Aircraft Braking System Market Report Scope & Overview:

To get more information on Aircraft Braking System Market - Request Free Sample Report

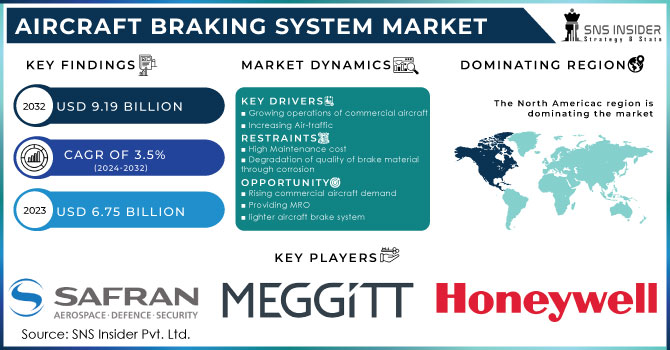

The Aircraft Braking System Market Size was valued at USD 6.75 billion in 2023 and is expected to reach USD 9.19 billion by 2032 and grow at a CAGR of 3.5% over the forecast period 2024-2032.

The aircraft brake system is used to slow or stop the aircraft's motion. Aircraft brakes are discs that are operated hydraulically or pneumatically. There are various types of aircraft brake systems, such as single disc, dual disc, multiple disc, and rotor-disc brakes. A properly designed aircraft brake can withstand a variety of adverse conditions and keep the plane from flying at excessive speeds. The development of aircraft braking systems necessitates extensive engineering and computation. The vast majority of aircraft brake systems are manufactured in accordance with predetermined standards. Global organizations, such as the Federal Aviation Administration, govern aircraft tire standards.

MARKET DYNAMICS

KEY DRIVERS

-

Growing operations of commercial aircraft

-

Increasing Air-traffic

RESTRAINTS

-

High Maintenance cost

-

Degradation of quality of brake material through corrosion

OPPORTUNITIES

-

Rising commercial aircraft demand

-

Providing MRO

-

lighter aircraft brake system

CHALLENGES

-

Emerging market player

-

Enhancements to the aviation industry

-

Steel brakes are being replaced with carbon brakes

THE IMPACT OF COVID-19

The COVID's influence on the aviation brake system market is unknown, although it is projected to last until the second quarter of 2021.

The COVID-19 outbreak compelled governments to enforce tight lockdown measures, resulting in aircraft cancellations and a restriction on e-commerce services, resulting in a major drop in commercial aviation and logistical activity worldwide.

Furthermore, the lockdowns impacted the supply chain by forcing various industrial facilities throughout the world to partially or completely shut down their operations.

The negative effects of the COVID-19 epidemic caused massive supply–demand concerns and lengthy delays in aircraft brake system operations around the world.

By Aircraft Type

The unmanned aerial vehicles category is expected to develop at the fastest CAGR for the aeroplane braking system market during the forecast period. UAVs, often known as drones, are widely used in a variety of military duties such as border surveillance. They are also used for mapping, surveying, and determining local meteorological conditions. Certain remotely piloted unmanned aerial vehicles are intended to serve as loitering weapons for defense forces.

By Component

The actuators market is expected to be the most valuable. Actuators are utilized in braking systems to convert hydraulic fluid pressure into motion. Brake actuators move the piston to apply pressure on the discs together, causing friction and bringing the aeroplane to a halt. The majority of commercial aircraft brake actuators are hydraulic, while electrically driven electromechanical actuators are also available. The Airbus A220 previously known as the Bombardier C-series and Boeing 787 use electromechanical brakes.

By Distribution

Throughout the forecast period, the OEM industry is expected to grow. OEMs are responsible for installing braking systems in aircraft during the assembly stage, following which they are distributed to aircraft manufacturers. Throughout the years, demand for various aircraft types has expanded dramatically across regions.

By Actuation

The independent brake sector is expected to have the highest CAGR rate for the aircraft braking system market over the forecast period, based on actuation. The increasing demand for general aviation and regional aircraft can be attributable to the expansion of the independent brake segment of the aircraft braking system market.

KEY MARKET SEGMENTATION

By Aircraft Type

-

Fixed Wing

-

Rotary Wing

By Component

-

Wheels

-

Brake Discs

-

Brake Housing

-

Valves

-

Actuators

-

Accumulator

-

Electronics

By Distribution

-

OEM

-

Replacement

By Actuation

-

Power Brake

-

Boosted Brake

-

Independent Brake

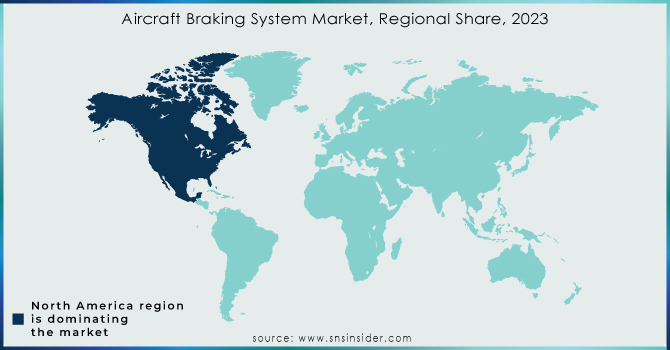

REGIONAL ANALYSIS:

North America is expected to be the largest regional market for air braking systems at the time of forecasting. A key feature for North America, it is leading the market for the flight brake system due to the rapid growth of the technological braking system in the region. In North America, rising orders for aviation have prompted manufacturers of brake system to increase their sales year after year. The growing demand for commercial airlines and the presence of some of the leading players in the market, such as Crane Co., Parker-Hannifin Corporation, and Honeywell International, Inc., is expected to boost the North American airline system. These players are focused on R&D to expand their product lines and utilize advanced technology systems, sub-systems, and other components to produce an airplane braking system.

Need any customization research on Aircraft Braking System Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Safran, The Carlyle Johnson Machine Company, Lufthansa Technik AG, Meggitt PLC, Beringer Aero, Collins Aerospace, Crane Co., Honeywell International Inc., Parker-Hannifin Corporation, AAR Corp. & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.75 Billion |

| Market Size by 2032 | US$ 9.19 Billion |

| CAGR | CAGR of 3.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Aircraft Type (Fixed Wing, Rotary Wing) • By Component (Wheels, Brake Discs, Brake Housing, Valves, Actuators, Accumulator, Electronics) • By Distribution (OEM, Replacement) • By Actuation (Power Brake, Boosted Brake, Independent Brake) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Safran, The Carlyle Johnson Machine Company, Lufthansa Technik AG, Meggitt PLC, Beringer Aero, Collins Aerospace, Crane Co., Honeywell International Inc., Parker-Hannifin Corporation, AAR Corp. |

| DRIVERS | • Growing operations of commercial aircraft • Increasing Air-traffic • New technologies |

| RESTRAINTS | • Safety • High Maintenance cost • Degradation of quality of brake material through corrosion |