Rockets and Missiles Market Report Scope & Overview:

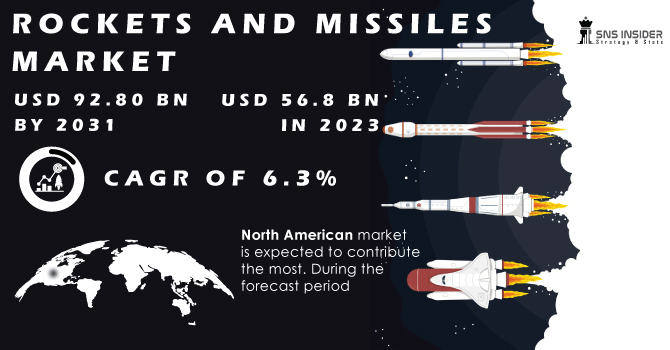

The Rockets and Missiles Market size was valued at USD 56.8 billion in 2023 and is estimated to reach USD 92.80 billion by 2031 with a growing CAGR of 6.3% from 2024 to 2031.

Due to continual increases in military budgets around the world and the need for new rockets and missiles to resist modern combat around the country's border, the rockets and missiles industry is likely to develop. Additionally, an increase in the number of conflicts and high defence spending are two important drivers driving the global market. Various governments, including the United States, China, India, and Russia, are investing considerably in modernizing their military forces. As a result, several armament makers are refocusing their efforts on producing rockets and missiles. However, challenges with missile integration pose a threat to the rocket and missile market's growth.

To get more information on Rockets and Missiles Market - Request Free Sample Report

KEY DRIVERS

The performance of US weapon systems is unrivaled, giving US defense forces a tactical fighting edge over any foe in any weather. The US Department of Defense (DoD) has requested USD 247.3 billion in acquisition funding for Fiscal Year (FY) 2020, which includes funding from the Base budget and the Overseas Contingency Operations (OCO) fund, totaling USD 143.1 billion for procurement and USD 104.3 billion for development, research, evaluation, and test (RDT&E). The funding requested in the budget request provides a balanced portfolio approach to achieving the National Defense Strategy's military force objective. The budget for USD 247.3 billion includes USD 83.9 billion for Major Defense Procurement Programs (MDAPs), which are large-scale acquisition programs.

exceed the cost ceiling set by the Under Secretary of Defense for Acquisition and Sustainment Approximately the last five years, the Missile Defense Agency reports a rise of over 1,200 more ballistic missiles. Outside of the United States, the North Atlantic Treaty Organization, Russia, and China, the total number of ballistic missiles has climbed to about 5,900. Hundreds of missile launchers and launchers are currently within range of deployed US soldiers. As a result, the market for rockets and missiles is being driven by governments' increasing demand for military programmers to guard against numerous threats.

RESTRAINTS

Import-export control regimes, exchange restrictions, the Foreign Corrupt Practices Act, and the Export Administration Act are only a few of the federal and legislative norms and regulations that state-owned defense organizations must follow. Many governments prevent munition makers from exporting their goods, limiting their ability to serve foreign clients. This makes it difficult for weapons makers to sell their products internationally.

Terrorist groups obtaining access to advanced equipment such as anti-tank-guided weapons and advanced land mines exacerbated the problem of technology and weapon transfer. As a result, technology and weapon transfers to other countries are strictly regulated. This aspect is a stumbling block to the rocket and missile market's expansion.

OPPORTUNITIES

The development of next-generation missiles with cutting-edge technology poses a significant threat to important locations and assets such as military airbases and ships. among the latest developments are high-speed cruise missiles and Nuclear-capable ballistic missiles. Various countries are developing new weaponry capable of destroying high-end air defense systems such as the MEADS, the Patriot Advanced Capability-3 (PAC-3), and the S-400. India, China, and Russia have developed hypersonic missiles that are challenging to intercept with missile defense systems. Missile developed jointly by India and Russia, The BrahMos missile,is difficult to intercept by earlier missile defense systems.

These improvements have necessitated the creation of new-generation high-speed air defense electronic warfare systems. Governments throughout the world are working on the development of stealth aircraft while also investing considerably in modern surveillance systems to counter stealth technology.

CHALLENGES

The integration of smaller precision-guided weapons is a simpler process than that of bigger ones. For example, missile integration occurs at three levels: first on the missile itself, second with the platform from which it is fired, and third with the current command and control network. The integration of diverse electronic devices, sensors, warheads, kill vehicles, propulsion systems, and other subsystems is extremely complex. The challenge rises in the case of Several Independent Re-entry Vehicle (MIRV) ballistic missiles, which contain multiple warheads assigned for multiple targets. Furthermore, if the missile is to be loaded with a nuclear payload, the integration process is extremely complex and requires professional engineers to complete the task. Integrating a missile with a launching platform provides benefits like as compatibility with a greater range of platform carriage, an unconstrained carriage envelope, safe and precise storage separation, and increased platform survivability. Checking for launch platform compatibility, limitations, firepower, survivability, missile-carrying, and launch compatibility is essential.

