Countertop Market Report Scope & Overview:

Get More Information on Countertop Market - Request Sample Report

The Countertop Market size was valued at USD 131.2 Billion in 2023 and is now anticipated to grow to USD 233.2 Billion by 2032, displaying a compound annual growth rate of 6.6% during the forecast Period 2024-2032.

The increased market growth rates are closely connected with the appearance and further applying of such advanced material as quartz. This material is exceptionally resistant to different influences being known for its strength and non-porous characteristics. As it is explained by the International Interior Design Association, quartz is an exceptionally essential component, and people prefer it while constructing and designing both residential and non-residential buildings. The products of this material are popular among consumers for taking the honed finish: they are resistant to different types of stains and damages. Moreover, they are appropriate for using in laboratories, which demands application to an enormous number of dangerous chemicals that frequently deteriorate less reliable products.

Common advantages of utilizing quartz countertops that provide their popularity in the recent period include their high performance and seamless characteristic. In other words, forming one space from different parts, it is impossible to reveal where one-part ends, and other starts facilitating one’s use of a room. Additionally, as people start satisfying their needs to obtain long-lasting and no-demanding materials, they also tend to increase their popularity among a great number of consumers that further promotes the product’s market growth rates.

One more factor stipulating the higher demand for this material include the prolonged tendency to urbanization and the development of a restaurant business all over the world. It means that there is a need to produce superior quality engineered stones, and their processors require finding a proper material being connected with the elevated popularity of quartz in the recent period. The market growth rates are also dependent on the constant development of the material science, which adds new fields of application for quartz. On the whole, the market for quartz and other types of engineered stones is experiencing great expansion because of these particular factors and great potential of further realization as the high-quality modern material.

Market Dynamics

Drivers

The increasing preference for materials like quartz and granite is driven by their durability, low maintenance, and stylish appearance, with quartz being favored for its non-porous properties suitable for various settings.

The growing popularity of quartz and granite types of surfaces for interiors is determined by the combination of elegant appearance with the highest durability, as well as virtually no need for maintenance. Composed of 90-95% of the crushed natural quartz crystals reinforced by resins and pigments, quartz, unlike other materials, boasts non-porous surface. It results in high resistance to dust, stains, bacteria, and moisture, making it ideal for kitchens and bathrooms, as the places where staff and family spends most of the time. In addition, natural sizes and patterns allow for a lot more options, which presents another advantage for general homeowners. Granite, as a natural stone, has been popular for centuries due to its strength and timeless beauty. Every slab feature unique difference in color and pattern, making it highly valuable and more advanced option for bath, countertops, and floor surfaces. Minimal scratching and the highest resistance to heat also make it a practical solution for all sorts of countertops.

Both products are considered to be so beneficial and ideal for kitchens and homes in general specifically due to the possibility to combine pure husbandry and cleaning capacity with exquisite appearance. Each material meets to the full even the most refined requirements of the times, preserving the key functional quality of the applicable material. This is why both products have features of modern and practical solutions and, as a result, are highly appreciated by both individual homeowners and designers.

Homeowners are driving up demand for high-quality countertops by investing in renovations and remodeling projects to upgrade their kitchens and bathrooms with premium materials.

The demand for high-quality countertops is increasingly growing due to homeowners’ investments in kitchen and bathroom renovations. People tend to improve the functional capacity and the aesthetic appeal of these essential spaces in the dwellings. While it may seem that acquiring a piece of granite, quartz, or marble is about satisfying affordability, it mostly pertains to functional qualities and lifespan. High-quality materials tend to be more durable, resistant to stains, and easier to clean. In addition, these elements are indispensable in the two rooms being used on a daily basis and often intensively. Finally, their premium quality contributes to better interior design, making the overall look more decent and complete. In conclusion, the demand for high-quality countertops is rapidly growing because people concentrate on making their homes more stylish and practical. They are willing to own the best materials to ensure that these serve a double or triple function, including the aesthetic one. The supply in the market is on the rise, which is why one can observe frequent material innovations. A growing number of people are becoming convinced that better quality equals greater value, and countertops are no exception.

Restraints

Certain durable countertop materials, like granite, need specialized care and complex installation, which can deter buyers.

There are some countertop materials that are very durable such as granite, however, they require special care and complicated installation, at times. In particular, this aspect can play a very negative role in the decision-making process. For instance, it is noteworthy that granite requires a lot of care in order to be maintained. According to Rusch its owners need to seal it on a regular basis and should hurry to remove dishes into the kitchen because granite is very sensitive to wine or lemon juice. The installation of granite countertops is also a very complicated process and only professionals are able to deal with it. It is necessary even if an owner wants to buy a piece of granite to make the countertop from. Therefore, granite should be considered a very good option because it is very durable and has a very expensive look. Nevertheless, many potential buyers who are seeking for a cheap and easy-to-get solution would not be interested in acquiring such countertops.

