Heat Exchanger Market Report Scope & Overview:

To get more information on Heat Exchanger Market - Request Free Sample Report

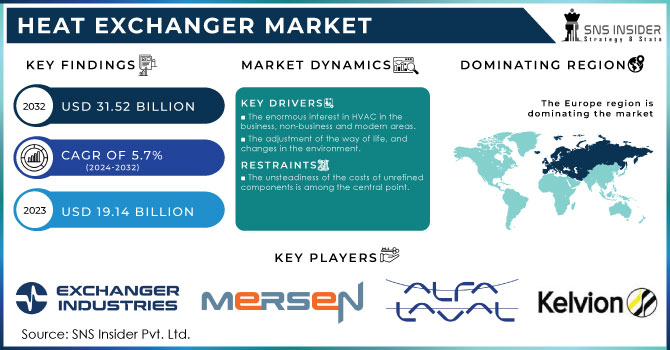

The Heat Exchanger Market size was valued at USD 19.14 Billion in 2023 and is expected to reach USD 31.52 Billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

The primary drivers are the increasing emphasis on energy efficiency and global efforts to reduce energy consumption. Heat exchangers, essential for heat recovery and waste heat utilization, are critical for enhancing process efficiency and reducing operational costs, leading to heightened demand across industries. The market is further boosted by industrial expansion, especially in developing economies like India and China, where rapid infrastructure development in sectors such as power generation and manufacturing is creating a substantial need for heat exchangers. The Asia-Pacific region, in particular, is a focal point for market growth due to ongoing industrialization and government initiatives supporting sustainable energy practices.

Additionally, the growing urban population and the expansion of infrastructure projects have escalated demand for HVAC systems, which heavily rely on heat exchangers for energy-efficient heating and cooling. In the renewable energy sector, the shift towards geothermal, solar thermal, and biomass energy sources is creating new opportunities for specialized heat exchangers, driving the development of more tailored solutions to handle these emerging energy applications.

KRN Heat Exchanger and Refrigeration Ltd made a strong market debut with its IPO on October 3, 2024, opening at ₹480, which marked an impressive 118% increase from its issue price of ₹220. The IPO was significantly oversubscribed, receiving 214.42 times the total offer, showcasing robust demand, especially among qualified institutional buyers (253.04 times) and non-institutional investors (430.54 times). The company raised ₹341.95 crore to invest in its subsidiary and expand its manufacturing capabilities. This successful listing underscores the increasing investor interest in the heat exchanger sector, driven by rising demand in various industrial applications.

Heat Exchanger Market Dynamics

DRIVERS

- The growing urbanization and construction of residential and commercial buildings are increasing the demand for HVAC and refrigeration systems, thereby driving the demand for heat exchangers.

The growing demand for HVAC and refrigeration systems is a significant driver in the heat exchanger market. Heat exchangers are essential components in these systems, as they regulate temperature by transferring heat between different mediums, ensuring optimal heating, cooling, and ventilation in both residential and commercial spaces. As urbanization continues at a rapid pace, particularly in emerging economies, the construction of new buildings, shopping complexes, and industrial facilities is expanding. This boom in construction directly increases the demand for HVAC systems, as temperature control and air quality have become critical aspects of modern infrastructure. Additionally, the rise in disposable income and the increasing focus on enhancing comfort and indoor air quality in homes and offices have further accelerated the demand for energy-efficient HVAC systems. With more people moving into urban areas, residential complexes, commercial offices, and public spaces are incorporating advanced HVAC systems to meet the growing need for reliable heating and cooling solutions.

- The increasing need for effective temperature control in residential, commercial, and industrial spaces is driving the demand for heat exchangers in HVAC and refrigeration systems, especially with the rise in urbanization and new construction projects.

The refrigeration sector, particularly in industries like food and beverage and pharmaceuticals, is also growing due to the need for precise temperature control for storage and transport. This increased use of refrigeration technology in various industries amplifies the demand for heat exchangers, which play a critical role in maintaining efficient and consistent temperature management.

The growing demand from HVAC and refrigeration systems is a significant driver for the heat exchanger market. HVAC systems (Heating, Ventilation, and Air Conditioning) are critical in regulating indoor environments across residential, commercial, and industrial sectors. As urbanization increases and modern buildings become more reliant on HVAC systems for comfort and operational efficiency, the demand for advanced heat exchangers rises. One of the key factors amplifying this demand is the increasing emphasis on energy efficiency regulations set by governments worldwide. In response to climate change and the need to reduce carbon footprints, regulatory bodies are implementing stricter energy efficiency standards. Heat exchangers play a vital role in these systems by efficiently transferring heat, reducing the energy consumption required to maintain optimal temperatures. They help HVAC and refrigeration systems operate more efficiently by minimizing energy waste, thereby complying with these regulatory requirements.

