Air-to-Air Refueling Market Report Scope & Overview:

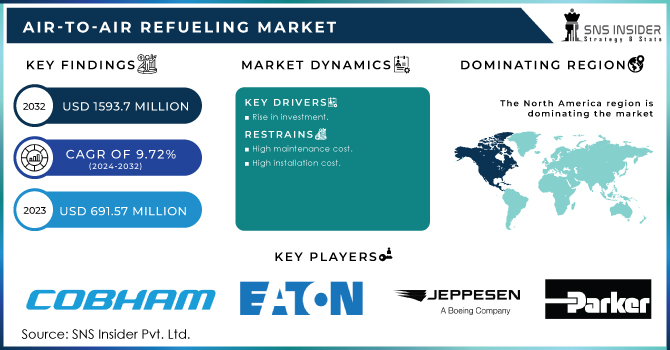

The Air-to-Air Refueling Market Size was valued at USD 691.57 million in 2023, expected to reach USD 1593.7 million by 2032 and grow at a CAGR of 9.72% over the forecast period 2024-2032.

Aerial refueling is primarily described as the process of transporting aviation fuel from one aircraft to another while both are in flight. fuel is transferred by an aircraft is known as a tanker and the aircraft that receives the fuel is called an aircraft receiver. The aerial refueling processes are carried out using two basic methodologies: flying boom and progue-and-drogue. The former technique is significantly faster than the latter, but it necessitates the installation of a specific sort of boom operator station.

To get more information on Air-to-Air Refueling Market - Request Free Sample Report

Air-conditioning systems are particularly important, especially in military aircraft, where the excess fuel obtained can cause the aircraft to stay in the air longer. In this way, the width of the aircraft and its efficiency can be greatly increased. In military aircraft, some of them can compensate for the small fuel stored at take-off. This can be done to compensate for the heavy weight of weapons, armor, and the like, by reducing the amount of departure. After taking off, the aircraft can get more fuel, thus avoiding overheating of the original fuel when it is lifted, and as a result, save it. An effective departure truck is also possible for planes that start with less fuel and gain more capacity after flying. In this way, the aircraft can gain significant momentum while taking off, thus enabling it to reach its peak in less time. According to reports, potential fuel savings can be done by adding up to 35-40% more fuel, especially on long-haul flights.

MARKET DYNAMICS

KEY DRIVERS

-

Rise in investment

RESTRAINTS

-

High maintenance cost

-

High installation cost

OPPORTUNITIES

-

Automatic refueling

-

Smart drogue system

CHALLENGES:

-

Fuel consumption for long-distance flights.

THE IMPACT OF COVID-19

The level of industrial production around the world has been disrupted, due to announced closures and government restrictions on public gatherings due to the COVID-19 epidemic.

There will be a huge increase in demand for air-conditioning components as governments plan to resume air travel soon. A series of supplies of spare parts such as pipe beads, pressure nozzle, aircraft fuel injection components, etc. are affected hampering further research and development in the aviation industry. The companies have decided to postpone their operations, which include reducing flights and eliminating more economical flights. For example, Qatar Airways suspended all ten of its A380 aircraft until May 31, 2020, as a precautionary measure against COVID-19. In addition, the Emirates has also suspended most of its passenger services due to the pandemic. Now, airlines and airport management companies are seeking bail packages from the government. For example, European airport operators are expected to incur $ 15.5 billion in losses as a result of the epidemic.

The gasoline tank sector is expected to account for the largest share of the air-to-air refueling market in 2022. Because it supports the safety of an aircraft's fuel systems, a gasoline tank system is an important component of an air-to-air refueling system.

This system is installed in the aircraft's fuel tank and stores non-flammable gases such as nitrogen. When the bleed air is given, the fuel tank operates during the flight.

The manned segment is expected to lead the air-to-air refueling market over the forecast period. The increasing use of manned systems for air-to-air refueling by military and naval forces around the world is predicted to boost the expansion of the manned segment.

According to the system, the boom refueling segment is expected to lead the air-to-air refueling market over the forecast period. Most tanker aircraft use boom refueling systems, which consist of a rigid tube that assists a tanker aircraft operator in extending the boom tube and inserting it into a vessel aboard the aircraft being refueled. The boom refueling segment's growth can be ascribed to its capacity to transfer gasoline as quickly as feasible. Because the boom is stiff, it has a higher transfer rate than the probe and drogue.

Fixed-wing aircraft are expected to lead the air-to-air refueling market during the projected period. A fixed-wing aircraft achieves flight by using wings attached to the fuselage to generate lift from the aircraft's forward motion. Fixed-wing aircraft are growing in popularity because they can travel longer distances and have better aerodynamic structures than rotary-wing aircraft. Fixed-wing aircraft may also fly in difficult climates and surroundings.

KEY MARKET SEGMENTATION

By Aircraft Type

-

Fixed Wing

-

Rotary Wing

By Type

-

Manned

-

Unmanned

By Component

-

Pumps

-

Nozzles

-

Valves

-

Booms

-

Pods

-

Fuel Tanks

-

Others

By System

-

Probe

-

Drogue

-

Boom Refuelling

-

Autonomous

By End-User

-

OEM

-

Aftermarket

REGIONAL ANALYSIS

North America is one of the leading markets for air-to-air filling programs in terms of research and development activities, deployment, and the presence of key market players.

The major countries in this region are Canada & US. The air-to-air refueling market in North America is led by the US. The North American military aviation sector is growing at a slower pace, resulting in a significant need for air-to-air filling programs. The presence of major players, OEMs, and component manufacturers is one of the key factors that is expected to boost the North-to-air filling market in North America. The US is expected to continue the growth of the North American air-to-air refueling market. The growing number of military aircraft development programs, the ongoing research and development of improved military airports, and the availability of large-scale systems and component manufacturers are expected to lead to a growing demand for air-to-air filling programs in North America during the forecast period.

Need any customization research on Air-to-Air Refueling Market - Enquiry Now

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Key Players are Jeppesen, PARKER HANNIFIN CORP, Cobham Limited, Eaton, Marshall Aerospace and Defence Group, Draken International, BAE Systems, GE, Safran, Airbus S.A.S. and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 691.57 Million |

| Market Size by 2032 | US$ 1593.7 Million |

| CAGR | CAGR of 9.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Aircraft Type (Fixed Wing, Rotary Wing) • By Type (Manned, Unmanned) • By Component (Pumps, Nozzles, Valves, Booms, Pods, Fuel Tanks, Others) • By System (Probe, Drogue, Boom Refuelling, Autonomous) • By End-User (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Jeppesen, PARKER HANNIFIN CORP, Cobham Limited, Eaton, Marshall Aerospace and Defence Group, Draken International, BAE Systems, GE, Safran, Airbus S.A.S. |

| DRIVERS | • Rise in investment |

| RESTRAINTS | • High maintenance cost • High installation cost |