Aircraft Interface Device Market Report Scope & Overview:

To get more information on Aircraft Interface Device Market - Request Free Sample Report

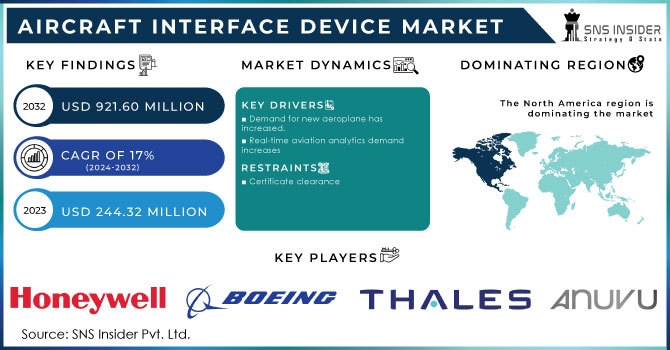

The Aircraft Interface Device Market Size was valued at USD 244.32 million in 2023 and is expected to reach USD 921.60 million by 2032 with a growing CAGR of 17% over the forecast period 2024-2032.

Modern air-crafts use aircraft interface devices for digital communication systems, new engines, in-flight entertainment, improved weaponry, navigation flying systems, data records, and other uses. The aviation interface device market is divided into four sections: platform is software and hardware, end-use are fixed wing and rotary wing, fit is line fit and retrofit, aircraft type are civil and military, connectivity are wired and wireless, and geography. During the forecast period, the worldwide aircraft interface device market is likely to grow due to increased demand for real-time aviation analytics and a growing need for situational awareness. Modern aircraft interface devices not only operate as an instantaneous data cruncher, but also enable efficient data exchange with ground support operators, such as maintenance people and dispatchers, and aid in making better decisions. Connecting the AID hardware platform greatly aids in driving fuel efficiency, enhancing flying performance and safety, and assisting in predictive aircraft maintenance. The aircraft interface's primary applications include rapid access recording, aircraft condition monitoring, and flight tracking.

MARKET DYNAMICS

KEY DRIVERS

-

Demand for new aeroplane has increased.

-

Real-time aviation analytics demand increases

RESTRAINTS

-

Certificate clearance

OPPORTUNITIES

-

in-flight entertainment services

CHALLENGES

-

Cyber-attack

IMPACT OF COVID-19

The outbreak of COVID-19 has been shown to be detrimental to various businesses and has forced governments around the world to adopt stricter shutters, which has led to public isolation to complicate the spread of the virus. As a result, people began to avoid visiting places, and the need for any means of transportation, including air travel, saw a dramatic decline in 2020. As a result, thousands of flights were grounded worldwide, and the industry saw a sharp decline in revenue. The aviation industry is expected to see huge losses this year by 2021 due to the uncontrollable nature of the epidemic in many parts of the world. The losses experienced by the aviation industry have contributed to the adoption of important technologies such as aircraft connection systems. Airports and airports have suffered greatly as a result of the epidemic that has forced companies and authorities to invest in advanced aviation systems around the world.

Because of technological improvements in the field of the aircraft interface device, the development of safety systems, and the increasing demand for real-time data, the retrofit segment is expected to increase significantly throughout the projection period. The fixed-wing sector is likely to be the most valuable market. The increased need for more efficient and innovative avionic components such as electronic flight bag and in-flight entertainment & connectivity systems can be linked to the expansion of the fixed wing segment of the aircraft interface device market. The rising demand for technologically enhanced aircraft interface devices has fueled the growth of the retrofit segment.

By Connection, the market is further split into wired and wireless segments. The wireless segment will boost the market's CAGR over the forecast period since wireless connectivity uses radio frequency to convey data between aircraft and MRO engineers. The real-time operation supplies the aircraft with data such as location, destination, and other information, which increases system quality. The aircraft interface device system is further differentiated by the aircraft type into fixed wing and rotatory wing. As the number of passengers increases, the fixed-wing category will accelerate market growth, making it easier for narrow and wide-body aircraft to keep up.The data sent between aircraft and MRO engineers on the ground is relayed utilizing radio frequency and satellites in wireless communication.

The aeroplane transmits data to MRO operators in real time, including the aircraft's location, destination, speed, and other pertinent information. All of this data necessitates increased bandwidth to convey information from aircraft to on-ground MRO operators. Most avionics systems now require enhanced connectivity, which allows for easier ground connections. This presents a significant opportunity for the expansion of wireless communication.

KEY MARKET SEGMENTATION

By End-Use

-

Fixed Wing

-

Rotary Wing

By Connectivity

-

Wired

-

Wireless

By Fit

-

Line Fit

-

Retrofit

By Aircraft Type

-

Civil

-

Military

REGIONAL ANALYSIS

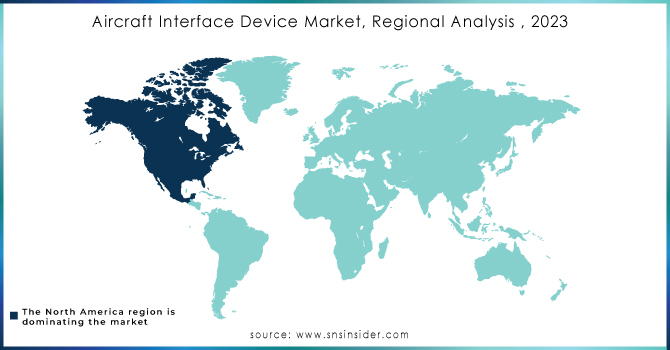

North America, Asia Pacific, Europe, and other regions are now included in the worldwide aircraft interface device market. Many major aircraft manufacturers are present in North America, such as Boeing, which significantly increases North America's market share. North American demand for aircraft and commercial carriers is also increasing. The region is also boosting its defence industry in order to expand surveillance and transportation activity, which boosts the market for aircraft interface devices.

Need any customization research on Aircraft Interface Device Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players Honeywell International Inc., Thales Group, The Boeing Company, Anuvu, Elbit Systems Ltd., Skytrac Systems Ltd., Teledyne Controls LLC, Astronics Corporation, Collins Aerospace, SCI Technology Inc., and other players

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 244.32 Million |

| Market Size by 2032 | US$ 921.60 Million |

| CAGR | CAGR of 17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-Use (Fixed Wing, Rotary Wing) • By Connectivity (Wired and Wireless) • By Fit (Line Fit and Retrofit) • By Aircraft Type (Civil and Military) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Honeywell International Inc., Thales Group, The Boeing Company, Anuvu, Elbit Systems Ltd., Skytrac Systems Ltd., Teledyne Controls LLC, Astronics Corporation, Collins Aerospace, SCI Technology Inc., and other players. |

| DRIVERS | • Demand for new aeroplane has increased. • Real-time aviation analytics demand increases |

| RESTRAINTS | • Certificate clearance |