Moreover, energy-efficient heat exchangers not only reduce operational costs for industries but also contribute to environmental sustainability. They help industries optimize their energy usage, meet emission reduction targets, and benefit from incentives like tax rebates and subsidies linked to energy-saving technologies. Consequently, manufacturers are focusing on developing compact, cost-effective, and high-efficiency heat exchangers that align with global energy standards.

RESTRAIN

- The high initial investment required for installing advanced heat exchanger systems can limit their adoption, particularly among smaller companies or industries with tight budget constraints.

The cost of replacing a heat exchanger can range significantly, typically falling between $800 and $5,000, with the average expenditure for homeowners being approximately $1,750. Several factors influence these costs, including the type of furnace, its size, and its age, as well as whether the furnace is still under warranty. Notably, secondary heat exchangers, particularly in high-efficiency and commercial furnaces, tend to be on the higher end of the cost spectrum. This is primarily due to their increased complexity and larger size, which contribute to the overall expense of the replacement process.

Additionally, customization requirements for specific applications, such as chemical processing, oil & gas, or power generation, often lead to higher expenses. These systems must be tailored to meet specific thermal and operational needs, which adds to the overall cost of design and installation. For small to mid-sized companies, this high upfront investment can be a deterrent, as they may not have the financial resources to afford advanced heat exchangers or may prioritize other capital expenditures.

Furthermore, while advanced heat exchangers can deliver long-term energy savings and operational efficiency, the initial outlay can pose a challenge in markets where return on investment (ROI) timelines are crucial for decision-making. Budget-sensitive sectors may opt for cheaper, less efficient alternatives, even if these choices lead to higher long-term operating costs. Therefore, the high initial costs of advanced heat exchanger systems can slow down market adoption, particularly in industries with tight financial constraints or short-term profitability goals.

Heat Exchanger Market Segments

By Product

Shell & tube heat exchanger dominated the industry and accounted for 35.6% of the global revenue demand in 2023. Shell & tube items consist of a collection of tubes arranged in a cylindrical shell, with the tubes aligned parallel to the shell's axis. The three most frequently seen shell & tube products are the floating-head type, U-tube design, and fixed tube sheet design. Shell and tube products are utilized in situations that necessitate a broad temperature and pressure range, as well as the transfer between two liquids, liquids and gases, or two gases. These units possess a basic design and are perfect for transferring heat from steam to water. Nevertheless, the need for expansive areas is expected to impede the growth of the sector in the foreseeable future.

By End-Use

Chemical & petrochemicals dominated the market and accounted for 24.08% of the global revenue demand in 2023. Heat exchangers are utilized in the chemical processing industry (CPI) due to their characteristics, including their design flexibility and strong resistance to corrosion. Their characteristics allow them to manage fluids with different concentrations of solid particles. The increasing need for fertilizers, plastics, packaging, digital devices, medical equipment, and clothing is expected to drive growth in the petrochemical industry.

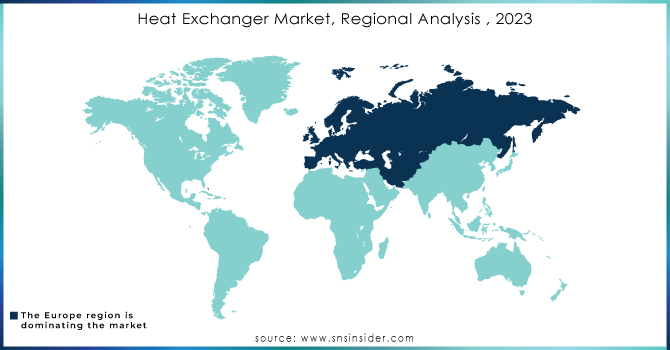

Heat Exchanger Market Regional Analysis

Europe region dominated the market and accounted for 32.07% of the market revenue share in 2023. The anticipated increase in public and private infrastructure investments is expected to boost the demand for HVAC & refrigeration products. Furthermore, the growth in demand from various end-use sectors for heat exchangers with increased durability, higher efficiency, and reduced fouling is anticipated to fuel growth in the upcoming period.

