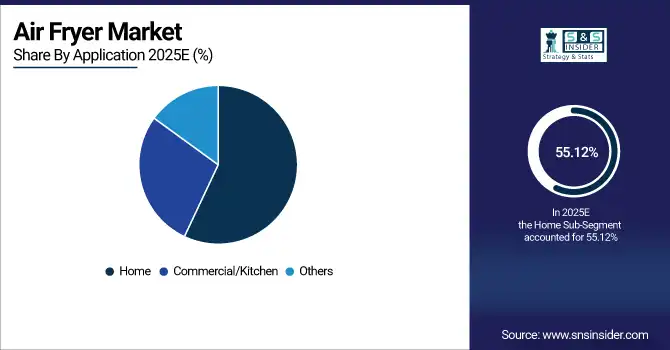

By Application, Home accounted for the highest market share of 55.12% in 2025, and Commercial/Kitchen is projected to record the fastest CAGR of 9.38%.

-

By Distribution Channel, Online Retail dominated with a 48.36% share in 2025, while Specialty Stores are projected to record the fastest CAGR of 9.22%.

By Product Type, Digital Air Fryers Dominates While Smart Air Fryers Expand Rapidly:

Digital Air Fryers sector dominated the Product Type segment in 2025 by selling more than 5.2 million units owing to its cost effective, consumer friendly and easy low-oil cooking product variant. These two leading units are supported by significant presence in North America and Europe. Smart Air Fryers is the fastest-growing Product Type segment, which scanned 2.1 million units in 2025 thanks to IoT-device features, app-control and multitasking. The growth of Smart Air Fryers illustrates diverging market trends in maturity versus innovation-based categories.

By Capacity, 3–5 L Dominates While 1–2 L Expands Rapidly:

The 3–5 L sector dominated the Capacity segment, with more than 4.8 million units sold in 2025 catering to home and light commercial requirements. This supremacy is based on versatility, cooking capacity and a focused brand in developed markets. The 1–2 L sector is fastest growing Capacity segment, reaching 2.7 million units sold in 2025 due to compact kitchens and urban households. The fact that a dominant mid-range is able live with the fastest-growing compact highlights the variety of consumer needs in markets and people’s lives.

By Application, Home Dominates While Commercial/Kitchen Expands Rapidly:

Home sector dominated the Application segments with more than 6.5 million units sold in 2025, driven by health awareness, convenience, and energy efficiency. Consumers prefer air fryers for daily cooking, reinforcing home dominance. Commercial/Kitchen sector is the fastest-growing Application segment, with over 2.4 million units estimated for sale in 2025 based on restaurants and catering services requiring effective appliances. This is a tale that says that, though home application leads in total volume, the industry's highest due to the trend impact of this China commercial air fryer product.

By Distribution Channel, Online Retail Dominates While Specialty Stores Expand Rapidly:

Online retail sector dominated by Distribution Channel with 5.8 million units sold in 2025 supported by e-commerce penetration, product range and home delivery. Specialty stores sector is the fastest growing Distribution Channel segment, with 2.3 million units in 2025; however, Suite of features such as In-Store Demo and Drive Instant Purchase is driving its growth momentum. The prominence of online sales alongside the fastest-growing specialty store channel indicates that while convenience drives adoption, experiential retail is gaining traction for shoppers seeking guidance and brand assurance.

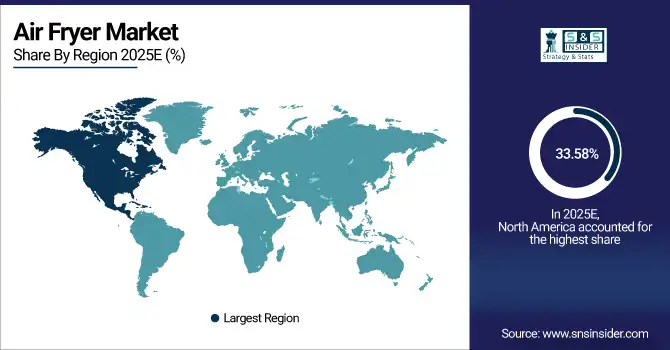

Air Fryer Market Regional Analysis:

North America Air Fryer Market Insights:

North America dominated with the share of 33.58% of the Air Fryer Market in 2025. It is driven by strong health consciousness, propensity for low oil cooking and increasing adoption of smart kitchen appliances. The area enjoys developed retail networks, strong e-commerce adoption and high consumer spending. Growth is led by the U.S. and Canada with product innovation and longer household appliance replacement cycles supporting demand.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Air Fryer Market Insights:

The U.S. purchased over 5.2 million air fryers in 2025, comprising 3.1 million digital air fryers for home use and another 2.1 million smart or multifunctional models for both home and commercial kitchens. The growth is attributed to increased health consciousness and preference for low-oil cooking, increasing urban household penetration and wider online and offline distribution.

Asia-Pacific Air Fryer Market Insights:

Asia-Pacific is the fastest growing region in the Air Fryer Market and it is projected to grow at a CAGR of 9.02% owing to urbanization, disposable income levels and demand for healthy cooking appliances. In 2025, China sold 4.1 million units, India sold 2.3 million units and Southeast Asia, sold 1.2 million units. Increasing household adoption, e-commerce penetration and encouraging trends depicted by smart, compact and multifunctional air fryers throughout the emerging economies will complement industry landscape.

