5G in Defense Market Report Scope & Overview:

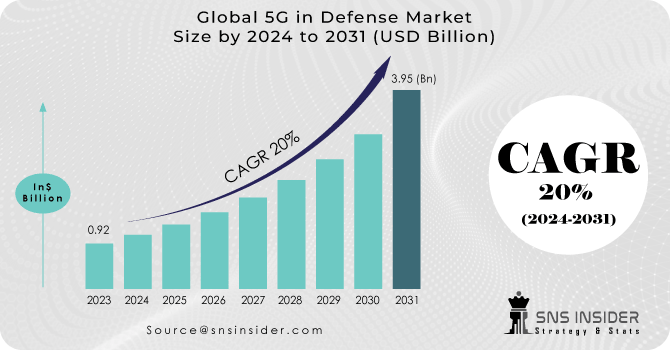

The 5G in Defense Market size is estimated at USD 0.92 Billion by 2023, and is expected to grow at a CAGR of 20% and will hit USD 3.95 Billion by 2031.

A fifth-generation wireless (5G) system, or 5G mobile network, is an advanced communication technology that allows for faster data transfers and more efficient viewing of the system (i.e. greater data capacity), and lower battery usage. It also offers the provision of connecting several devices at once. 5G defense will enhance intelligence, surveillance, and re-processing (ISR) systems and enable new methods of command and control (C2). Things like high network speed and low latency in 5G, and the growing adoption of standalone and connected devices are driving factors that help 5G growth in the defense market.

To get more information on 5G in Defense Market - Request Free Sample Report

KEY DRIVERS

5G technology can support up to 1 million devices over a square mile (approximately). This means that many devices like sensors can be connected to each other using a 5G network. All independent systems or platforms operate on a network to which data is transmitted. This data is interpreted and received by systems across the network, which is used to take action by private systems. With a high-speed network and low latency, such systems will work very well. For example, the connection between an unmanned aerial vehicle and its controller will be faster and more efficient if it is in a 5G network compared to current communication systems.

Private platforms, such as armed cars and unmanned ground cars, can work well with a secure 5G network. 5G network is seen to improve the performance of independent systems. Countries like China, US, and Israel are testing and/or using 5G technology within their military base. European countries, such as France and Italy, are also looking forward to using 5G within their military base. According to a report by the Federation of American Scientists (FAS) of Artificial Intelligence and National Security, published in November 2020, the US military plans to use various anti-aircraft robots (RCVs) with various independent capabilities, such as navigation, surveillance, and IED. removal. These gadgets will be used in conjunction with a personalized combat vehicle. In addition, the Navy has developed a rapid autonomous integration lab (RAIL) to build, test, validate, and deliver new and advanced independent systems. By delivering faster speeds and more capacity, the 5G network has reportedly increased the efficiency of independent systems. As a result, the increasing adoption of standalone systems and connected devices due to their improved performance and the rise of the 5G network is likely to drive the market.

RESTRAINTS

5G technology is coming, and to develop, manage, and effectively use 5G infrastructure, companies need agreements and rules to be followed. Currently, very few countries use 5G in the military, leading to a lack of standards and procedures. There is a delay for the international community in the use of 5G military due to the lack of adequate hardware providers. Some of the major suppliers are Huawei (China), Nokia (Finland), and Ericsson (Sweden). As 5G security infrastructure is in the development phase, companies involved in this technology have to deal with problems related to access to information, military platform testing, and access to development and testing regulations, among others. The lack of skilled workers is also a problem facing security firms. Since 5G military technology is in the early stages of the life cycle, personnel with in-depth knowledge of these technologies are limited. Therefore, the effect of this inhibitor is likely to continue throughout the early years of the forecast period

OPPORTUNITIES

The widespread adoption and continuous development of the Internet of Things (IoT) are among the things that transform various industries by connecting a few types of devices, electronics, systems, and services. IoT is among the 5G network applications that I can support; for example, it allows communication between a large number of sensors and connected devices. application requirements of IoT can be categorized as low latency, high power Application, (e.g., limit monitoring), low power, and long-distance IoT applications (e.g., smart base). To support these emerging IoT application needs, categorized as high-end machine communications and the most important applications in principle, the 5G market is expected to gain momentum. Also, the need to provide seamless internet connectivity to a growing number of devices, as well as a reduction in power consumption, is driving 5G market growth.

CHALLENGES

Many countries, such as the US, Canada, France, Germany, and the UK, are looking forward to identifying potential 5G providers and providers. Players like Huawei, Nokia, and Ericsson have been dominating the 5G market. Since the implementation is for security purposes, data and network security are paramount. The US is adamant not buying computer hardware and solutions from unreliable sources, where data security can be a concern. It has decided to close down Chinese companies, especially Huawei. A similar request for a Huawei ban has been made by Canadian troops to the government. After intense competition between China and the US, the US is pressuring G7 countries to adopt similar policies. European countries did not explicitly approve the ban on infrastructure in Chinese companies; however, they have set a limited contract period. European countries prefer to purchase 5G devices in the European region to ensure data security. In Asia, countries like India look forward to banning Chinese companies wherever data sensitivity is concerned.

Concerns about sensitive data sharing with private companies exist. The military maintains data for each of its operations and activities, and sharing that data with others could jeopardize their security and safety plans. There are also concerns about cloud-based storage services, which are at risk of cyberattacks, leading to the loss of sensitive information.

