Unmanned Aerial Vehicle (UAV) Report Scope & Overview:

To get more information on Unmanned Aerial Vehicle Market - Request Free Sample Report

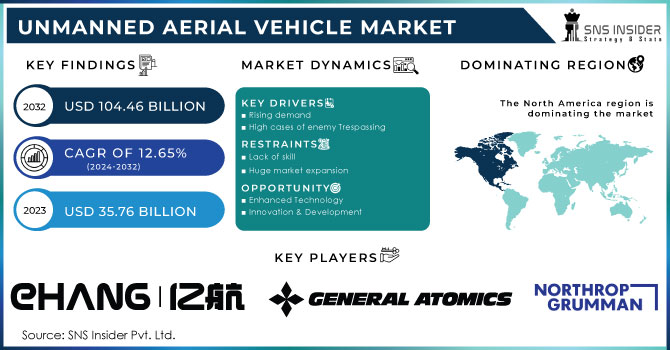

The Unmanned Aerial Vehicle Market Size was valued at USD 35.76 billion in 2023 and is expected to reach USD 104.46 billion by 2032 with a growing CAGR of 12.65% over the forecast period 2024-2032.

An unmanned aerial vehicle is a type of aerial transportation that works without onboard personnel or passengers and is guided remotely, autonomously, or both. UAVs are next-generation aircraft used for surveillance, evaluation, logistics, and photography, among other things. The introduction of laws and regulations governing the use of unmanned aerial vehicles by various countries has a direct impact on the market for unmanned aerial vehicles. Drones are unmanned aerial vehicles. The increasing use of smart technology for monitoring, analysis, and imaging, among other things, is likely to drive the expansion of unmanned aerial vehicles. It is used in a variety of industries, including military and defense, agriculture, civil and commercial, logistics and transportation, healthcare, construction and mining, and others.

MARKET DYNAMICS

KEY DRIVERS

-

Rising demand

-

High cost

-

High cases of enemy Trespassing

RESTRAINTS

-

Lack of skill

-

Huge market expansion

-

Risk of collateral damage

OPPORTUNITIES

-

Enhanced Technology

-

Innovation & Development

-

Increasing use of Drones

CHALLENGES

-

Drug trafficking.

-

Terror attacks.

THE IMPACT OF COVID-19

The outbreak of the COVID-19 epidemic has had a devastating effect on the global airline aircraft market, due to property disruptions, tightening the budget for end-users, and is expected to weaken the financial performance of market players by 2020. It has impacted the entire economy, and participants as market participants formulate cost-effective strategies. The major risks for Unmanned aerial vehicle market participants are regulatory and policy changes, staff dependence, effective cash management, and liquidity & solvency management. Most of the developing areas of unmanned aerial vehicles have been closed during the violence due to traffic restrictions, staff shortages, and disruption of supply. The private and commercial security industries were one of the industries most affected by the epidemic and saw a decline in investment initially.

By System Analysis

In terms of system, Payload, Airframe, avionics, propulsion, and software are the market segments. The adoption of a contemporary electronics system, route control, and automated flight management system is expected to drive strong growth in the avionics industry throughout the projected period. To ensure flight efficiency, several organizations are concentrating on enhancing their navigation system based on the global navigation satellite system. This advancement will improve drones' capacity to identify obstacles, prevent collisions, and use an autonomous flight control system. For wartime missions, logistics and transportation, and disaster relief operations, the software system will be more precise and completely equipped with real-time, airspeed, altitude detection, and location detection. This element is anticipated to accelerate the rise of software systems in the next years.

By Technology

Based on technology, the market is divided into remote, semi-autonomous, and completely independent. The completely independent segment is expected to grow at the highest CAGR on the market at the time of forecasting. It contains a command delivery system and a combat planning system where the flight path and width are determined prior to operation. It is fully controlled by LIAVS without any external command from the ground operator. These UAV are based on highly paid machines designed for specific tasks in various countries such as the U.S. China, Russia, and Israel. The remote-operated segment has a large share of the unmanned aerial vehicle market by 2022. It is likely to continue earning marks during the forecast period due to the wide range of products used by remote sensing technology. The drone is used directly on the ground by various drones such as the Beyond the Visual Line Sight (BVLS) to collect information on remote sensing Many commercial agricultural applications, forest surveillance, and aerial photography are also used with remote sensing technology.

