Aircraft and Marine Turbochargers Market Report Scope & Overview:

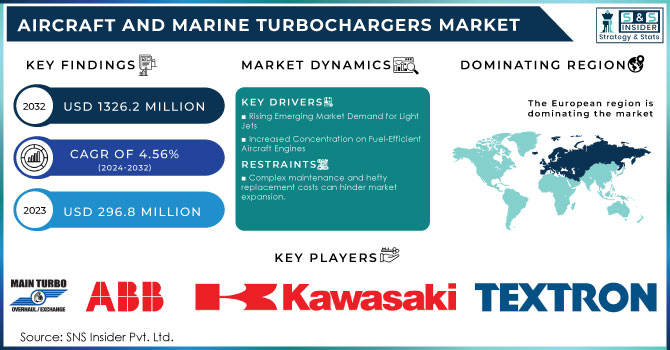

The Aircraft and Marine Turbochargers Market Size was valued at USD 296.8 million in 2023 and is expected to reach USD 1326.2 million by 2032 with a growing CAGR of 4.56% over the forecast period 2024-2032.

To get more information on Aircraft and Marine Turbochargers Market - Request Free Sample Report

Turbochargers, also known as turbine-operated forced induction devices, are used to boost the power output and efficiency of internal combustion engines in aircraft and ships (IC). It operates by forcing compressed air into the combustion chamber, improving the overall efficiency of aviation and marine engines. Turbochargers employ waste energy from the engine exhaust stream to power a turbine, which drives a compressor. This compressor pulls in ambient air, compresses it, and feeds it to the engine intake, resulting in a larger mass of air and, as a result, more fuel entering the cylinders during the intake stroke.

Furthermore, turbochargers play a significant function in all aircraft engines. When the aircraft is at a high altitude, it may experience a quick pressure drop in the ambient air. During that time, the turbochargers compress the air back to normal pressures in a fraction of a second. Furthermore, this process is known as turbo-normalization or pressure boost, which is also known as turbocharging, and it allows the engine to produce the rated power at high altitudes. As a result, this trait is critical in aeroplane mobility. Turbochargers, on the other hand, are utilised in engines of large ships and cruise ships to boost engine output capacity and power-to-weight ratio.

MARKET DYNAMICS

KEY DRIVERS

-

Rising Emerging Market Demand for Light Jets

-

Increased Concentration on Fuel-Efficient Aircraft Engines

RESTRAINTS

-

Complex maintenance and hefty replacement costs can hinder market expansion.

OPPORTUNITIES

-

3D Printing is being used to manufacture aircraft turbochargers.

-

Turbochargers for Marine Gasoline and Diesel Engines

CHALLENGES

-

Rates of Global Marine Freight

-

The Complex Design of Aircraft Turbochargers Leads to Difficulties in Maintenance

IMPACT OF COVID-19

Governments in major countries have declared a state of emergency because to the COVID-19 epidemic, which has caused a standstill in business. Furthermore, the lockout has had a negative impact on both the aircraft and marine industries. Because of the lockdown and travel restrictions, all aircraft were stranded at airports, significantly affecting the aviation industry. Furthermore, due to the possibility of the virus spreading, all cargo ships were stranded in the middle of the ocean and were not allowed to enter the port by authorities. The marine industry was impacted by the delayed delivery of products.

Furthermore, the pandemic interrupted all aircraft and ship manufacturing, which immediately impacted demand for aircraft and marine turbochargers. Furthermore, demand for ship and aeroplane maintenance fell during the epidemic, affecting demand for turbocharger replacement. The unavailability of workers for production and maintenance services, as well as raw materials for manufacturing, hampered the operation. Both aircraft and marine are emerging sectors that were impacted by the pandemic but are projected to recover and support the growth of the aircraft and marine turbocharger markets.