-

China Air Fryer Market Insights:

China, more than 4.1 air fryers were sold in 2025 that include 2.5 million of digital for household use and about 1.6 million smart/ multifunction for home and commercial use. The demand is driven by growing health awareness, urbanization, rising disposable incomes and an improving network of e-commerce and retail across the country.

Europe Air Fryer Market Insights:

Europe air fryer market for 2025 in terms of volume, with Germany accounting for around 1.4 million units, followed by France (1.1 million) and Italy (0.9 million). Most of the use came from homes, but small commercial kitchens played a substantial part. Growing demand will be supported by increased health consciousness among consumers, greater demand for low oil cooking solutions, growing penetration of smart kitchen appliances and robust retail and e-commerce networks in major countries.

-

Germany Air Fryer Market Insights:

Germany shipped 1.4 million air fryers in 2025, including over 0.9 million digitals for household and over 0.5 million smart/multifunctional for home/small commercial kitchen use. Digital air fryers were all over the market. Growing health consciousness, uptake of energy-efficient appliances and a robust retail and e-commerce network are pushing growth across the country.

Latin America Air Fryer Market Insights:

Latin America sold over 1.5 million air fryers in 2025, of which Brazil accounted for 51%, Argentina 32%, and Colombia 17%. Domestic use prevailed with a strong contribution from small commercial kitchens. "Health consciousness, increasing urban household numbers, growing e-commerce and demand for energy-efficient and multi-functional appliances is leading to the growth in the market among nations.

Middle East and Africa Air Fryer Market Insights:

Middle East & Africa air fryer market exceeded 0.7 million units in 2025 with UAE contributing over 0.28 million and South Africa was over 0.18 million units. Household adoption was prevailing with increased commercial use. The market is driven by a growing health consciousness, rise in disposable incomes and availability of products at retail and ecommerce stores in key countries.

Air Fryer Market Competitive Landscape:

Philips, Netherlands-based, dominated the Air Fryer Market with over 2.1 million units sold in 2025. The company leadership is inspired by advanced digital, & energy efficient design concepts and it has also strong DISTRIBUTION network of smart kitchen appliances products. Philip’s adaptable low-oil cooking alternative, reliability and innovation to provide ease in healthy living has made the Philips someone to count on in millions of homes globally keeping a strong hold on both mature markets and emerging markets.

-

In February 2025, Philips launched an improved design with increased cooking capacity the Airfryer 3000 series, aimed at home chefs of the future. This model's focus on versatility and simplicity mirrors Philips' dedication to innovative home-cooking tools.

Ninja, a US-based company, came top with 1.6 million units sold in 2025, selling app-enabled air fryers that could serve multiple purposes for home and small commercial kitchens. They secure the market from innovations, premium designs and good retail and ecommerce surroundings. Thanks to its every aspect-centric focus on convenience, greenness, and multiple cooking requirements, Ninja is the undisputed world leader in the air fryer market.

-

In March 2025, Ninja grew its arsenal of kitchen gadgets with the Air Fryer Pro 4-in-1, a compact yet powerful kinda-sorta space-saving fryer. It offers 4-in-1 cooking: Air Fry, Roast, Reheat and Dehydrate all in one.

Cosori US-based, with over 1.2 million units shipped in 2025, Cosori specializes in portable, accessible smart air fryers. Digital interfaces, integration with recipes and new multifunctional units all continue to aid in driving growth from value-focused consumers. A strong online presence, ease of use and innovation in healthy cooking appliances has established Cosori among the fastest growing market share grab at home and abroad as it competes vigorously with premium competitors.

-

In April 2025, released a TurboBlaze 6.0-Quart Air Fryer with an upgraded airflow system to more evenly cook food and use less energy. This demonstrates Cosori’s design for usability, creativity and diverse healthy cooking appliances, facilitating its stable growth and recognition.

Air Fryer Market Key Players:

Some of the Air Fryer Market Companies are:

-

Philips

-

Ninja (SharkNinja Operating LLC)

-

Cosori

-

Instant Brands (Instant Pot)

-

Cuisinart

-

Black+Decker

-

Breville

-

Tefal (Groupe SEB)

-

GoWISE USA

-

Chefman

-

Hamilton Beach

-

Farberware

-

Midea Group

-

Conair Corporation

-

NuWave, LLC

-

Gourmia

-

Kalorik

-

De'Longhi Appliances S.r.l.

-

Corelle Brands LLC (Corelle Brands)

-

TTK Prestige Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.55 Billion |

| Market Size by 2033 | USD 2.80 Billion |

| CAGR | CAGR of 7.68% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Digital Air Fryers, Manual Air Fryers, Smart Air Fryers, Compact Air Fryers, Others) • By Capacity (1–2 L, 2–3 L, 3–5 L, Above 5 L) • By Application (Home, Commercial/Kitchen, Others) • By Distribution Channel (Online Retail, Specialty Stores, Supermarkets & Hypermarkets, Direct Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Philips, Ninja (SharkNinja Operating LLC), Cosori, Instant Brands (Instant Pot), Cuisinart, Black+Decker, Breville, Tefal (Groupe SEB), GoWISE USA, Chefman, Hamilton Beach, Farberware, Midea Group, Conair Corporation, NuWave, LLC, Gourmia, Kalorik, De'Longhi Appliances S.r.l., Corelle Brands LLC (Corelle Brands), TTK Prestige Ltd. |