By Application

Depending on the application, the UAV market is divided into military, commercial, and recreational. Half of the troops are expected to hold the highest share during the forecast period. The growing demand for strategic UAV and UAV strategic military operations drives partial growth. A few countries have increased their purchases for specific UAV purposes such as Medium Altitude Long Endurance UAV and High Altitude Long Endurance UAV for various equipment. It is likely to increase demand in the coming years.

Major activities that include border surveillance, surveillance, and border security are designed to promote global demand. The commercial sector will grow significantly in the future due to the rapid adoption of exploration, aerial mapping, crop monitoring, forest surveillance, and resource utilization. The high investment of large companies such as Uber to upgrade Air Taxi and Logistics giant DHL Logistics to develop new AV aircraft is expected to boost the growth of the commercial segment at the time of forecasting.

By Class Analysis

The market is divided into four classes: small UAV, strategic UAV, tactical UAV, and special purpose UAV. Because of its multiple military and chill uses across the world, the tiny UAV category is expected to be the fastest expanding in the market. They are commonly used for security, monitoring, and surveillance. The market is expanding due to increased demand for small military drones for intelligence, surveillance, and reconnaissance (ISR) applications. The widespread use of tiny UAV for commercial applications such as agriculture, mapping, surveying, and logistics is also projected to drive demand in the future years.

KEY MARKET SEGMENTATION

By Class

-

Small UAV’s

-

Tactical UAV’s

-

strategic UAV’s

By System

-

UAV Payload

-

UAV Avionics

-

UAV Propulsion

-

UAV Software

-

UAV Airframe

By Technology

-

Semi-autonomous

-

Remotely operated

-

Fully-autonomous

By Application

-

Commercial

-

Recreational

-

Military

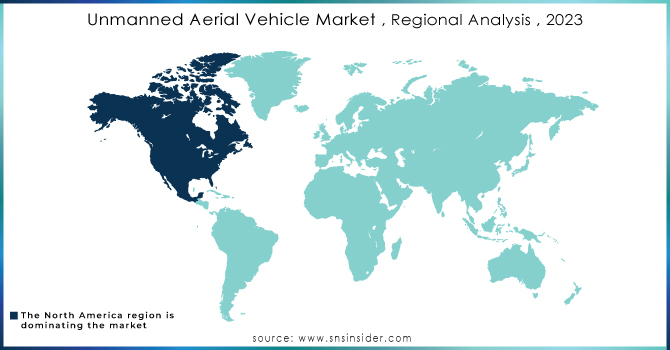

REGIONAL COVERAGE:

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

Need any customization research on Unmanned Aerial Vehicle Market - Enquiry Now

Key Players

The Major Players are General Atomics, Northrop Grumman Corporation, EHang, Parrot, PrecisionHawk, Israel Aerospace Industries Ltd, DJI Technology Co. Ltd., AeroVironment Inc., Lockheed Martin Corporation and Other Players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 35.76 Billion |

| Market Size by 2032 | US$ 104.46 Billion |

| CAGR | CAGR of 12.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Class (Small UAV’s, Tactical UAV’s, strategic UAV’s) • By System (UAV Payload, UAV Avionics, UAV Propulsion, UAV Software, UAV Airframe) • By Technology (Semi-autonomous, Remotely operated, Fully-autonomous) • By Application (Commercial, Recreational, Military) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Atomics, Northrop Grumman Corporation, EHang, Parrot, PrecisionHawk, Israel Aerospace Industries Ltd, DJI Technology Co. Ltd., AeroVironment Inc., and Lockheed Martin Corporation. |

| DRIVERS | • Rising demand. • High cost. • High cases of enemy Trespassing. |

| RESTRAINTS | • Lack of skill. • Huge market expansion. • Risk of collateral damage. |