Key Market Segmentation

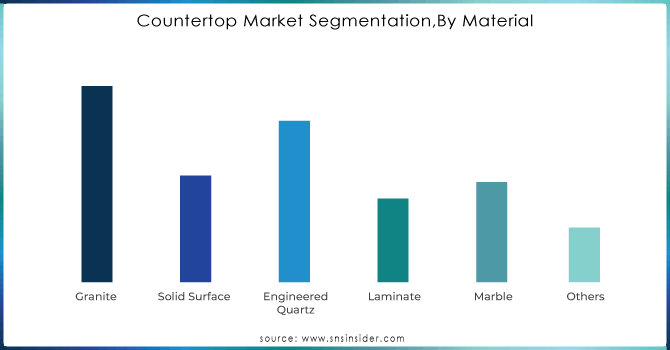

By Material

The Granite material is dominating the market with a share of around 29.15% in 2023. The dominance for granite because of its strength, resistance to abrasion and weathering durability. Granite is the best material option available because of higher lifespan, low cost & wide range of color availability & texture availability.

Need Customized Research on Countertop Market - Enquiry Now

By Application

The kitchen segment dominated the industry in 2023 and accounted for the largest share of more than 64.18%. The segment is estimated to remain dominant throughout the forecast period. The rising demand for countertops in the kitchen is accelerating the growth of this application segment. Moreover, a rise in the average share of housing space dedicated to kitchens in new residential constructions is expected to accelerate the segment growth over the forecast period.

By End User

The Residential user is dominating the market with a share of around 73.50% in 2023. The dominance is because of rising preference for large modular kitchen and multiple bathrooms in single-family houses. Also, the growing investments of consumers in remodeling with robust and aesthetic looks is driving the segment towards growth.

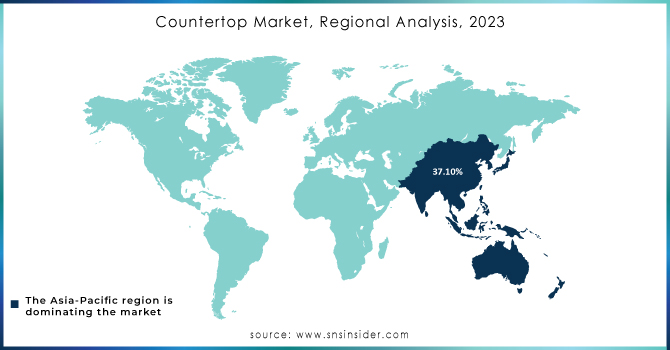

Regional Analysis

The Asia-Pacific region dominated the market with a share of around 37.10% in 2023. The dominance is because of rising disposable income & improved standard of living. The rising population and migration in urban areas is creating demand for residential and commercial building consecutively increasing the demand for countertops. Also, the increasing popularity of countertop replacement as renovation of homes is driving the market.

Key Players

The major key players are Arborite, Cambria, ARISTECH SURFACES LLC, Wilsonart LLC, Caesarstone, Formica, Cosentino SA, M S International Inc., Daltile, Masco Corp., and others.

Recent Development

In August 2022: Wilsonart LLC, a world-class innovator of engineered surfaces, was named a winner of Kitchen & Bath Business (KBB) magazine's 2022 Readers' Choice Awards. The company has been voted as the top kitchen countertop brand in the Readers' Choice Awards for the second consecutive year.

In February 2022: Caesarstone Ltd. unveiled eight new, nature-inspired surfaces at the Kitchen & Bath Industry Show (KBIS) in Orlando February 8-10, including the Pebbles Collection, which features five designs that celebrate the never-ending transformation of wind and water over stone. The surface manufacturer also unveiled three additional innovative colors and showcased its entire portfolio in Booth W629, designed by renowned interior designer Brian Brown of Brian Brown Studio and produced by WBE Exhibits with all stone fabricated by JDS Surfaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 131.2 Billion |

| Market Size by 2032 | US$ 233.2 Billion |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Granite, Solid Surface, Engineered Quartz, Laminate, Marble, Others) • By Application (Kitchen, Bathroom, Others) • By End User (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arborite, Cambria, ARISTECH SURFACES LLC, Wilsonart LLC, Caesarstone, Formica, Cosentino SA, M S International Inc., Daltile, Masco Corp. |

| Key Drivers | • The increasing preference for materials like quartz and granite is driven by their durability, low maintenance, and stylish appearance, with quartz being favored for its non-porous properties suitable for various settings. • Homeowners are driving up demand for high-quality countertops by investing in renovations and remodeling projects to upgrade their kitchens and bathrooms with premium materials. |

| Opportunities | • Certain durable countertop materials, like granite, need specialized care and complex installation, which can deter buyers. |