The compressor segment is likely to lead the aircraft and marine turbochargers market by component during the forecast period. Turbos often use compressor wheels, which are commonly built of aluminium alloys. However, titanium wheels machined on 5-axe mills are already being used in some commercial diesel and performance racing applications of aircraft and marine turbochargers. Despite their high cost, these wheels have been shown to reduce the number of premature failures of turbocharger components in high-boost applications in aircraft and ships.

Turboprop engines are used in ultralight (turboprop) aircraft. These engines are a more advanced variant of traditional jet engines with propellers in the engine inlets. These propellers are rotated at high speeds by engine power, which is delivered to gearboxes. Because of the enormous size of the propellers, turboprop engines are only used in applications where the aircraft flies at moderate speeds. These engines are mostly utilised in general aviation. Because turboprop engines are more fuel-efficient than typical jet engines, the market for them is expected to rise during the forecast period.

The segment held the greatest proportion of the Aircraft and Marine Turbochargers Market in 2021 and is predicted to grow at the fastest rate from 2021 to 2028. Single turbo units are commonly found in aircraft, unmanned aerial vehicles, and marine engines. This is projected to drive the segment's growth. Twin Turbocharged During the projected period of 2021 to 2028, the segment is expected to increase rapidly. The growing need for twin turbo for small planes is projected to propel this category forward.

KEY MARKET SEGMENTATION

By Component

-

Compressor

-

Turbine

-

Shaft

By Technology

-

Single Turbo

-

Twin Turbo

-

Electro-Assist Turbo

By Platform

-

Aircraft

-

Marine

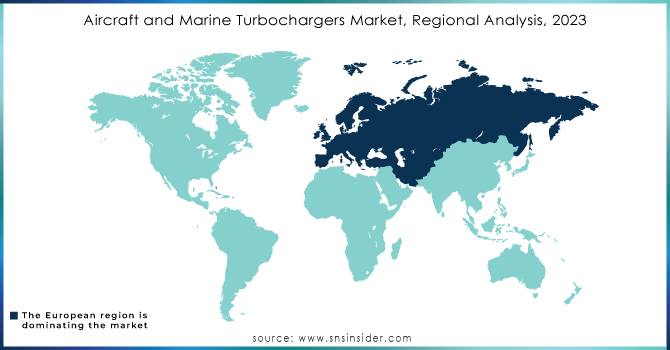

REGIONAL ANALYSIS

The European region is expected to have the highest share of the aircraft and marine turbochargers market. The presence of a large number of turbocharger manufacturers in the region, such as PBS Velka Bites (the Czech Republic), Rolls-Royce (UK), and ABB (Switzerland), can be linked to the expansion of the Europe aircraft and marine turbochargers market. Furthermore, the region's severe adoption of various emission requirements in countries such as Germany, the United Kingdom, and France is increasing demand for fuel-efficient engines, which is adding to the expansion of the market for aircraft and marine turbo chargers.

Need any customization research on Aircraft and Marine Turbochargers Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Main Turbo Systems, ABB, Cummins, Kawasaki Heavy Industries, MAN Energy Solutions, Textron Aviation Inc., PBS Velka Bites, Rolls-Royce, Hartzell Engine Technologies, Mitsubishi Heavy Industries, and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 296.8 Million |

| Market Size by 2032 | US$ 1326.2 Million |

| CAGR | CAGR of 4.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Compressor, Turbine, and Shaft) • By Technology (Single Turbo, Twin Turbo, and Electro-Assist Turbo) • By Platform (Aircraft, Marine, and Unmanned Aerial Vehicle (UAV)) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Main Turbo Systems, ABB, Cummins, Kawasaki Heavy Industries, MAN Energy Solutions, Textron Aviation Inc., PBS Velka Bites, Rolls-Royce, Hartzell Engine Technologies, Mitsubishi Heavy Industries, and other players. |

| DRIVERS | • Rising Emerging Market Demand for Light Jets • Increased Concentration on Fuel-Efficient Aircraft Engines |

| RESTRAINTS | • Complex maintenance and hefty replacement costs can hinder market expansion. |