Satellite Payloads Market Report Scope & Overview:

To get more information on Satellite Payloads Market - Request Free Sample Report

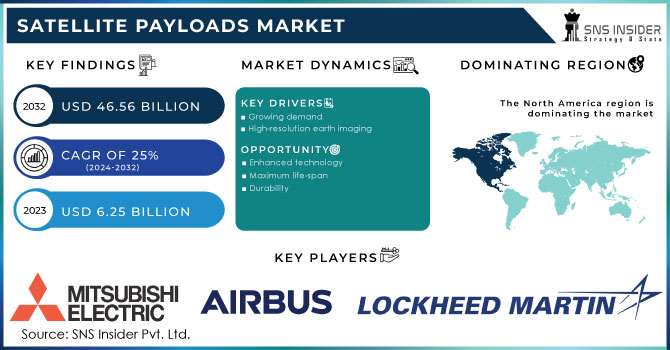

The Satellite Payloads Market Size was valued at USD 6.25 billion in 2023 and is expected to reach USD 46.56 billion by 2032 and grow at a CAGR of 25% over the forecast period 2024-2032.

The satellite payload market is growing rapidly globally, and a similar trend is expected to be observed during the forecast period. Continued advances in space technology and satellite loading, rising satellite delivery rates, and the growth of automated industrial investment are encouraging the growth of the satellite upload market. Continued advances in low satellite loading and the development of digital technology, lower costs, and increased use of satellite stars are major factors in the growth of this market.

Satellite load is defined as modules that are operated on satellites that can perform specific functions. The satellite is made up of a payload and a bus. Satellite buses are used to transport substandard systems and payloads, while payloads are designed to perform specific functions in orbit such as communication, photography, and navigation. Satellite uploads include, among other things, transponders, multipliers, antennas, spectrometers, and cameras. Cameras, radar, and other sensors are used in Earth View and remote sensor applications to collect relevant data. Payload includes antennas, receivers, and transmitters available both in space and on the ground to enable the delivery of satellite communications services. The main reason for the demand for paid cargo is to increase the total cost of satellite use. Currently, satellite loading is failing due to power supply problems associated with the satellite bus. The volume, weight, and limitations of the cost of satellite buses have contributed to the issue used by leading space technology organizations to accept satellite payments. The deployment of heuristic solutions to eliminate satellite loading barriers has skyrocketed over the past decade.

Because satellites are important in military systems, manufacturers are focused on developing payload-based carrier designs by increasing their resistance to environmental degradation, increasing engineering compliance across all types of buses, and equipping them with transcoding performance and data sequencing performance beyond their basic capabilities.

MARKET DYNAMICS

KEY DRIVERS

-

Growing demand

-

High-resolution earth imaging

RESTRAINTS

-

Government policies

-

High Spectrum

OPPORTUNITIES

-

Enhanced technology

-

Maximum life-span

-

Durability

CHALLENGES

-

High Capital investment

-

Huge risk & loss

THE IMPACT OF COVID-19

The impact of the COVID-19 epidemic has led to delays in development and the introduction of satellite payments, declining performance for key players, and a shortage of components. The epidemic caused supply chain disruption leading to delays in the delivery of satellites. Shortages of shares due to regulations related to the import and export of goods have also affected the market. The limited availability of liquid oxygen and liquid nitrogen due to high demand in hospitals to treat patients with COVID-19 has caused further delays in the delivery of payloads. The satellite payload market also contributed to chip shortages due to production closures in China, South Korea and Taiwan. However, satellite services have been used during the violence to provide services such as voice, data, and broadband communications around the world. Satellite services have enabled communication delivery, navigation, landscaping, and remote sensing services in health care, businesses, and government agencies throughout the epidemic.

In 2022, the small satellite segment is expected to account for the largest share of the satellite payloads market. This large share can be attributed to an increase in satellite payload launches for commercial and government purposes. These small satellite payloads are used in constellation architecture for scientific data collection and communication.

Laser communications are superior because light wavelengths are much more densely packed than sound waves and can transmit more information per second with a stronger signal. As a result, laser communications and sensing are critical in mortar defense and other critical aerospace applications. Laser-based communication payloads are increasingly being used in commercial and defense applications.

Demand for satellite payload is increasing across all industries. Because advanced payload technologies such as software-defined and quantum-based satellites are becoming critical components of current satellite strategies, the demand for these satellites is rapidly increasing. Because of growing application areas such as communication and earth observation, the commercial segment is expected to have high demand for satellite payload. Telecommunications companies like One Web are currently using satellite payloads to provide global internet access at the same speed as fiber-optic cables. This was not possible with traditional satellites.

KEY MARKET SEGMENTATION

By Application

-

Telecommunication

-

Remote Sensing

-

Scientific Research

-

Surveillance

-

Navigation

By Frequency Band

-

C Band

-

Ka Band

-

S and L Band

-

X Band

-

VHF and UHF Band

-

Others

By Payload Type

-

Communication

-

Imaging

-

Navigation

By Vehicle Type

-

Small

-

Medium

-

Heavy

By Payload Weight

-

Low

-

Medium

-

High

By Orbit Type

-

LEO

-

MEO

-

GEO

REGIONAL ANALYSIS

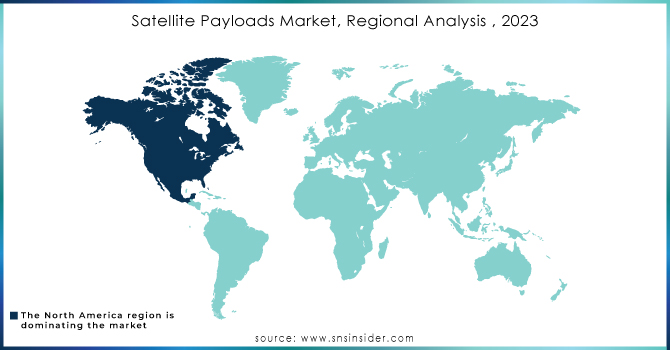

In 2022, North America is expected to account for the largest share of the Satellite Payloads market. Satellite Payloads are expected to grow significantly in the North American region during the forecast period, owing to increased R&D investments and expenditures by countries in this region. The successful execution of flexible payloads in space has increased the number of space expeditions, and technological advances in satellite payloads and resourceful insights gained from previous satellite missions have increased investments by existing and new market players. Northrop Grumman, Raytheon Technologies, Lockheed Martin, and others are among the prominent players in this region.

Need any customization research on Satellite Payloads Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Lockheed Martin Corporation, Thales Alenia Space, Sierra Nevada Corporation, Mitsubishi Electric Corporation, Airbus SE, Honeywell International Inc., The Boeing Company, Intelsat S.A., Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, ViaSat Inc, and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.25 Billion |

| Market Size by 2030 | US$ 46.56 Billion |

| CAGR | CAGR of 25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Telecommunication, Remote Sensing, Scientific Research, Surveillance, and Navigation) • By Payload Type (Communication, Imaging, and Navigation) • By Vehicle Type (Small, Medium, and Heavy) • By Payload Weight (Low, Medium, and High) • By Frequency Band (C Band, Ka Band, S and L Band, X Band, VHF and UHF Band, and Others) • By Orbit Type (LEO, MEO, and GEO) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Airbus Defense and Space, Lockheed Martin Corporation, Thales Alenia Space, and Sierra Nevada Corporation, Mitsubishi Electric Corporation, Airbus SE, Honeywell International Inc., The Boeing Company, Intelsat S.A., Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, ViaSat Inc, and other players. |

| DRIVERS | • Growing demand • High-resolution earth imaging |

| RESTRAINTS | • Government policies • High Spectrum |