Asia Pacific heat exchanger demand is likely to grow at a CAGR of 6.4% over the forecast period. This growth is largely driven by rapid industrialization in developing economies within the region. As these countries continue to expand their manufacturing capabilities, there has been a significant increase in investments in various commercial and industrial projects. This influx of capital is fostering the development of infrastructure and technology, which, in turn, boosts the demand for heat exchangers, essential components in numerous applications, including HVAC systems and industrial processes. The combined effects of economic growth and the need for efficient energy management solutions further enhance the market potential for heat exchangers in Asia Pacific, making it a key area of focus for manufacturers and investors alike.

Do You Need any Customization Research on Heat Exchanger Market - Inquire Now

KEY PLAYERS

Some of the major key players of Heat Exchanger Market

- ALFA LAVAL: (Plate Heat Exchangers, Shell and Tube Heat Exchangers)

- Kelvion Holding GmbH: (Shell and Tube Heat Exchangers, Plate Heat Exchangers)

- Exchanger Industries Limited: (Custom Heat Exchangers, Air-Cooled Heat Exchangers)

- Mersen: (Graphite Heat Exchangers, Metal Heat Exchangers)

- Danfoss: (Heat Exchangers for HVAC and Industrial Applications)

- API Heat Transfer: (Shell and Tube Heat Exchangers, Plate Heat Exchangers)

- Boyd Corporation: (Thermal Management Solutions, Heat Exchangers)

- H. Güntner, Limited: (Refrigeration and HVAC Heat Exchangers)

- Johnson Controls: (HVAC Heat Exchangers, Chillers)

- XYLEM: (Heat Exchangers for Water and Wastewater Applications)

- SPX Flow: (Heat Exchangers for Food and Beverage Industry)

- Kaori: (Plate Heat Exchangers, Shell and Tube Heat Exchangers)

- Tetra Pak: (Food Processing Heat Exchangers)

- Schneider Electric: (Heat Exchangers for Energy Management)

- Wärtsilä: (Marine and Power Plant Heat Exchangers)

- Tranter: (Plate Heat Exchangers, Thermal Management Solutions)

- Heat Transfer Products: (Industrial Heat Exchangers)

- Fives: (Heat Exchangers for Energy and Process Industries)

- Thermoelectric: (Thermal Management Solutions and Heat Exchangers)

- Enerquip: (Sanitary Heat Exchangers, Custom Heat Exchangers)

RECENT DEVELOPMENTS

-

In October 2023: Conflux Technology commenced manufacturing a metal heat exchanger using 3D printing. The upcoming release will build on the impressive achievement of the new heat exchanger in the M 4K system, AMCM aims to incorporate this concept into their newly revealed M 8K system, which features a larger build volume of 800 x 800 x 1200 mm.

-

In April 2023: Kelvion introduced a specialized line of air coolers designed for use with natural refrigerants. The CDF & CDH ranges are dual discharge air coolers that feature a highly efficient tube system.

-

In May 2023: Alfa Laval is increasing its production of brazed plate heat exchangers to support the worldwide shift towards renewable energy. The creation of new facilities in Italy, China, Sweden, and the U.S. marks a major step forward in their effort to enhance manufacturing intelligence and efficiency across the entire supply chain.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 19.14 Billion |

| Market Size by 2032 | USD 31.52 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Plate & frame heat exchanger, Brazed plate & frame heat exchanger, Gasketed plate & frame heat exchanger, Welded plate & frame heat exchanger, shell & tube heat exchanger, Air-cooled heat exchanger, Others) • By End-Use (Chemical, Food & Beverage, HVAC & refrigeration, Oil & Gas, Power Generation, Pulp & Paper, Others) • By Material (Metals, Alloys, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ALFA LAVAL, Kelvion Holding GmbH, Exchanger Industries Limited, Mersen, Danfoss, API Heat Transfer, Boyd Corporation, H. Güntner, Limited, Johnson Controls, XYLEM, SPX Flow, Kaori, Tetra Pak, Schneider Electric, Wärtsilä, Tranter, Heat Transfer Products, Fives, Thermoelectric, Enerquip. |

| Key Drivers | • The growing urbanization and construction of residential and commercial buildings are increasing the demand for HVAC and refrigeration systems, thereby driving the demand for heat exchangers. • The increasing need for effective temperature control in residential, commercial, and industrial spaces is driving the demand for heat exchangers in HVAC and refrigeration systems, especially with the rise in urbanization and new construction projects. |

| RESTRAINTS | • The high initial investment required for installing advanced heat exchanger systems can limit their adoption, particularly among smaller companies or industries with tight budget constraints. |