IMPACT OF COVID-19

Even as the globe deals with the COVID-19 pandemic, military procurement, maintenance, and manufacture in practically every country continues, because national safety is paramount and protecting soldiers is a top priority.

Defense spenders such as the United States and Russia commit around 4% of their GDP to defense, which is a significant sum. But, for the time being, all army movements, missions, and drills have been halted.

Cessation or reduction of military exercises would diminish engagement time, informal testing, and equipment assessment, as well as the latent rocket and missile market development potential.

Supply-side shocks are among the most visible effects of the pandemic's ramifications on the defense sector. Businesses based in virus-stricken nations or those depending on supply chain operations situated in impacted countries are the direct victims of the epidemic.

By Launch Mode

Surface-to-Surface: This segment held the biggest market share in 2023 and is predicted to grow at a steady CAGR throughout the forecast period.

conventional weapons such as Surface-to-surface missiles and rockets, and as such, they are generally utilised by military forces.

Air-to-Surface: During the review period, this category is predicted to have the greatest CAGR. The growing usage of guided missiles launched by fighter planes and helicopters is likely to boost expansion in this market.

Surface-to-Air: In 2023, this sector held the second-largest market share. This is due to the increased usage of surface-to-air missiles to eliminate enemy aircraft.

By Propulsion

Solid Propulsion: In 2023, this sector dominated the rocket and missile market. This is because solid-state propulsion systems are widely used in rockets.

Hybrid propulsion: is predicted to grow at the fastest rate during the forecast period. This is owing to a rise in demand for hybrid propulsion systems for intercontinental ballistic missiles.

Turbojet: During the projected period of 2024 to 2031, the segment is expected to increase steadily. In missiles, turbojet propulsion methods are commonly employed.

MARKET ESTIMATION

The surface-to-surface launch mode is expected to account for the greatest percentage of the rockets and missiles market in 2023.

The rockets and missiles market has been divided into surface to surface, surface to air, air-to-air, air to surface, and subsea to surface launch modes. Surface-to-surface rockets and missiles are launched from land or sea. They can be fired from handheld, vehicle-mounted, or stationary installations. These missiles, which are utilised in land combat operations, are meant to strike targets on the ground or at sea. As a result, they are also referred to as ground-to-ground rockets and missiles.

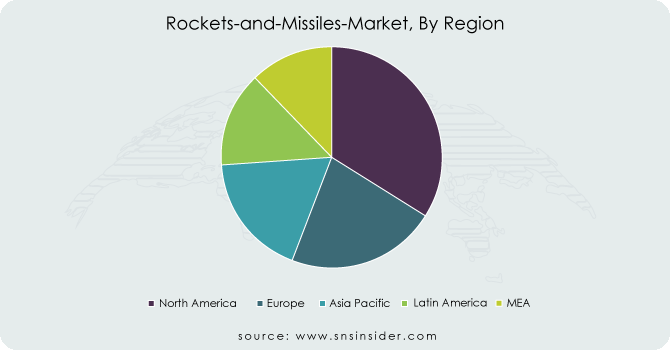

From 2024 to 2031, the North American market is expected to contribute the most. During the forecast period, North America is expected to have the highest regional share of the rockets and missiles market. Northrop Grumman Corporation, Lockheed Martin, Raytheon Technologies, and General Dynamics Corporation are all headquartered in the United States. These players are constantly investing in the research and development of new and innovative technology employed in the missile defense system.

KEY MARKET SEGMENTATION

By Speed

-

Subsonic

-

Supersonic

-

Hypersonic

By Product

-

Cruise

-

Ballistic Missiles

-

Rockets

By Propulsion Type

-

Solid

-

Liquid

-

Hybrid

-

Ramjet

-

Turbojet

-

Scramjet

By Guidance Mechanism

-

Guided

-

UnGuided

By Launch Mode

-

Surface to Surface

-

Surface to Air

-

Air to Air

-

Air to surface

-

Subsea to Surface

REGIONAL ANALYSIS

From 2024 to 2031, the North American market is expected to contribute the most. During the forecast period, North America is expected to hold the highest geographic share of the ROCKETS AND MISSILES market. Northrop Grumman Corporation, Lockheed Martin, Raytheon Technologies, and General Dynamics Corporation are all headquartered in the United States. These players are constantly investing in the research and development of new and improved technology utilized in missile defense systems.

Need any customization research on Rockets and Missiles Market - Enquiry Now

REGIONAL COVERAGE

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

Key Players

The Key Players are Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems, Thales Group and other Players.

Lockheed Martin Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 56.8 Billion |

| Market Size by 2031 | US$ 92.80 Billion |

| CAGR | CAGR of 6.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Speed (Subsonic, Supersonic, Hypersonic), Product, Propulsion Type (Solid, Liquid, Hybrid Propulsion, Ramjet, Turbojet and Scramjet), Guidance Mechanism (Guided and Unguided) • By Launch Platform |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Northrop Grumman Corporation, Lockheed Martin Corporation, BAE Systems, and Thales Group. |