Aviation Asset Management Market Report Scope & Overview:

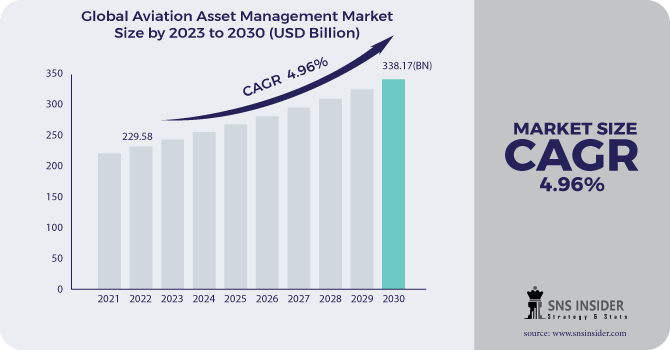

The Aviation Asset Management Market Size was valued at USD 229.58 billion in 2022 and is expected to reach USD 338.17 billion by 2030 with an emerging CAGR of 4.96% over the forecast period 2023-2030.

A commercial aircraft consultation service is aviation asset management. Under this management, companies such as Aviation Asset Management Limited (AAM) conduct surveys of leased aircraft and review maintenance documents. With the increased number of flying passengers, the concept of asset management is gaining traction. Growth in aviation asset management can be linked to commercial airline operators' increased focus on expanding their service offerings in response to increased demand for aerial cargo movement and in-flight passengers. Major corporations involved in commercial aircraft operations are looking for ways to outsource aviation asset management services.

To get more information on Aviation Asset Management Market - Request Free Sample Report

Asia-Pacific is expected to gain a considerable market share, with an increased growth rate in the coming years as the region's aviation industry develops.

Airlines are actively extending their operational fleet in order to meet market demand for regional roots. Regional governments' efforts to develop their manufacturing and operational capacities in the aviation industry are drawing massive brownfield and greenfield investments, which are positively influencing the market. China Airlines has a partnership with IFS to provide aviation asset management services. This contract aided China Airlines in increasing management process efficiency by 10%, A checks delivery efficiency by 3%, and a 30-day average reduction in scheduled aircraft maintenance downtime.

MARKET DYNAMICS:

KEY DRIVERS:

-

The market is growing due to a rise in air traffic, the purchase of new aircraft models with enhanced features, a greater emphasis on competitive intelligence and analytical solutions, and technical advancement.

-

Government rules are impeding the expansion of the aviation asset management business.

OPPORTUNITY:

-

Aviation Industry Green Initiatives

-

Increase in the number of low-cost carriers and domestic civil aviation

CHALLENGES:

-

Existing Aircraft Delivery Backlogs

-

Aircraft Instrument Configuration Difficulties

IMPACT OF COVID-19:

Despite the COVID-19 concerns causing a reduction in high technology investment across sectors, tech firms are expanding their focus on high-demand technologies and developing innovative ways to service their customers. IBM, SAP, and Microsoft are poised to exploit these developing technologies to bring value to their clients. Supply-side shocks are one of the most visible effects of the pandemic on the defence industry. Businesses based in virus-stricken nations, as well as those depending on supply chain operations situated in afflicted countries, are victims of the epidemic.

Major nations, like as the United States, have already suspended all troop movements, missions, and exercises. Ceasing or lowering military exercises is predicted to minimise engagement time, informal testing, and equipment evaluation, as well as the market development possibilities for aircraft asset management.

The commercial platforms segment is expected to lead the aviation asset management market in terms of end use throughout the forecast period. The relationship between economic development and air traffic is clear, and the prospect for the global aircraft fleet's future development is equally promising. According to the International Air Transport Association (IATA), the global aircraft fleet will treble by 2028, implying that the commercial platforms portion of the aviation asset management market has enormous growth potential.

The aviation asset management market is divided into three segments based on service type: lease services, technical services, and regulatory certification.

The leasing services sector of the aviation asset management market is expected to develop at the fastest CAGR during the projected period. Some of the primary leasing services in the aviation asset management sector include contract negotiation/renewal, lease renewal, and re-marketing, among others.

Aircraft leasing and other related components such as airframes and engines are included in the leasing services. In general, airlines prefer to lease aircraft since it lowers ownership costs. This market category is likely to be the market leader during the forecasted period. In the future, technical services such as inspection and maintenance may contribute to market revenue. The regulatory certification market, which includes airworthiness certification, may gain traction as a result of the implementation of new regulatory rules.

KEY MARKET SEGMENTATION

By Service Type

-

Leasing Services

-

Technical Services

-

Regulatory Certifications

ByType

-

Direct Purchase

-

Operating Lease

-

Finance Lease

-

Sale & Lease Back

ByEnd Use

-

Commercial Platforms

-

MRO Services

.png)

Need any customization research on Aviation Asset Management Market - Enquiry Now

REGIONAL ANALYSIS

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa account for the majority of the aviation asset management market. Historically, the North American region has played a significant role in increasing worldwide market growth. Because of the presence of powerful and profitable market participants, the area is predicted to lead during the forecasted time. The Asia Pacific region is also expected to perform well in the worldwide market due to favourable variables such as increased air passenger traffic and an increase in the number of low-cost airlines in the region. Large-scale airline fleet upgrades in the Middle East and Africa may also have a positive impact on the aviation asset management business.

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are Acumen, AerData, Charles Taylor Aviation (Asset Management) Ltd., GE Capital Aviation Services (General Electric Company), GA Telesis, LLC, Skyworks Capital, LLC., Airbus Group, AerCap Holdings N.V, Aviation Asset Management Inc, BBAM Aircraft Leasing & Management, and Other Players

AerData-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 229.58 Billion |

| Market Size by 2030 | US$ 338.17 Billion |

| CAGR | CAGR of 4.96% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Leasing Services, Technical Services, and Regulatory Certifications) • By Type (Direct Purchase, Operating Lease, Finance Lease, and Sale & Lease Back) • By End Use (Commercial Platforms, and MRO Services) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Acumen, AerData, Charles Taylor Aviation (Asset Management) Ltd., GE Capital Aviation Services (General Electric Company), GA Telesis, LLC, Skyworks Capital, LLC., Airbus Group, AerCap Holdings N.V, Aviation Asset Management Inc, BBAM Aircraft Leasing & Management, and Other Players. |

| DRIVERS | • The market is growing due to a rise in air traffic, the purchase of new aircraft models with enhanced features, a greater emphasis on competitive intelligence and analytical solutions, and technical advancement. • Government rules are impeding the expansion of the aviation asset management business. |

| OPPORTUNITY | • Aviation Industry Green Initiatives • Increase in the number of low-cost carriers and domestic civil aviation |