THE IMPACT OF COVID-19

COVID-19 is an unprecedented public health emergency that has affected the entire industry almost, and outcomes are expected to long-term contribute to the Growing industry during forecasting. Our ongoing research expands our research framework to ensure the inclusion of the underlying problems of COVID-19 and possible alternatives. The report provides information on COVID-19 when considering changes in consumer behavior and demand, purchasing patterns, supply chain reorganization, current market volatility, and significant government interventions. The revised study provides data, analysis, estimates, and predictions, taking into account the impact of COVID-19 on the market.

KEY MARKET SEGMENTATION

By Communication Infrastructure

-

Small cell

-

Macro Cell

By Core network technology

-

Fog Computing (FC)

-

Mobile Edge Computing (MEC)

By Platform

-

Land

-

Naval

-

Airborne

By End-User

-

Military

-

Homeland security

By Network type

-

Enhanced Mobile Broadband (EMBB)

-

Ultra-Reliable Low-Latency Communications (URLLC)

-

Massive Machine-Type Communications (MMTC)

By Chip-set

-

Application-specific integrated circuit (ASIC) Chip-set

-

Radio Frequency Integrated Circuit (RFIC) Chip-set

-

Millimeter Wave (mm wave) Chip-set

By Operational Frequency

-

Low

-

Medium

-

High

By Installation

-

New Implementation

-

Upgradation

Need any customization research on 5G in Defense Market - Enquiry Now

REGIONAL ANALYSIS

North America may have the largest share in the world due to its rapidly growing wireless network. The presence of key market players throughout North America is a key factor in promoting market growth throughout the region. Developing communication technologies further accelerate the adoption of communication technologies. The increasing tendency to work away from business trips pushes the need for strong, reliable, and high-speed communication infrastructure. The ever-increasing demand for high-speed telecommunications networks increases the demand for telecommunications equipment throughout North America. The ever-growing demand for loT-based, smart applications strengthens the growth of the telecommunications equipment market across the region. The proliferation of wireless connectivity has increased the need for wireless connectivity with network infrastructure.

Europe is expected to demonstrate significant adoption of communications technology in the growing telecommunications sector. Many companies plan to establish their presence in all European countries, which is important in promoting market growth throughout Europe. Significant investment in advanced communication technologies such as 5G, LTE, and VoLTE further enhances market demand. Intelligent infrastructure and application development based on loT can strengthen the need for communication equipment throughout Europe.

Asia-Pacific is likely to show significant growth in the telecommunications technology market due to the continued development of internet infrastructure. Countries such as India, Japan, and China show great demand for advanced communication technologies such as 5G, LTE, or VOLTE. SG technology will create opportunities and demand across Asia-Pacific through platforms such as robots, the Internet of Things (IoT), and virtual reality (VR). Apart from this, the leading market players have begun to expand their production and production facilities across the region. For example, in December 2020, Nokia Corporation began producing the next generation of 5G telecommunications equipment in India. Therefore, these factors can be integrated that can help market growth in all Asian countries. Rapid industrial development and urbanization are likely to further market growth throughout Asia-Pacific.

REGIONAL COVERAGE

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

Key Players

The Major Players are Raytheon Technologies Corporation, Ligado Networks, Wind River Systems, Inc.,Thales Group, L3Harris Technologies, Inc., Telefonaktiebolaget LM Ericsson, Huawei Investment & Holding Co., Ltd, Nokia Corporation, Samsung Electronics Co., Ltd, NEC Corporation. and other players

Raytheon Technologies Corporation-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 0.92 Billion |

| Market Size by 2031 | US$ 3.95 Billion |

| CAGR | CAGR of 20% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2023-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

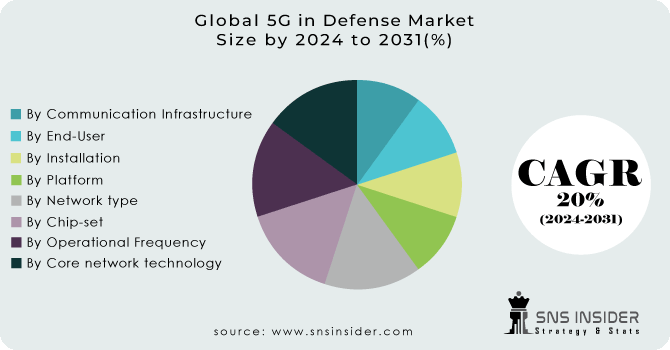

| Key Segments | • By Communication Infrastructure (Small cell, Macro Cell) • By Core network technology (Software-Defined Networking (SDN), Fog Computing (FC), Mobile Edge Computing (MEC), Network Functions Virtualization (NFV)) • By Platform (Land, Naval, Airborne) • By End-User (Military, Homeland security) • By Network Type (Enhanced Mobile Broadband (EMBB), Ultra-Reliable Low-Latency Communications (URLLC), Massive Machine-Type Communications (MMTC)) • By Chip-set (Application-specific integrated circuit (ASIC) Chip-set, Radio Frequency Integrated Circuit (RFIC) Chip-set, Millimeter Wave (mm wave) Chip-set) • By Operational Frequency (Low, Medium, High) • By Installation (New Implementation, Upgradation) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Raytheon Technologies Corporation, Ligado Networks, Wind River Systems, Inc.,Thales Group, L3Harris Technologies, Inc., Telefonaktiebolaget LM Ericsson |

| Key Drivers | • many devices like sensors can be connected to each other using a 5G network |

| RESTRAINTS | • 5G technology is coming, and to develop, manage, and effectively use 5G infrastructure, companies need agreements and rules to be followed. |